Die Zombies kommen

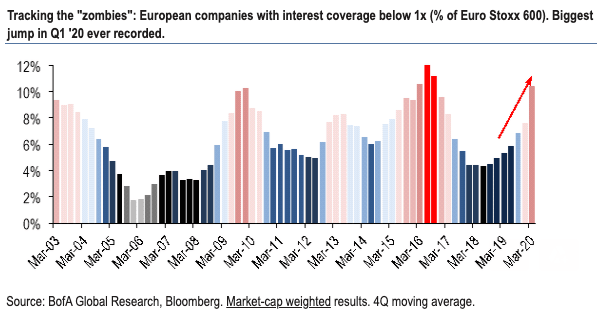

Vor allem zwar in UK, aber auch in ganz Europa führt die Corona-Krise zu weiterer Zombifizierung, so zumindest das Ergebnis einer Studie der Bank of America:

- “The rush to inject money into the economy by central banks and governments will have prevented thousands of companies in the UK and globally from going bankrupt, but the support packages risk propping up so-called zombie companies that will ultimately blunt the economic recovery.” – bto: in Fortsetzung des langjährigen Trends, was zu entsprechend geringerem Wachstum und tendenziell deflationären Druck führt.

- “New research shows the covid-19 economic crisis has produced a swathe of new companies that are only able to service their debt obligations, particularly because the loans and funding made available by central banks and governments is not necessarily targeted in an efficient manner.” – bto: Wie sollten sie auch? Und wenn man Arbeitslosigkeit verhindern will, muss man auch Zombies retten.

- “The economic argument against zombie companies is that they hog too much market share and drain resources from the economy, thereby depriving more robust and dynamic firms of the resources they would require to expand. ‘We find that zombie companies have displayed much weaker levels of capex and employment growth over the last decade, vis-à-vis their less levered peers. Thus, zombies make a vibrant economic recovery more challenging, we argue,’ (says) Bank of America.” – bto: Klar, doch wie kommt man aus dem Problem wieder heraus?

Quelle: Bank of America

- “According to research conducted by audit firm KPMG in 2019 – before the onset of the covid crisis – 8% of UK firms were displaying ‘zombie-like symptoms’. However, they said this could be an underrepresentation and the proportion of such companies across the UK could be as high as 14%. The highest concentrations of zombie firms were in the energy, automotive and utilities sectors.” – bto: was wiederum interessant ist.

- “>We shouldn’t bail out firms – like old-line retailers – that were already in decline before the crisis; to do so would merely create ‘zombies,’ ultimately limiting dynamism and growth,< says world-renowned economist Joseph E. Stiglitz in a recent piece for Project Syndicate.” – bto: Recht hat er. Siehe Karstadt/Kaufhof. Doch das geht nicht angesichts des politischen Drucks.

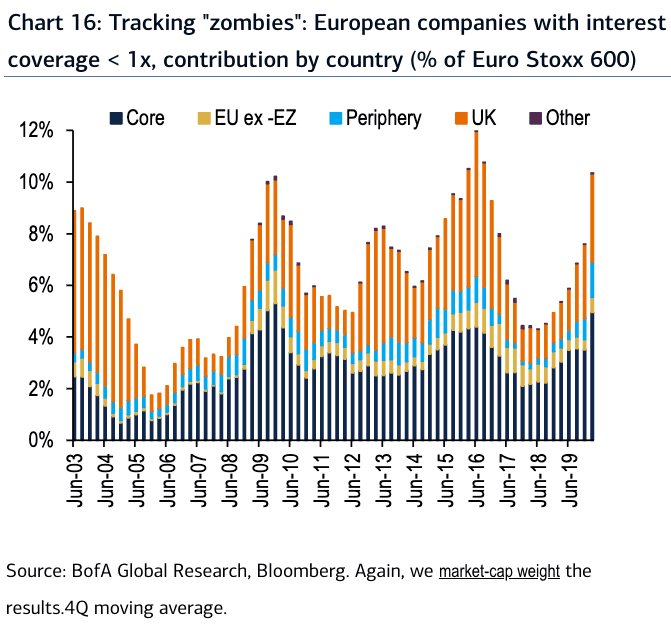

Quelle: Bank of America

Aus der der Abbildung ist ersichtlich, dass auch das sogenannte “Core” hohe und steigende Zombie-Zahlen aufweist.

- “In terms of solutions to a potential zombie apocalypse, Bank of America says in the past central banks could simply lower the yield paid on debt by companies by lowering base interest rates and engaging in quantitative easing. However, owing to the aggressive rate cuts and money printing conducted in 2020, they are running out of road and simply no longer offer an easy way out. ‘This puts extra urgency on proactive fiscal policy by governments to help reduce corporate leverage in this crisis,’ (…).” – bto: Das ist eines Erachtens falsch. Denn die staatlichen Gelder würden immer noch unproduktive Unternehmen erhalten. Besser wäre, diese Pleite gehen zu lassen.

- “Of interest to Bank of America is the EU’s proposed Next Generation EU fund which is a proposed €750BN at helping EU countries and companies win the economic recovery. The Solvency Support Instrument included in the package will channel guarantees from the EU budget in support of viable European companies that suffer from solvency issues due to the coronavirus crisis. (…) In total, €300bn of capital could potentially be made available based on €31bn of new money. ‘Will €300bn do the trick? We estimate that the average net debt/equity ratio of European IG non-financials – with 2x or greater leverage – would fall from 2.2x to 1.2x if this equity was injected. In other words, €300bn could be a powerful sum of money, if deployed by the EU and in a timely fashion,’ (…).” – bto: Das halte ich für grundlegend falsch. Die Unternehmen leiden doch unter hohen Schulden als Folge der schlechten Marktstellung. Die Schulden sind das Symptom.