Kann die EZB noch handeln – oder nicht?

Eine der spannenden Fragen für die kommenden Monate und Jahre dürfte sein, ob die EZB überhaupt noch handeln kann, um eine Rezession und eine Deflation zu verhindern. Zumindest mit Blick auf Italien verdüstern sich die Aussichten immer deutlicher:

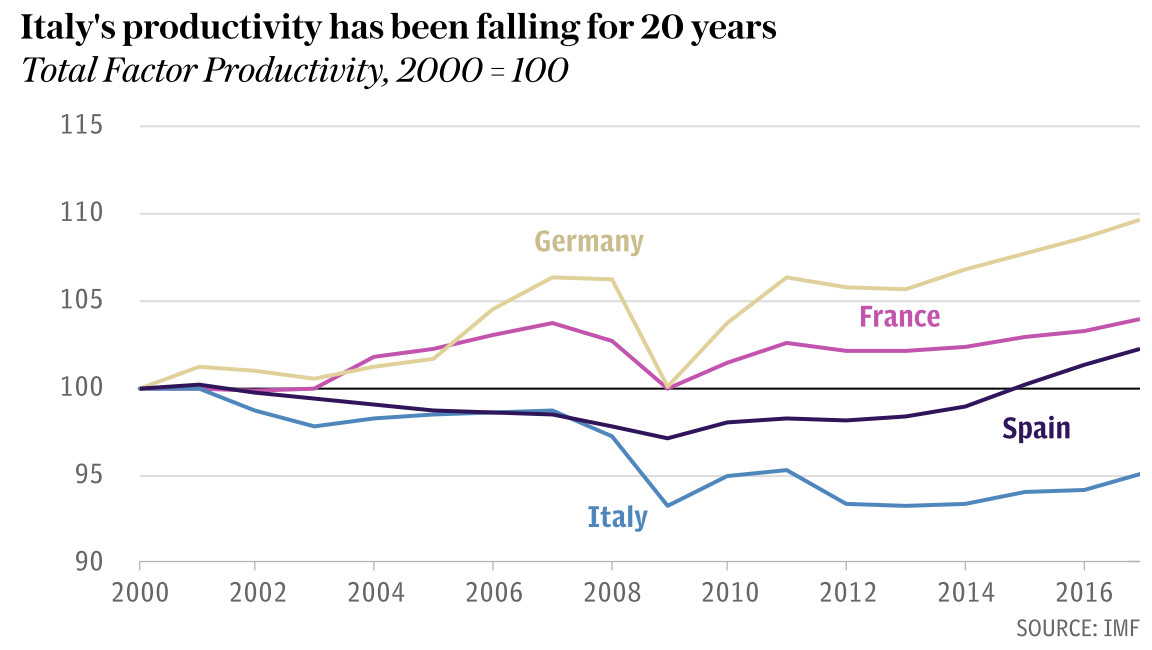

- “Italy may be teetering on the brink of a ‘perma-recession’ that will see its public debt spiral out of control and bring the future of the single currency into question. New analysis has concluded that a toxic combination of a rapidly ageing population, dire productivity growth and monetary policy ill-suited to its economic needs could see the country ‘stagnate in the long term’.” – bto: Das ist die Eiszeit, die zunehmend auch andere Länder und letztlich auch Deutschland erfassen wird.

Quelle: The Telegraph

So, nun sitzen wir in einem Boot und die Politik weigert sich das Problem zu lösen. Bleibt die EZB. Doch kann diese noch handeln?

- “Mario Draghi tried valiantly to bluff his way through the ECB Watchers conference on Wednesday, laying out his surgical toolkit should the worst happen. ‘We are not short on instruments to deliver our mandate,’ he said.

“‘What instruments?,’ asked Ashoka Mody, the former deputy-director of the International Monetary Fund in Europe. ‘Aside from its jumble of words, the ECB has nothing else to offer.’ (…) ‘The ECB has lost its ability to act as a normal central bank. Its forward guidance is meaningless since markets know that it cannot raise rates,’ said professor Mody. The ECB has frittered away its firepower and allowed a deflationary psychology to take hold.” – bto: Aber kann man sie wirklich dafür verantwortlich machen? Ist es nicht die verunglückte Politik? - “Mr Draghi argued that the eurozone region has seen 50 ‘growth slowdowns’ since 1970 that are comparable to the current dip. Only four of these led to recessions. (…) What he did not say is that the eurozone was then firing on all four cylinders, enjoying a rare moment of self-propelled ‘endogenous’ growth as it closed the output gap after the Long Slump. An oil price crash – thanks to Saudi efforts to flood the market – was then acting as a ‘tax cut’ for European consumers. Above all the ECB was buying €80bn of bonds each month. This spigot has been turned off.” – bto: Und deshalb ist es eher Zweckoptimismus von Draghi.

- “Nor is the global picture remotely akin to 2016. As we learned again this morning, China is not coming to the rescue this time. (…) Nomura said its ‘credit impulse’ measure in China has risen just 2.5 percentage points in the latest burst of stimulus. This compares to 14 points in the reflation episode of 2015-2016, and 30 points in the aftermath of the Great Recession.” – bto: Das wissen wir. Die Wirkung neuer Kredite wird immer geringer. Die weltweite Schuldenparty läuft sich aus. Und damit kommt die deflationäre Gegenbewegung.

- “Mr Draghi (…) cannot admit that the ECB was forced to shut down QE prematurely under pressure from Germany and the northern bloc. The real motives were political, rooted in the dysfunctional character of Europe’s half-built monetary union and German fears of debt union by stealth.” – bto: Ob das stimmt, kann ich nicht beurteilen. Richtig ist, dass die EZB Risiken zwischen Ländern verschiebt, und zwar in erheblichem Umfang.

- “The Germans, Dutch, Finns, and allies may ultimately agree to restart QE if the downturn spins out of control but by then it is too late. Nor is it clear whether much can be achieved by plain vanilla debt purchases when the bonds of core Europe are already trading at negative yields and the ECB’s balance sheet is nearing technical limits at 43pc of GDP.” – bto: Das Grundproblem der EZB dürfte sein, dass sie langsamer als andere reagieren kann.

- “It would take ‘helicopter money’ or people’s QE injected into the veins of the real economy to pull Europe out of a deflationary vortex in today’s circumstances. That would breach the Lisbon Treaty and precipitate a storm in the German constitutional court.” – bto: Ach, der würde wie immer für den Euro und die Politik urteilen, da bin ich entspannt. Man blicke auf die Zusammensetzung des Verfassungsgerichts.

- “Europe’s only option is a fiscal stimulus but this brings us back to the elemental failings of a monetary union composed of sub-sovereign borrowers with vastly different levels of legacy debt, but with no joint budget, shared borrowing mechanism (eurobonds) or a common ‘safe asset’.” – bto: Das betrachte ich dediziert anders. Es geht nicht, wie man in Japan sehen kann. Wir müssen uns auf eine lange Zeit geringen Wachstums einstellen und vorbereiten.

- “In a sense Europe is paying the price for policy errors made almost a decade ago. The ECB should never have raised rates in 2011 and triggered EMU’s double-dip recession. It should not have delayed QE for five years after the Fed had already shown the way. This inertia – or hubris – allowed ‘Japanese’ pathologies to take root. Now the task is becoming impossible.” – bto: Ich denke nicht so. Vielleicht wären wir etwas besser dran, aber der Weg in die Eiszeit ist unvermeidbar.

→ telegraph.co.uk: “Italy may face ‘perma-recession’ as ECB warns of hazards ahead”, 27. März 2019