Diesmal will der IWF nicht dumm dastehen

- “The title of (the new IMF) Financial Stability Report is intended to provoke – ‚A Decade After the Global Financial Crisis: Are We Safer?‘ – yet the Fund fails to answer its own question. Our fate is left dangling. So let me try flesh out what the IMF might think but dares not say because it is the political captive of Washington, Beijing, and the defenders of Europe’s monetary union.” – bto: Wenn er so denkt wie ich, dann kann die Aussage nur lauten: alles schlimmer.

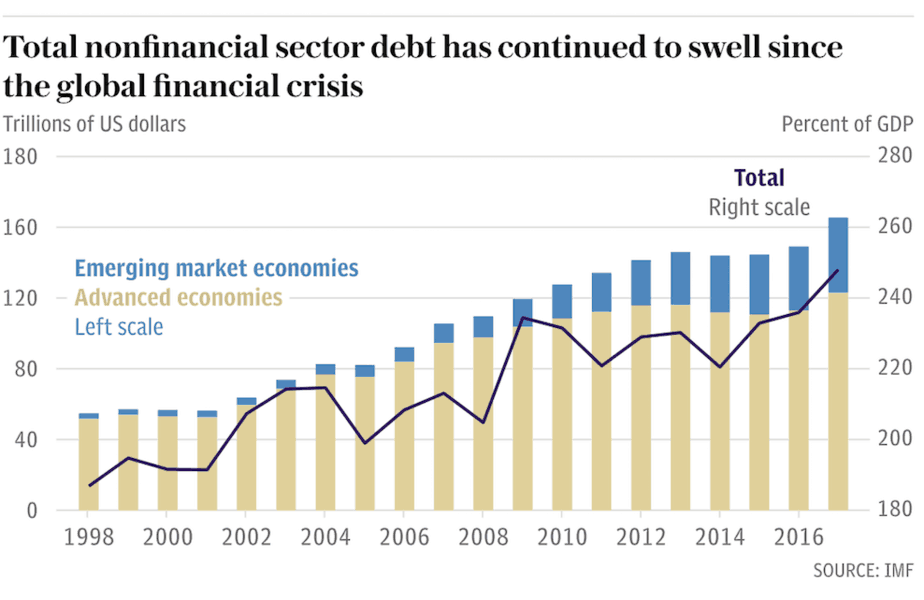

- “There is the usual nod to debt in the IMF risk list. The liabilities of states, households, and non-financial companies have reached $167 trillion, galloping ahead of economic growth. This is over 250pc of world GDP, up from 210pc on the cusp of the Lehman crisis.” – bto: Klar, wir bekämpfen Schulden mit noch mehr Schulden.

- “An eye-watering paragraph on Chinese ‚repo‘ market borrowing – linked to the $11 trillion ‚investment vehicle‘ sector – says that daily volumes have risen fifteen-fold over the last year alone. They are now double the peak ratio in the US just before the 2008 collapse. These repos are being used ‚to bridge the maturity gap‘ between short-term debts and illiquid long-term assets. It was exactly such a mismatch that blew away Northern Rock and then Lehman when the capital markets seized up.” – bto: Bei China haben wir halt das Thema, dass man gut argumentieren kann, dass es die Regierung in der Hand hat, alle Krisen im Keim zu ersticken.

- “The Fund delicately blames US overheating on ‚pro-cyclical fiscal policy‘. That is a euphemism for tax cuts and pork barrel spending by the Trump White House and the Republican Congress, a late-cycle policy mix of criminal irresponsibility. The IMF’s Fiscal Monitor states that the US federal deficit will soar to 5pc of GDP next year and remain near that level as far out as 2023, by which time gross public debt will have rocketed to 117pc.” – bto: Hier hält der IWF nichts zurück. Die Kritik ist ja bekannt. Kommt die Rezession, bleibt es natürlich nicht bei den fünf Prozent Defizit.

Quelle: The Telegraph

- “It is redundant extra debt that does not pay for itself and will come back to haunt US society. But that is tomorrow’s story. For the next year or so US overheating is the world’s number one problem. We are at a unique juncture in economic history where the US is no longer the hegemonic economic power and no longer able to lift the trading system during upswings in the way it used to do. This aspect of the global system is ‘multi-polar’. East Asia is a bigger force. Europe is no minnow. The lion’s share of net growth over the last decade (80pc in some years) has come from emerging markets.” – bto: Stimmt, die USA können die Weltwirtschaft nicht mehr alleine retten. Andererseits beeinflussen sie natürlich mit ihrer Wirtschaftspolitik immer noch erheblich den Rest der Welt.

- “Yet the US does remain the global financial hegemon. (…) The global payments nexus is dollarized. So are the offshore lending markets. The Bank for International Settlements says cross-border loans in dollars outside US jurisdiction – with no direct lender-of-last resort behind them – have ballooned from $2 trillion in 2002 to $13 trillion today. This rises to $26 trillion when equivalent derivatives are included.” – bto: Es ist immer gefährlich, außerhalb der eigenen Währung verschuldet zu sein.

- “The imminent risk now is a US inflation scare. Yields on 10-year US Treasuries have this month broken out of their trading range and punched higher to 3.25pc. Let us suppose that they ratchet rapidly towards 4pc, driven by the ‘crowding out’ effect of Trumpian deficits on the US debt markets, and by the Fed’s quantitative tightening– a net $50bn of bond sales each month.” – bto: und die abnehmende Bereitschaft der Ausländer, es zu finanzieren.

- “By wicked coincidence, this happening just as the European Central Bank halts its bond purchases, cutting off a rich source of funding (via QE leakage) for US Treasuries. In the doomsday scenario, the world would then be faced with a systemic emerging market crisis. China would be in the sights. The country cut the reserve requirement ratio for banks by 100 basis points over the weekend to shore up the economy but still struggled to stabilize the Shanghai bourse, down 22pc since January.” – bto: Das Land verfügt über eine erhebliche Verschuldungskapazität. Und die Regierung ist handlungsfähiger. Wollen wir zumindest glauben.

- “China is caught in a variant of the ‚impossible trinity‘. It cannot deleverage the credit bubble, fight the economic slowdown, and defend the currency at the same time. ‚It’s definitely going to be a balancing act for them,‘ said Maury Obstfeld, the IMF’s chief economist.” – bto: weshalb es durchaus strategisch gut gewählt ist von den USA, das Land jetzt unter Druck zu setzen.

- “The final channel of contagion is into the unreformed eurozone. As the IMF makes clear, the ‘doom-loop’ between banks and sovereigns remains an ineluctable feature of the EMU structure and is on vivid display right now in Italy.” – bto: Das ist aber nun rein Symptom. Die Eurozone ist – und auch das zeigt der IWF in seinen Studien – als Ganzes dysfunktional und wird so nicht überleben können.

- “The IMF warns that a blow-up of the ‚sovereign-bank nexus‘ in Italy will not be contained. It will spread through southern Europe. Some have taken comfort that bond spreads in Spain and Portugal have barely moved during the latest opera buffa in Rome but it is far-fetched to imagine that this could last in a full-blown crisis, with all the risks of an epic default and a euro break-up.” – bto: Und deshalb wird es nicht passieren. Es wird alles mit Geld der EZB zugeschüttet.

- “Jacques Delors’ think tank ‚Notre Europe‘, among others, has warned that the eurozone will not survive another global recession as currently designed. Without fiscal union the prospects are hopeless. Public debt ratios are much closer to the danger line than at the outset of the last downturn.” – bto: Und das ist der Wahnsinn. Der IWF selbst sagt, dass die Fiskalunion gar nicht groß genug sein kann. Deutsche Steuergelder reichen nicht. Was es bewirkt, wäre nur ein noch schnellerer Niedergang hierzulande.

- “The contagion from a global crisis would push the eurozone into recession and shift the calculus on debt sustainability. The ECB would have no monetary ammunition left to combat the shock since interest rates are currently minus 0.4pc and its QE balance sheet is already 43pc of GDP.” – bto: Sie wird die Staaten direkt finanzieren und so die Krise verhindern, allerdings mit erheblichen Nebenwirkungen.

- “Only a massive fiscal response could rescue Europe but this is expressly prohibited by the ‚Ordoliberal‘ Stability Pact, and would in any case be impossible for the Club Med bloc without an EU fiscal guarantee.” – bto: Wir können auch dann eine Schuldenkrise nur mit noch mehr Schulden bekämpfen.

- “If it reached this point, the eurozone would crash into deflation, leading to a string of sovereign bankruptcies and the devastation of Europe’s banks and financial system. Monetary union would shatter. Radical national movements of the Salvini stripe would sweep into power. It would the end of the post-War European order as we have known it.” – bto: So ist es. Und es wäre die Folge des politischen Versagens der letzten Jahrzehnte.

- “The benign scenario is that US inflation ebbs in the nick of time. The Powell Fed takes the global pulse, dials down its rhetoric, and abandons tightening altogether. China gains another two years to engineer a soft-landing.” – bto: Was wünschen sich die Strategen?

- “My working assumption is that the Fed will continue on its set course until something breaks: the world economy.” – bto: Je mehr das denken, desto größer der Verkaufsdruck an den Märkten.