“Rising recession risk leaves Europe acutely vulnerable to no-deal Brexit shock”

Leicht lässt sich aus Brexit, Handelskrieg, Ucitalia und Geldpolitik das Szenario eines (globalen) Wirtschaftsabschwungs und einer neuen Eurokrise ableiten. Alleine die Tatsache, dass es so einfach geht, sollte alle Alarmglocken leuten lassen. Wie immer gelingt es Ambroise Evans-Pritchard, eine schöne Mischung zusammenzustellen:

- “Germany and Italy are flirting with recession while eurozone business growth has slumped to a four-year low,(…) The closely watched IHS Markit index of German manufacturing fell to 50.2 in November, close to the ‘boom-bust line’ that divides growth from contraction. It is the weakest level since the tail-end of eurozone banking crisis in 2013. Foreign export orders fell to a six-year low. (…) Italy’s economy has also stalled. Peter Praet, the European Central Bank’s chief economist, warned that the country is uncomfortably close to a fresh crisis as the budget showdown between Brussels and the insurgent Lega-Five Star coalition in Rome continues to escalate.” – bto: Es zeigt aber auch, dass der Aufschwung eine monetär erzeugte Illusion war.

- “Hopes that the economic slowdown in the third quarter would prove nothing worse than a ‘soft patch’ have been dashed as a blizzard of ominous figures point to further trouble in the fourth quarter. The eurozone’s open trading economy and heavy reliance on export demand makes it more leveraged to the ups and downs of the world cycle than the US economy.” – bto: weil es eben auch in China nicht mehr so gut geht.

- “Risk spreads on 10-year Italian bonds have been stuck above 300 basis points for nearly two months, gradually tightening the noose on the economy. Italian banks are mostly unable to roll over their bonds, forcing them to curb lending. (…) Mr Praet told the Handelsblatt that there would be no ECB reprieve for Italian lenders at the next meeting in December, a warning that may cause alarm in banking circles.” – bto: Es ist klar, dass die EZB wieder tut, was nötig ist, wenn es ernst werden sollte.

- “It is becoming clear that the credit crunch in emerging markets – caused by vanishing dollar liquidity – is doing more damage to Europe than anticipated. So is the economic slowdown in China, where monetary and fiscal policy stimulus has so far failed to gain much traction. (…) The abrupt downturn in Germany and Italy has echoes of mid-2008. We now know that the two economies went into recession in the second quarter of that year, leading the rest of the eurozone into crisis.” – bto: Es ist nicht ausgemacht, dass das diesmal auch so ist. Doch gibt es zweifellos Gegenwind!

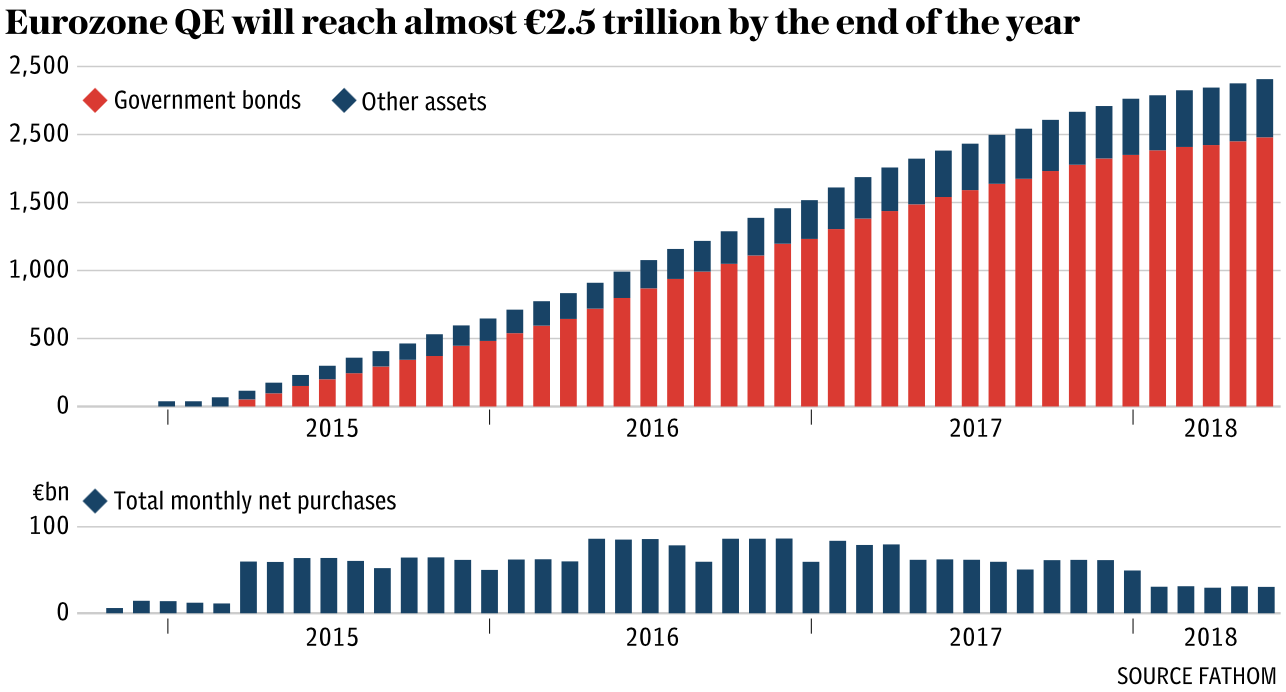

- “The ECB (…) it is nevertheless taking a risk by proceeding with pre-set plans to wind down quantitative easing and halt bond purchases at the end of this year – not least because it has been the lonely buyer of Italy’s net debt issuance for almost three years.” – bto: Wir alle wissen, sie kauft wieder. Dazu muss aber das Problem so offensichtlich sein, dass die Politiker offiziell “Danke” sagen können, gerade bei uns. Bisher war sie ja auch nicht zimperlich:

- “The reduction in QE has mechanical effects on the growth rate of broad M3 money, and therefore constrains bank lending. M3 was growing at around 5pc a year during the peak QE period when the ECB was buying €80bn of bonds a month. It has been slowing ever since. The rate dropped to 2.1pc in September on a three-month annualized basis. ‘On announced policies M3 will stop growing completely in 2019. Frankly, they are setting themselves up for a catastrophe unless there is a change of course,’ said Professor Tim Congdon from the Institute of International Monetary Research. ‘The eurozone is in state of monetary civil war. There is a game of chicken going on between Italy and the protestant ethic countries of the North, and Germany in particular. This is very dangerous for the whole world economy,’ he said.” – bto: Klar, wenn die Eurozone platzt, hat das enorme Auswirkungen. Hier immer wieder erläutert und diskutiert.