Warum die Fed die Party crashen sollte

Die Börsen sind nervös. Könnte es sein, dass die Notenbanken den wichtigsten Faktor der hohen Bewertungen, die Flut an Liquidität, wegnehmen? In Europa besteht die Gefahr nicht. Die EZB bleibt fest auf Monetarisierungskurs. Aber in den USA? Nun, es gibt ernsthafte Stimmen, dass die Fed es tun sollte.

Bevor wir dazu kommen, zunächst ein paar Fakten zur Einordnung vom wie immer brillanten John Authers von Bloomberg:

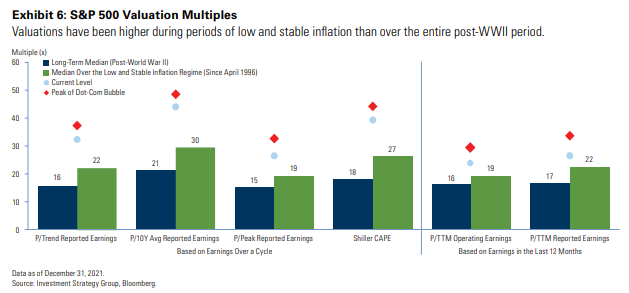

- “The following chart points out that valuations have been higher during periods of low and stable inflation, as theory predicts and as the chart below shows. Stocks aren’t much cheaper now than at the peak of the dotcom bubble. On the face of it, if you think that inflation is going to settle in at a higher level, then you should also brace for valuations to move from the pale blue circles in the Goldman Sachs graphic down to the level of the dark blue bars.” – bto: Das leuchtet ein, weil die Erträge unter Druck kommen.

Quelle: GoldmanSachs, Bloomberg

Hinter den hohen Bewertungen der heutigen Zeit steht eine Flut an Liquidität:

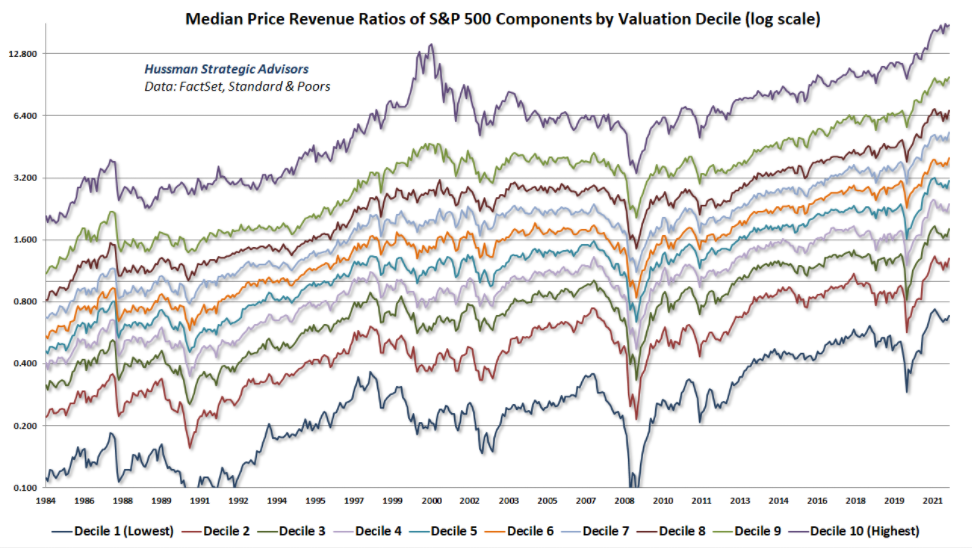

- “The following charts come from John Hussman, a fund manager and market theorist who has produced a series of research reports over the last decade suggesting U.S. stocks are overvalued. In his latest missive published this month, he splits the S&P into deciles according to valuation — and shows that every one is more expensive than it has been before. Previous booms may have been based on a few companies, but this time everything looks rich.” – bto: Das ist deshalb bedeutsam, weil wir so wissen, dass es eben nicht nur die FANGS sind, die den Markt verzerren.

Quelle: Hussman, Bloomberg

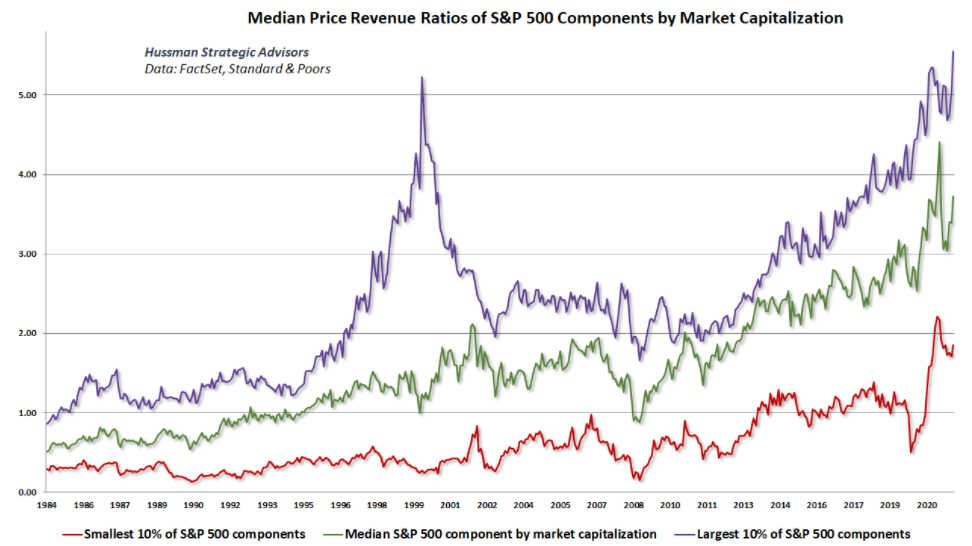

- “Adjusting for size renders the same finding. The following chart divides the S&P by market cap, and both the smallest and largest are more expensive than they were in 2000 (…).” – bto: Das kann nur mit dem billigen Geld erklärt werden.

Quelle: Hussman, Bloomberg

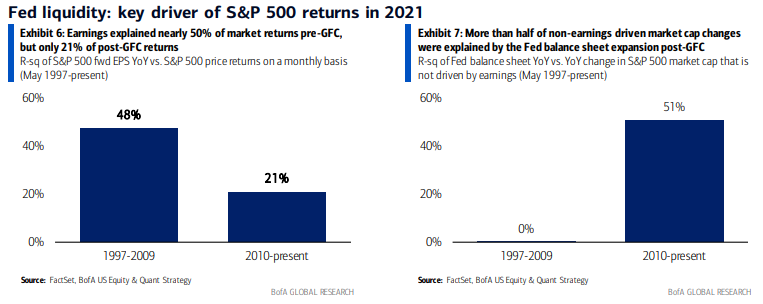

- “Liquidity, particularly from the Federal Reserve, has come to matter far more than corporate earnings since the desperate rescue operations over the financial crisis in 2009. As Savita Subramanian of BofA shows in the following chart, expected earnings are far less helpful in explaining market outcomes since 2010 than they were before. Meanwhile, changes in the Fed’s balance sheet, the amount of money it’s making available to markets, have become hugely important.” – bto: Alles andere würde auch nicht einleuchten. Ja, die Gewinne sind gestiegen, aber das genügt nicht als Erklärung!

Quelle: BofA, Bloomberg

Fazit Authers:

“Betting on stocks to continue on their current course requires confidence that inflation will come under control, and earnings will keep growing. Betting on a crash entails confidence that there will be no ‘put,’ whether from the Fed or the target-dated fund industry. History suggests extreme vulnerability to a selloff, so some evasive action, like adding to cash from bonds and shifting toward cheaper stocks more likely to prosper under inflation, seems like a good idea.”

Und der Druck auf die Fed, zu handeln, ist offensichtlich. Kristin Forbes, Professorin of International Economics at MIT-Sloan School of Management and a former member of the monetary policy committee of the Bank of England, schreibt in der FINANCIAL TIMES (FT):

- “In the past, the standard central bank playbook has been to wait for the recovery to solidify, then end any asset purchase programmes, then raise interest rates several times, and only then, if the recovery was still on track and inflation was nearing target, consider quantitative tightening.” – bto: Wir sind aber schon seit mehr als zehn Jahren im Umfeld von Rettungsmaßnahmen …

- “This approach may have made sense back then when inflation was low and the labour market slow to heal. If only a modest amount of tightening is needed, central banks should prioritise the tool that people understand and which can be better calibrated. And in an era of very low interest rates, it made sense to focus on raising rates. But this time is different. There are several reasons why quantitative tightening should be a priority today.” – bto: Das heißt übersetzt: Die Notenbanken müssen in Kauf nehmen, die Party an den Börsen zu beenden.

- “First, with inflation well above target, the output gap largely closed and above-trend growth likely to continue, the Federal Reserve will need to tighten monetary policy by quite a bit. Unlike the last recovery, there will be room to tighten using more than one tool. Quantitative tightening should not prevent interest rates from being raised several times.” – bto: mehrfache Zinseerhöhungen in der hoch-geleveragten Weltwirtschaft? Das wird eine Freude!

- “Second, accomplishing some of the necessary tightening via the balance sheet could allow the Fed to raise interest rates more gradually. This would give vulnerable segments of the economy more time to prepare.” – bto: Da kann man sich schlecht vorbereiten, wenn die Schulden zu hoch und die Vermögenspreise auf Blasen-Niveau sind.

- “Third, tightening via the balance sheet would have a greater effect on the medium and longer end of the yield curve (which shows the different interest rates that investors demand for holding shorter and longer-dated government debt) and thereby more impact on the housing market. With house prices in the US hitting record highs, reducing stimulus for this sector could not only be manageable, but reduce the risk of a more painful adjustment later on. The Fed could also prioritise unwinding its $2.6tn of mortgage-backed securities faster than its Treasury holdings.” – bto: Das ist vollkommen richtig. So lässt man Luft aus Blasen raus.

- “Finally, putting more emphasis on unwinding the balance sheet would be an important signal of central bank independence. It would confirm that quantitative easing is not permanent financing of fiscal deficits, and that asset purchases to support market liquidity (a key justification in early 2020) are not permanent support for markets.” – bto: Das genau darf die EZB nicht machen, sonst steht die nächste Euro-Krise vor der Tür.

- “This would be an important change in the central bank playbook, and therefore should be communicated in advance to the public to avoid provoking a sharp market adjustment that could undermine the recovery. Also, although recent research has improved our understanding of how QE works, we have no comparable metrics for the impact of quantitative tightening. Any unwinding should initially occur gradually so that we can learn about the magnitude of the effects.” – bto: Ich denke, wir können sie bereits beobachten.

John Authers dazu: “The Fed has stepped in to arrest market routs on several occasions over the last quarter-century, but throughout this period low inflation was a constant. If consumer prices are rising, it grows much harder for the central bank to come to the rescue. Or, it could give up on fighting inflation, in which case the stock market’s real returns will suffer.”