“Why so low for so long? A long-term view of real interest rates”

Beim Stichwort “säkulare Stagnation” und tiefe Zinsen aufgrund der demografischen Entwicklung fiel mir wieder eine interessante Studie der BIS von 2017 ein, die ich bei bto noch nicht besprochen habe. Die BIS ging der Frage nach, ob sich die Notenbanken hinter externen Faktoren verstecken können oder ob sie erhebliche Mitschuld an der Tendenz zu immer billigerem Geld tragen. Schauen wir uns die Studie genauer an:

- “Prevailing approaches to explaining real interest rates are premised on the notion that the desired (ex ante) supply of saving and the desired (ex ante) demand for investment determine some notional equilibrium real interest rate consistent with full employment or output at potential, also known as the ‘natural rate’. This notion takes root in the ‘loanable funds’ framework, where saving-investment determinants drive the demand for, and supply of, funds that pin down the market-clearing interest rate (in equilibrium at the marginal product of capital).” – bto: von mir etwas despektierlich als “Badewannen-Theorie” bezeichnet.

- “How far does the resulting empirical evidence support the hypothesis that saving- investment imbalances have driven real interest rates to such low levels? Existing studies, in our view, have provided estimates of the extent to which saving-investment determinants can explain real interest rate movements conditional on the theory, but not convincing evidence supporting the underlying theory itself. Too much of the theory has been embedded in maintained hypotheses and thus its validity has not been subject to a test.” – bto: Da die meisten Ökonomen vom Staat und/oder von den Notenbanken finanziert werden, haben sie allen Grund, externen Faktoren die Schuld für die Entwicklung zu geben.

Also schauen wir uns die Daten mal gründlicher an, dachten sich dann die Ökonomen der BIS, die – obwohl auch von den Notenbanken bezahlt – scheinbar einen Hofnarrenstatus genießen:

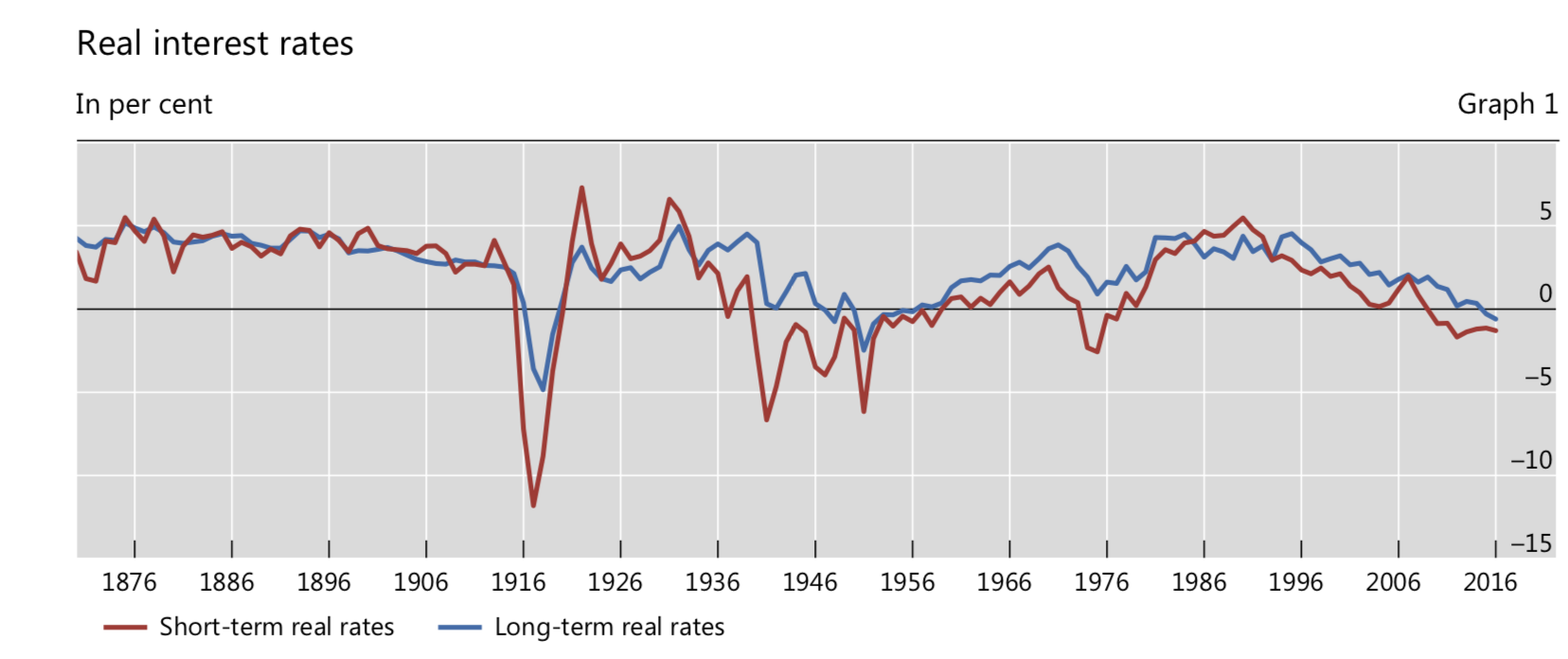

Zunächst ein Blick auf die langfristige Entwicklung der realen Zinsen:

Quelle: BIS

- “Graph 1 shows the time series of global real interest rates, captured by the cross-country median. We see that real rates of both long and short maturities tend to co-move closely, although short-term rates are naturally more volatile. Excluding the World Wars, when real rates drop, sometimes deeply into negative territory, one can discern four distinct phases. Up to World War I – mostly the classical gold standard – real rates were comparatively high and stable. In the interwar years, after recovering quickly from World War I, they started to fall markedly in the wake of the Great Depression. Real rates then rose much more gradually starting in the early 1950s and, after a new big dip during the Great Inflation, peaked in the early to mid-1980s, reaching levels broadly similar to those seen in the early part of the sample. Finally, real rates have been declining since then, to historically low levels, wars excepted.”– bto: Die entscheidende Frage ist: Warum sinken die Zinsen seit den 1980er-Jahren? Ist das die Folge des Ungleichgewichts in der Badewanne? Oder haben hier doch die Notenbanken ihre Finger im Spiel?

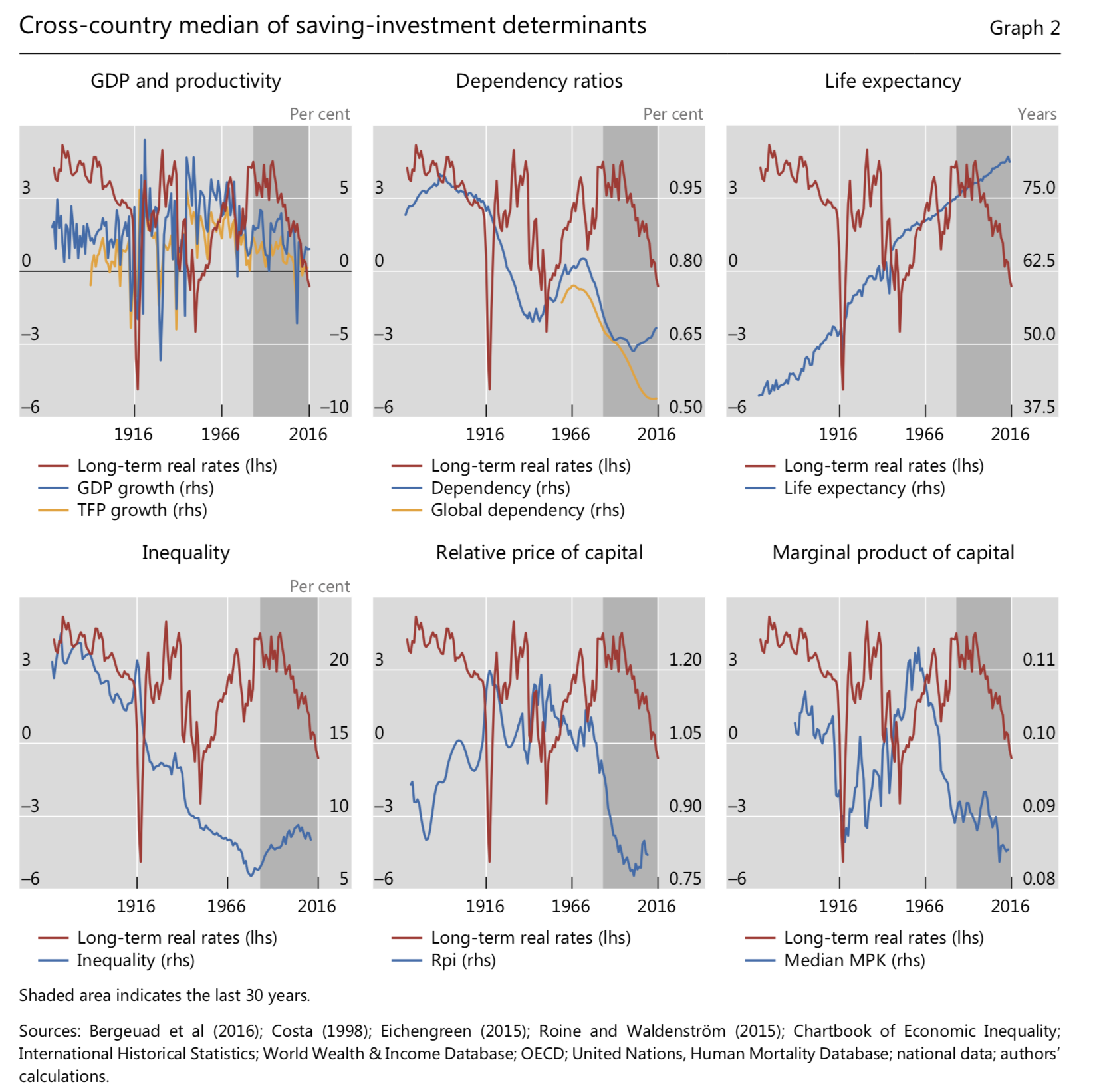

- “Graph 2 plots the long-term real interest rates against the standard factors singled out as potential drivers, all in terms of cross-country medians. Two observations stand out.”

- “First, over the latest phase starting in the early 1980s, most of the standard factors are correlated with the decline in real interest rates with signs that accord with the saving-investment framework. (…) The median dependency ratio is the only exception – although a correct correlation resurfaces if one takes into account the demographic dividends of large EMEs in recent decades and looks at the dependency ratio based on a larger set of countries, including the likes of China and India (broad dependency ratio).” – bto: Das bedeutet, das Modell der Badewanne passt für die letzten Jahrzehnte.

- “Second, once we extend the sample to cover preceding periods, almost all of the correctly-signed correlations disappear. Only life expectancy is consistently correlated with real interest rates and with the right sign. (…) Even the marginal product of capital, which according to theory should be a summary statistic of the net saving-investment balance, is hardly correlated with the real interest rate over the full sample.” – bto: Nun könnte man sagen, dass man, wenn man länger lebt, mit geringeren Zinsen auskommen kann, weil die Zeitpräferenz abnimmt. Das wäre eine plausible Erklärung. Allerdings würde die nicht ausreichen, um den gesamten Rückgang der letzten Jahrzehnte zu erklären.

Danach folgen detaillierte statistische Analysen zu den Einflussfaktoren auf den Zins, die allesamt zeigen, dass die Badewannentheorie zwar theoretisch schön klingt, empirisch, aber nicht nachweisbar ist. Ich spare mir das hier und verweise auf die Quelle am Ende.

- Zur Rolle der Geldpolitik: “In light of the weak empirical support for saving-investment proxies in explaining real interest rate movements, is it possible to find a tighter relationship with other factors? Note that the nominal long-term yields are currently at their unprecedented lows for most countries.” – bto: Wir wollen mal schauen, was die Notenbanken so treiben!

- “There is a broad consensus that market interest rates are determined by a combination of central bank and market participants’ actions, given the supply of the underlying assets. Central banks set the nominal short-term interest rate and influence the nominal long-term interest rate through signals of future policy rates and asset purchases. Market participants adjust their portfolios based on expectations of central bank policy, views about the other factors driving long-term rates, attitudes towards risk and various balance-sheet constraints, not least regulation. Given nominal rates, by construction, actual inflation – effectively predetermined at a given point in time – determines ex post real rates, and expected inflation determines ex ante real rates.” – bto: Man kann es auch einfacher sagen: Ein Marktteilnehmer, der keinem Konkursrisiko unterliegt und der aus anderen als rein ökonomischen Gründen agiert, kann den Preis im Markt manipulieren. Vor allem dann, wenn er die Ware kostenlos herstellt.

- “If, as long as inflation is low and stable, central banks do not lean against the build-up of financial imbalances but ease aggressivelyand persistently after the bust, this will tend to impart a downward bias to nominal and real interest rates. Moreover, if, as a result, debt continued to rise in relation to GDPor did not adjust sufficiently, a ‘debt trap’ might even emerge: it would become harder to raise interest rates without causing damage to the economy. Seen through the standard framework lens, this would look like an exogenous decline in the natural rate, whereas in fact it would simply reflect the path-dependent interaction of monetary policy with the economy.” – bto: Es könnte doch sein, dass die Manipulation durch die Notenbanken dazu führt, dass diese weiter manipulieren müssen, um keine Krise auszulösen. Doch zeigt sich das auch in den Daten?

Um das zu analysieren, werden lange Zeiträume in verschiedenen Ländern und unterschiedlichen „monetary regimes“ – also Goldstandard etc. – betrachtet. Das Ergebnis scheint eindeutig:

- “(…) real interest rates have been declining following a combination of factors. A first factor, at work in the first sub-phase, is a natural normalisation from the levels needed to fight the Great Inflation. (…) A second factor(…) is the asymmetric response to successive financial booms and busts, most notably those that culminated with the banking strains in the early 1990s and then again, most spectacularly, the GFC. Central banks focused on tight inflation objectives, as well as short-run macroeconomic stabilisation, and did not respond to the build-up of financial imbalances. The third factor, especially at play post-GFC, has been thecentral bank’s difficulty in pushing inflation towards target post-crisis, not least as a result of the long-term headwinds induced by globalisation and, possibly, technology.” – bto: und wegen des deflationären Drucks hoher Schulden! Das darf an dieser Stelle nicht vergessen werden!

Das führt zum entscheidenden Fazit:

- “While there is a reasonable, although by no means watertight, link between the posited underlying saving-investment determinants and the real interest rate in the recent reference period, the link does not survive beyond the standard sample. By contrast, we find robust evidence of the relevance of monetary policy regimes, defined by the central banks’ interest rate-setting behaviour.” – bto: Dies bedeutet, die Notenbanken tragen erhebliche Mitschuld an vergangenen und kommenden Krisen!

Und nun stellt sich die Frage: Warum arbeiten anerkannte Ökonomen wie Larry Summers noch immer mit der Badewannentheorie? Wohl weniger, weil sie stimmt, sondern weil sie Notenbanken und Politik nicht nur die Möglichkeit gibt, von eigenem Versagen abzulenken, sondern extremere Maßnahmen zu ergreifen. Politik statt Wissenschaft.