Eiszeit an den Kapitalmärkten

Das Szenario der Eiszeit trifft Realwirtschaft und Kapitalmärkte gleichermaßen. In einem Umfeld von geringem Wachstum, schwachen Produktivitätsfortschritten, stagnierender bzw. schrumpfender Erwerbsbevölkerung und hoher Verschuldung kann die Realwirtschaft keine großen Sprünge machen. Ein Umfeld geringen Wachstums ist per Definition auch ein Umfeld geringer Kapitalerträge. Vor allem wenn die Notenbanken alles daran gesetzt haben, zukünftige Erträge in die Gegenwart zu holen. Alle Finanzassets sind zur “Perfektion” gepriced. Es gibt nicht mehr viel Luft nach oben.

Das meinen auch die Experten von GMO, die ich an dieser Stelle immer wieder zitiere:

→ „Quantifying the Fed’s Impact on the S&P 500“ – erheblich

→ Staatsschulden – wirklich so schlecht?

→ Kritischer Blick auf die USA

→ Maue Renditen mit allen Assets – im besten Fall

→ „Der Aktienmarkt ist abscheulich teuer“

→ A CAPE Crusader – A Defence Against the Dark Arts

Hier nun die Erkenntnisse aus dem letzten Quartalskommentar:

- “In most of the economic ways that count, the years following the financial crisis have been somewhere between disappointing and unspeakably bad. Economic growth in the developed world has been slower than at any comparable period barring the Great Depression. Productivity growth has been the worst since the invention of GDP and corporate investment has remained stubbornly low.” – bto: die Eiszeit eben.

- “After a burst of growth in the emerging world associated with China’s enormous stimulus policy of 2008-10, growth has also come to a crawl in the emerging economies, laying bare corruption and structural problems that appeared to be minor when times were better.” – bto: was typisch ist. In den schlechten Zeiten ist die Toleranz der Gesellschaft dafür geringer.

- “But in one way, the last seven years have been a glorious success. Performance of most financial assets has been very strong, with assets from US equities to global real estate and infrastructure to credit and government bonds all giving strong returns.”

- “We have been conditioned to think of stocks and bonds as complements to each other, with one doing well when the other does poorly. In this cycle, we’ve gotten an almost magical benefit, where on a daily basis the correlations have been negative, but over the full seven years both assets have gone up strongly, along with most other assets.”

- “We believe further that it is important to realize that the strong returns to the assets that have done well over the last seven years are at best a one-off benefit and, more plausibly, will have to be given back over time. To us, this suggests that while alternatives have been a drag on institutional portfolios over the last six or seven years and privates (real estate, private equity, venture capital) have been a boost, in coming years the reverse may well be true.”

- “The assets that have done well do not necessarily share that much in common, but they do all share a structure that they embody at least somewhat predictable cash flows that will occur over an extended period of time. The value of those cash flows changes materially if the discount rate applied to those cash flows changes.” – bto: Das ist der entscheidende Punkt!

- “(…) all of these assets can readily be valued through a discounted cash flow process, and the sensitivity of the present value to a change in the discount rate is precisely analogous to the duration of a fixed income security.”

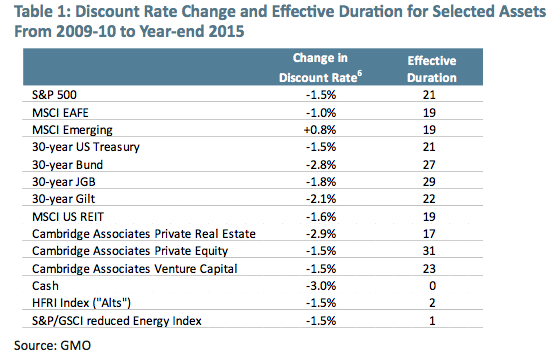

- “Table 1 shows an estimate of the change in the discount rate from a 2009-10 average to year end 2015 along with the effective duration of the asset class with regard to that change:”

- “(…) the striking discrepancy is between the first 11 asset classes and the last 3. For any asset with a long duration, the discount rate fall has been a decided positive for returns for the asset class. But for short duration assets, it has actually been a negative. This occurs because there are two sides to the fall in discount rates. It increases the present value of distant cash flows, but it also decreases the current income available on the asset. The negative side of this is simplest to think about in the case of cash. Cash is the purest short duration asset. If cash rates fall, there is no capital gain to enjoy, but the income earned in subsequent periods will be reduced.” – bto: Das gilt allerdings umgekehrt auch, was Cash dann attraktiver macht.

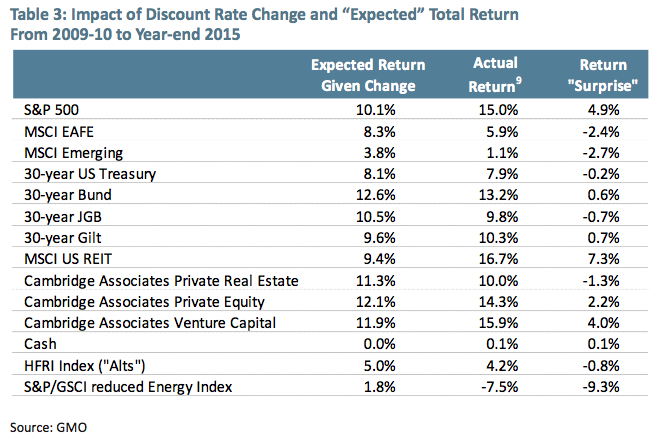

- Sodann vergleicht GMO den aus dem Fall des Diskontsatzes erwarteten Return mit dem tatsächlichen Return der Assets:

- “REITs have done surprisingly well behind pretty strong FFO (funds from operations) growth, the S&P 500 has done surprisingly well behind good earnings growth, and commodities have done impressively badly as boom turned to epic bust.”

- “In general, there has not been a particularly apparent rush into long-duration fixed income despite the strong returns, because the simple math of bonds is such that most investors realize intuitively that falling bond yields are a negative for future returns.”

- “(…) the trouble with returns that come from falling discount rates is that they represent an increase in the present value of the asset without any increase to the cash flows to the asset class. The future expected return to the asset has fallen, and in a way that more or less precisely counteracts the increase in current value. In other words, the present value of the assets has risen but the future value of the assets has not.” – bto: Die Zukunft ist also heute schon da!

- “Let’s say that you will need, with absolute certainty, $1 million in 2026. The safest way to reach that goal is to buy a $1 million face value 10-year zero coupon Treasury bond maturing in 2026. Such a bond currently has a yield of 1.625%, which means it will cost you $851,127 to buy it today. Assume that tomorrow the yield falls by 1% to 0.625%. Your brokerage statement will declare the value of your bond to be $939,596, a gain of over $88,000.”

- “You’ve just made over half of the necessary return over the next 10 years in a single day. But the value of that bond in 2026 has not changed at all. It has a fixed maturity value of $1 million. The only thing that has changed is the discount rate being applied to that cash flow, not the cash flow itself. Assuming you still need $1 million in 2026, there is no windfall to spend. Economically, nothing has changed for you, whatever your brokerage statement says.” – bto: Dennoch dürften die Gebühren steigen, man ist ja jetzt “reicher”. Übrigens noch ein Punkt in unserer Vermögensdebatte.

- “(…) the fact that the valuation of US equities has risen guarantees that the future returns to US equities from here will be lower than they would have been otherwise, and the same is true for all of the long-duration assets whose discount rates have fallen over the period.”

Spannend ist natürlich die Frage, was passiert, wenn die Zinsen wieder steigen sollten. Die Erkenntnisse von GMO kann man dann eigentlich nur so übersetzen: Es darf schlichtweg nicht passieren!

- “The most shocking hole that will be blown through people’s portfolios is if discount rates rise again fairly quickly. Even if the circumstance is one in which the global economy is doing well, the impact of a 1.5% increase in the discount rate on equities from here is a fall of over 30%, which would almost certainly be enough to swamp the earnings impact of the decent growth.” – bto: Die Annahme dürfte nicht falsch sein, dass in diesem Szenario die Assetpreise nach unten überschießen!

- “For a portfolio that is fully invested in long-duration assets (i. e., consists of a combination of stocks, bonds, real estate, and private equity), the possible performance implication is on the order of the falls experienced in the financial crisis – perhaps a 20-33% fall depending on the weightings – despite the fact that the global economy was doing just fine.”

- “So what can we do to protect portfolios against this possibility? One answer would be to hold cash, which, as a zero-duration asset, would be a beneficiary of rising discount rates. The trouble with cash, of course, is that if the discount rates do not rise, it is doomed to deliver little or nothing.”

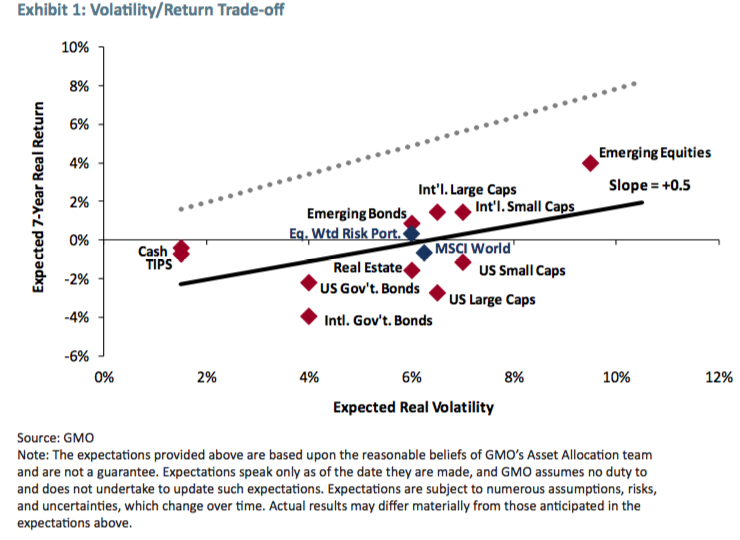

- “Today does not look like a great opportunity to reach for risk, despite the temptation in the face of unprecedentedly unattractive yields on government debt.Exhibit 1 shows a simple way of looking at the risk/reward trade-off available to investors today. It takes our seven-year forecasts for asset classes and plots the expected returns against expected volatilities for the assets.”

- “This tells us the general relationship between volatility and return available today. The slope of the line at equilibrium would be about 0.7. Today it is 0.5, although arguably even that flatters the attractiveness of risk assets because a fair bit of the slope comes from the extremely unattractive returns on offer from non-US government bonds, which today have an average yield of 0.16%, and most of the rest comes from emerging equities, which happens to be both the cheapest and most volatile asset of the group.” – bto: Die Idee, in Emerging Markets zu investieren, dürfte so blöd nicht sein.

- “The most striking thing about the chart is how low the regression line is on the page. The dotted line above shows what the line would look like at equilibrium. While it is true that today’s slope is somewhat flatter than normal, the striking difference is how much lower the line is on the page than equilibrium – four to five percentage points lower!“

- “(…) market prices give no indication that this is a good time to move risk up in your portfolio. Perhaps one could make an argument for taking close to a normal amount of risk, but certainly not more. And second, the expected return to a normal portfolio today is somewhere between meaningfully lower and stunningly lower than normal.”

“If the shift is permanent – the ‚Hell‘ scenario we’ve written of before (bto: Eiszeit!) – returns will be lower to all assets for which the discount rate has fallen, but at least the windfall gains will have to be repaid only very slowly. If the shift is temporary, we will wind up giving back the windfalls of the last six to seven years. The temporary shift scenario is better for investors in the long run, but it would be massively painful in the interim, because it will affect almost every asset in most investors’ portfolios.”

“There is no panacea for the low returns implied by asset valuations today. Anyone suggesting differently is either fooling themselves or trying to fool you. But piling into the assets that have been the biggest help to portfolios over the past several years, as tempting as it may be, is probably an even worse idea than it usually is. And a deeper analysis of what led returns to be disappointing for the asset classes that have lagged may help investors avoid the error of abandoning decent assets just when their time may be about to come.”