Inflation – eine ernste Bedrohung?

Morgen (27. Juni 2021) ist Tim Congdon in meinem Podcast zu Gast. Er hat mehr als 40 Jahre die Diskussion um wirtschafts- und vor allem geldpolitische Themen in Großbritannien mitbestimmt. Unter anderem war er im Beirat des Finanzministeriums. Heute lehrt er als Professor an der University of Buckingham. Er gilt als ein Vertreter des Monetarismus und warnt heute deutlich vor den Gefahren einer Inflation.

Zur Einstimmung Auszüge aus einem Beitrag, den er gemeinsam mit einem Kollegen vor einem Jahr verfasst hat:

- „Governments have reacted to the current crisis as if the falls in output reflected a deficiency of aggregate demand, as in a “standard” recession. (…) In a desperate effort to sustain companies and people’s income, a wide range of budget measures have been implemented by governments in a record time. (…) In a similar vein, central banks have acted promptly to provide as much cash as needed, both to governments, to help finance the budget deficits, and to the banking sector, to support asset expansion.“ – bto: Das ist eine akkurate Beschreibung. Es ging letztlich um die Verhinderung einer Kernschmelze im Finanzsystem und einer tiefen Rezession.

- „The reaction of central banks and financial regulators to the current crisis is in sharp contrast to their response to the Global Financial Crisis (2008-2010). Rather than ‘punishing’ banks with demands for higher ratios of capital to risks assets (which by 2010 were over 60 per cent higher than they had been three years earlier), they have relaxed the bank capital requirements. They have even asked banks to limit bad debt provisioning, fearful that provisioning may lead, first, to loan write-offs and the loss of capital and, second, to balance-sheet shrinkage as banks cut assets so that they are in line with lower capital.” – bto: Ich denke, es war noch mehr. Die Banken haben faktisch eine Ausfallgarantie bekommen, weshalb sie mehr Geld ausliehen.

- „Only when central banks implemented their asset purchase programmes (QE) did they manage to stop the fall in the amount of money and stabilise its rate of growth at levels consistent with sustained growth of real output at around the annual trend rates of 1 per cent to 2½ per cent, with low inflation. The USA offers a good example of the success of QE in this respect, delivering in effect a second round of the Great Moderation with excellent macroeconomic outcomes (see Figure 1 and Table 1). After a fall in broad money in 2009 and 2010, the conduct of US monetary policy came, for the eight years from 2011 to 2018 inclusive, with an average annual growth rate of 4.0 per cent for both the quantity of money (on the M3 measure) and nominal GDP.“ – bto: Das ist ein wichtiger Punkt. Das Wachstum der Geldmenge ist ein guter Indikator für das künftige nominale Wirtschaftswachstum.

- „Figure 1 shows that in 2019 the USA had already started to depart from the path of monetary stability. In the second half of the year the annual rate of growth of money rose above 8 per cent. In fact, the monetary developments in the USA by the end of 2019 were already inflationary, in the sense that they were incompatible with a rate of inflation of 2 per cent or so. Of course, no one could have anticipated in autumn 2019 that there would soon be a shock to the economy like the coronavirus crisis.“ – bto: Das war, als die Fed im Repo-Markt intervenieren musste und deshalb eigentlich ein Krisenereignis vor der Krise.

- „The key determinant of the growth of nominal GDP in the long run is the growth of the quantity of money. In that sense monetary policy matters more to macroeconomic outcomes than fiscal policy. True, governments may overspend and incur deficits in an effort to increase internal demand. This policy, however, will be inflationary if the central bank opts for a monetary policy that accommodates too readily the needs of the government (i.e. so-called ‘fiscal dominance’, when the central bank’s priority is to finance the budget deficit, not to keep inflation under control or to attain the usually understood objectives of macroeconomic policy). Unhappily, current developments in countries with full monetary sovereignty – notably the USA and the UK – look very much like the ‘fiscal dominance’ that sound-money economists deplore.“ – bto: Und die Eurozone versucht durchaus mitzuhalten.

- „Since their inception central banks have had a close relationship with government, with their ability to raise money coming to the rescue of the Treasury in times of crisis. This is the direct financing or so-called ‘monetisation of budget deficits’ from which spendthrift governments have benefited for centuries. In recent years proponents of self-described ‘Modern Monetary Theory’ have appealed to a ‘magic money tree’ to justify their appeal to central bank finance for government expenditure. In their view, the monetisation of the deficit overcomes traditional government budget constraints and enables the state to implement active economic policies in a quest for full employment.“ – bto: Damit treffen die MMT-Befürworter aber genau den Zeitgeist. Sie liefern das Argument, welches heute gebraucht wird.

- „MMT supporters are right in saying that there is no limit to the creation of money under purely fiat monetary systems. But their theory forgets that private-sector agents have a finite demand to hold real money balances. In other words, there is a ‘monetary equilibrium’ in which a maximum quantity of nominal money balances is compatible with a given price level of goods and services. If the monetary authorities double the quantity of money and shatter the equilibrium, the level of real money balances will not change in the long run. Instead the price level will also double. More generally, persistent increases in the amount of money relative to existing output will end up in inflation.“ – bto: Und hier wird immer entgegnet, dass wir ja in den letzten Jahren keine Inflation hatten, obwohl die Geldmenge stark gewachsen ist.

- „If the Treasury issues $100 billion of new bonds, they are acquired by the central bank and add to its assets, and the central bank pays for them by increasing the Treasury’s deposit also by $100 billion. The new money comes ‘out of thin air’; it is just a balance-sheet entry, no more and no less. When the Treasury uses the $100 billion to purchase goods and services from private sector non-banks, their bank deposits rise. Those deposits are extra money in the economy. In principle, the process has no limits.“ – bto: weshalb es ja auch keine Geldknappheit geben muss. Es kann beliebig viel produziert werden, um die Nachfrage zu stärken.

- „Because of their obsession with interest rates, they believe that central banks can do nothing more to affect the economy once interest rates are at or close to zero. This is a grotesque under-estimation of the potential for monetary abuse. Citizens of Zimbabwe or Venezuela – victims of hyperinflations that have ruined their countries – would be bemused by the notion that monetary policy can be exhausted.” – bto: Sie wissen, dass MMT funktioniert.

- „US commercial banks’ holdings of US Treasuries advanced in the six months to October 2019 by 7.9 per cent, or at an annualised rate of 16.5 per cent.This pattern will become more pronounced in the next few months and quarters, because the US federal deficit – almost $1,000 billion in the 2019 fiscal year – is expected to fall within the $3,000 billion to $4,000 billion band in the 2020 fiscal year.“ – bto: Hier wird damit die These verbunden, dass diese Ausweitung der Geldmenge letztlich inflationär wirken muss, eben weil es zu echter Nachfrage im Markt führt.

- „When the Covid-19 outbreak comes under control, it will take a few quarters to curb the budget deficit, while the excess money balances will still be present. Unless drastic steps are taken to remove these excess balances, an inflationary boom is possible. The dimensions of the boom, and the extent of the inflationary damage, are still uncertain at this stage. Much will depend on money growth in the rest of 2020 and in early 2021.“ – bto: Vor allem stellt sich die Frage, ob es nur ein kurzer Inflationsschub ist oder ob es sich strukturell ergibt.

- „Let us assume that monetary financing of the federal deficit will average $100 billion to $150 billion a month over the year from May 2020. Then, with US broad money on the M3 measure at just over $20,000 billion at present, an upward bump in broad money growth of perhaps 7½ per cent to 10 per cent is on the cards. Given that the Fed is also undertaking QE operations which include purchases of newly issued commercial paper (i.e. securities issued by the private sector), it seems plausible that annual money growth in the year to late 2020/early 2021 will stay near to the 25 per cent number and may go higher. To repeat the message, these will be the highest-ever rates of increase in the quantity of money in US peacetime history.“ – bto: was schon beeindruckend ist. Heute wissen wir zudem, dass die neue US-Regierung richtig auf das Gaspedal geht und Billionen schwere Programme auflegt.

Doch was ist mit der Umlaufgeschwindigkeit? Diese geht doch schon seit Jahren zurück und ist in der Krise weiter gesunken. Dies bedeutet doch, dass es eben keine Inflation gibt?

- „These increased precautionary and speculative demands to hold money will be associated in 2020 with a sharp fall in the velocity of circulation. It is entirely possible that a fall in nominal GDP will coincide with an unusually large rise in the quantity of money. Nevertheless, the evidence is that over the medium term the underlying stability of the demand to hold money causes velocity to revert to its long-run mean. Figure 2 is a histogram of annual changes in the velocity of circulation of broad money in the USA. The chart suggests the interpretation that these changes are normally distributed, implying that large and continuing changes in velocity away from its mean value are improbable.“ – bto: Es kommt also über die Zeit zu einer Normalisierung um den langfristigen Durchschnitt.

- „When the aggregate quantity of money is growing sharply, at well above the economy’s trend rate of output growth, some sectors in the economy will have excess money balances. An argument can be made that the excess money balances are already affecting behaviour and will continue to do so. The Fed’s QE asset purchases have been mostly from financial institutions, many of which are investors in equities and bonds. These financial institutions have constantly to balance ‘cash’ (i.e. bank deposits) against their longer-term investments. When their bank deposits soared from mid-March, many of them took the view that the pandemic crisis would not last forever and refused to let their ‘cash ratios’ (i.e. the ratio of bank deposits to total assets) rise above already high levels. Between a low point on 23 March and the time of writing (10 June) the S&P 500 index, the best measure of US equity prices, jumped 45 per cent.“ – bto: Man kann auch durchaus anmerken, dass das Gleiche für die privaten Haushalte gilt, die ebenfalls angefangen haben, an den Börsen zu spekulieren.

- „The prices of assets do not move in isolation from the prices of goods and services. Eventually, a range of arbitrage mechanisms keep the price of goods and services rising – over the medium and long runs – at rates similar to the prices of assets. The logical forecast here is that the current and probably continuing money growth explosion will promote further gains in share prices, and that these gains will spill out into real estate, both residential and commercial. Surprising though it may seem today, annual money growth percentage rates in the teens imply an inflationary boom in 2021 and perhaps 2022. The size of the boom will depend on the rate of growth of money in coming months and quarters, and on the extent to which any spare capacity and unemployment due to the lockdown is eliminated.“ – bto: Ich finde es einen interessanten Gedanken, dass die Inflation der Entwicklung an den Vermögenswerten folgt.

Passend dazu die Korrelation zwischen der Geldmenge und dem nominalen BIP:

- „Given that the growth of real output is in most countries lower and more stable than that of nominal output, the link between excessive money growth and inflation is clear and consistent. For the time being, no one can offer precise inflation forecasts for 2021 and 2022 in any economy. So much is uncertain and conjectural. But – given that the return to normality will be accompanied by bottlenecks and supply shortages, and given also that the current energy price slump may give way to an energy price surge – an inflation rate of over 10 per cent in the USA would be a plausible consequence of annual rates of money growth of well over 20 per cent.“ – bto: Zehn Prozent Inflation hat nun wirklich niemand auf dem Radar, wie wir zuletzt am Donnerstag gesehen haben.

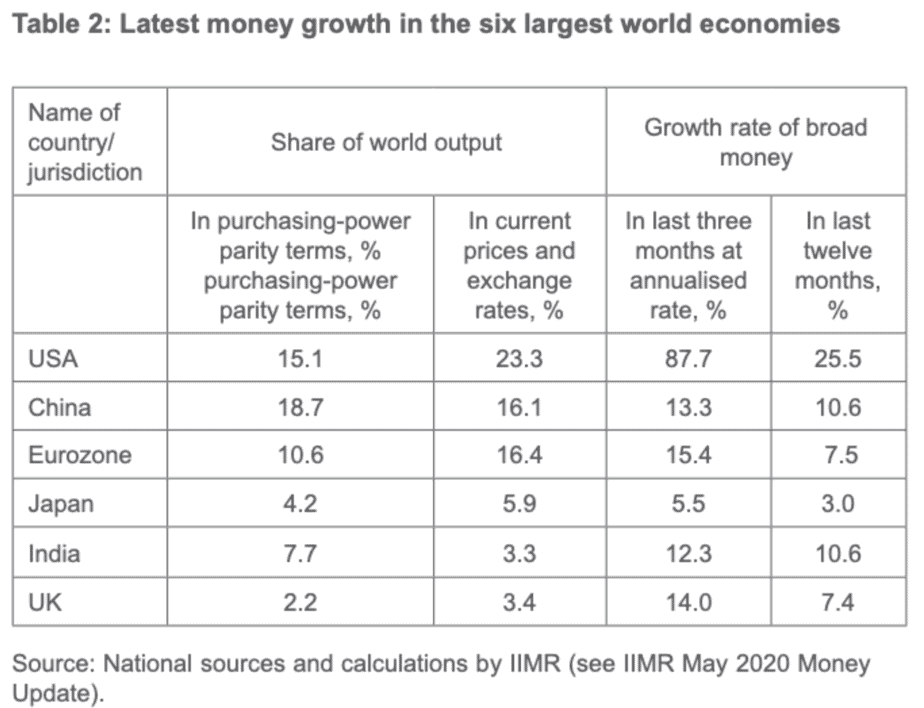

- “Table 2 summarises the latest money growth figures in the six largest world economies, and Table 3 gives the Institute of International Monetary Research’s view on the likely peak rates of money growth in the next 12 to 18 months. One message is that the USA is at present departing most radically from the ‘old religion’ of balanced budgets and sound money. Developments elsewhere are less extraordinary, but higher inflation is again a likely sequel to the money growth surges now being recorded.”

- „Central banks in the developed world do not pay much attention to money growth. (…) Why do central banks in the leading countries ignore money? The problem lies in the main model typically used by central banks when they make policy decisions. In this model, often called ‘New Keynesian’, the rate of inflation depends on expected inflation and the degree of spare machine capacity (summarised in a so-called ‘output gap’); the rate of change of output (and so the level of output relative to trend, ‘output gap’) depends on the central bank discount rate and expected output gap; and the discount rate is set by the central bank in response to inflation pressure and the estimated ‘output gap’. The model overlooks the banking system and its monetary liabilities more or less entirely. So, money cannot determine either national income or national wealth; it cannot affect the price level of goods and services or any significant asset yield.“ – bto: was offensichtlich nicht der Fall ist. Wir wissen, dass Geld eine wichtige und aktive Rolle spielt.

- „However, there is something wrong with three-equation New Keynesianism. During and after the Great Recession central banks adopted QE programmes to maintain monetary stability and achieve sound macroeconomic outcomes. This adoption may have been inadvertent and unplanned, but it was the favoured method to defeat recession. But QE-type measures – which impact on the quantity of money (and perhaps on banks’ cash reserves) – make no sense in a New Keynesian framework. Further, as shown in Figure 1 above, the rate of growth of M3 broad money in the USA from 2011 to 2019 seems to have followed almost perfectly a rule first proposed by Milton Friedman in 1959, in which the rate of growth of money in nominal terms is managed by the monetary authorities so that it is close to the rate of growth of real output. Specifically, M3 broad money grew on average by 4 per cent a year – and the rate of increase in nominal GDP was almost exactly the same. The growth of demand and output was stable, while inflation was low and in line with the Fed’s target at just under 2 per cent a year. It would be nice if these outcomes had been predicted by the Fed as a consequence of the stability at a low but positive rate of money growth. But Fed officials have been charmingly frank in admitting that they were not looking at any monetary aggregate! The superb macroeconomic numbers in this eight-year period were due to … well, serendipity.“ – bto: Man kann es dennoch als Beweis für die Wirksamkeit der Politik nutzen.

- „Some economists – whom we might call the inflation doubters – believe that the very recent spurt of money growth will not lead to any inflationary damage. They point out that QE operations were widely forecast in 2009 and 2010 to have serious inflation effects, but it just did not happen. The inflation mongers then were quite wrong. But the inflation doubters need to be more careful. (…) In the 2008 to 2011 period M3 growth was very weak, despite the money injected into the economy by QE operations.“ – bto: Es geht nämlich um die breite Geldmenge und nicht nur um die Zentralbankgeldmenge.

- „At some point in the next two or three years the annual growth rate of US nominal GDP will accelerate towards double digit figures. A similar trend, though not as dramatic, will be followed in other advanced economies. Given that the trend growth rate of real output is not much more than 3 per cent a year, a big resurgence in inflation is implied by our analysis. The only way to prevent this is for the US Fed and other central banks not only to end their current stances as ready financiers of government deficits, but to withdraw the money stimulus (…) that seems very unlikely.“ – bto: Das würde ich auch sagen.