Nächster Schritt in die Eiszeit: der Währungskrieg

In einer Welt mit Überkapazitäten, Überschuldung, ungedeckten Verbindlichkeiten für eine alternde Gesellschaft und unzureichendem Wachstum, um die Lasten tragbar zu machen, ist es nur eine Frage der Zeit bis gilt: Jeder kämpft für sich alleine. Dazu gehören Protektionismus und Abwertung der eigenen Währung. Haben die USA – und alle anderen, wenn auch weniger laut – dieses Instrument schon in den letzten Jahren genutzt, stehen wir nun vor einer Neuauflage der massiveren Art, denkt Albert Edwards und bto schließt sich an:

- “SocGen’s Albert Edwards (…) brings attention to the barrage of recent tweets from President Trump indicating that ‘his tolerance for the strong dollar has just about run out’ (…) as the global economy falls ever closer towards outright deflation, Edwards predicts that ‘the global currency war will explode into life. Countries will fight to avoid deflation in the next recession and competitive devaluation will be the tool of choice.’” – bto: Wir wissen aus der Großen Depression, dass jene, die abgewertet haben wie Japan, besser gefahren sind. Wer weiß, wie Deutschland heute aussähe, wenn Brüning diesen Weg auch hätte gehen können?

- “Indeed this was the solution Ben Bernanke suggested in his famous 2002 speech about how to avoid ending up like Japan, to wit: (…) it’s worth noting that there have been times when exchange rate policy has been an effective weapon against deflation. A striking example from US history is Franklin Roosevelt’s 40% devaluation of the dollar against gold in 1933-34, enforced by a program of gold purchases and domestic money creation. The devaluation and the rapid increase in money supply it permitted ended the U.S. deflation remarkably quickly.” – bto: Das leuchtet auch ein. Es ist massive Monetarisierung und damit Entwertung von echtem Geld.

- “Edwards (…) writes, ‘it would not have missed President Trumps attention that while the US recorded an overall $625bn trade deficit in 2018, the eurozone ran a huge $600bn surplus (over 4% of GDP). By contrast China and Japan ran surpluses of only $100bn and a $10bn respectively.’ In other words, ‘when it comes to global trade imbalances China and Japan are not the problem’.” – bto: Richtig, und auch wer das Problem darstellt, ist für Leser von bto keine Überraschung. Es ist Deutschland, was am meisten vom schwachen Euro profitiert:

Quelle: SocGen, Zero Hedge

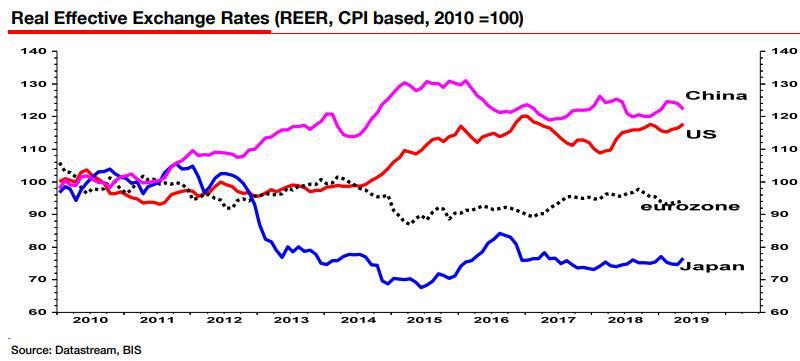

- “Edwards explains further, ‘there is no doubt that the dollar is overvalued, not just against the euro but against a basket of currencies. But so too is the Chinese renminbi (although the gap versus the US has narrowed as the Chinese have allowed the bilateral rate to slide towards $7.0/Rmb). But if you really want to see a major currency that is cheap, it is the yen and not the euro that stands out as anomalously undervalued (see chart below).’” – bto: Aber der Euro hat weniger Munition, um sich gegen den Dollar zu verteidigen, weil die Schwäche schon jetzt von der EZB organisiert ist. Normalerweise werten Währungen von Überschussländern auf. Siehe Schweiz.

Quelle: SocGen, Zero Hedge

- “When we talk about the burgeoning eurozone external surplus, we all really know that is shorthand for Germany (…)Germany’s overall current account surplus dominates the eurozone surplus and has been topping a massive 8% of its own GDP recently (although projected by the OECD to decline to 7.3% GDP this year).” – bto: Und wir legen die Überschüsse auch noch schlecht an. Was für ein Wahnsinn!

- “Germany now runs the biggest single dollar trade and current account surplus in the world. (…) until the eurozone crisis of 2011 (…) the eurozone periphery was the mirror image of Germanys huge current account surplus (see chart below). (…) The periphery acted as a sponge, soaking up German excess saving – and the overall eurozone, by and large, remained broadly in external balance with the rest of the world. Germany’s huge surplus was nobodys concern but the eurozone’s.” – bto: Das war, als wir große Forderungen gegen die heutigen Krisenländer aufgebaut haben und nun nicht fällig stellen können, sondern stattdessen mit TARGET2 umschulden zu Nullzins und ohne Tilgung.

- “(…) the problem for the rest of the world now is that under stringent post-eurozone crisis austerity, the eurozone periphery sponge has been totally squeezed out and the rest of the world is being now forced to soak up excess German saving (ie the mirror image of the current account surplus).” – bto: genau. Heute exportieren wir mehr in die Welt außerhalb der Eurozone, was zu weiteren Problemen führt. Das Chart ist schon beeindruckend:

Quelle: SocGen, Zero Hedge

- “(…) according to Edwards, the problem going forward is ‘it won’t just be Japan and the eurozone that will be trying to devalue their way far from the deflation quagmire, but also the US.’ Specifically, US authorities under the lead of President Trump will embrace Ben Bernanke’s 2002 advice of a competitive devaluation similar to that seen in 1933/4 like a long-lost friend.” – bto: Und ich denke, habe ich schon früher geschrieben, dass die EZB in diesem Spiel nicht richtig mitmachen kann.

- “A US recession and outright deflation could be closer than many suppose. The recent slide in US ISM manufacturing new orders relative to inventories warns us of a sharp and imminent GDP slowdown as does the recent weakness in Gross Domestic Income. The NY Fed Nowcast stands at only 1.5% for Q2 and 1.7% for Q3. The US economy is at stall speed and may even already be sliding into recession and outright deflation.” – bto: Und wir alle wissen, dass Deflation für die überschuldete Welt “game over” bedeutet.

- “the US will soon be forced by events to join the eurozone and Japan in aggressively fighting deflation. I expect that in addition to President Trump using auto tariffs as a weapon in the intensifying currency war against the eurozone (Germany), he will instruct the US Treasury (via the NY Fed) to intervene directly and unilaterally to drive the dollar lower – much lower.” – bto: Ich sehe auch die sehr hohe Wahrscheinlichkeit eines Angriffes auf die deutsche Automobilindustrie, die gerade besonders anfällig ist. Das beendet das Märchen vom reichen Land und stürzt Deutschland und die EU in die Krise.

- “Edwards writes that he is surprised the US ‘has not done so already, but any additional ECB easing will surely be the straw that will break the camels back. (…) With both the ECB and BoJ key policy rates already negative, it would be madness for the US Administration not to fight the global currency war on this battlefield in addition to all the others.’” – bto: Damit haben wir den Wettlauf nach unten.

- “Edwards reminds Japan watchers that the catalyst that tipped the country into outright deflation in the 1990s was a persistently strong yen, and he goes on to point out that ‘President Trump is not about to make that same mistake. Personally, I am surprised he has put up with the ECB winning the competitive devaluation game for so long. Expect the dollar to fall – bigly.’” – bto: und den Euro am Ende zu zerbrechen, würde ich ergänzen. Denn das überlebt die Eurozone nicht.

es gibt die Theorie eines globalen Dollar-Shortage- was für einen tendenziell starken Dollar spricht.

Aber welche Währungen würden im oben beschriebenen Szenario aufwerten(abgesehen von Gold und Crypto)? Im Prinzip haben alle entwickelten Staaten die selben Probleme und sollten sich daher an den Abwertungswettlauf beteiligen. Ich halte bestimmte EM für interessant.

„bto: Das leuchtet auch ein. Es ist massive Monetarisierung und damit Entwertung von echtem Geld.“

Was bitte schön ist Ihrer Meinung nach „echtes Geld“, was unterscheidet es von „unechtem“ und wie wird es entwertet in einem disinflationären Umfeld?

„Damit haben wir den Wettlauf nach unten.“

Es gibt keinen Wettlauf nach unten. Die Abwertung der einen Währung impliziert immer zugleich die Aufwertung der anderen Währungen.

Was treibt die Wechselkurse:

a) Langfristig die KKP/Inflationsdifferential

b) Mittelfristig Leistungsbilanzungleichgewichte sowie insbesondere das Zinsdifferential

c) Kurzfristig spekulative Erwartungen

d) Sonderrolle von Reservewährungen

Was spricht für einen schwächeren Dollar?

1. Eine Überbewertung des Dollar auf Basis realer effektiver Wechselkurse (KKP).

2. Die persistent hohen LB-Defizite der USA.

3. Eine Verringerung des Zinsdifferentials.

Insofern wäre eine Abwertung des Dollar kein Wettlauf nach unten, sondern eine längst fällige Korrektur der Überbewertung.

LG Michael Stöcker

Das Rechnungslegungssystem und sein korrespondierendes Rechtssystem gehen von der Konvention aus, daß für Eigenkapital und Fremdkapital, die gegeben werden an Unternehmen oder Einzelunternehmer positive Zinserträge gezahlt werden. Eine Verringerung der Zinsunterschiede würde, die US Zinsen derzeit nach unten befördern oder die EU Zinsen nach oben.

Ein Geldsystem das negative Zinsen als Konvention voraussetzt zerstört somit die bisherigen Grundsätze unserer Wirtschaftsverfassung.

Geld zu verschenken, also zu verringern wegen negativer Verzinsung, ist kein rationales Wirtschaftsgebaren einer Gesellschaft, die sich erhalten oder erweitern will.

ad ruby:

Verfügen Sie über Quellen, die diese gesellschaftliche Übereinkunft dokumentieren?

ad M.S.:

“Insofern wäre eine Abwertung des Dollar kein Wettlauf nach unten, sondern eine längst fällige Korrektur der Überbewertung.”

Wenn das so ist, warum wird das Mittel der Abwertung nicht eingesetzt via Fed-System, um der Politik “America first” Folge zu leisten (da Exporte deutlich günstiger würden)?

@Horst

Das Bundeswirtschaftsministerium legt nach Preisverordnung i.V.m. LSP einen kalkulatorischen Zinsatz von höchstens 6,5% fest.

Zum Öffentlichen Preisrecht eine Zusammenfassung

http://www.preisrecht-anwender.de/fachinformationen/das-oeffentliche-preisrecht/preisrecht-fuer-auftraggeber/

IMHO gilt Dr. Krall‘s Hinweis für den Krisenfall

der da wäre?

Markus Krall empfiehlt aus dem Euro auszusteigen und u.a. Dollar zu kaufen. Wenn man das hier liest kommen doch Zweifel. Welche Währungen soll man nun kaufen, welche verkaufen?

@Herrn Hansjörg Pfister:

Dazu äußert sich Dr. Krall ganz klar: einen zusätzlichen Mix aus verschiedenen stabilen Nicht-Euro-Währungen: US-$, Kanadische $, Neuseeland-$, Austral-$, Tschechische Krone, Singapur $ und – horribile dictu – das Britische Pfund, nicht aber den Schweizer Franken (wegen seiner Insellage im Euro). Außerdem einen Teil in Gold, das als Währung gilt. Das können Sie jederzeit auf youtube nachprüfen, wenn Sie Dr. Markus Krall eingeben und einige seiner Vorträge hören.

Seine Argumentation ist m.E. kurz, aber nicht schlecht. Ich würde nur den Schweizer Franken stabiler sehen als das Pfund und die tschechische Krone, aber das können Volkswirte besser beantworten.

@ SFR

Erwähnenswert finde ich, dass Dr. Krall nur 5-10% Anteil Gold empfiehlt.

@trooden: Finde ich auch bemerkenswert, vor allem, da er dazu rät, das Gold außerhalb der Jurisdiktion der EU zu halten. Umgekehrt hat er in seiner Vorträge mal das Thema Goldverbot erwähnt, das ja nicht nur in Deutschland, sondern auch in den USA lange Zeit gegolten hat. Er hat es nicht so explizit erläutert, aber ich meine ihn so verstanden zu haben, dass er durchaus auch politische Maßnahmen wie Goldverbote und -konfiskationen für möglich hält und daher nicht zu viel in Gold investieren will.

Das erscheint nicht unrealistisch. Bei einer Krise der Bundesrepublik dürften inländische Immobilien und Schließfächer die ersten Vermögensgüter sein, auf die der Staat zugreift.

In der 4. Novelle des Geldwäschegesetzes wurde in §24c KWG die Identifizierungspflicht für Schließfächer eingeführt:

“Für den automatisierten Abruf von Kontoinformationen werden die Kreditinstitute verpflichtet, eine Datei zu führen, in der die Nummer eines Kontos, das der Verpflichtung zur Legitimationsprüfung i.S.d. § 154 Abs. 2 S. 1 AO unterliegt, oder eines Depots sowie der Tag der Einrichtung und der Tag der Auflösung und der Name und – bei natürlichen Personen – das Geburtsdatum des Inhabers, eines Verfügungsberechtigten und eines wirtschaftlich Berechtigten zu hinterlegen sind.”

Für die nächstes Jahr anstehende 5. Novelle sieht der Referentenentwurf vor, die Melde-(und Identifizierungs-)pflicht beim Goldkauf von derzeit 10 Tsd. auf 2 Tsd. Euro abzusenken.

Listen von Goldkäufern und Schließfachbesitzern könnte man bei einem Verbot gut abgleichen und entsprechend kontrollieren. Ein Nachweis für den Verbleib des Goldes bei privater Lagerung könnte dann für die gelisteten Besitzer, die nicht im Schließfach lagern auch interessant werden.

Verhindert den Besitz von Gold nicht, macht ihn aber deutlich unattraktiver durch höheren Aufwand bei der Lagerung und fehlende Anonymität.

@ SFR

…und da Dr.Krall eben nicht WISSEN kann, wann der große Einbruch/Crash kommt erachte ich es als fahrlässig NICHT AUCH aktienorientiert investiert zu sein. Immer angepasst an die individuelle Situation.

Bei vielen grundsätzlichen Aussagen bezüglich “mehr Markt” stimme ich mit Dr. Krall überein.

Im Detail definitiv nicht bei allen.

Seine immer wieder gemachte Aussage ” 80% der Bankerträge seien Zinserträge”, die er als Basis für seine Crashprognose nimmt, stimmt für die von der EZB überwachten Banken nicht. Für einzelne Banken wird es stimmen, wahrscheinlich insbesondere für Sparkassen. Aber eben nicht für die große Masse.

Für die von der EZB überwachten Banken gilt: In Q1 2018 trugen die Netto-Zinseinnahmen zu 56,3%, im gesamten Jahr 2018 zu 58,6% und in Q1 2019 zu 58,3% zu den gesamten operativen Erträgen bei. 2015 waren es übrigens ~56% und 2016 und 2017 je ~ 57%

Und wenn sich der Markt ändert, das Geschäftsmodell der Banken/Sparkassen nicht schnell genug angepasst wird, dann ist es marktwirtschaftlich nur wünschenswert, wenn etliche Banken aus dem Markt ausscheiden müssen.

Insofern KANN es eben auch nicht oder erst sehr viel später zu dem Krall Knall Szenario kommen…

Da mich die gleiche Frage vor einiger Zeit beschäftigte, hatte ich ergebnisoffen recherchiert und war im Endeffekt bei einer ähnlichen Liste von Währungen für kurzlaufenden Staatsanleihen gelandet: US-$, Kanadische $, Australische-$ und das Britische Pfund.

Kriterien waren:

– Reservewährung / international verbreitet und relevant

– nennenswert positive Zinsen auf kurzlaufende Staatsanleihen (damit waren Euro, Yen und Franken raus)

– leicht handelbar (damit war Yuan raus)

Mag schon sein, dass der Dollar nach klassischen Maßstäben überbewertet ist. Aber vermutlich sind das die falschen Maßstäbe heutzutage… Außerdem, entscheidet nicht ohnehin der Markt die faire Bewertung ? ;)

Hier ein paar interessante Infos zu King Dollar…

https://www.thebalance.com/world-currency-3305931

Kurios finde ich die Relativität: In den USA gibt es Mahner, die rufen “Die Tage des Dollars sind gezählt, ihr müsste aus dem Dollar raus”. Hier machen wir und Sorgen um den € und suchen womöglich Schutz im US-$. Safe Haven ist halt auch relativ.

@troodon:

Sehe ich so wie Sie. Aktien müssen sein, es ist illusorisch zu glauben, dass ein deflationärer Crash als Prognose gesichert ist und man dann von kurzlaufenden Fremdwährungen problemlos auf hochkarätige Aktien umsteigen kann, die gerade auf tiefstem Niveau notieren. Wer sieht, wie manche Notenbanken Aktien kaufen (z.B. die SNB), der sollte genügend Phantasie haben, dass auch die großen Notenbanken wie die FED oder die EZB eines Tages massiv in Aktien einsteigen könnten. Und dann war es das mit der Kaufgelegenheit.

Das zweite ist die Ertragssituation der Banken. Erstens sinken die Nettozinserträge der Banken – wie Sie richtig feststellen – nicht so wie von ihm prognostiziert, zweitens werden inzwischen neue Einnahmemodelle kreiert (“Verwahrentgelte” = Negativzinsen, neue Gebühren für bisher kostenlose Dienstleistungen, höhere Gebühren für bereits kostenpflichtige Dienstleistungen, usw.) und drittens wird jetzt das erste Mal seit Jahrzehnten auf breiter Front bankenübergreifend auf die Kostenbremse getreten. Wenn man die riesige Zahl der Filialschließungen nimmt, den Stellenabbau (nicht nur bei der Deutschen Bank) und die Digitalisierungsinitiativen als Rationalisierungsinvestitionen begreift, dann sehe ich gute Chancen, dass die Banken das Jahr 2020 (in dem Dr. Krall den Crash sieht) überstehen. Wenn auch sicher mit Fusionen bei Sparkassen und Genossenschaftsbanken.

Viel mehr Sorgen als die Ertragslage der Banken macht mir inzwischen die Ertragslage ihrer Kunden. Wenn die Exportindustrie schwächelt, schwächelt schnell das ganze Land. Und dann auch die Erträge der Banken. Aber nicht wegen der schmelzenden Zinsmarge, sondern wegen der drohenden Sonderabschreibungen der Banken auf faule Kredite. Herr Dr. Krall erwähnt zwar auch diese Zombies, aber er sieht den Zusammenbruch der Banken als Auslöser für den Zusammenbruch der Zombies. Ich denke, es wird umgekehrt laufen. Die Zombies brechen zuerst zusammen und reißen die Banken in einem zweiten Schritt mit sich.

@ SFR

” Ich denke, es wird umgekehrt laufen. Die Zombies brechen zuerst zusammen und reißen die Banken in einem zweiten Schritt mit sich.”

Und genau da würde es dann spannend. Denn ob die Banken tatsächlich (in der breiten Masse) mit in den Abgrund gerissen würden, erachte ich eher als unwahrscheinlich. Eher würde dann weltweit nochmal staatlich gestützt werden oder im optimalen Fall schaffen es die Banken dies selbst zu verarbeiten. Käme auf die Größenordnung der neuen Ausfälle an.

Jedenfalls hätte auch dann kein Politiker ein Interesse daran, dass Banken/Finanzsystem komplett gegen die Wand fahren zu lassen. Die Rückwirkung auch auf dann eigentlich noch gesunde Unternehmen wäre zu groß mit den bekannten Folgen von Massenarbeitslosigkeit etc.

Man wird somit in der Eurozone versuchen, die Bankbilanzen die nächsten Jahre langsam weiter zu gesunden/weniger insolvent zu machen und dann die Zombie-Insolvenzen durch verschärfte Kreditregeln langsam, stückweise nachzuholen. Dies wäre aus heutiger Sicht das extrem positive Szenario…

@ Peter79

Danke für den Hinweis mit der kommenden Änderung der Identifizierungspflicht bzgl. Gold.

War mir bis eben nicht bekannt, habe es aber per googeln bestätigt bekommen.

@ troodon

>Man wird somit in der Eurozone versuchen, die Bankbilanzen die nächsten Jahre langsam weiter zu gesunden/weniger insolvent zu machen und dann die Zombie-Insolvenzen durch verschärfte Kreditregeln langsam, stückweise nachzuholen. Dies wäre aus heutiger Sicht das extrem positive Szenario…>

Sehe das auch so.

Auf dem Weg darf der Zug nicht entgleisen.

Deshalb bastelt man im Hintergrund fieberhaft – vermute ich – an einer Bankenunion und sonstigen Auffangfazilitäten mit dem ganz GROSSEN Back up aller Länder, die in der Eurozone sind.

Ich glaube, dass die Politik sich durchweg sicher ist, dass die Lage prekär ist, auch was dieses Gelingen betrifft.

@ D.T.

“Deshalb bastelt man im Hintergrund fieberhaft – vermute ich – an einer Bankenunion und sonstigen Auffangfazilitäten mit dem ganz GROSSEN Back up aller Länder, die in der Eurozone sind.

Ich glaube, dass die Politik sich durchweg sicher ist, dass die Lage prekär ist, auch was dieses Gelingen betrifft.”

Zustimmung. Zumindest an einigen Stellen -in der obersten Politik- dürfte dies der Fall sein. Man versucht den Zug nicht entgleisen zu lassen.