Wie Politik und EZB Deflation und Stagnation fördern

Das ist so einleuchtend, dass es von Ökonomen, die den Kurs der Notenbanken gut finden, rundweg in das Reich der Fabel verwiesen wird. Namen brauche ich nicht zu nennen. Die lassen sich auch nicht davon beirren, dass niemand anderes als die Bank für Internationalen Zahlungsausgleich (BIZ) deutliche Anzeichen der Zombifizierung sieht und vor den Folgen warnt.

Nun, wo wir vor der gigantischsten Zombifizierung der europäischen Wirtschaft stehen, lohnt es sich, nochmals hinzuschauen. Passend kommt da eine aktuelle Studie:

Zombie Credit and (Dis-)Inflation: Evidence from Europe, veröffentlicht vom National Bureau of Economic Research (NBER) im Mai. Spannende Lektüre. Ich konzentriere mich auf die Kernergebnisse:

- “More than ten years after the global financial crisis, Europe’s economic growth and in- flation remain depressed, even though the European Central Bank (ECB) and other European central banks provided substantial monetary stimulus, including negative deposit rates, longer-term refinancing operations, and large-scale asset purchase programs.” – bto: Ja, es ist halt schwer, Wohlstand zu drucken.

- “Europe’s ‘missing inflation puzzle’ bears a striking resemblance to Japan’s ‘lost decades.’ Besides a deflationary pressure, both economies have been characterized by ultra accommodative central bank policies and zombie lending (i.e, cheap credit to impaired firms) by undercapitalized banks. Along with search-for-yield behavior of investors, these forces have collectively pushed borrowing costs to record lows, even for high-risk firms allowed many struggling firms to stay afloat, leading to a ‘zombification’ of the economy.” – bto: Aber nicht doch! Wie kann man etwas so schreiben, was man nicht schreiben darf, glaubt man an die Rettung des europäischen Projektes durch die EZB?

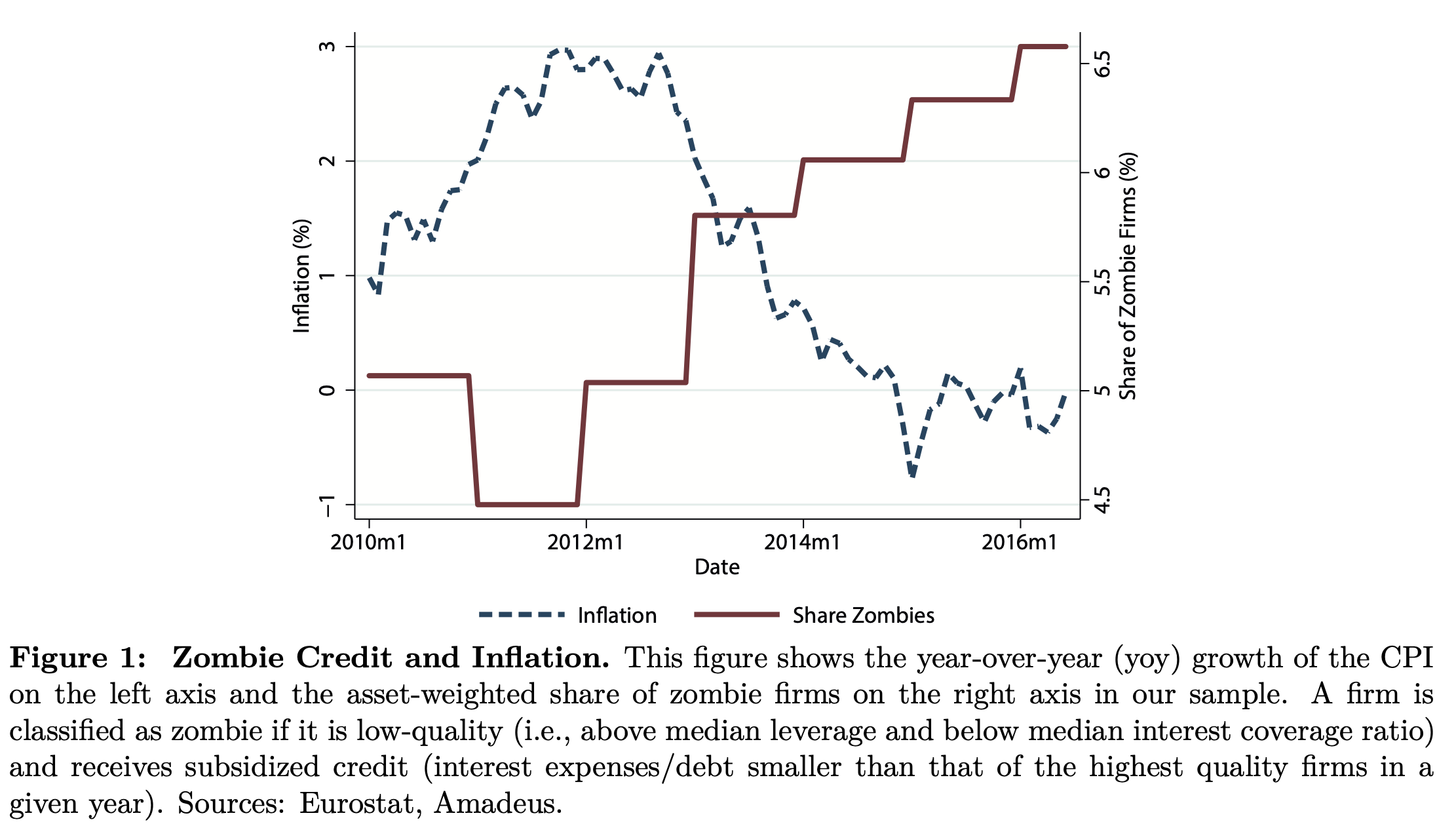

- “In this paper, we provide an explanation for the co-occurrence of the rise of zombie credit and low inflation shown inFigure 1:” – bto: Das Bild gab es schon so ähnlich bei früheren Diskussionen des Themas:

Quelle: Zombie Credit and (Dis-)Inflation: Evidence from Europe

- “Following a negative demand shock and the resulting price decline, zombie credit keeps alive some firms that would otherwise default, weakening the downward adjustment in the number of active firms. The resulting excess production capacity puts downward pressure on firms’ markups and product prices. In equilibrium, zombie credit causes (i) a reduction in firm default and entry, firm markups, product prices, and firm productivity; and (ii) an increase in sales, number of active firms, and input costs.” – bto: ein generell schwierigeres Wettbewerbsumfeld.

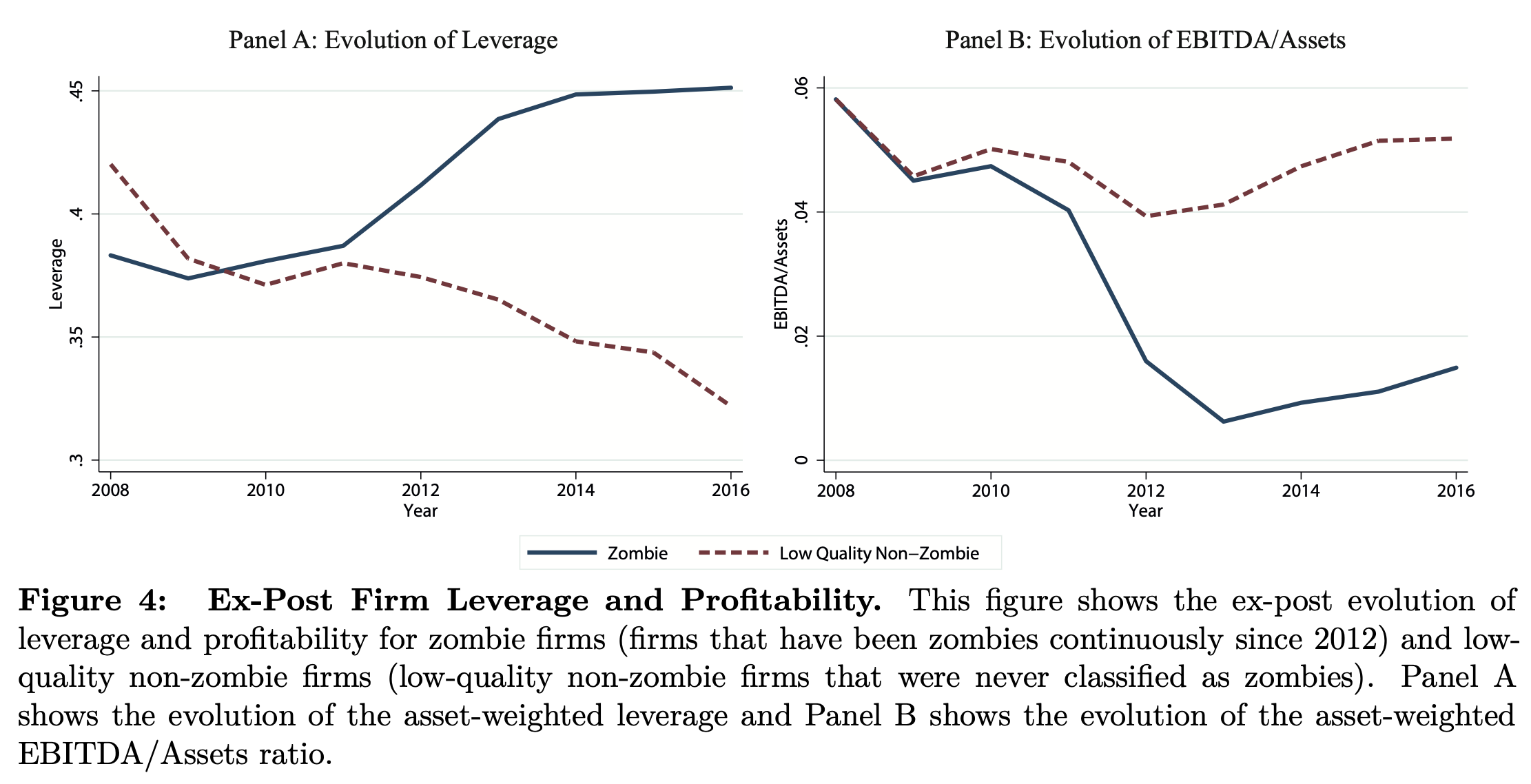

- “(….) we identify zombie firms as firms that meet two criteria: (i) the interest coverage ratio is below the median and the leverage ratio is above the median—where medians are calculated at the industry-country level—and (ii) the cost of debt financing is lower than the cost paid by the most creditworthy comparable firms. Zombie firms’ ex-post financial and real outcomes suggest that their access to cheap credit is not driven by a positive future outlook. In particular, while low-quality non-zombie firms on average deleveraged and maintained a stable profitability, zombie firms increased their leverage and experienced a drop in their profitability.” – bto: Eine Studie zeigte am Beispiel Portugals genau das: Die Banken geben lieber den bankrotten Firmen weiteren Kredit als gesunden, weil sie die Abschreibung nicht verkraften können.

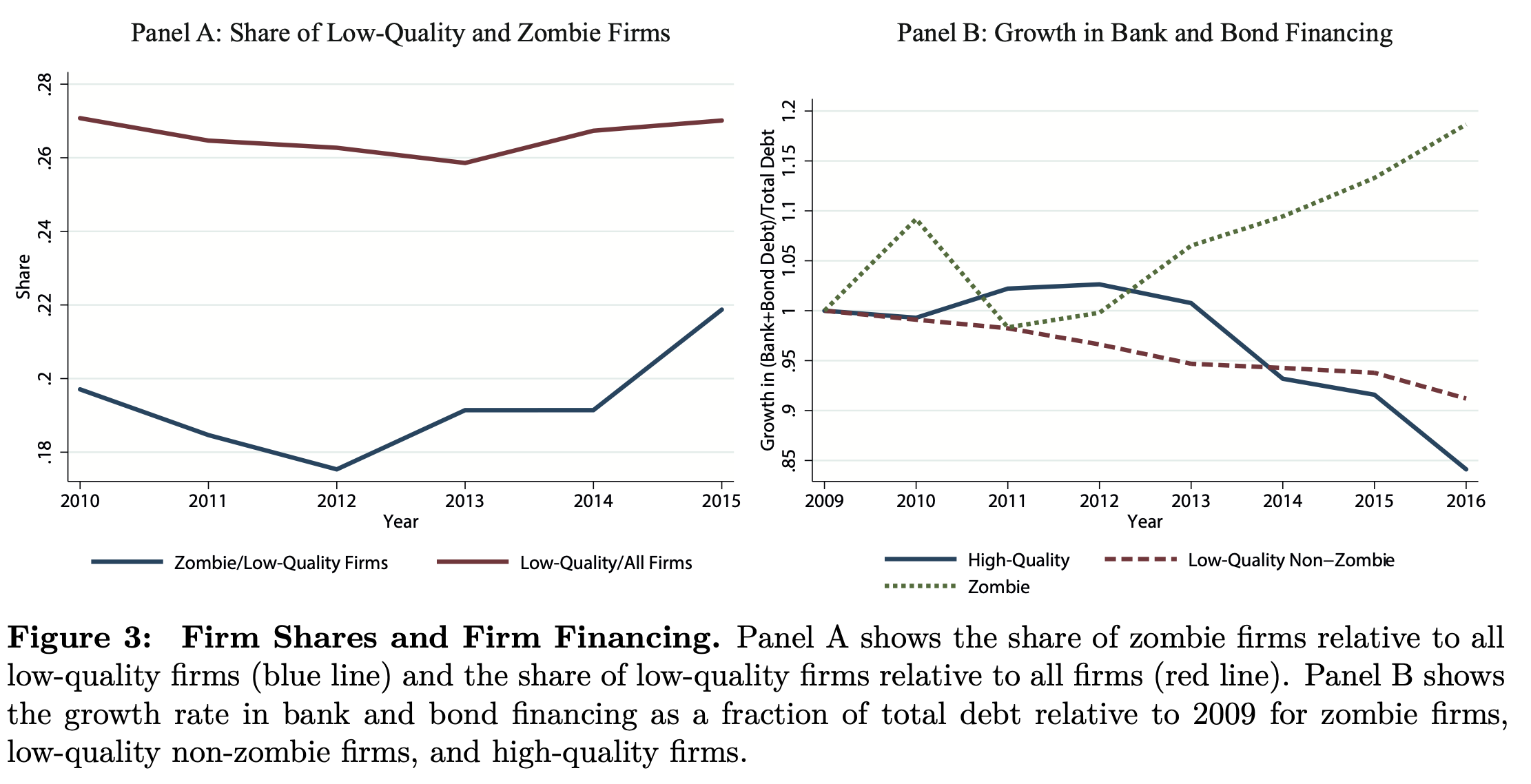

- “Figure 1 shows that the share of zombie firms in our sample increased from roughly 4.5% to 6.7% from 2012 to mid-2016. In Figure 3 we document that this rise of zombie firms is driven by low-quality firms obtaining credit at very low interest rates and not by firms that already enjoy access to cheap credit deteriorating in quality. The left panel shows that, while the share of low-quality firms is constant at roughly 27% during our sample period, the share of zombie firms relative to low-quality firms increased from 17.5% to 22% between 2012 and 2015. The right panel shows that bank loans and bonds play an increasingly important role in the debt funding mix of zombie firms.” – bto: Das sind durchaus spannende Zahlen. Sie stützen, was der gesunde Menschenverstand erwarten lässt.

Quelle: Zombie Credit and (Dis-)Inflation: Evidence from Europe

- “We also confirm that the firms that we classify as zombie are not temporarily weak firms, i.e. firms that ‘look weak’ based on observable characteristics but that might actually have a promising future outlook that allows them to obtain cheap debt financing. To this end, we track their ex-post leverage, profitability, and default rates. In Figure 4 we plot the time-series evolution of leverage and EBITDA margin, respectively, for firms that have been zombies continuously since 2012 (solid line) and low-quality firms that were never classified as zombies (dashed line).” – bto: Allein schon die Entwicklung der Zombies muss negativ auf eine Gesamtwirtschaft wirken. Hinzu kommt der Ausstrahlungseffekt auf die gesunden Unternehmen.

- “Figure 6 shows the year-over-year CPI growth separately for markets with a high (above median) and low (below median) growth of zombie firms over our sample period. Consistent with the rise of the share of zombie firms in the aggregate starting in 2012, we see that beginning in mid-2012, markets with a higher increase in the share of zombie firms experience a decline in CPI growth compared with markets with a lower increase in zombies firms.” – bto: Die Politik, die vorgibt, Inflation erzeugen zu wollen, erhöht stattdessen den deflationären Druck. Muss man erst mal drauf kommen.

Und dann das: “The timing of the reversal of the inflation dynamics coincides with the adoption of extraordinary monetary easing measures, including negative rates, by the ECB and other national central banks.“ – bto: Mehr muss man dazu nicht sagen.

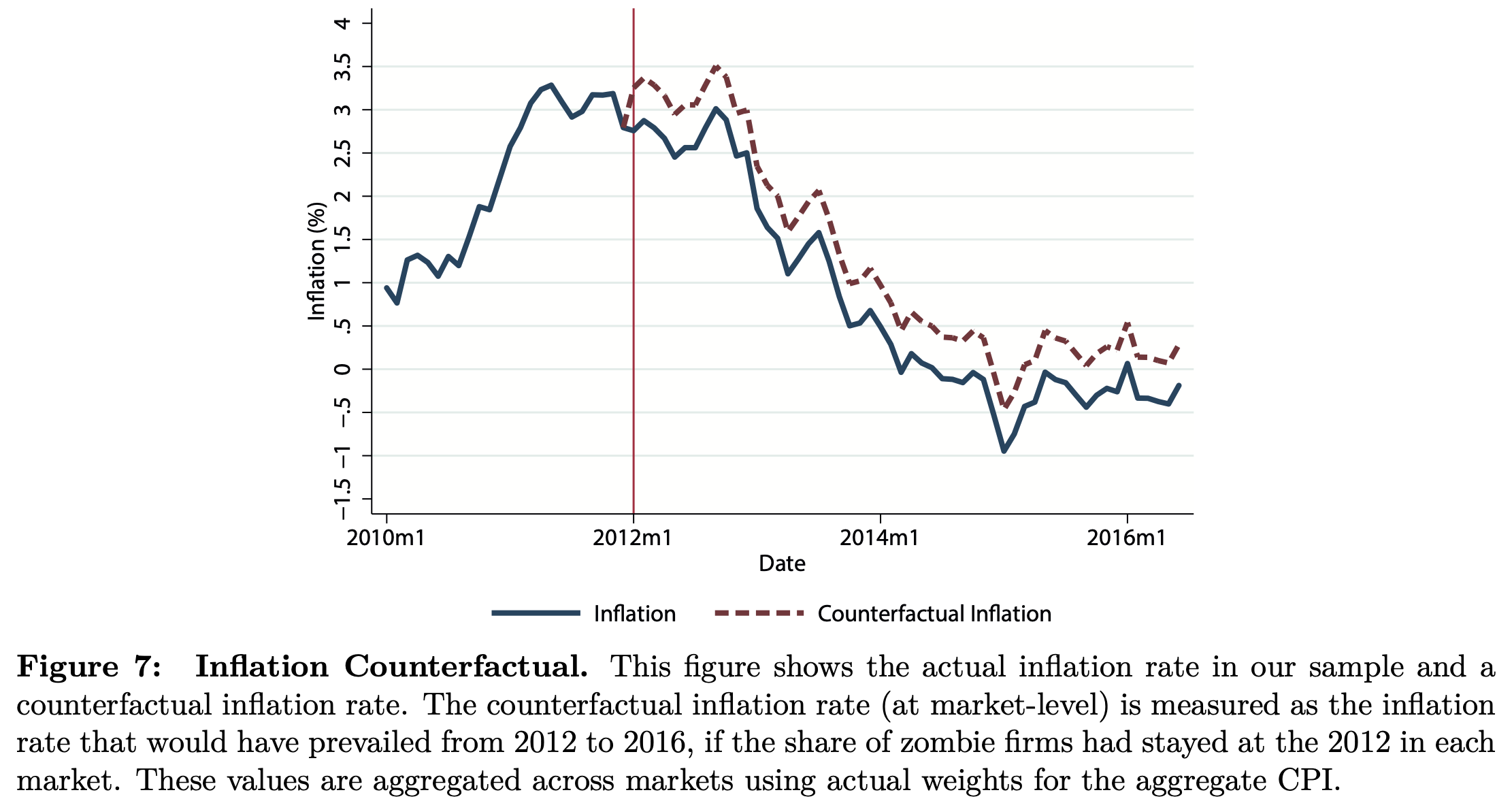

Quelle: Zombie Credit and (Dis-)Inflation: Evidence from Europe

- “A simple counterfactual exercise shows that these magnitudes are economically significant. Suppose that the share of zombie firms remained at its 2012 level in each market. Using our estimates, we can (i) calculate, for each market, what the CPI growth would have been under this counterfactual scenario in the post-2012 period and (ii) aggregate these counterfactual inflation rates across all markets, using the CPI industry weights. We present the results in Figure 7, where the solid line is the observed inflation and the dashed line is the counterfactual inflation. With the obvious caveats of a partial equilibrium exercise, our estimates suggest that inflation would have been on average 0.45 percentage points higher if the share of zombies stayed at its 2012 level.” – bto: Was wollte die EZB noch mal bekämpfen? Ach ja, Deflation. Klappt ja gut.

Quelle: Zombie Credit and (Dis-)Inflation: Evidence from Europe

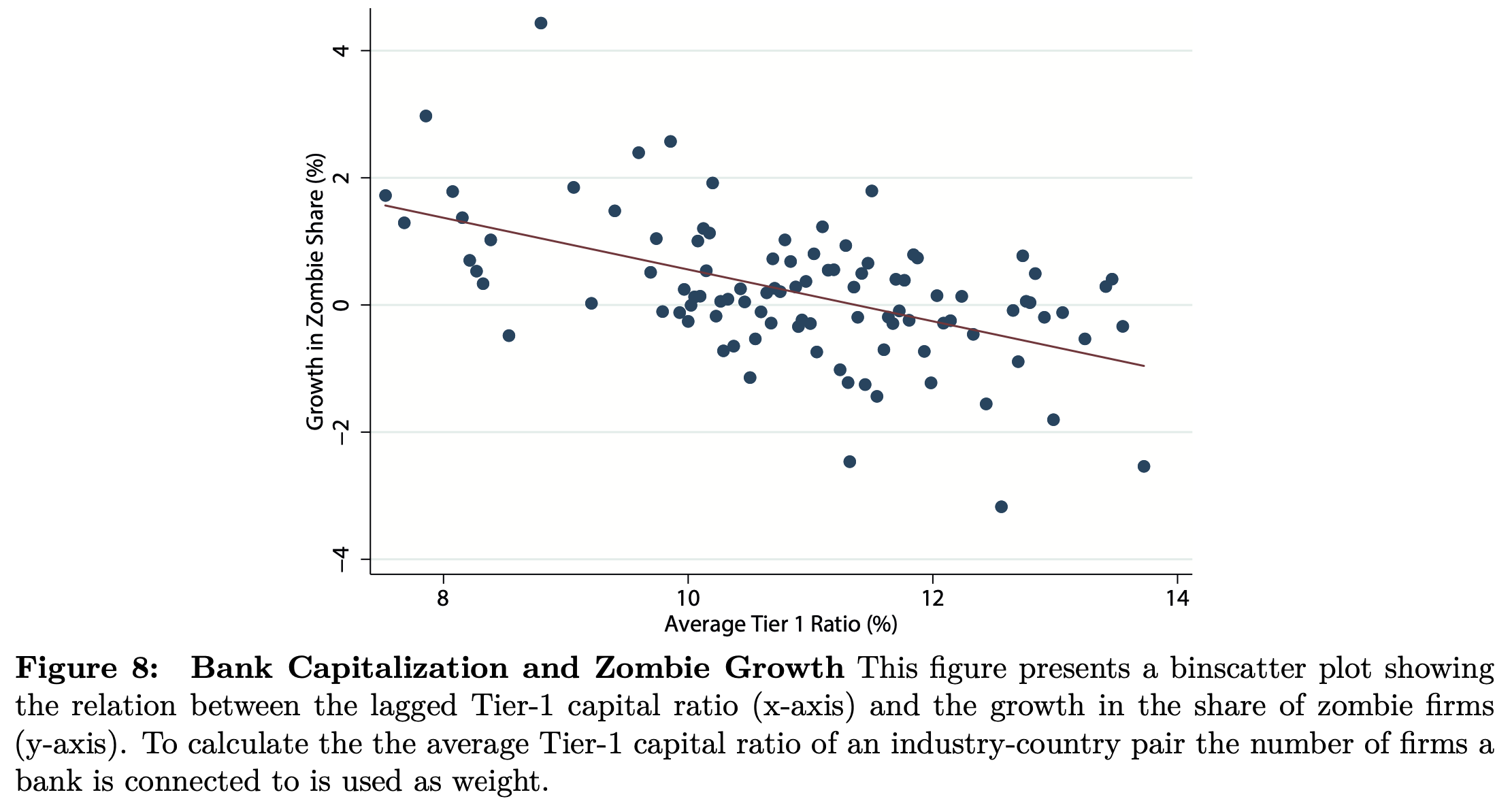

- “(…) weakly-capitalized banks have an incentive to evergreen loans to distressed borrowers. By extending loans at very low interest rates, these banks provide their impaired borrowers with the liquidity necessary to meet payments on other outstanding loans. Thereby, these banks avoid (or at least defer) realizing immediate loan losses in the hope that the respective borrowers will eventually regain solvency. Figure 8 confirms this conjecture by documenting a pronounced negative relationship between a market’s Average Tier-1 Ratio and its zombie share growth.” – bto: Ich finde es nicht überraschend, dass es so ist, sondern dass es ernsthaft Ökonomen gibt, die dieses hoch-rationale Verhalten der Banken nicht für denkbar halten.

Quelle: Zombie Credit and (Dis-)Inflation: Evidence from Europe

- “For accommodative monetary policy to be effective in times of a weakening financial sector, it should thus be accompanied by a targeted financial sector recapitalization program.” – bto: Besser noch – wenn man die Banken saniert, braucht man die aggressive Geldpolitik nicht mehr.

- Und dann noch mal zur Ansteckungsgefahr für gesunde Unternehmen: “(…)there might be a zombie contagion from zombie to non-zombie firms in markets with a strong rise in zombie credit. That is, good firms in zombie markets not only suffer because they have lower individual sales growth due to the higher number of firms, but also because their profitability drops due to the excess capacity-induced fiercer competition in these markets. As a result, initially good non-zombie firms can turn into zombies over time due to a high prevalence of other zombies in their markets.” – bto: EZB – “Europäische Zombifizierungsbank”? Das wäre doch man ein Titel.

Was zum Fazit führt:

„Accommodative policy measures reduce financial pressure and thereby fuel the survival of weak firms with unsustainable business models. As these zombie firms proliferate, aggregate supply increases compared to the case where the business cycle runs its normal course. The resulting excess capacity puts downward pressure on producer prices, and, ultimately, depresses inflation levels.“ – bto: ein hoher Preis, den wir alle bezahlen für die “Rettung” des Euro. Problem: Diese Art der Rettung beschleunigt seinen Niedergang.