Liquiditätsspritzen der Notenbanken genügen nicht mehr

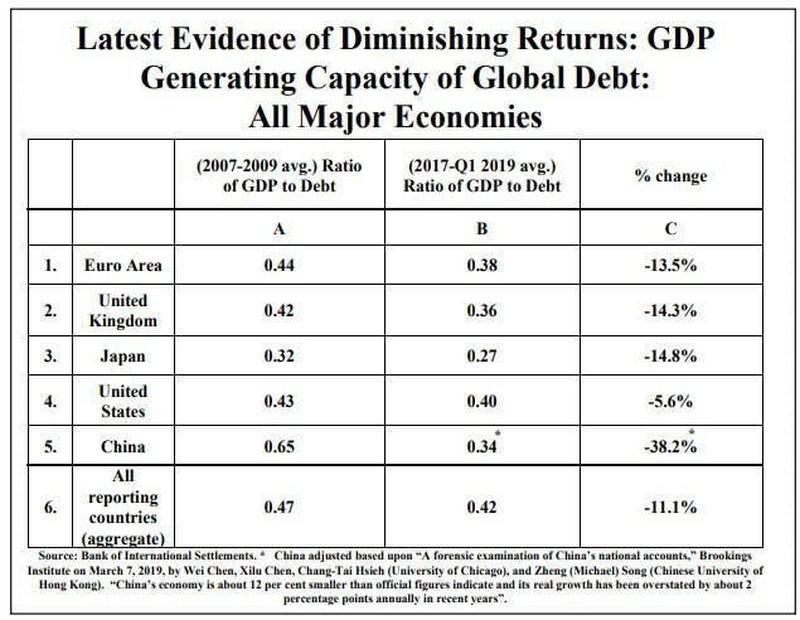

Wir wissen, dass die Wirkung neuer Schulden auf die Realwirtschaft immer weiter abnimmt:

Quelle: Zero Hedge, Hoisington

Gut möglich, dass es nicht nur einen abnehmenden Grenznutzen neuer Schulden gibt, sondern auch einen abnehmenden Grenznutzen von QE. In der Tat gab es schon vor Corona Anzeichen dafür. Nun wird das von der Bank of Montreal ausführlich diskutiert, hier via Zero Hedge:

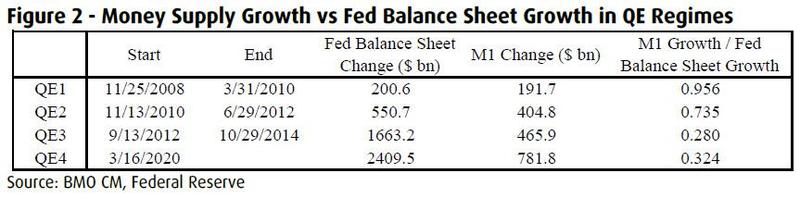

- “(…) the marginal utility of every new QE is now declining to the point where soon virtually none of the money created by the Fed out of thin air will enter the economy and instead will be stuck in capital markets, resulting in hyperinflation for asset prices even as the broader economy collapses. Or, as BMO’s Daniel Krieter writes, ‘QE has fed through to the real economy in a slower manner than previous QE campaigns’ and for each dollar the Fed’s balance sheet has grown, M1 money supply has increased about $0.32, compared to $0.96 and $0.74 in QE1 and QE2. ‘The expansionary policy thus far has mostly resulted in increased asset prices’ (…).” – bto: Das klingt sehr einleuchtend und passt zur stetig fallenden Umlaufgeschwindigkeit des Geldes.

- “Traditionally, as BMO explains, we analyze the business cycle from a classical economic perspective where monetary authorities are more passive and ‘the invisible hand’ guides economies. (…) In an expansionary phase, prices and consumption are increasing. Because prices and investment opportunities are high, demand for money among consumers/businesses is high, and interest rates (r) increase alongside borrowing. When r rises to (high), consumption slows, earnings fall, and a recession ensues. (…) as uncertainty and risk aversion grow. This is a ‘business cycle’ recession.” – bto: immer in der Annahme, dass es sich um ein nicht manipuliertes System handelt.

- “In recession, r falls as consumption remains low as long as it is greater than (the rate accepted by the potential borrowers). (…) At some point, (interest rates are low enough). Once this happens, consumption/ investment picks up and the economy enters recovery.” – bto: Auch das ist bekannt und deckt sich mit Ray Dalios Economic Machine.

- “Unfortunately, since 1913, theory has not worked due to the intervention of the Fed. So now let’s look at how all this works in reality, and introduce an active central bank with a wider range of monetary policy tools at its disposal.” – bto: was wir bekommen, ist klar: Manipulation der Zinsen, um Rezessionen zu verhindern bzw. zu verkürzen.

- “As the economy cools, the central bank lowers interest in an attempt to spur consumption. Consumption increases in response, and recession/defaults are avoided. But business resources aren’t returned to the economy. Recovery will be less robust due to fewer relative attractive investment opportunities. As Krieter argues, this was the experience of 2001.” – bto: Das ist wiederum interessant, denn die Argumentation ist weniger, dass die schlechten Schuldner nicht ausscheiden – die man dann als Zombies beschreiben kann –, sondern, dass es sich generell nicht mehr so lohnt.

- “After 2008, (…) The Fed moves rates lower, but is constrained by the zero bound. In order to further ‘lower r’, the Fed embarks on asset purchases during QE and is successful in spurring consumption, as evidenced by the strong correlation between increases in excess reserves and increases in M1. M1 is the most basic measure of money supply and includes essentially only cash and checking/demand bank accounts.The theory is that for a good or service to be consumed, it must be paid for out of M1. Therefore, the increase in M1 following QE is a measure of the degree to which QE results in actual consumption.” – bto: Es hat also am Anfang wie gewünscht funktioniert.

- Trotzdem war der wirtschaftliche Schaden enorm, weil die Regierungen etwas zu langsam reagiert haben: “In the end, almost a trillion dollars’ worth of debt was affected by default in 2008/09, but QE certainly prevented actual defaults from being likely exponentially greater. BMO notes however that defaults avoided were once again economic resources that were not returned to the economy and barriers to entry that are not lowered. This argues that attractive investment opportunities following the financial crisis were not as abundant as the depth of recession would suggest.” – bto: einfach deshalb, weil die Bereinigung verhindert wurde.

- “(…) the problem is that QE appears to be experiencing diminishing returns, as evidenced by a falling correlation between excess reserves and M1 in successive episodes of QE following the financial crisis. As QE leads to a direct increase in bank reserves, only a fraction is translated into money supply growth, and thus potentially consumption and investment. QE1 was highly effective and an important factor behind pulling the economy out of recession. QE2 had a marginally lower, but still high, follow through of .735 indicating that on average, $0.74 of each dollar of QE translated to increased money supply. We observe elevated inflation and personal consumption rates during the period of QE2 as evidence of its effectiveness. However, during Q3, the correlation fell to just $0.28 and resulted in very little inflation of GDP growth. Through this lens, the impact of QE on the real economy has diminished over time.” – bto: vermutlich auch deshalb, weil die Verschuldungskapazität immer mehr abgenommen hat.

Quelle: Zero Hedge, BMO

Woran könnte das liegen?

- “Diminishing marginal utility of consumption: QE (and monetary policy) is often referred to as “borrowing from the future”. However, there is only a limited amount of future consumption that can be pulled into the current period via monetary policy. This could apply to consumption of durable goods: as rates have been relatively low for a long period of time, demand for credit no longer increases at the same rate with incrementally lower interest rates. At some point, consumption does not bring sufficient to utility no matter how low prices or interest rates are.” – bto: Man kann nicht mehr und/oder will nicht mehr.

- “Wealth disparity: Wealth disparity exacerbates the impact of diminishing marginal utility of consumption. (…) QE tends to inflate the price of financial assets, making those who own the assets more wealthy. A large percentage of QE money ends up in the hands of the wealthy, whose consumption patterns are unlikely to change in response to a near term increase in wealth.” – bto: was übrigens dafür spricht, dass man mit dem Geld direkte Ausgabenprogramme finanziert.

- “Inflation expectations: Finally, the crux of monetary policy plays on expectations. Inflation is self reinforcing as demonstrated by a very high correlation between inflation and inflation expectations. Around the introduction of QE, there was an expectation that it could spawn runaway inflation. Having been through multiple rounds of QE without a large increase in inflation, people have likely generally come to understand that QE is not likely to result in inflation, therefore there is marginally less impetus to consume now.” – bto: Auch das stimmt natürlich. Es gibt eine stärkere Neigung, anzunehmen, dass man keine Inflation erzeugen kann. So auch die Reaktionen, die ich bekomme, wenn ich nun für die kommenden Jahre höhere Inflation für wahrscheinlich halte.

- “Following five years of no QE in the United States, it appears the utility of current QE has increased modestly in comparison to QE3. However, the follow through to consumption still remains well below levels experienced between Q1 and Q2. It is likely then that current QE is unlikely spurring much consumption as r isn’t influenced lower (via money supply increase) as much as in the past and likely remains (too high).”

- “(…) when people are afraid to their leave their house for fear of infection, future consumption actually is more attractive than current consumption. So r* is arguably negative for fundamental reasons for the first time. Greatly heightened uncertainty only pushes it even further negative.” – bto: Der “natürliche Zins” ist in diesem Umfeld also negativ, weil späterer Konsum mehr Nutzen verspricht als heutiger – oder auch erst später möglich ist.

- “When money supply goes up, but consumption fails to be generated (because r remains well above r*), then savings rates mathematically increase. Therefore, the prices of financial assets increase generally.

- This, according to BMO, is what’s driving the paradoxical relationship between bond and equity prices in recent weeks, and explains why stocks are performing so well despite the outlook for the greater economy. Money supply that doesn’t translate into consumption must result in higher financial asset prices until defaults result in wealth destruction.” – bto: Das klingt nett, aber Pleiten werden doch weiter verhindert. Geht es also dauerhaft gut?

- “During that time, one of two things will happen. Either the government will continue to assist companies in avoiding bankruptcy, or it will not. If it does, confidence (and r*) will likely return relatively more quickly at a huge cost to the government. However, there will not be a large return of economic resources at the end of this recession and the ensuing recovery will be disappointing given the degree of economic pain currently being felt.” – bto: Es wäre die Fortsetzung der Entwicklung, die schon lange sichtbar ist.

- “If it does not, defaults could potentially reach historic proportions, and the recession will be long and painful. However, using the ‘ripping the bandaid’ analogy, this scenario would result in likely the largest return of economic resources in the history of the country and lead to a very powerful economic expansion in the wake of the current recession.” – bto: Da bin ich mir nicht so sicher. Es gibt ja diese Diskussion auch mit Blick auf die Maßnahmen nach der Großen Depression.

Wie problematisch die Verschuldung der Unternehmen in den USA schon vor Corona war, habe ich u. a. hier diskutiert:

→ Löst General Electric die nächste Finanzkrise aus?

Nun zur aktuellen Entwicklung:

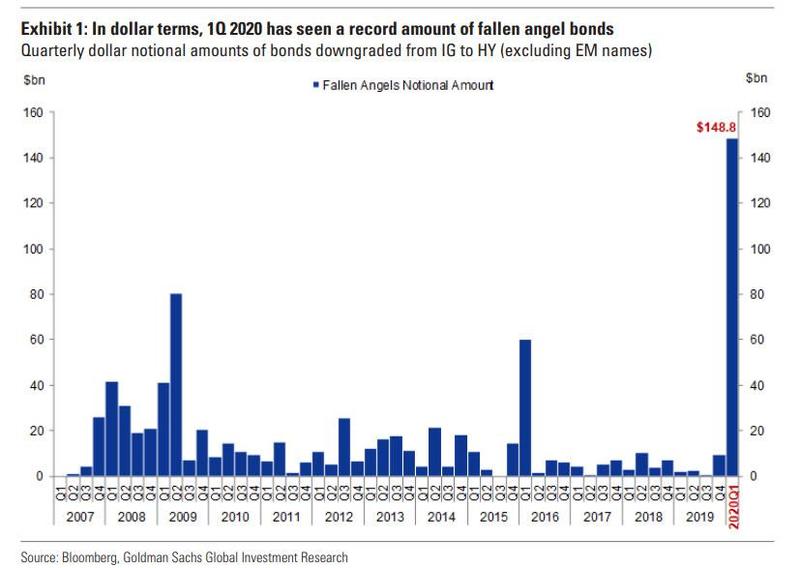

- “Moody’s recently expanded its ‘B3 Negative and lower list’ which soared to its highest tally ever — 311 companies. That tops a former peak of 291 companies, reached during the credit crisis of 2009 and the commodity-related downturn in April 2016. At 20.7% of the total rated spec-grade population, the list also shot up above its long-term average of 14.8%, and closing in on its all-time high of 26.1%. This spike is the result of the confluence of a coronavirus outbreak, plunging oil prices, and mounting recessionary conditions, which created severe and extensive credit shocks across many sectors, regions and markets, the effects of which are unprecedented.” – bto: Das kann und sollte nicht wundern, ist es doch normal, dass in einer solchen Krise die Unternehmen unter Druck geraten. Zumindest wurde schon ein Rekord aufgestellt. So viele Unternehmen haben noch nie ihren Investment-Grade-Status verloren:

Quelle: GoldmanSachs, Zero Hedge

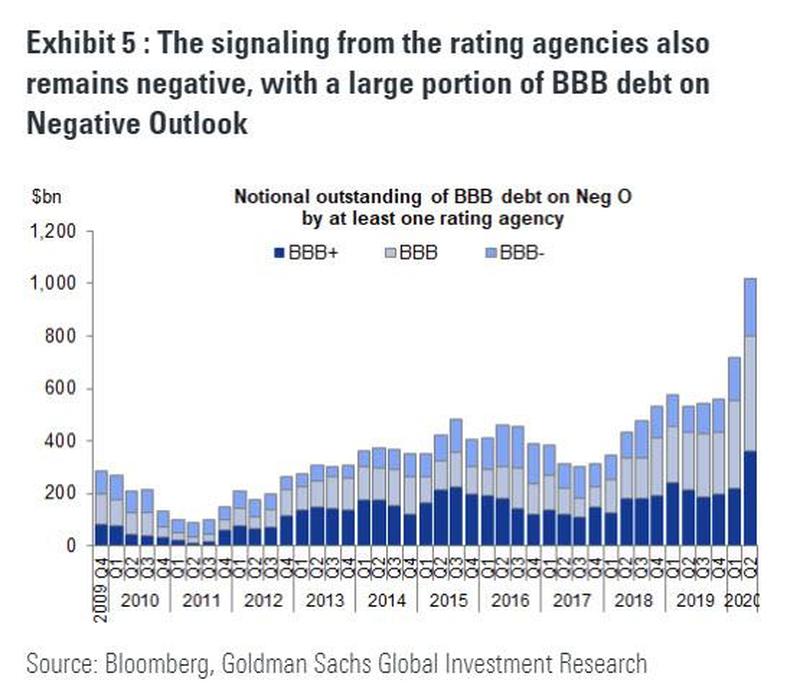

Und weitere werden folgen:

Quelle: GoldmanSachs, Zero Hedge

Doch zurück zu dem Szenario für die Börse:

- “What does this mean for risk assets? It means that risk assets are being technically supported by stimulus measures so far, particularly QE that is no longer as effective as it was. However, a large wave of defaults is unavoidable without an unlikely near-term (and complete) solution to COVID-19. Heavy defaults, will likely bring about another wave of risk asset price weakness as wealth is destroyed and technical upward pressure on financial asset prices and a higher percentage of savings demand is met with safe haven assets.” – bto: Müssen wir eine solche Pleitewelle erwarten oder wäre es nicht denkbar, dass Pleiten ab sofort abgeschafft sind?

- “This also explains why the Fed was compelled to enter the bond market, as absent a direct intervention in the secondary market, bond prices would crater and trigger a self-fulfilling doom-loop, where lower bond prices lead to higher defaults, lead to even lower prices and so on. For now, the Fed has managed to delay this process but there is only so much Powell can do to offset the collapse in fundamentals which will lead to continued ratings erosion, and the eventual defaults of countless companies, many of which the Fed will be directly invested in. At that point, the Fed’s action in the ‘market’ will become the topic of non-stop Congressional hearings, and will culminate with doubts emerging about the viability of the dollar as a reserve currency.” – bto: Andererseits ist es ein weltweites Phänomen. Damit könnte es sein, dass es keinen Kollaps des Dollars gibt, weil er letztlich immer noch viel besser dasteht als Euro und Co.

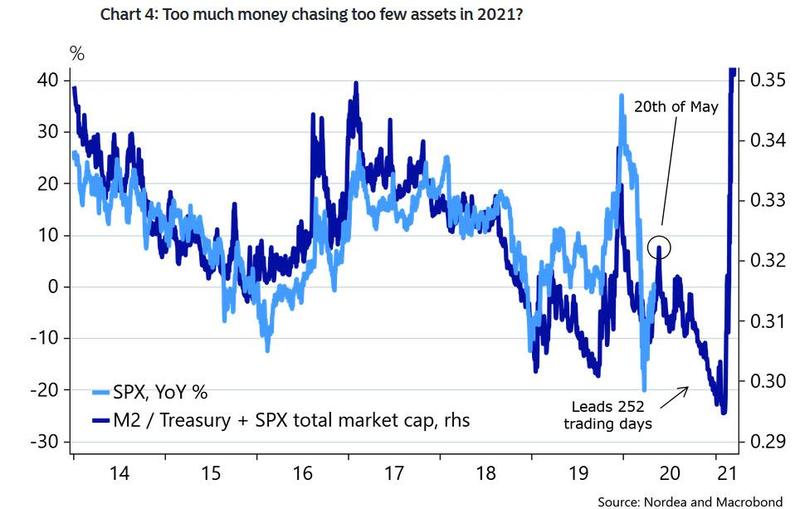

- “Until this trigger level is reached, however, QE will continues to pose a technical tailwind, influencing financial asset prices higher. This can be sustained until default rates increase, which is likely not until June or later as government stimulus money starts to run dry, and which point assets will likely take another nosedive lower, (…) What happens then? Risk assets will continue to slide into the election and into 2021, at which point as Nordea showed last week, we will hit a point where the lagged effect of the flood central bank liquidity will finally hit into the S&P500, and result in one final explosion in risk assets, sending stocks over 40% higher (…) although not of a benign nature but more of what one would expect to see in the Caracas or Weimar stock market.” – bto: der inflationäre Schub? Es sind zumindest spannende Gedanken.

Quelle: Zero Hedge

→ zerohedge.com: “‘Biblical’ Wave Of Bankruptcies Is About To Flood The US”, 7. Mai 2020