Chinas Aufstieg wird gebremst

Die weitere Entwicklung in China ist von überragender Bedeutung für die Weltwirtschaft. Kurz- und mittelfristig hat das Land mit den strukturellen Ungleichgewichten und der hohen Schuldenlast zu kämpfen. Langfristig mit den Gegenwinden der demografischen Entwicklung. Hoffnung kommt meiner Meinung nach nur aus der guten Qualität der Bildung und den hohen Standards gerade in Mathematik. Capital Economics hat eine Studie erstellt, die die FINANCIAL TIMES (FT) ausführlich bespricht. Demnach gelingt China der Sprung an die Weltspitze nicht:

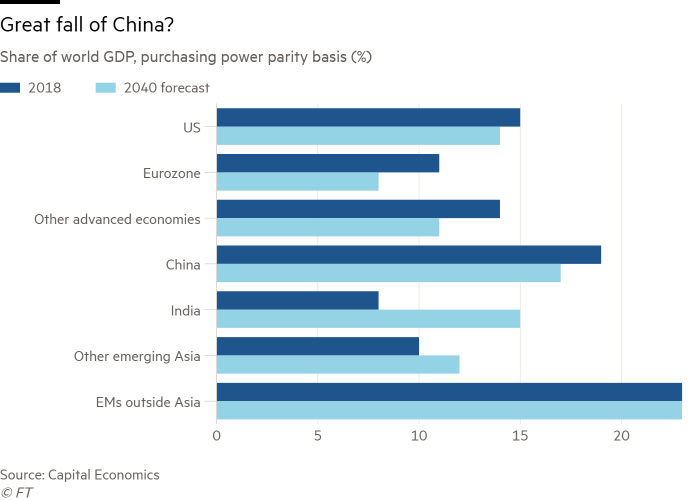

- “China’s share of global output will fall over the next two decades, (…) upending the expectations of a generation that has only ever seen the Middle Kingdom rise inexorably in importance. The country will account for 17 per cent of global gross domestic product, measured on a purchasing power parity basis, by 2040, below its current 19 per cent weight, according to Neil Shearing, group chief economist at Capital Economics, having peaked at 20 per cent in the mid-2020s, as the first chart shows.” – bto: Der aufmerksame Leser weiß sofort, dahinter muss die Demografie stehen.

Interessant ist auch der deutliche Rückgang der Eurozone. Vermutlich sogar noch überzogen, weil nicht nur die Demografie schlecht ist, sondern auch die Politik.

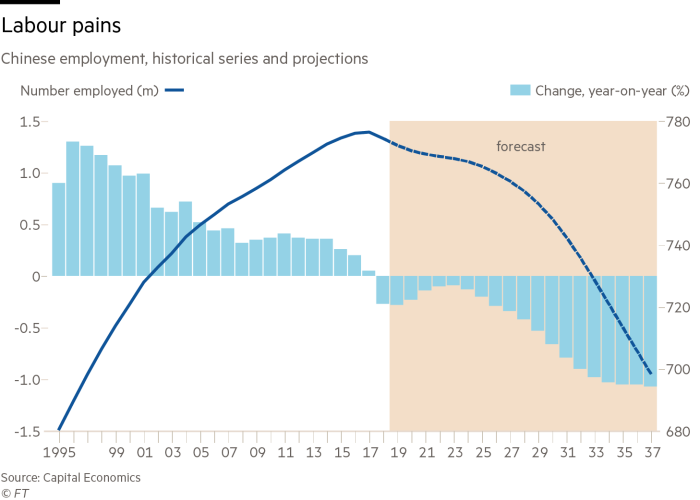

- “The (…) reversal in China’s dramatic rise to prominence since it opened up to the world 40 years ago is largely driven by an expected 12 per cent decline in its working-age population by 2040, depicted in the second chart. China’s working age population peaked in 2013 and employment will start to shrink before long, possibly as soon as this year, which will become an increasing headwind to economic growth, (…) In combination with other structural headwinds — such as an over-investment boom that has bolstered growth in recent years but led to too many resources being pumped into relatively unproductive parts of the economy — this means that China’s sustainable growth rate will fall to just 2 per cent by the late 2020s (…).” – bto: was durchaus interessant ist! Denn damit ist es auch nicht mehr der große Markt der Zukunft. Es geht nur mit steigendem BIP pro Kopf, was bekanntlich entsprechende Reformen voraussetzt. Ausgeschlossen ist es nicht, gegeben das hohe Bildungsniveau.

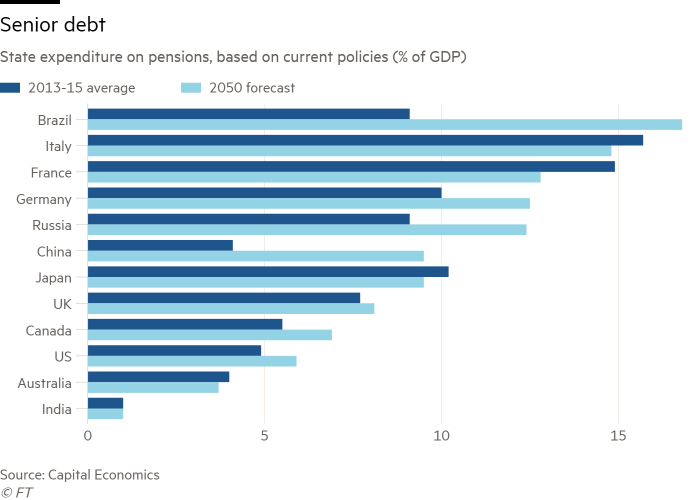

- “China’s rapidly ageing population, a result of its one-child policy, and its lack of private provision, means that, without reform, it is on course to spend 9.5 per cent of its GDP on pensions, a larger slice than in developed countries such as Japan, the UK and the US by 2050 (…).” – bto: Es ist auch interessant, sich die anderen Staaten anzuschauen. Das vermeintlich reiche Deutschland hat nicht vorgesorgt.

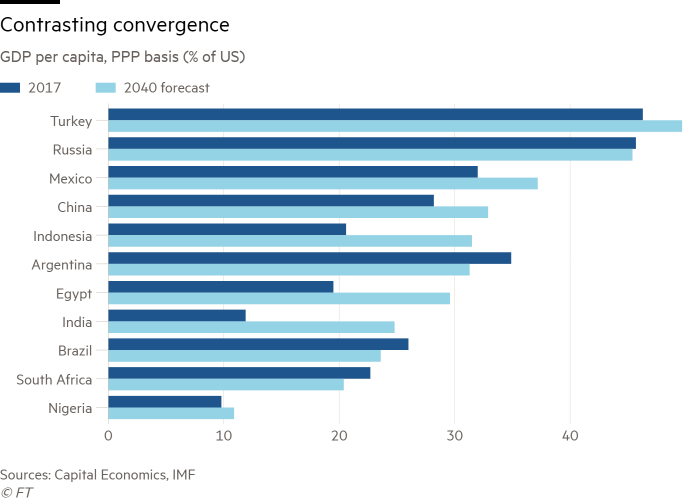

- “We think China will fall off the path of rapid development laid down by the Asian growth stars of Japan, Korea and Taiwan, (…). Our forecasts suggest that China will remain much poorer than all the major advanced economies, with its GDP per capita staying around a third of that of the US.”– bto: Damit wäre China an der Wohlstandsmauer abgeprallt.

- “Capital Economics’ analysis suggests a challenging future for many emerging market countries. While many economists and policymakers work on the assumption that, broadly, the developing world will gradually narrow the income gap with advanced economies thanks to faster growth in GDP per capita, the consultancy suggests that convergence will actually reverse over the next 20 years in some countries. Mexico is seen as the only major Latin American country that is likely to increase its GDP per capita as a proportion of that of the US (in PPP terms) in the period to 2040 (…) Brazil and Argentina are both projected to go backwards by this measure, with productivity growth constrained by low investment rates, largely a result of weak savings rates, which also dictate that real interest rates are likely to remain high.”

- “Although headline growth rates in sub-Saharan Africa may look solid, per capita incomes will rise less rapidly, with the region’s population forecast by the UN to rise from 1bn this year to 1.7bn in 2037. Mr Shearing also forecast that per capita incomes in the Middle East and north Africa would be flat as a share of those in the US over the coming two decades, with the sole exception of Morocco, which has successfully positioned itself as a manufacturing hub for Europe.” – bto: womit der Migrationsdruck weiter zunimmt.

- “Most of the success stories are likely to be in Asia, though, with India forecast to almost double its share of global GDP from 8 per cent to 15 per cent by 2040, and the rest of emerging Asia (bar China) likely to expand from 10 per cent to 12 per cent. (…) India is on track to usurp China as the nation with the largest labour force by 2025, (…) High savings and investment rates and a gradual process of structural reform should also help. Vietnam is also predicted to make progress, thanks to an improving business environment, political stability, low wages and the continued migration of low-end manufacturing from China.” – bto: Deshalb sind diese Märkte potenziell interessant mit Blick auf Investitionen.

- “Not everyone agrees that China’s share of global output will start to decline any time soon, however. Adam Slater, lead economist at Oxford Economics, said he was ‚surprised‘ by the forecast, with his own calculations pointing to China having a 24.7 per cent share of global GDP, on a PPP basis, by 2040, taking its income per head from 28.6 per cent of US levels at present to 54.9 per cent by 2040. His figures are based on Chinese growth only slowing to 4 per cent by the early 2030s and 3.5 per cent by 2040, comfortably above the 2 per cent rate Capital Economics is pencilling in by the late 2020s. ‚If [growth] falls to 2 per cent [soon], it would be an unusually early decline,‘ Mr Slater said. ‚While this scenario is not out of the question it’s quite a big call for it to happen to a country like China at this level of per capita income. It’s not an implausible scenario but it’s at the bottom of the range and you have to be fairly pessimistic to get there.‘” – bto: der Unterschied liegt an anderen Annahmen zur Erwerbsbevölkerung und Produktivität. Das macht es so schwer, die Dinge vorherzusehen.

- “More broadly, the country still has ‚tremendous catch-up opportunity‘, due to its still relatively lowly income levels, (…) ‚but the phenomenon of China getting bigger every year will probably come to a plateau and then start to decline over time,‘ adding ‚they will probably get old before they get rich.” – bto: Das ist aus unserer Sicht aber auch kein Trost.