In der fiskalischen Falle

Im aktuellen Jahresbericht beschäftigt sich die Bank für Internationalen Zahlungsausgleich mit der wirtschaftlichen Lage im Zuge der Corona-Epidemie. Drei Szenarien stehen im Mittelpunkt:

- „The central scenario (…) is for the economic recovery to continue, albeit at varying speeds across countries. The pickup in growth should go hand in hand with better labour market conditions. As slack diminishes, inflation is projected to move closer to central bank targets, and in some cases exceed them. However, with the exception of a few EMEs, inflation overshoots are seen as temporary. Accommodative fiscal and monetary policy are envisaged to underpin the recovery. Considerable fiscal stimulus remains to be deployed, on top of measures introduced last year, particularly in the United States. Monetary policy is also expected to remain highly expansionary in AEs, where a number of central banks have committed to maintaining their current stance until inflation reaches, or in some cases exceeds, its target. As a result, any tightening in global financial conditions is seen as moderate.“ – bto: also quasi das “Goldilocks-Szenario der Post-Corona-Zeit: Geld bleibt billig, Inflation tief, die Staaten helfen weiter und alles wird gut.

- Ein weiteres Szenario sieht eine verlangsamte Erholung und eine Zunahme der Insolvenzen voraus: „In this scenario, the recovery stalls. As growth slows, business insolvencies, which were remarkably low in 2020 given the state of the global economy, start to rise substantially. The resulting corporate loan losses weaken the financial position of banks, sapping their lending capacity. An adverse turn in the pandemic is an obvious trigger for this scenario. A particular risk comes from the emergence and spread of new vaccine-resistant virus strains from countries with high infection rates and slow progress in vaccination. (…) Based on the historical relationship between infection rates, lockdowns and GDP, the emergence of a vaccine-resistant virus strain could lower GDP by between 1.5% and 3.5% in the second half of 2021 (…).” – bto: Klar, die Herbst-Welle mit oder ohne wirksamen Impfstoffen wird für viel Freude sorgen. Dann haben wir einen echten Einbruch an den Finanzmärkten, weil am Ende alles frische Geld nicht über den realwirtschaftlichen Schaden hinwegtäuschen kann.

- Alternativ sieht die BIZ mehr Inflation: „In this alternative scenario, inflation in a number of countries exceeds current expectations by enough to bring forward the expected start of monetary policy normalisation and prompt an unexpected and substantial tightening of global financial conditions. Naturally, this scenario involves stronger growth than currently projected. (…) One reason why growth might surprise on the upside is that fiscal policy could turn out to be more stimulatory than expected.“ – bto: Das ist gut möglich, vor allem weil man es mit dem Thema Kampf gegen den Klimawandel verbindet.

- Zum Thema der Inflation in diesem Szenario: „The impact on inflation is harder to assess. There are grounds to believe that any further increase would be limited and temporary. The relationship between inflation and slack has weakened in recent decades: empirical estimates suggest that even very tight economic conditions would prompt only a modest rise. Inflation expectations are also better anchored, so that the ‘second- round’ effects of an initial rise in inflation are typically small. Moreover, many of the structural factors that have been exerting downward pressure on inflation for a long time and have further dampened second-round effects are still at play. Foremost among these are the globalisation of product and labour markets and technological change, which have reduced the pricing power of labour and many firms.” – bto: Hier finde ich die BIZ nicht ganz konsistent. An anderer Stelle hat sie auch diskutiert, dass die Faktoren sich abschwächen oder gar umkehren könnten.

- „That said, given the strength of the forces at play in the scenario, one cannot rule out a larger and more sustained increase in inflation. The relationship between inflation and economic slack – the Phillips curve – could turn out to be non-linear, meaning that inflationary pressures rise substantially when spare capacity is sufficiently small. Such an outcome would be more likely in this scenario, as the pickup in growth would be synchronous across many countries, so that capacity would come under stronger pressure at the global level. Inflation expectations could also become less well anchored.“ – bto: Hier kann also Inflation aus der Kombination eines verringerten Angebots mit deutlich stärkerer Nachfrage ein Thema werden.

- „Even a temporary rise in inflation could deliver a sizeable financial tightening, especially given stretched financial markets. This would be more likely if uncertainty about central banks’ response caused financial markets to bring forward the anticipated start of policy normalisation. Such a scenario could lead to a rapid and disorderly unwinding of positions taken on the assumption of persistently easy monetary conditions.“ – bto: Klar, die Vermögenswerte kämen dann unter Druck, sind diese doch von der Welle an Liquidität getragen worden.

So gesehen gibt es laut BIZ ein gewisses Risiko höherer Inflation, doch vor allem für die Finanzmärkte, weil die Zinsen früher steigen als erwartet und damit natürlich die Bewertungen unter Druck gerieten. Denn besonders Aktien und Immobilien sind 2020 deutlich schneller und höher gestiegen als fundamental gerechtfertigt, stellt die BIZ fest.

Was zu der Frage führt, ob die Zinsen wirklich steigen, würden im Zuge einer höher als erwartet ausfallenden Inflation. Denn nicht nur die Märkte für Vermögenswerte hängen am Tropf des billigen Geldes, sondern auch die Schuldner, allen voran die Staaten. Die BIZ erkennt hier „langfristige Herausforderungen“:

- “Peering further into the future, once the pandemic is left behind and the economy is restored to health, a key challenge will be to reorient policy back towards longer- term objectives. This will involve fostering a sustainable path to stronger growth while at the same time gradually normalising monetary and fiscal policies and dealing effectively with any tension that might arise between the two along that path. In doing so, policymakers will have to contend with the legacy of the pandemic, including much higher public debt, lower interest rates and larger central bank balance sheets.“ – bto: was aber mit Corona nicht so viel zu tun hat, waren doch die Schulden schon vorher viel zu hoch

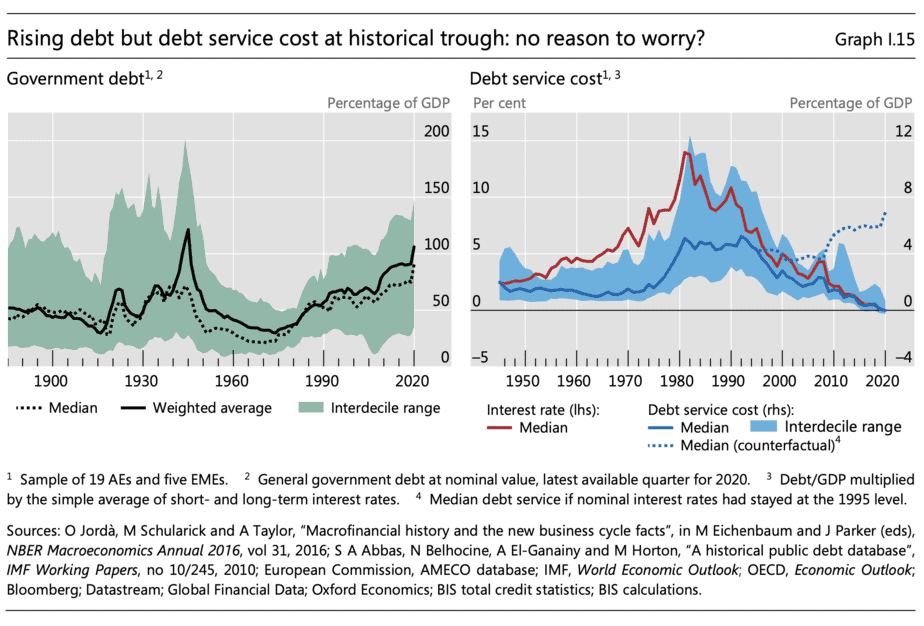

- „The starting point is unprecedented. On the one hand, fiscal expansion has pushed government debt-to-GDP ratios to levels on a par with, or higher than, those in the aftermath of World War II (Graph I.15, left-hand panel). On the other hand, according to historical records, nominal interest rates have never been so low (right-hand panel). In fact, they are so low that, despite the exceptionally high debt ratios, debt service costs are at historical troughs. The debt burden has never felt so light.“ – bto: Und jeder, der einen Anruf von seiner Bank bekommt mit der Ankündigung einer „Verwahrgebühr“ für das Geld, weiß, wie es auf der anderen Seite dieser Gleichung aussieht.

- „Policy normalisation cannot be taken for granted. The years leading up to the Covid-19 pandemic illustrate the challenges. Pre-pandemic, few central banks had managed to raise policy interest rates from the levels prevailing in the immediate aftermath of the GFC, even in countries that saw a long economic expansion and low unemployment rates. In many AEs, central bank balance sheets grew further, to peacetime highs. Public debt levels generally rose too, before the pandemic pushed them higher still.“ – bto: richtig. In den zehn Jahren seit der Finanzkrise sind alle Versuche – so es sie denn gab –, die Zügel anzuziehen, gescheitert.

- „One reason why normalisation is so hard is because it involves intertemporal trade-offs. The costs of normalisation, such as generally lower growth and higher unemployment, are immediate and concrete. Its benefits, such as having more room to combat economic downturns, are less tangible and accrue only in the future.“ – bto: So ist es immer und deshalb handeln Politiker immer zu langfristigem Nachteil.

- „A second reason reflects economic conditions. Ideally, faster growth and a pickup in inflation would support normalisation. But generating sustained inflation has proved surprisingly difficult, especially in AEs, where it has remained stubbornly below targets. (…) How much inflation will rise on a sustainable basis remains an open question, not least because the longer-term effects of the pandemic on structural forces such as globalisation and technology have yet to play out.“ – bto: Klar, das führt zu der Unsicherheit, die die Diskussion prägt. Die Frage ist, wie sich die Angebotsstruktur ändert. Ich denke, vor allem das Thema Klima wird uns beschleunigte Inflation bringen.

- „A third reason is that postponing normalisation beyond a certain point may actually make it harder. Keeping monetary policy accommodative to support fiscal consolidation could encourage a further build-up of financial imbalances in the private sector. Given the exceptionally low service burdens, it could also induce further increases in government debt. In both cases, the economy’s sensitivity to higher interest rates would rise.“ – bto: Das ist der Trend der letzten 40 Jahre. Es gibt einen massiven Anreiz zur Verschuldung und er wurde bisher belohnt.

- „The joint need to normalise monetary and fiscal policies poses specific challenges. Along the path, normalisation in one area could complicate normalisation in the other. Fiscal consolidation would act as a drag on economic activity and inflation, hindering prospects for monetary policy normalisation. Conversely, given increased debt burdens, higher interest rates would increase the size of the required fiscal adjustment. In fact, the interest sensitivity of service costs is already very high. For example, should interest rates return to the levels prevailing in the mid-1990s, when inflation had already been conquered, median service costs would exceed the previous wartime peaks (Graph I.15, right-hand panel).“ – bto: Das ist sehr schön zusammengefasst. Höhere Zinsen bringen Regierungen in Probleme, Sparanstrengungen dämpfen die Wirtschaft und führen zu noch mehr Notenbankintervention. So fühlt es sich an, wenn man sich in die Ecke manövriert hat.

- „From this perspective, large-scale central bank purchases of government debt can heighten the interest rate sensitivity of borrowing costs. Considering the consolidated public sector balance sheet, these operations retire long-term government debt from the market and replace it with overnight debt – interest- bearing central bank reserves. Indeed, despite the general tendency for governments to issue at longer maturities, central bank purchases have shortened the effective maturity of public debt. Where central banks have used such purchases more extensively, some 15–45% of public debt in the large AE jurisdictions is in effect overnight.“ – bto: Auch das ist ein sehr interessanter Aspekt. Die Kaufprogramme der Notenbanken machen aus langfristigen Schulden kurzfristige. Das ist nicht so positiv, bedeutet aber im Klartext, dass die Notenbanken gar nicht anders können, als um jeden Preis die Zinsen unten zu halten.

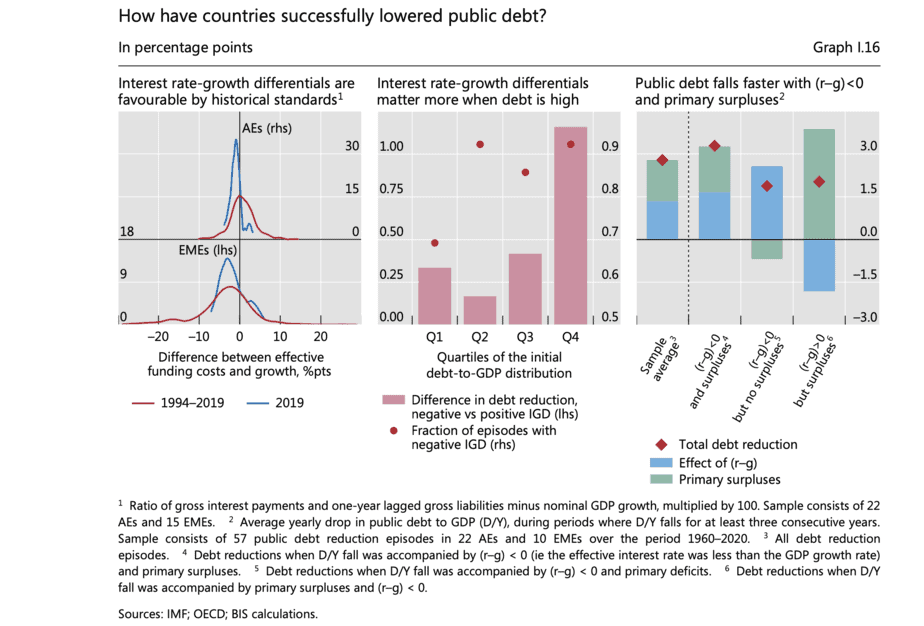

- „One cause for optimism concerning fiscal policy normalisation prospects is that interest rates have been generally below growth rates for some time. Such a favourable configuration sets a ceiling on the ratio of debt to GDP for a given fiscal deficit and means that the ratio will start to decline when deficits are sufficiently small. It can also facilitate an increase in the average duration of public debt, lowering rollover risk in countries where fiscal sustainability is a concern. And indeed, interest rate-growth differentials are very favourable from a longer-term perspective (Graph I.16, left-hand panel), in part because real interest rates have been negative for an exceptionally long time.“ – bto: Klar, finanzielle Repression hilft, man muss sie aber auch betreiben.

- „However, the history of successful episodes of consolidation raises a note of caution. Successful debt-to-GDP reductions have relied exclusively on a favourable interest rate-growth differential only in a small fraction (22%) of cases. Primary surpluses alone have hardly ever succeeded (only 15% of cases), particularly when public debt is high (Graph I.16, centre panel). Instead, a combination of surpluses and favourable interest rate-growth differentials has generally been necessary (64% of cases). Such a combination naturally also increases the speed of adjustment, by some 50% (right-hand panel). Thus, the window of opportunity provided by favourable interest rate-growth differentials should not be missed.“ – bto: Das war Deutschland nach der Eurokrise. Schwer vorstellbar, dass dies wieder geht, gerade auch mit Blick auf die Lage in unseren Partnerländern.

- „The fact that, along the normalisation path, the objectives of fiscal and monetary policy could give rise to tensions raises the spectre of fiscal dominance. Fiscal dominance denotes a situation in which monetary policy is unable to tighten as a result of fiscal constraints. The mechanism operates through the sensitivity of debt service costs to higher interest rates.“ – bto: Und dieses Primat der Staatsfinanzierung gilt bereits in der Eurozone. Wer da nicht mitmacht, ist der Dumme.

- „Fiscal dominance can arise for two reasons: economic conditions and political economy pressures. In the case of fiscal dominance related to economic conditions, higher interest rates cause major economic damage, forcing the central bank to refrain from tightening even when it would otherwise be desirable to do so. (…) In the case of political economy pressures, the government forces the central bank to deviate from its objectives in order to limit the rise in its borrowing costs. All this suggests that the risk of fiscal dominance depends on institutional and economic factors, and is generally higher where the creditworthiness of the sovereign is weaker.“ – bto: Italien, Spanien, Frankreich – mehr muss man dazu nicht sagen.

- „(…) when the origin is purely economic constraints, even an independent central bank may have little choice but to keep interest rates low. In this case, the only remedy is fiscal consolidation. Given the scale of the challenges involved, a key imperative is to adopt policies that strengthen sustainable growth without seeking to achieve it simply through easy monetary policy or fiscal stimulus. Structural reforms that promote a vibrant, flexible and competitive economy are essential. At the current juncture, those facilitating a reallocation of resources in the light of the pandemic-induced changes in demand patterns have a specific role to play. In addition, besides a supportive tax regime, the allocation of government expenditure matters. The necessary large increases in government transfers to households and firms during the pandemic seem to have come at the cost of lower public investment. Shifting the composition of spending back towards investment as economic conditions improve would provide welcome support. That said, as history indicates, the political economy obstacles to the implementation of growth-friendly policies should not be underestimated.“ – bto: Reformen? Es gibt doch eine breite Kampagne gegen alles “Neoliberale“, gemeint sind Reformen. Hält man auch meinem “Ein Traum von einem Land” vor.