Geldpolitik und Ungleichheit – sind die Notenbanken wirklich unschuldig?

Gestern habe ich an dieser Stelle den aktuellen Bericht der BIZ zitiert und mich auf den Teil beschränkt, der mit den langfristigen Gefahren der aktuellen Politik umgeht.

Im zweiten Teil des Berichts geht es um die Frage, ob die Notenbanken eine (Mit-)Schuld an der zunehmenden Ungleichheit tragen. Das Fazit der BIZ war eher “Nein”. Martin Wolf von der FINANCIAL TIMES (FT) hat sich diesen Teil des Berichts vorgenommen und schreibt:

- “(…) since (…) the ‘Great Financial Crisis’, the proportion of speeches by central bankers mentioning inequality has soared. This partly reflects rising political concern about inequality. But it also reflects a specific critique. This is, in the report’s words, that ‘central banks have deployed policies featuring exceptionally low interest rates and extensive use of balance sheets to support economic activity and lower unemployment. Such measures have fuelled concerns that central banks’ actions, by boosting asset prices, have benefited mostly the rich’.” – bto: Und ich finde, dieses Argument ist nicht so ganz von der Hand zu weisen.

- “Yet there is also an opposite critique from people who upbraid central banks for not being activist enough. People in this camp argue that the failure has been to be too passive, letting inflation remain too low and labour markets stay too weak. At present, central banks, even the European Central Bank, are far closer to this position (…).” – bto: Klar, rechtfertigt es doch ihr Handeln.

- “The view of the BIS itself is threefold. First, the rise in inequality since 1980 is ’largely due to structural factors, well outside the reach of monetary policy, and is best addressed by fiscal and structural policies’. Second, by fulfilling their monetary mandates, central banks can reduce the impact of shorter-term shocks to economic welfare caused by inflation, financial crises and, no doubt, real shocks (such as pandemics). Finally, central banks can also do something about inequality with good prudential regulation, promoting financial development and inclusion and ensuring safe and effective payments.” – bto: Das mit den strukturellen Faktoren – Demografie, Globalisierung – stimmt, ist aber keine Begründung für den Anteil, den die Notenbanken daran haben.

- “It is clear (…) that falling real interest rates and easy monetary policies have tended to raise asset prices, to the benefit of the wealthiest. But, interestingly, the measured impact on wealth inequality has not been as dramatic as one might have expected. More important, it would have made no sense to adopt a deliberately more restrictive monetary policy solely in order to lower asset prices. This would have reduced activity and raised unemployment. (…) Meanwhile, how would the majority of people, who own almost no assets, be better off because billionaires were a bit poorer? It would be mad for central banks to cause slumps in order to lower asset prices.” – bto: Vor allem, weil diese als Sicherheit dienen und damit als Anker des Weltfinanzsystems, ist es brandgefährlich, sie fallenzulassen. Was das Problem auf den Punkt bringt.

- “A more relevant concern is raised by the dominant contemporary demand to ‘run the economy hot’. That raises two real (and possibly related) dangers: inflation and financial instability. On the former, proponents of this approach argue that one cannot know where the risk of significant inflation lies without pushing the economy not just to, but beyond, the limit. But that could also prove costly if, as some fear, inflation soars and that overshoot proves very expensive to reverse.” – bto: Ich denke, hier herrscht ein breiter Konsens, dass es versucht werden wird, koste es, was es wolle.

- “There is simply so much debt. That may be fine if interest rates stay low. But will they?” – bto: Die Notenbanken werden alles dafür tun …

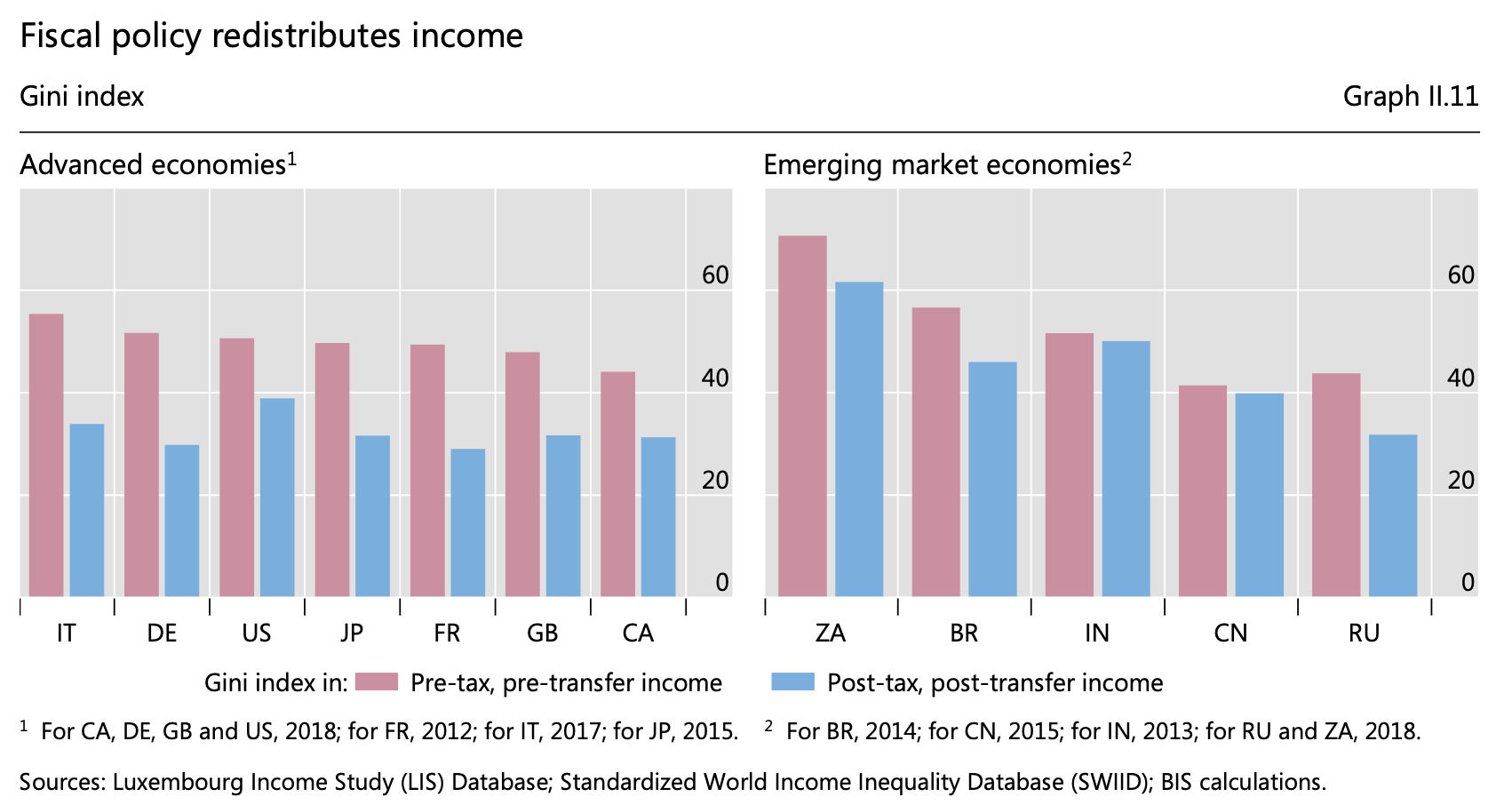

- “Where the BIS is clearly correct is that fiscal and structural policies are the main way to address inequality. Indeed, some high-income countries are quite effective in using the former in this way. The big contrast between the US and other high-income countries in income inequality, for example, is in the relative absence of redistribution in the former.” – bto: Und wo schreit man am lautesten? Genau, bei dem Land, das schon am meisten macht:

Quelle: BIZ

- “Structural policy is a still more complex issue. Too often, this is just a synonym for market liberalisation. But financial liberalisation has surely increased inequality and financial instability. So, good structural reform would almost certainly seek to constrain finance. Similarly, in labour markets with significant monopsonies, labour market deregulation might well be bad for employment and inequality. Moreover, rising inequality is almost certainly a factor in creating the structurally weak demand that explains the declining real interest rates and soaring indebtedness characteristic of our era of ‘secular stagnation’. For all these reasons, the structural reforms we should be thinking about are more difficult than conventional wisdom imagines.” – bto: Das mag sein. Was bei uns zu tun ist, dürfte allerdings weitgehend offensichtlich sein.

- “(…) given our chronic reliance on expansionary monetary policy (…) financial excess is sure to re-emerge, making regulation an unending game of ‘whack a mole’. The BIS is correct to call for radical structural reforms. But they have to be the right kind of structural reforms.” – bto: Und es müssen die richtigen Politiker sein, die die strukturellen Reformen durchführen. In Deutschland sehe ich die nicht.

→ ft.com (Anmeldung erforderlich): „Monetary policy is not the solution to inequality“, 29. Juni 2021

Heute aus der “WELT”

“In einem Gutachten erklärt Paul Kirchhof, Rechtsprofessor und ehemaliger Bundesverfassungsrichter, warum die EZB mit ihrer Zinspolitik in ein elementares Grundrecht eingreift. Im Interview sagt er auch, was Deutschland tun sollte, um den stabilen Euro zu retten.”

https://www.welt.de/wirtschaft/article232256037/Verfassungsrechtler-Paul-Kirchhof-Negativzins-ist-verfassungswidrig.html

@ weico

Kirchhof in welt.de:

>Es gibt ein Grundrecht, sein Eigentum nutzen zu dürfen. Das ist Teil der Eigentümerfreiheit. Und dieses Grundrecht wird dem Sparer durch die Zinspolitik der EZB genommen.>

Der erste und der zweite Satz sind richtig.

Der dritte ist falsch.

Beispiel als Beweis, dass er falsch ist:

Jemand ist Eigner von Gold.

Er nutzt das Gold derart, dass er es im Ozean in 10.000 m Tiefe versenkt.

Dieses Grundrecht, seine Eigentümerfreiheit wahrzunehmen, nimmt ihm niemand, auch die EZB nicht.

Was Kirchhof implizit sagt, aber falsch ist:

Wie auch immer jemand sein Eigentum nutzt, er MUSS einen Ertrag durch diese Nutzung haben.

Das ist kein Grundrecht.

Kirchhof:

>Es geht hier um das individuelle Recht des Sparers, sich am Finanzmarkt zu beteiligen, ohne täglich Risiken einzugehen und neue Anlageformen zu verfolgen. Das will die Mehrheit der Deutschen nicht.>

Aus dem, was die Mehrheit der Deutschen will oder nicht will, ist KEIN Recht abzuleiten.

Die Thesen von Kirchhof sind nicht neu.

Sie wurden schon vor 8 Jahren diskutiert und zu den Akten gelegt.

Hier:

thttps://blog.zeit.de/herdentrieb/2013/12/11/paul-kirchhofs-wunderbare-welt-der-wirtschaft_6868?sort=asc&comments_page=8 – comments

Siehe insbesondere Kommentar # 78 von Henry Kaspar, dem kompetentesten Ökonomen, dem ich begegnet bin:

>Nach Kirchhofs Auffassung gibt es ein Grundrecht auf ertragfähiges Eigentum. „Besitzen und Nutzen wird garantiert. Wesentliche Formen sind mit der EZB-Zinspolitik aber ertraglos geworden“, kritisierte der Heidelberger Universitätsprofessor.

Und dies verwechselt Ursachen und Folgen. Die EZB-Zinsen sind niedrig als Folge der niedrigen realwirtschaftlichen Rendite, welche wiederum die Folge von Ueberschussersparnis (relativ zu den Investitionen) ist. Nicht umgekehrt.

Man muss Sachen auch mal beim Namen nennen. Aus Kirchhofs Aussagen spricht bodenloser oekonomischer Unverstand, der nur noch uebertroffen wird von der Dreistigkeit, mit welcher Kirchhof sein Gestuemper als Erkenntnis verkauft, getragen von seinem Presitge als Verfassungsrechtler.

Ich erinnere mich gut wie abstossend ich zu Zeiten Schroeders Wahlkampfkampagne gegen den „Professor aus Heidelberg“ empfand.

Inzwischen daemmert mir dass Schroeder damit das Land vor Schaden bewahrt hat.>

Bemerkung:

Ich habe Kirchhof immer als Verfassungsrechtler geschätzt

Die Kritik an Kirchhof beinhaltet nicht, dass ich die Zinspolitik der EZB für richtig halte.

“Man muss Sachen auch mal beim Namen nennen. Aus Kirchhofs Aussagen spricht bodenloser oekonomischer Unverstand, der nur noch uebertroffen wird von der Dreistigkeit, mit welcher Kirchhof sein Gestuemper als Erkenntnis verkauft, getragen von seinem Presitge als Verfassungsrechtler.”

Richtig !

Es ist wirklich erstaunlich, dass ein Verfassungsrechtler solchen Blödsinn (Null- und Negativzinspolitik verfassungswidrig) “verzapft”….und ist ein absolutes Armutszeugnis für einen ehemaligen Bundesverfassungsrichter !

Jeder Jus-Student ,im ersten Semester, könnte Kirchhof’s Aussage leicht “parieren”…. Stichwort :Allgemeine Handlungsfreiheit/Vertragsfreiheit !

Zentrale These des Mainstream sowie auch der MMT-Fraktion: Die Notenbanken bestimmen das Zinsniveau.

Diese These ist NACHWEISLICH falsch. Es sind NICHT die Zentralbanken, die im Mittelpunkt der Wirtschaft stehen und alle anderen kreisen um sie herum. ZBen bestimmen weder die Geldmenge noch das Zinsniveau: https://think-beyondtheobvious.com/is-inflation-about-to-return/#comment-191862

Ob nun monetär-geozentrisches Mittelalter oder monetärer Irrgarten: Wer in der Lage ist, jenseits von simplifizierenden Angebots- und Nachfragekurven aus Eco 101 zu denken – eben bto – , der wird solchen Ammenmärchen nicht mehr auf den Leim gehen.

LG Michael Stöcker

@Herr Stöcker

Jaja, der Markt für Staatsanleihen ist der einzige, bei dem eine Ausweitung der Nachfrage durch die Zentralbanken nichts am Preis, und demzufolge am Zins, ändert.

Was für unsinnige Dogmen man doch glauben muss, wenn man der Gelddrucker-Fraktion angehören will.

PS: Was macht eigentlich Ihr Goldanteil im Portfolio?

>… the rise in inequality since 1980 is ’largely due to structural factors, well outside the reach of monetary policy …>

Das ist DIE Erkenntnis, von der alle Erklärungen „richtiger“ oder „falscher“ Politik ausgehen müssen, wenn sie auf die gebotene URSÄCHLICHKEIT abheben.

>bto: Das mit den strukturellen Faktoren – Demografie, Globalisierung – stimmt, ist aber keine Begründung für den Anteil, den die Notenbanken daran haben.>

Wenn es strukturelle Faktoren AUSSERHALB der Geldpolitik sind, hat die Geldpolitik KEINEN Anteil daran.

Die Geldpolitik kann sie verstärkt oder geschwächt haben, was etwas ANDERES, wenn auch nicht immer scharf Trennbares ist.

Oder:

Obige Aussage der BIZ ist FALSCH.

Das muss dann auch so gesagt werden.

Dr. Stelter, Sie verwischen die Analyse.

Das ist nicht hilfreich.

Zur Thematik nur kurz und komprimiert meine Meinung:

Angesichts der STRUKTURELLEN Faktoren UND der UNFÄHIGKEIT der Politik, ihnen entschieden entgegenzusteuern, haben die Notenbanken folgende grundsätzliche Wahl (wenn man sie als vollkommen unabhängig ansieht):

STABILISIERUNG der Einkommen auf Kosten einer ZUNAHME der Vermögensungleichheit, was sie verfolgen,

oder

KOLLAPS des Systems mit der Folge von weitgehender VERMÖGENSGLEICHHEIT aller, was in der Größenordnung NULL für die allermeisten sein würde, wenn man die in einem solchen Fall erforderlichen Notfall-Verteilungsmaßnahmen einer jeden Regierung einbezieht.

Etwas anderes sehe ich REALISTISCHERWEISE nicht als grundsätzliche Handlungsoption der Notenbanken.

>bto: Und es müssen die richtigen Politiker sein, die die strukturellen Reformen durchführen. In Deutschland sehe ich die nicht.>

Es gibt in Deutschland jede Menge „richtiger Politiker“, die wie von der BIS gefordert sogar RADIKALE strukturelle Reformen durchführen.

Stichwort: Energiewende.

Das Problem ist nicht der Mangel an „richtigen Politikern“, sondern es sind Wohlstand bewahrenden bzw. ihn fördernden strukturellen Reformen, die aufgrund VORHERRSCHENDER gesellschaftlicher Interessen NICHT angegangen werden können.

Demnächst der Beweis dafür:

Das Wahlergebnis am 26. September.

bto: “Und es müssen die richtigen Politiker sein, die die strukturellen Reformen durchführen. In Deutschland sehe ich die nicht.”

Warum nicht, Herr Dr. Stelter? Politiker ist keine geschützte Berufsbezeichnung. Keine Partei wird davon abgehalten, jemanden wie Sie zu fragen, ob er z.B. Bundesfinanzminister werden will.

Das ist alles eine Frage des Leidensdruckes der breiten Masse. Solange die Verbraucherpreisinflation noch so erfreulich niedrig ist, werden halt Leute wie Herr Scholz gefragt. Das gibt sich in den nächsten Jahren…

bto: “Geldpolitik und Ungleichheit – sind die Notenbanken wirklich unschuldig?”

Natürlich erhöht es die Ungleichheit, wenn die Notenbanken mit ihrer Nullzinspolitik die Asset-Preise aufpumpen – denn davon profitiert man selbstverständlich umso mehr, je mehr Assets man besitzt.

Das gibt ja schon Titanic-Titelseiten-Vibes:

https://www.titanic-magazin.de/fileadmin/_migrated/pics/card_1788728667.jpg

@Herrn Richard Ott: Sie immer mit Ihren rechten Thesen! Natürlich kommen die neu geschaffenen Milliarden allen Bürgern zur gleichen Zeit im gleichen Anteil zu Gute und es gibt natürlich kein Frontrunnig der großen Erstbesitzer des neuen Geldes.

@ susanne F-R

verweise auf den cantillon-effekt

hierbei profitieren die erstempfänger beim geld-druck, am meisten!

@foxxly

Es spricht auch gegen die Satire daß die Umstände sie übertreffen

Ulrich Erckenbrecht