Ohne China gibt es keine Erholung der Weltwirtschaft

Letzte Woche habe ich den optimistischen Fall erwägt, dass es durch die steigende globale Liquidität doch noch gelingen könnte, das Weltwirtschaftswachstum nach oben zu drücken:

Heute der etwas kritischere Blick:

- “To see Wall Street’s recent bullish reversal (…) look no further than the latest piece from Goldman’s David Kostin who starts his latest Weekly Kickstart piece by saying that ‘The performance of the US equity market during the past three months suggests the pace of US economic growth will improve in the near future’ adding that ‘recent data releases have supported the market’s expectation for a rebound in the US economy’. Additionally, (…) perennial market bear Morgan Stanley finally threw in the towel and after downgrading global stocks to a Sell in July, turned Neutral.” – bto: Das ist auch bei mir der Fall. Man muss einsehen, dass die Notenbanken es nochmal so richtig krachen lassen.

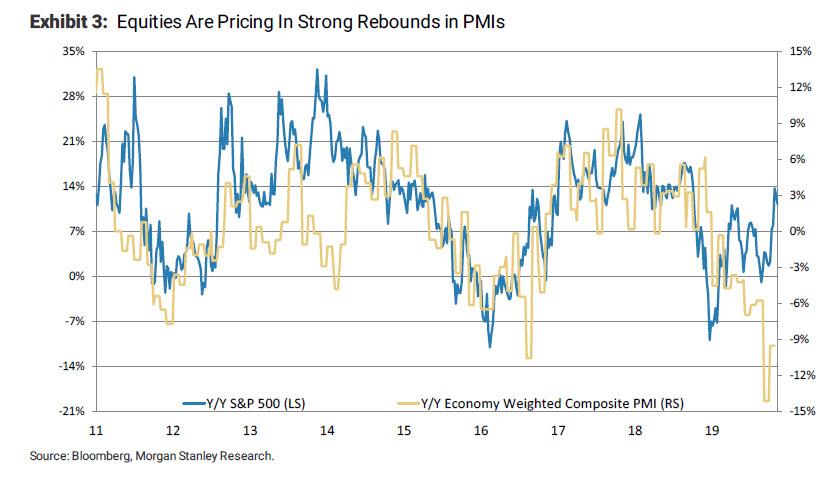

- “One look at the market, and it’s clear: stocks have now fully priced in a global recovery, and are expecting a dramatic surge in global PMIs in the coming months.” – bto: Man kann zumindest davon ausgehen, dass sich die Kurven wieder annähern.

Quelle: Zero Hedge

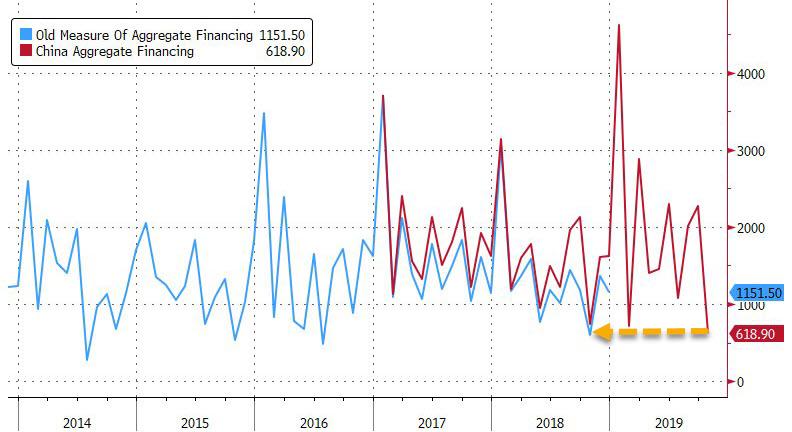

- “The answer will depend (…) on whether China will stimulate both its own, and the global economy to the point where it successfully triggers a global inflationary shockwave around the globe. Unfortunately, the answer for now appears to be a resounding no, (…) China will not open massively the credit tap anytime soon. (…) as a reminder, the latest Chinese credit data was a disaster, with the revised Aggregate Financing data series printing at its lowest level on record (…).” – bto: Es ist allerdings eine sehr volatile Kurve. Gut möglich, dass es doch nach oben schießt. Vorerst sieht es aber nach Dämpfung aus.

Quelle: Zero Hedge

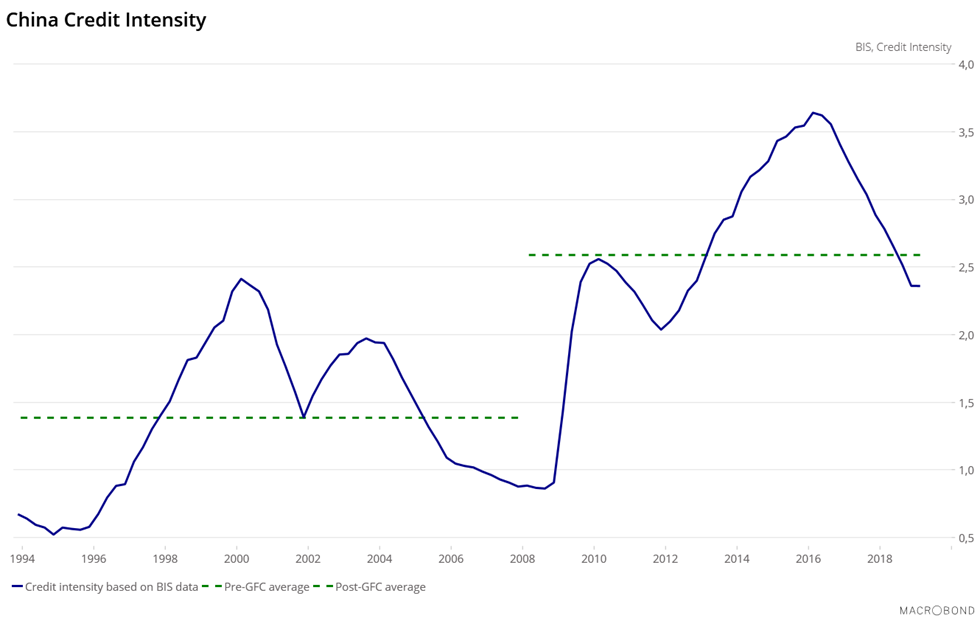

- “Before the Global Financial Crisis, China needed on average one unit of credit to create one unit of GDP. Since 2008, 2½ units of credit are required to create one unit of GDP. In other words, it means that China needs much more credit than 10 years ago to have the exact same amount of GDP. Injecting more credit in the economy is not the miracle solution it used to be, and the disadvantages of credit push tend to surpass the advantages.” – bto: China holt da nur das nach, was auch in der westlichen Welt passiert. Wir haben nicht mehr ausreichende Wirkung der Schuldendroge.

Quelle: Zero Hedge

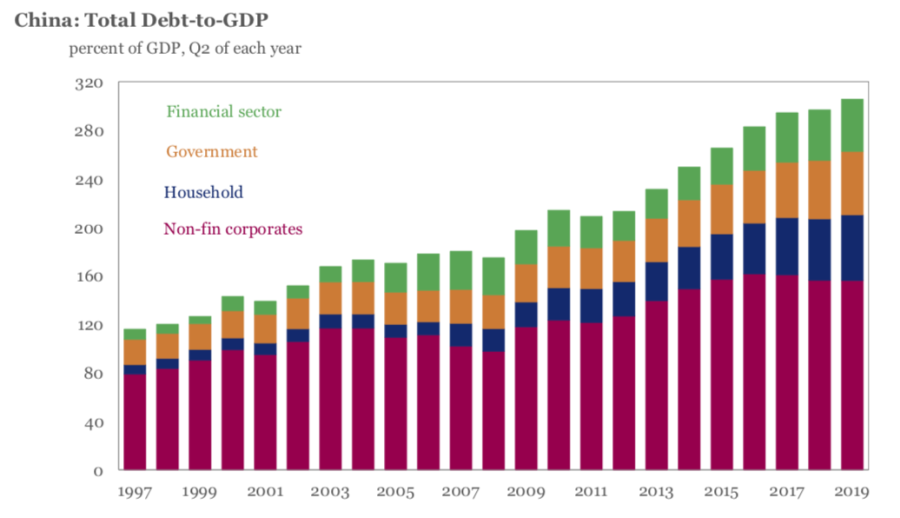

- “China’s public and household debts are at their highest historical levels, respectively at 51% of GDP and 53% of GDP, and the private sector debt service ratio is becoming a burden for many companies, reaching on average 19.7% This records an increase from 13% before the crisis. Overall, China’s debt to GDP is fast approaching an unprecedented 320%!” – bto: Wie schrieb ich schon vor Jahren: Schuldenwirtschaft nach westlichem Vorbild.

Quelle: Zero Hedge

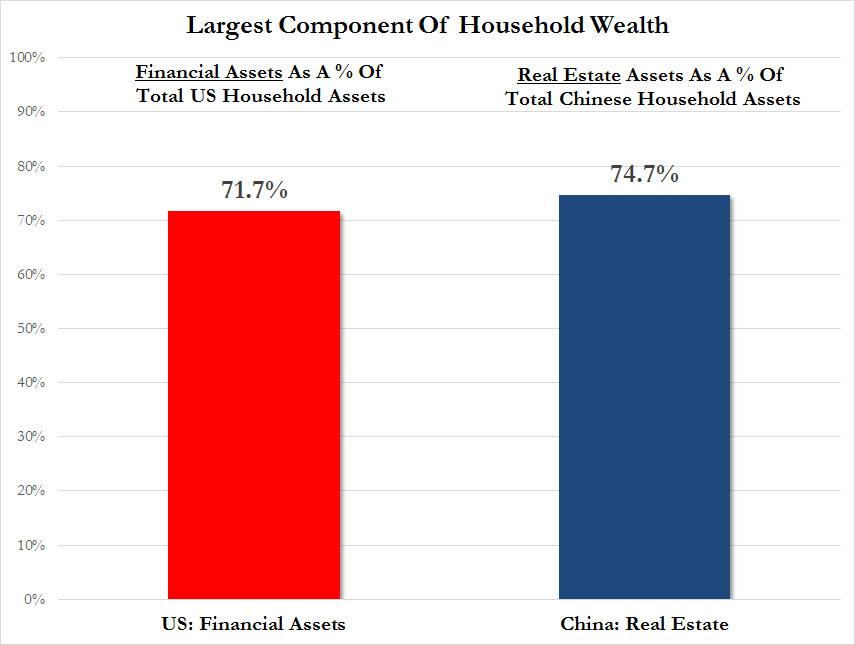

- “(…) the PBoC will probably refrain from massive easing as long as the real estate sector remains well-oriented. As we have discussed here extensively in the past, Chinese housing is the key economic sector for China’s growth as it represents around 75% of Chinese people’s wealth (in the US, it is financial assets that are the primary source of household net worth).” – bto: China macht ernst in seinem Bemühen, die Abhängigkeit von Krediten zu reduzieren.

Quelle: Zero Hedge

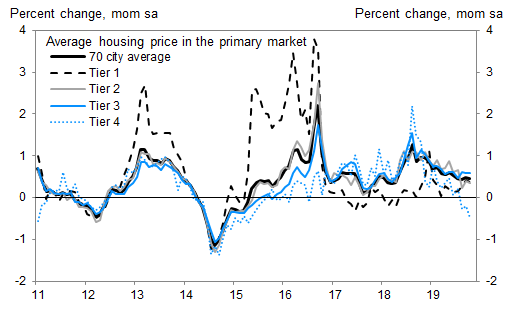

- “(…) China’s real estate sector is still at high level compared with previous years, running slightly above 10% YoY in last September.” – bto: auch hier langsameres Wachstum, aber eben noch Wachstum.

Quelle: Zero Hedge

- “(…) that high credit intensity combined with resilience in the real estate sector will push the PBoC to be in wait-and-see position until the end of the year and to adopt a fine-tuning policy in 2020 if needed. (…) China is actually deliberately slowing the economy in hopes of buying more time to enjoy economic stability, well aware that one wrong move with 320% debt/GDP could lead to catastrophe.” – bto: Da bin ich nicht so sicher. Da wir ohnehin in den kommenden 1zehn Jahren einen globalen Schulden-Reset bekommen, müssen wir uns anders darauf einstellen. Wer da nicht voll dabei ist, ist der Dumme.

- “Incremental global growth is no longer driven by the Fed, the ECB or BOJ. It is driven by China. They’re deliberately slowing. And only a contraction in the real estate sector will get them to stimulate. (….) Contrary to previous periods of slowdown, notably in 2008-2010, 2012-2014 and in 2016, China is unlikely to save the global economy once again.” – bto: Ich würde sagen “vorerst”. Wenn es schlimmer wird, werden auch die Chinesen wieder aufs Gas drücken.

- “Needless to say, without China – which has created 60% of all new global debt over the past decade – there can be no global recovery.” – bto: außer wir bekommen den New Green Deal …