Chinas Schuldenblase zusammengefasst

Schon vor einiger Zeit hat Martin Wolf die chinesische Abhängigkeit von Schulden beleuchtet und Szenarien diskutiert. Angesichts der Bedeutung Chinas für die Weltwirtschaft ein wichtiges Thema:

- “‚If something can’t go on forever, it will stop.‘ This statement by Herbert Stein, chairman of the US council of economic advisers under Richard Nixon and Gerald Ford, tells us that debt cannot grow faster than an economy forever. That is going to be true for China, too. What we do not know is when and how it will end. Will it be sooner or later? Will it be easy to cope with or will it be devastating? The manageability of China’s enormous domestic debts will be of great importance, not just for China, but for the many economies whose exports depend on it.” – bto: Zum einen gilt das mit dem Schuldenwachstum nicht nur für China, sondern für die gesamte Weltwirtschaft. Zum anderen trifft es dann ganz besonders Länder wie Deutschland, die sich darauf jedoch überhaupt nicht vorbereitet haben!

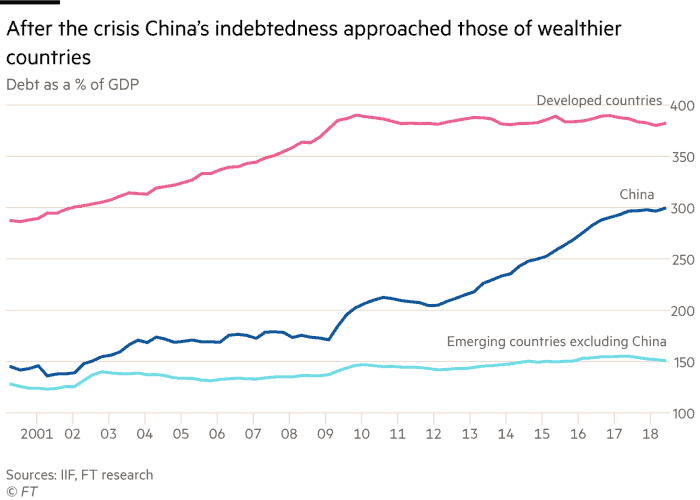

- “Between early 2004 and late 2008, Chinese gross debt was stable at between 170 and 180 per cent of gross domestic product. This was higher than in other emerging countries, but not much higher. This seemed manageable.Then, in 2008, came the meltdown of the western financial system and subsequent deep recession in high-income countries. China responded with a huge investment programme amounting to some 12.5 per cent of GDP, probably the biggest ever peacetime stimulus.” – bto: China hat uns den Arsch gerettet. So deutlich muss man das sagen.

Quelle: FT

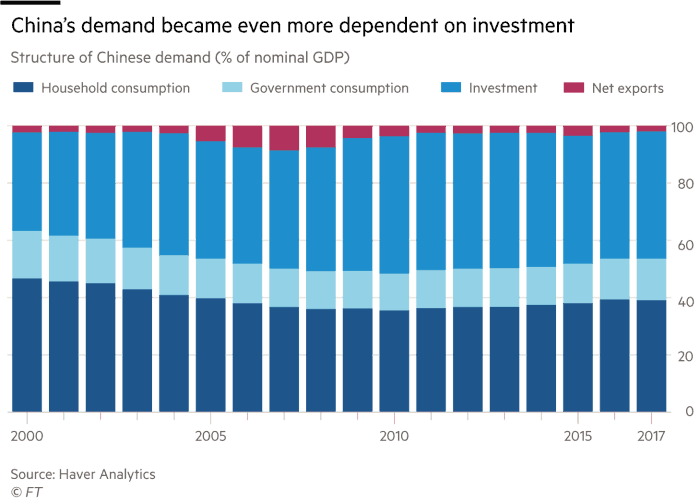

- “Given the structure of the economy and the levers in the hands of the authorities, only investment could be increased quickly enough and on a large enough scale. As a result the share of gross investment in GDP soared from an already extremely high 41 per cent of GDP in 2007 to 48 per cent in 2010. This huge investment boom maintained measured growth at close to 10 per cent after the crisis. (…) But ominously, far from raising China’s underlying rate of growth, a marked slowdown followed.” – bto: Es hatte erhebliche positive Effekte für die Weltwirtschaft. Die Abschwächung des Wachstums dürfte auf das zunehmend unproduktive Verwenden der Schulden zurückzuführen sein.

- “It also led to a huge and sustained surge in debt, predominantly to non-financial corporations, including off-balance sheet local government financing vehicles.” – bto: was dann so aussieht:

Quelle: FT

- “According to the Institute for International Finance, between the fourth quarter of 2008 and the first quarter of 2018 China’s gross debt exploded from 171 to 299 per cent of GDP. A simple measure of the efficiency of the investment is the incremental capital output ratio, which measures the ratio of the investment rate to the growth rate. Until the crisis, the ICOR had not exceeded four for any sustained period. Ever since 2011, it has been close to six.” – bto: Das zeigt ebenfalls, dass die Produktivität der Investitionen abnimmt, immer ein Zeichen für kommende Probleme.

- “For Beijing, this response to the financial crisis had an additional drawback — distracting it away from a necessary rebalancing of its economy. In 2007, then premier Wen Jiabao declared that China’s growth was ‚unstable, unbalanced, uncoordinated and unsustainable‘. (…) By 2017, net exports were back down to 2 per cent of GDP: that did represent a rebalancing. But investment was still higher than in 2007, at 44 per cent of GDP, private and public consumption was still only 54 per cent of GDP and debt had soared to three times GDP. In sum, the rebalancing of China’s external accounts came at the cost of still greater domestic imbalances.”

Quelle: FT

- “There are four conceivable possibilities: a crisis, followed by lower growth; a crisis, not followed by lower growth; no crisis, but reduced growth; and no crisis and no reduction in growth.” – bto: Alle Szenarien haben eine erhebliche Wirkung über China hinaus.

- “In a paper published in 2010, Moritz Schularick of the Free University Berlin and Alan Taylor of the University of California Davis argued that ‚credit growth is a powerful predictor of financial crises‘. This finding was from a database of 14 high-income countries. Yet a paper by Sally Chen and Joong Shik Kang of the IMF, published this year, argues that the evidence also applies to China, saying: ‚China’s credit boom is one of the largest and longest in history. Historical precedents of ‘safe’ credit booms of such magnitude and speed are few and far from comforting.‘“ – bto: So ist es. Ohnehin sind die Worte “This time it`s different” bekanntlich sehr gefährlich!

- “The salient characteristics of a system liable to a crisis are high leverage, maturity mismatches, credit risk and opacity. China’s financial system has all these features.” – bto: und ist eben nicht “anders”.

- “It could (…) be argued that China is a creditor nation with a controlled capital account. That makes it relatively invulnerable to a run by foreign lenders of the kind familiar to observers of financial crises in emerging economies. Yet financial crises are possible in countries that are relatively immune to such runs: Japan in the 1990s is an example.” – bto: Und China hat eine ähnliche Demografie.

- “(…) China’s banking system has a lower ratio of credit to deposits than those of most countries that have experienced funding crises. But this ignores non-loan assets. In China the ratio of non-loan assets — assets other than conventional bank loans — to total assets was 50 per cent in 2016, a relatively high level. This is one indicator of the scale of China’s shadow banking system.” – bto: weil in diesem Bereich Dinge finanziert werden, die über die offiziellen Wege nicht funktionieren und die Sparer mit höheren Zinsen angelockt werden.

- “(…) lending to non-financial corporate borrowers accounted for just over a half of the increase in debt between late 2008 and early 2018. But the quality of much of this lending is questionable. Moreover, ‚if debt is rising, but GDP is not, then the payment capacity is deteriorating‘, the IMF paper argues.” – bto: Es ist so einfach: Unproduktive Kredite sind schlechter zu bedienen.

- “The strongest reply is that the government is powerful and has a well-run central bank, effective control over the banking system, ownership of vast domestic and foreign assets, untapped fiscal capacity and tight controls over transactions with, and by, foreigners. If it were determined to protect the financial system from collapse it could do so. But if gross debt were to rise above 400 per cent of GDP over the next decade, even that would be less certain.” – bto: Und es hängt viel davon ab, ob es China gelingt, die Wohlstandsmauer zu durchbrechen, bevor die Alterung massiv einsetzt.

- “Imagine, however, that there is a financial crisis. Would it be followed by lower growth? The answer is: yes, in both the short and long term. (…) The extent and duration of such a recession would depend on how far and how quickly other spending would rise. China might be tempted to revert to a weaker exchange rate and a big increase in net exports. But the Trump administration would not tolerate this. The alternative would be much higher private and public consumption.” – bto: Das wäre ein deflationärer Schock für die Welt und würde auch Europa und die Eurozone massiv treffen und hier die nächste Phase der Krise auslösen.

- “A surge in consumption sufficient to offset the impact on domestic demand of a big cut in investment spending would be impossible without a far bigger shift in incomes towards households. Moreover, that would squeeze profits, which would reduce investment still further. Ultimately, the only plausible offset to the impact of a big crisis in demand would be a huge increase in spending financed by central government.” – bto: noch mehr Investitionen?

- “In the longer term, growth would also slow from current reported levels. That would be largely because a significant part of the credit-fuelled investment spending had been wasted, partly in building unneeded dwellings and excessive industrial capacity.” – bto: Ja, so ist es.

- Wie stehen die Chancen für eine weiche Landung? “The longer the authorities take to control debt trends the more difficult it will be to achieve such an outcome. But this is clearly the animating principle behind current policy, which is aimed at strengthening the financial system and halting the trend towards higher debt. Just how difficult it will be to stick to those principles is shown by this week’s announcement of another round of infrastructure spending, in order to stimulate demand. That implies more investment and debt. But the trade war with the US may make such backsliding inevitable.” – bto: Die Chinesen sind wie wir gefangen in einer Politik, die auf Schulden setzt. Deshalb kann es nur böse enden.

- “Given its reliance on high investment, debt might need to rise rapidly again. Furthermore, the slowdown in credit growth could be an example of Goodhart’s law, named after Charles Goodhart of the London School of Economics. It states that ‚when a measure becomes a target, it ceases to be a good measure‘. This has long been true of GDP in China. Might it now be true of reported debt?” – bto: wie bei uns, wo plötzlich Prostitution und Schattenwirtschaft in das BIP eingerechnet wurden, um das BIP und damit die Schuldenquote zu schönen …

- “China has a choice between a whimper today and a destructive bang tomorrow. It can curb the debt surge and allow growth to slow now, or risk a crisis followed by a more severe slowdown later.” – bto: Ich glaube, China hat diese Wahl nicht. Es ist gefangen in einer Politik, die von der Schuldendroge abhängt. Nach dem Opium eine andere Droge, die aus dem Westen in das Land geschwappt ist.