Ein Überblick über die Lage der Inflation in den USA

John Authers von Bloomberg hat einen Indikator für Inflation vorgestellt. Eine interessante Überlegung:

- “In today’s polarized dialogue, the Weimar Republic and Zimbabwe often get invoked on one side of the debate, against contemporary Japan or the deflation that accompanied the Great Depression on the other. There’s no need to be so hyperbolic. Inflation could rise enough to change some of the basic economic and investment assumptions of the last four decades without subjecting us to Weimar-style hyperinflation. The West saw double-figure inflation as recently as 1990; that would have quite an impact if it returned.” – bto: Das ist mir auch wichtig. Wir haben Argumente für beides – Inflation und Deflation. Inflation: Geldmenge, knapperes Angebot, Umkehrung der deflationären Treiber der letzten Jahre. Deflation: Schulden und Vermögenspreise wirken deflationär (Nachfrage, Risiko von Verlusten).

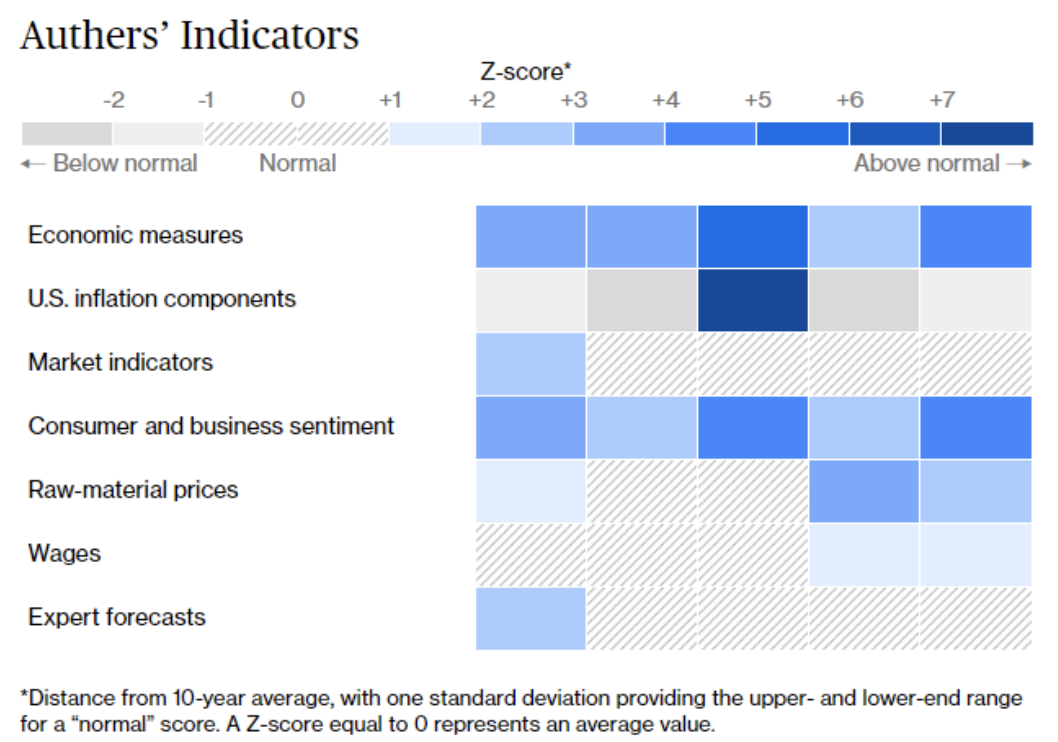

- “We tend to think in terms of narratives, and it’s easy to pick the right data to support your pre-existing deflationary or inflationary narrative. The Indicators will attempt to guard against this and force us to look at the balance of the evidence. For ease of presentation, we are presenting the indicators as a heat map, with each square determined by its Z-score for the last 10 years. In other words, they will be colored according to how far they are from the average for the last decade (in which everyone grew accustomed to a ‘low-flationary’ paradigm). A Z-score above 2 implies that a measure is higher than it was for 95% of the time over the last decade. Much higher numbers suggest a clear and present danger of inflation. (…) The overall heat map then gives you a great snapshot of where the inflationary debate stands.” – bto: ein interessanter Ansatz:

Quelle: Bloomberg

- “(…) there is little reason for anxiety. Of the five inflation components I chose to follow, one is at an extreme high, and all the others are below normal. As for the bond market, most of its measures have inflation expectations below where they’ve been for much of the last decade. Commodity prices aren’t yet suggesting we need to be terrified, wages remain almost completely under control, and the experts surveyed by Bloomberg, whose forecasts often become self-fulfilling prophecies, are almost totally unconcerned. If anything, central banks will be worried that professional economists still expect inflation to be so low.” – bto: Auf die Experten würde ich bei so grundlegenden Trendwenden nicht hören.

Er erklärt dann noch die Indikatoren und das wiederum finde ich durchaus spannend:

-

Economic measures

“We offer you the U.S. consumer price index; U.S. CPI excluding food and fuel (or core CPI); producer price index; ‘trimmed mean’ inflation, another version of core inflation that automatically excludes the constituents that have risen the most and least; and the PCE deflator, because it’s measured in a different way from the CPI (surveying what businesses charge rather than what consumers pay) and because it’s the Fed’s favorite indicator. There’s room for some argument around the edges but this gives a broad picture of where official statisticians see inflation.” – bto: Ich finde das schon deshalb interessant, weil es hier mehr um die Messung als um die echte Inflation geht. Klar, so kann man das auch machen. Aber es zeigt natürlich, dass wir bereits mit der Messung unsere Probleme haben können.

-

U.S. inflation components

“I chose shelter because it’s the single biggest, and because if the inflationistas are right, we might see it start to rise in a significant way quite soon; rental car prices because they have had an obvious extreme boost from reopening; recreation, as the sector should logically be exposed to inflationary pressure amid reopening; medicine, because it is important and hugely politically sensitive; and college tuition, because it is the most frequently cited measure by those who complain that official numbers are deliberately understated. (…) At present, the broad picture is consistent with a deflationary environment, with some pockets of extreme (and therefore probably transitory) inflation. Current car rental inflation is a nine-standard deviation event; that doesn’t happen often.” – bto: und ist natürlich vorübergehend, weil es ja zu einer Angebotsausweitung kommen wird.

-

Market indicators

“There are many ways the bond market gauges inflation. I went with the 5-year and 5-year/5-year measures, as the latter is the most closely watched by the Fed, and the two between them mean we can do without the 10-year. Usually, markets are geared for inflation to be higher further into the future; this is one of the rare times when the 5-year/5-year measure is lower than for the next five years — and indeed only the measure for the next five years is particularly high. Between them, these suggest a transitory phenomenon. Then we have the 2-year/10-year yield curve, which incorporates shorter rates, and I thought it worth including breakevens for Germany and Japan, the two countries where conviction is strongest that there is no inflation to worry about.” – bto: Das klingt nachvollziehbar. Allerdings kann es gut sein, dass die Inflation in den USA sich deutlich dynamischer entwickelt als in Japan und bei uns. Die Rahmenbedingungen sind zu unterschiedlich.

-

Consumer and business sentiment

“We need to know what consumers expect, so we have both the Michigan and Conference Board surveys. They almost always predict that inflation will be worse than the actuality, but we cover for that by presenting these surveys in terms of Z-scores. Both are currently high in comparison to their own history; this is more significant than their actual levels. Then we have the National Federation of Independent Business survey on whether members’ prices are rising or falling — a good leading indicator — along with the ‘prices paid’ data produced by the ISM surveys of both manufacturing and services. The ISM surveys are hugely influential, and much trusted. The common feature of all these numbers is that there is a lot of worry about inflation, along with a belief that it is already with us.” – bto: Das spiegelt auch die aktuelle Nachrichtenlage. Das muss nicht bedeuten, dass es ein geeigneter Indikator für die künftige Entwicklung ist. Die Gefahr ist natürlich, dass die Inflationserwartungen steigen und dies könnte einen verstärkenden Effekt haben.

-

Raw-material prices

“Bloomberg has sectoral indexes for agriculture, energy and industrial metals, I used those. That should guard against over-excitement caused by outliers. I included lumber futures because they have seen sharp inflation over the last few months, and there is good reason to assume that this will be transitory. (…) I included the Commodity Research Board’s RIND index, which includes industrial materials for which there are no futures markets. Note that it’s pretty elevated at present. Commodities have dipped somewhat in the last few weeks, but I’d say it still isn’t clear that they’ve peaked; they are important to watch for the next few weeks.” – bto: Und hier gilt natürlich, dass dies in den kommenden Jahren das Thema sein wird, je nachdem wie der Umbau der Wirtschaft vollzogen wird und die Kapazitäten im Bergbau ausgebaut werden.

-

Wages

“We have average hourly and weekly earnings, both buffeted by weird compositional effects entering and leaving the pandemic shutdown, and the Atlanta Fed’s Nowcast for wage rises for both the low-skilled and highly skilled. This could be critical to monitor, amid fears about skill mismatches, and concerted political attempts to lever up incomes of the lowest paid. Finally we have the NFIB survey on compensation, which should catch up with the complaints of small businesses that they are under pressure to pay more. Obviously, wage inflation and expectations are fundamental to any significant return of inflationary psychology — beyond anecdotes, there’s no sign of any increase yet.” – bto: Das ist wohl das stärkste Argument gegen Inflation. Erst wenn die Löhne zulegen, kommt diese in Schwung.

-

Expert Forecasts

“Bloomberg regularly surveys economists offering forecasts for this year and next. They may be wrong, but their opinions are influential and can become self-fulfilling. We have numbers for the U.S., which has now bumped up to the still not very high level of 2.5% for this year, and for Germany and Japan (the two countries most believed to be mired in deflation), China (the only country whose economy rivals the U.S. in importance), and the U.K. (the developed country that appears most prone to inflation). Some international perspective is necessary; the influence of China will generally make itself felt in wages and commodity prices, but the economists’ outlook for it is important. At present there is almost no concern at all.” – bto: Außer man nimmt sie wie ich als Kontraindikatoren …

Ich finde diese Liste der Inflationsindikatoren hilfreich und interessant. Wie immer an dieser Stelle kein Link, aber der Hinweis auf den unentgeltlichen Newsletter von John Authers bei Bloomberg.