Weshalb auch Trump nichts an der Eiszeit ändern kann

In der Vergangenheit habe ich regelmäßig Beiträge von GMO kommentiert und verlinkt.

→ „Quantifying the Fed’s Impact on the S&P 500“ – erheblich

→ Staatsschulden – wirklich so schlecht?

→ Kritischer Blick auf die USA

→ Maue Renditen mit allen Assets – im besten Fall

→ „Der Aktienmarkt ist abscheulich teuer“

→ A CAPE Crusader – A Defence Against the Dark Arts

→ Eiszeit an den Kapitalmärkten

Heute bringe ich (erneut) einen Beitrag des angesehenen Assetmanagers, der zeigt, dass es strukturelle Gründe für geringeres Wachstum und damit auch schlechtere Erträge an den Kapitalmärkten gibt:

- “The key metric that I believe has driven market valuations upward in recent years and could conceivably drive them right back down is short-term interest rates: So much of this comes down to a question of whether cash rates over the next 10, 20, or 50 years will look like the ‘old normal’ of 1-2% above inflation or whether they will look more like the average of the last 15 years of about 0% after inflation. The scenario where they average 0% real is what we have referred to as ‘Hell,’ whereas the other scenario is ‘Purgatory.’” – bto: Das ist die Kernfrage – eine Eiszeit oder eine Anpassungskrise an den Märkten, die uns erlaubt, später wieder ordentliche Erträge zu bekommen.

- “(…) it has been the extended period of time in which extremely low interest rates, quantitative easing, and other expansionary monetary policies have failed to either push real economic activity materially higher or cause inflation to rise. The establishment macroeconomic theory says one or the other or both should have happened by now.” – bto: und zwar schon vor Jahren. Hat was damit zu tun, dass wir uns in einem Umfeld von Überschuldung und damit in Deflation befinden.

- “It seems to us that there are two basic possibilities for why the theory was wrong.”

- “The first is a secular stagnation explanation of the type proposed by Larry Summers and others. This line of argument can be boiled down to saying that the reason why exceptionally easy monetary policy has not been particularly stimulative and/or inflationary is that the ‚natural‘ rate of interest has fallen to extremely low levels relative to history. This means that the apparently extremely easy monetary policy has not, in fact, been particularly easy.” – bto: Deshalb sollte man noch mal so richtig Gas geben, um die Wirtschaft aus der Krise zu bekommen. Etwa das, was nun Trump andeutet.

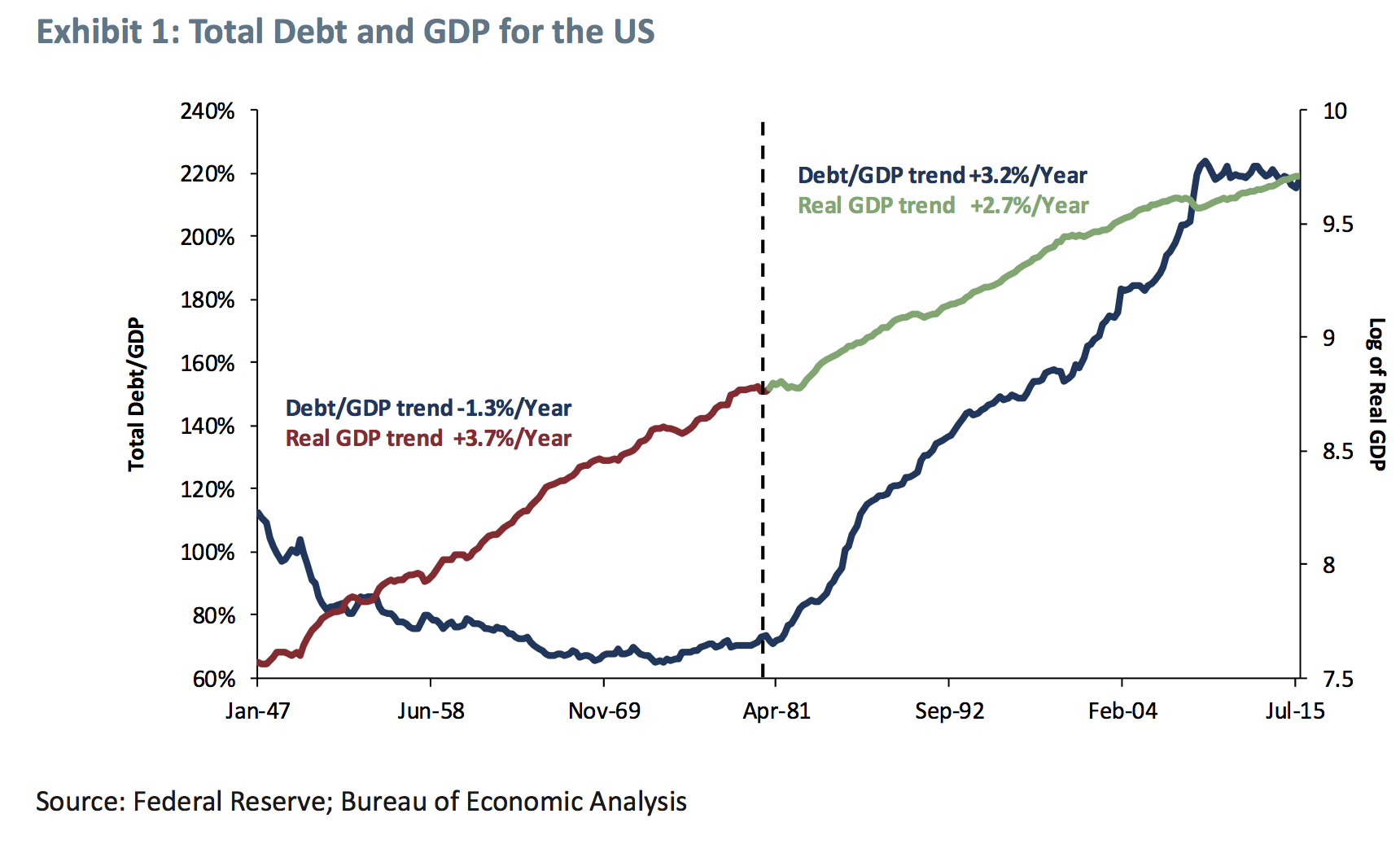

- “If this argument is correct, then we should see that as interest rates rise to levels that are still low by historical standards, they will choke off economic growth. Part of the plausibility of this argument comes from the fact that debt levels have grown steadily and massively in most of the developed world over the last 30 years, so it is easy to imagine that indebted households and corporations could run into problems if rates were to back up even 200 basis points from the recent lows.” – bto: Ich bin eher in diesem Lager. Nicht, weil ich die These der säkularen Stagnation teile, sondern weil ich finde, dass die hohe Verschuldung nur mit Null-Zinsen tragbar ist.

- “The second possibility for why extraordinarily easy monetary policy has not had the expected effects on the economy and prices is an even simpler one: Monetary policy simply isn’t that powerful. This line of argument suggests that the reason why monetary policy hasn’t had the expected impact on the real economy is that monetary policy’s connection to the real economy is fairly tenuous.” – bto: Ich denke, es ist beides und es hängt zusammen.

- “(…) if debt increases and easy monetary policy are such a boon to economies, why haven’t we seen any boost to growth as debt has grown relative to GDP? (…) The build-up of debt since the 1980s certainly hasn’t coincided with a speed-up in GDP growth, or even evidence of an economy straining to run faster than its potential growth rate.” – bto: Das liegt an der unproduktiven Verwendung der Schulden.

- “If the secular stagnation theory is correct and equilibrium interest rates have fallen a lot, we should expect to see rising interest rates slow the economy considerably, and the Federal Reserve will find itself unable to raise rates as much as it is planning to. The economy will either slide back into recession, causing rates to come right back down (…).” – bto: Das wäre mein Szenario.

- “If, on the other hand, the “monetary policy doesn’t matter” explanation holds true, then the economy has every reason to power through the Federal Reserve’s gradual rate rises without too much trouble.” – bto: Das wäre wirklich erfreulich, wenn auch schlecht aus Sicht der Investoren.

- “This will, of course, push up bond yields. Higher bond yields will provide some competition for stocks in portfolios and the higher cost of debt will discourage corporations from taking on ever-increasing amounts of debt in order to buy back stock. P/Es may, at long last, come back down to levels consistent with their longer history of somewhere in the middle to upper teens. Investment portfolios will take a hit, but we will at least be back to a level of valuations where investors can expect to earn the kinds of returns they need in the long run. It will be Purgatory, and while Purgatory is painful, it is finite.” – bto: genau. Kurzfristig schmerzhaft, langfristig aber eine Normalisierung, die allen hilft.

- Zum Ziel höherer Wachstumsraten in den USA: “While labor participation rates have fallen, (…) there are only about two million people who could be coaxed back into the workforce by a strong economy, and even a very optimistic reading of the data would put that number at around five million.” – bto: Das ist ein wichtiges Argument, das ich selbst übersehen habe. Es gibt also eine nachhaltige Grenze für die Steigerung der Wachstumsrate in den USA.

- “(…) but it should be remembered that such marginal workers would be unlikely to be particularly productive. In general, it is the least trained, productive, and employable who were the ones to drop out of the workforce, and they are likely to be employed in relatively low wage and output jobs if they are coaxed back in.” – bto: Das kommt noch hinzu.

- “And even if we can get those additional millions into the workforce, it would be a one-off benfit to GDP.” – bto: Ein einmaliger Boost, der zudem die nachhaltige Wachstumsrate dämpft, weil es vor allem weniger produktive Jobs sind.

- “Sustained high growth in the context of a slowly growing population requires fast productivity growth, which the US economy has been particularly bad at delivering of late.” – bto: Das gilt nicht nur für die USA, sondern für den gesamten Westen, der in der Eiszeit gefangen bleibt.

- “The current trend looks to be something south of 1.5%, and population growth is set to add somewhere between 2-0.5% to the workforce over the coming decade, absent a change in labor participation rates or a burst of immigration.” – bto: Das ergibt rund zwei Prozent reales Wachstum pro Jahr.

- “While it is tempting to believe we can return to the 3% productivity growth that we saw for the decade ending in 2005, the reality is that is probably a pipe dream. The overwhelming driver of the spike in productivity in that decade was the extraordinary growth in production of IT equipment, which grew at 10% real per year for the decade ending in 2005, despite a declining number of people employed.” – bto: Vielleicht gibt es ja einen neuen Boom. Nur darauf setzen würde ich nicht.

- “Deceleration looks more likely. Even the most plausible productivity breakthrough for the next 5-10 years, autonomous vehicles, seems much more likely to be a job killer than job creator.” – bto: Das gilt für alle Innovationen. Die Automatisierung wird massive Folgen haben. Diese sehe ich bekanntlich positiv, geben sie doch eine Alternative zur Zuwanderung.

- “(…) it’s possible that looking at the trailing 10-year number understates how slow productivity growth has gotten, as productivity over the last 3 and 5 years has averaged 0.7% and over the last 12 months a nice round 0%.” – bto: In Europa dürfte es nicht besser aussehen.

- “Attempting to grow a 1.5-2% economy at 4% is a recipe for inflation (…) Any acceleration of inflation will require far faster interest rate increases than is generally being priced in and we will likely learn relatively quickly whether the economy can withstand those increases.” – bto: und damit auch die Finanzmärkte!

- “It seems more or less impossible that the right interest rate level for an economy growing at 4% would be 0% real (…) and with it a big part of the justification for higher P/Es for the stock market. And while the faster growth would seem at first blush to be a big plus for equities – after all, it would mean that corporate revenues will grow significantly faster than they have been – our best guess is actually that faster growth might well be associated with a stock market trading at significantly lower valuations than today.” – bto: Wann würden die Märkte reagieren?

- “In fact, for an economy in which consumption is around 70% of output, one can make the argument that a necessary condition of sustained strong economic growth would be the share of income going to labor going up from here. This would almost certainly require corporate profits to fall as a percent of GDP. And if profit margins fall materially, even a moderate acceleration of revenue growth would lead to falling, not rising, overall profits.” – bto: Das wird ohnehin passieren, schon alleine aufgrund des politischen Drucks. Vor allem der Finanzsektor dürfte erneut getroffen werden.

- Schlussfolgerung GMO: “If Trump’s policies work or if they otherwise demonstrate that we are not stuck in secular stagnation, it’s bad for stocks and bonds and good for the economy. If we wind up back in recession, it’s good for bonds and not necessarily terrible for stocks because valuations can stay high, buoyed by low cash and bond rates.”

bto: In den nächsten 18 Monaten dürften wir wissen, wie es ausgeht. Ich setze auf tiefere Börsenkurse, aber nicht, weil wir die Eiszeit überwinden. Nur temporär, weil der Zinsanstieg die Bewertungen drückt, bevor die Notenbanken in die nächste Runde gehen.

In der Tat drückt die Hohe Verschuldung das Wachstumspotential. Hinzu kommt eine immer stärkere Reglementierung und Büroktatiesierung welche die Produktivität massiv beeinträchtigen und Investitionen behindern. Strategisch war es ein Fehler, dass die Geldmengenausweitung der Notenbanken über Aktienrückkäufe und ähnlichen letztendlich die Verschuldung weitererhöht hat. Man hätte parallel zu den Zinssenkungen Aktienrückkäufe für deutlich verschuldete Unternehmen wesentlich erschweren und direkte Beteiltigungen (auch über Kapitalerhöhungen) im Vergleich zu reinen Finanzanlagen begünstigen müssen. Dann wären die Firmen wesentlich schwächer verschuldet. Dadurch wäre auch das Potential für Investitionen und Geschaäftsausweitungen wesentlich größer wenn man die oben genannten Wachstumshemmnisse reduziert. Aber die weiter gestiegende Verschuldung dämpft nun natürlich zusätzlich jede positive Dynamik und macht die Wirtschaft kriesenanfälliger.

Spannend ist heute vor allem die Frage, senkt das FED den Zins um 25 oder um 50 Basispunkte?