“Fitch warns time is running out for China’s debt-driven boom”

Warnungen zu China sind nicht neu. Ich erinnere an:

→ „Does It Matter If China Cleans Up Its Banks?“

→ China wird die Probleme der Weltwirtschaft weiter verstärken

→ „Globales Wachstum – noch immer ‚Made in China‘“

→ „China must wean itself off debt addiction if it is to avoid financial calamity, warns IMF chief“

→ Chinas Finanzsystem immer fragiler?

→ Margin Call in und aus China? (I)

Nun eine erneute Warnung von Fitch zum Schuldenboom des Landes. Der Telegraph berichtet:

- “China is creating credit at twice the pace of underlying growth and is relying on hazardous bubbles to keep growth running far above the safe speed limit, Fitch Ratings has warned.” – bto: Bis jetzt ist es aber gut gegangen.

- “(…) state control over the banking system will prevent a sudden collapse in confidence or a western-style financial crash, but the Communist authorities are running out of tools to meet their inflated GDP targets.” – bto: Das ist natürlich die entscheidende Frage.

- “‚Fitch’s base case remains that China’s large debt burden will translate into substantially slower economic growth by the end of the decade rather than an outright financial crisis‘, said Andrew Fennell, the agency’s director in Asia.” – bto: Das wird auch durch die schlechte demografische Entwicklung verstärkt. Alleine deshalb dürfte China weniger wachsen. Ein weiteres Symptom des Ponzi-Schemas, das dort gerade abläuft.

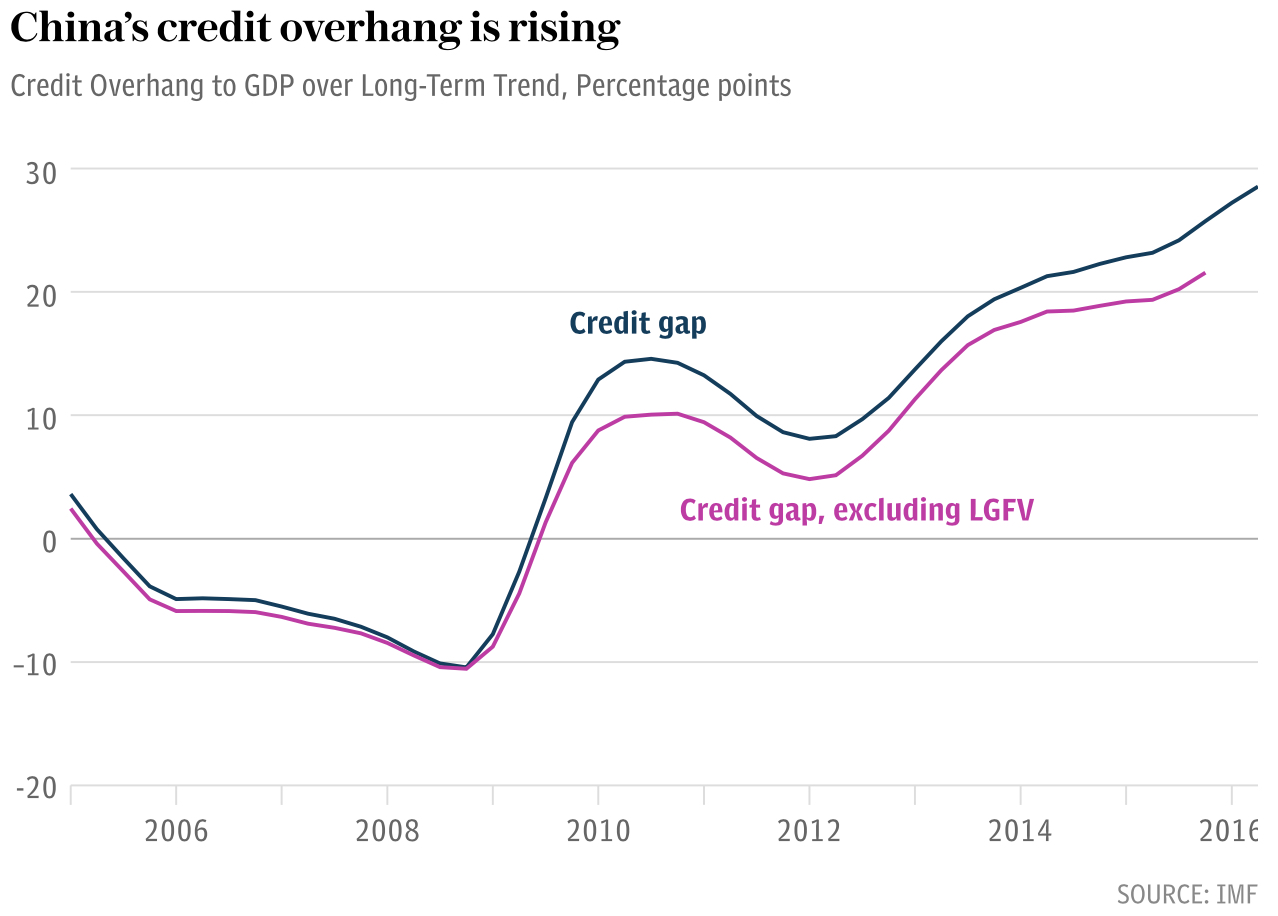

- “(…) all forms of credit – including local government bond issuance – grew at annual rate 16.1pc last year while nominal GDP expanded at just at 8pc. ‚The rapid increase in credit required to keep GDP growing at its current rate strongly suggests that a sustainable rate of medium-term economic growth is well below the authorities’ prevalent targets (…).‘” – bto: Es ist eine Schuldenwirtschaft nach westlichem Vorbild.

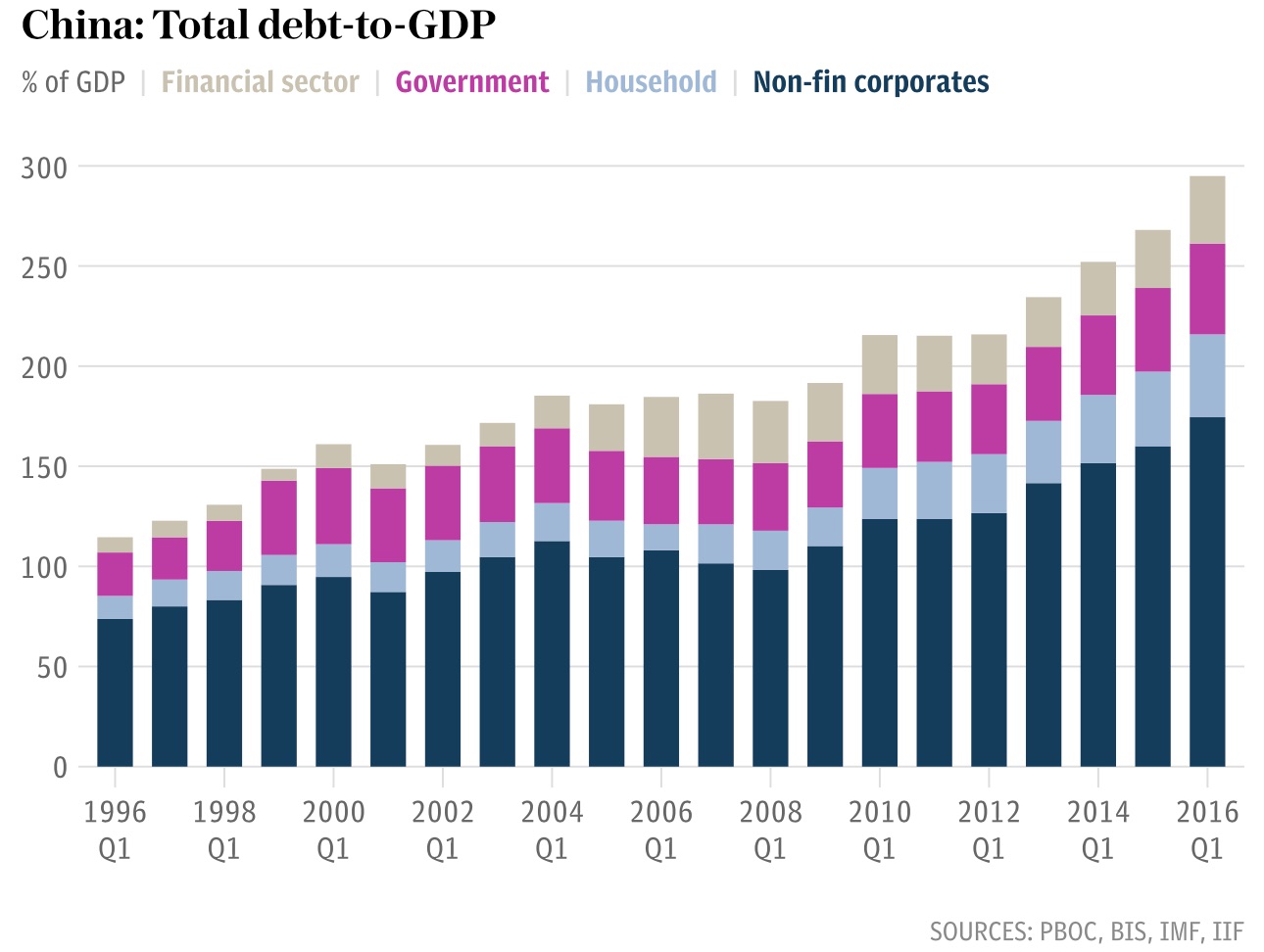

- “(…) total non-financial debt is approaching 270pc of GDP – up from 250pc at end-2015 – and is on track to hit 300pc within three years..” – bto: Auf dem Chart im Telegraph sieht noch schlimmer aus:

- “(…) the latest burst of lending has ‚resulted in a surge in home prices and appears to have fueled asset bubbles‘. (…) The boom was not accidental. The government actively pushed buyers into the real estate market last year (…).” – bto: Auch dies entspricht dem Vorgehen bei uns im Westen, man denke an die Greenspan-Bubble von 2007.

- “The economy went into an (unacknowledged) recession in early 2015 due to the combined squeeze of monetary tightening and a fiscal shock, taking global commodity prices down with it. The slump hit bottom eighteen months ago. Beijing lost its nerve and let rip with a fiscal stimulus comparable in intensity to the post-Lehman blitz in 2009, encouraging a boom that is now near its peak and is completely unsustainable. The augmented budget deficit reached 11.8pc of GDP at the end of last year.” – bto: Kann man aber wiederholen. Wie auch ich hier.

bto: Und die Kredite sind immer unproduktiver, wie man hier zeigt. Genau deshalb wird man es nicht ewig fortsetzen können:

Quelle: The Telegraph

→ The Telegraph: “Fitch warns time is running out for China’s debt-driven boom”, 23. Januar 2017

Ein Aspekt, der hier nicht erwähnt wird, aber mit ins Bild gehört:

Das Wachstum der chinesischen Wirtschaft hängt ganz erheblich vom EXPORT ab.

Die Regierung hat es nicht in der Hand, dass dies so bleibt.

Trump, weiterhin maues Wachstum in den entwickelten Volkswirtschaften mit schlapper Nachfrage nach in China produzierten Gütern sowie andere Länder mit günstigeren Arbeitskosten könnten das chinesische Wachstum erheblich dämpfen.

Die Inlandsnachfrage würde sich ganz sicher nicht kurzfristig entsprechend erhöhen lassen.

Dies nur NEBEN der nicht endlos verfolgbaren Strategie, das ambitionierte Wirtschaftswachstum – sicher sozial erforderlich – mit hohem Verschuldungswachstum in Gang zu halten.

Ernsthaft Besorgnis ist angebracht.

Gerated soll es natürlich heißen.

Sehr geehrter Herr Dr. Stelter,

der Beitrag ist nicht uninteressant, aber mir als Außenseiter fehlen ein paar wichtige Daten zur Einordnung:

Wie wichtig ist das China-Geschäft für Fitch? Wird China von Fitch überhaupt geraten? Soll das eine Herabstufung des Ratings ankündigen oder ist es nur eine Meinungsäußerung? Das wäre für die Beurteilung der eigenen Interessen von Fitch hilfreich.