Papiervermögen

John Hussmann habe ich immer wieder bei bto diskutiert. Er gefällt mir durch seinen analytischen Ansatz mit Blick auf die Kapitalmärkte, wobei er ähnlich wie ich der Kritik ausgesetzt ist, zu früh auf die Probleme hinzuweisen. Damit dürfte er am Ende zwar recht haben, aber dann zu hören bekommen: Keine Kunst, wenn man immer die Krise prognostiziert, muss man ja mal recht haben … Kenne ich auch nur zu gut.

Deshalb heute ein Beitrag von ihm aus dem letzten Jahr. Ein Leser machte mich darauf aufmerksam und es lohnt durchaus, nochmals die Prinzipien in Erinnerung zu rufen:

- “Despite risks that I fully expect to devolve into a roughly -65% loss in the S&P 500 over the completion of the current market cycle, it’s absolutely critical to distinguish the long-term effects of valuation from the shorter-term effects speculative pressure. Historically-reliable valuation measures are remarkably useful in projecting long-term and full-cycle market outcomes, but the behavior of the market over shorter segments of the market cycle is driven by the psychological inclination of investors toward speculation or risk-aversion.” – bto: Das ist mittlerweile Lesern von bto gut bekannt – und eigentlich allen, die mit offenen Augen auf die Märkte blicken.

- “Across history, the evaporation of paper wealth following periods of speculation has repeatedly taught a lesson that is never retained for long. Unfortunately, the lesson has to be relearned again and again because of what J.K. Galbraith referred to as “the extreme brevity of the financial memory.” Speculation is dangerous because it encourages the belief that just because prices are elevated, they must somehow actually belong there. It encourages the belief that the paper itself is wealth, rather than the stream of future cash flows that investors can expect their securities to deliver over time.” – bto: Das ist so richtig! Es ist immer nur die Ertragskraft eines Assets, die den Wert determiniert. Das sollten sich auch die Immobilienbesitzer und -käufer in Deutschland vor Augen halten.

- Mit Blick auf die beabsichtigte Wirkung der Null-/Negativzinspolitik auf Assetpreise hält er fest: “A moment’s reflection should make it obvious that once a security is issued, whether it’s a government bond or a dollar of base money, that security must be held by someone, at every point in time, until that security is retired. The only way to get people to invest in something ‚more stimulating to the economy‘ than government bonds is to stop issuing government bonds.” – bto: Das ist eine brillante Aussage! Chapeau!

- “It takes only a bit more thought to recognize that securities, in themselves, are not net wealth. Rather, every security is an asset to the holder, and an equivalent liability to the issuer. (…) Neither the creation of securities, nor changes in their price, create net wealth or purchasing power for the economy. Yes, an individual holder of a security can obtain a transfer of wealth from someone else in the economy, provided that the holder actually sells the security to some new buyer while the price remains elevated. But in aggregate, the economy cannot consume off of its paper ‚wealth,‘ because in aggregate, those paper securities cannot be sold without someone else to buy them, and those paper securities must be held by someone until they are retired.” – bto: Und ich würde sagen, dass diese Aussage auch für andere Assets wie zum Beispiel Immobilien gilt.

- “What actually matters, in aggregate, is the stream of cash flows. Specifically, the activity that produces actual economic wealth is value-added production, which results in goods and services that did not exist previously with the same value. Value-added production is what actually ‚injects‘ purchasing power into the economy, as well as the objects available to be purchased.” – bto: in “bto-Sprech” produktive Investitionen (gerne auch mit Kredit finanziert).

- “If one carefully accounts for what is spent, what is saved, and what form those savings take one obtains a set of ‚stock-flow consistent‘ accounting identities that must be true at each point in time:

- 1) Total real saving in the economy must equal total real investment in the economy;

- 2) For every investor who calls some security an ‚asset‘ there’s an issuer that calls that same security a ‚liability‘;

- 3) The net acquisition of all securities in the economy is always precisely zero, even though the gross issuance of securities can be many times the amount of underlying saving;

- 4) When one nets out all the assets and liabilities in the economy, the only thing that is left – the true basis of a society’s net worth – is the stock of real investment that it has accumulated as a result of prior saving, and its unused endowment of resources. Everything else cancels out because every security represents an asset of the holder and a liability of the issuer. Securities are not net wealth.” – bto: Ich würde da weiter gehen. Jedes Asset hat nur einen Wert aufgrund des künftigen Ertrages, wobei das auch gesparte künftige Kosten sein können. Und die spart man dann, weil man sie sich selbst schuldet, nicht Dritten. Beispiel: selbst genutztes Eigentum.

- “Conceptualizing the ‘stock of real investment’ as broadly as possible, the wealth of a nation consists of its stock of real private investment (e.g. housing, capital goods, factories), real public investment (e.g. infrastructure), intangible intellectual capital (e.g. education, knowledge, inventions, organizations, and systems), and its endowment of basic resources such as land, energy, and water. In an open economy, one would include the net claims on foreigners (negative, in the U.S. case). A nation that expands and defends its stock of real, productive investment is a nation that has the capacity to generate a higher long-term stream of value-added production, and to sustain a higher long-term standard of living.” – bto: Abgesehen von meiner anderen Definition (siehe oben) stimme ich dieser Aussage zu! Und wenn man dann an Deutschland denkt, dann – oh je.

- “When paper ‘wealth’ becomes extremely elevated or depressed relative to the value-added producedby an economy, it’s the paper ‘wealth’ that adjusts to eliminate the gap. (…) it shouldn’t be surprising that this measure is based on the ratio of equity market capitalization to corporate gross-value added.” – bto: also der Vergleich der Marktkapitalisierung mit der tatsächlichen Wertschöpfung der Unternehmen. Das ist konzeptionell konsistent.

- “(…) the chart below shows the market capitalization of U.S. nonfinancial equities, divided by the gross value-added of U.S. nonfinancial companies, including estimated foreign revenues. This measure is shown on an inverted log scale (blue line, left scale). The red line shows actual subsequent S&P 500 average annual nominal total return over the following 12-year period. We prefer a 12-year horizon because that’s where the ‘autocorrelation profile’ of valuations (the correlation between valuations at one point and valuations at any other point) reaches zero. Presently, we estimate negative total returns for the S&P 500 over the coming 12-year period.” – bto: Hussman zitierte ich schon mehrfach und dieses Bild ist bekannt. Dennoch lohnt es sich aufs Neue, es anzusehen.

Quelle: HUSSMANFUNDS

- “Among the valuation measures we find best correlated with actual S&P 500 total returns in market cycles across history, the S&P 500 is currently (das war im Herbst 2017) more than 2.8 times its historical norms. Importantly, this estimate of overvaluation is not somehow improved by accounting for the level of interest rates. The reason is that interest rates and economic growth rates are highly correlated across history. Lower interest rates only ‘justify’ higher market valuations provided that the trajectory of future cash flows is held constant. But if interest rates are low because growth rates are also low, no valuation premium is ‘justified’ at all.” – bto: Diese Logik stimmt und die habe ich auch bei bto schon mal ausführlich diskutiert, weshalb ich das an dieser Stelle nicht wiederhole.

- “At present, U.S. investors are under the delusion that the $37.3 trillion of paper wealth in their equity portfolios represents durable purchasing power. Unfortunately, as in 2000 and 2007, they are likely to observe an evaporation of this paper wealth. Nobody will ‘get’ that wealth. It will simply vanish. If a dentist in Poughkeepsie sells a single share of Apple a dime lower than the previous trade, over $500 million dollars of paper wealth is instantly wiped from the stock market. That’s how market capitalization works. Over the completion of this market cycle, we estimate that between $19.8 and $24.2 trillion in paper ‘wealth’ will evaporate into thin air.” – bto: weil es eben eine überzogene Bewertung künftiger Cashflows ist.

- Dann gehen sie auf die Möglichkeit ein, deutlich höhere Wachstumsraten zu erzielen, was ja hinter der Politik von Trump steht. Auch hier eine Beschreibung dessen, was bto-Lesern schon seit Jahren geläufig ist: “Real economic growth is the sum of two components: employment growth plus productivity growth. That means growth in the number of employed workers, plus growth in the level of output per-worker. (…) Let’s take a look at these components, and how they’ve changed over the decades. You’ll quickly see that while a quarterly pop in GDP growth is always possible, expectations of sustained 4% real GDP growth fall into the category of ‘delusion.’” – bto: Genauso ist es!

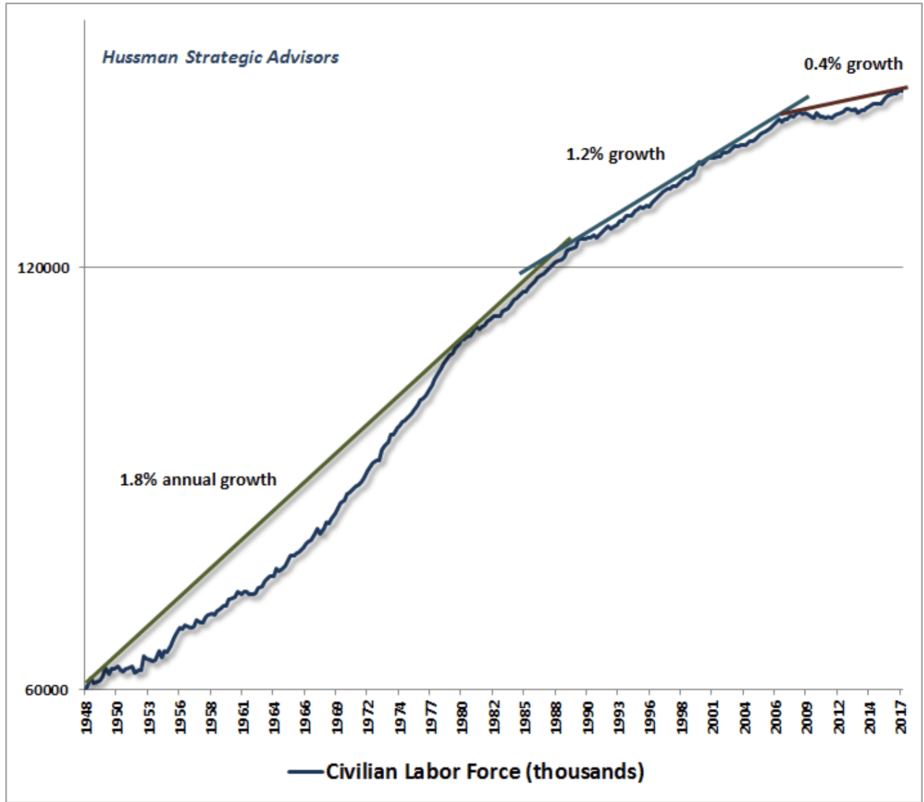

- “The chart below shows the civilian labor force, on a log scale (so trendlines of different slopes represent different growth rates). For much of the post-war period until about 1980, the growth rate of the civilian labor force averaged about 1.8% annually. That growth slowed to 1.2% until about 2010. That 2010 figure is 1945 plus 65; the year that the first post-war baby-boomers hit retirement age. Since then, the growth rate of the civilian labor force has dropped to just 0.4% annually. That’s demographics.” – bto: So ist es!

Quelle: HUSSMANFUNDS

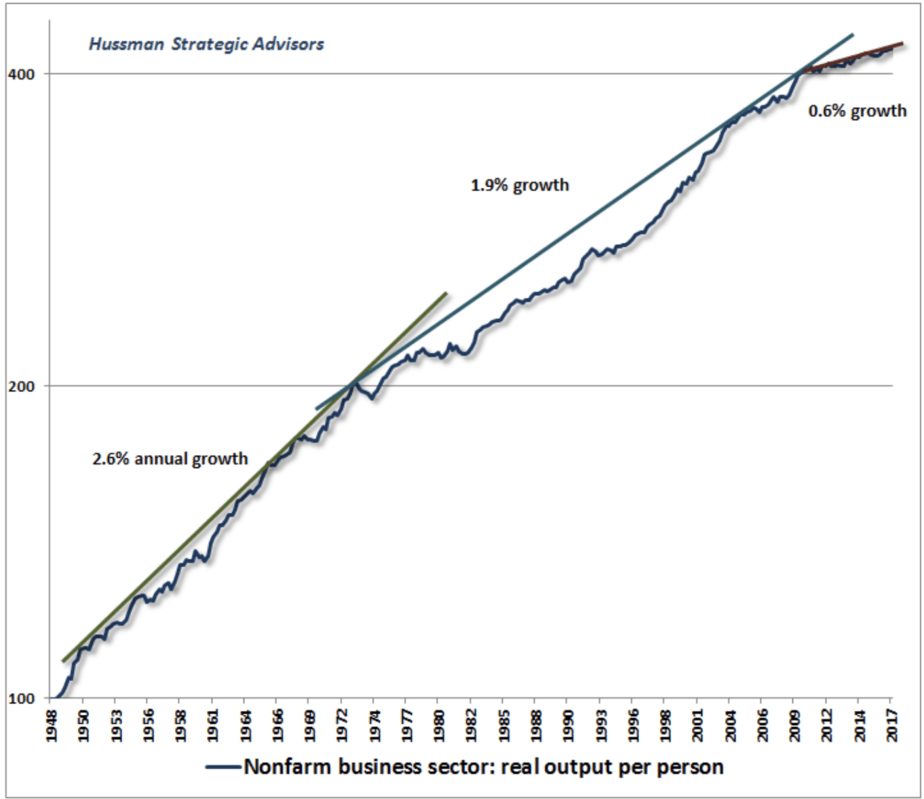

“Now let’s take a look at productivity growth. In the early years of the post-war era, labor productivity increased at a rather explosive 2.6% annual growth rate. Growth then gradually slowed to about 1.9% annually, though in fits and starts, until about 2003. Over the past 14 years, U.S. productivity growth has slowed to just 0.6% annually.” – bto: Auch das ist bekannt und es sieht in Europa noch schlechter aus.

Quelle: HUSSMANFUNDS

- “(…) add the current 0.4% growth rate in the civilian labor force to 0.6% growth in productivity, and you get the current “structural” growth rate of the U.S. economy; that is, the growth rate we would observe in the absence of changes in the unemployment rate. That structural growth rate has deteriorated to just 1% annually.” – bto: was deutlich unter dem liegt, was wir in der Vergangenheit hatten und vor allem unter dem, was wir für die Bewältigung der ungedeckten Verbindlichkeiten brauchen!

Es passt nicht zusammen: hohe Schulden, wenig Wachstum, immens hohe Bewertungen aller Finanzwerte. So ist es kein Wunder, dass derzeit die Anzeichen zunehmen, die auf ein Platzen der Blase hindeuten. In den Finanzmärkten, aber eben auch in der Realwirtschaft. 2019 wird turbulent.