Der kritische Pfad des Exits aus der Politik des billigen Geldes

Manchmal gibt es Artikel, die ich intellektuell für äußerst spannend halte. Vielleicht sind sie auch etwas überdreht. Auf jeden Fall geben sie mir eine Anregung zum Nachdenken. So das Konzept der “Meta-Stabilität” des Analysten Aleksandar Kocic von der Deutschen Bank, das wir hier im November letzten Jahres an dieser Stelle diskutiert haben:

→ „Charting Today’s Minsky Moment Dynamics“

Heute bauen wir darauf auf; erneut basierend auf einem Beitrag in Zero Hedge, weil mir die Studie nicht im Original vorliegt:

- “(…) what is really happening is the gradual – and on February 5th, not so gradual – unwind of a decade of unconventional monetary policy. That’s the claim made by Deutsche’s derivatives strategist, Aleksandar Kocic, best known in the past year for introducing the concept of “metastability, or the market’s current precarious, and unsustainable, state.” – bto: hier nochmals mit der damaligen Abbildung.

Quelle: Deutsche Bank, Zero Hedge

- “(…) those seeking the real reason behind the recent bizarre cross-asset moves, should go back in time not a few days or weeks, but years – all the way back to 2011, which is when everything changed. (…) “the current policy unwind is qualitatively different from traditional recoveries” and “the underlying complications can be traced back to the later installments of QE, around 2011, which signaled the beginning of a new regime of market functioning, an utterly new mode rarely seen to persist beyond transient episodes.” – bto: Er argumentiert mit dem unnormalen Aufschwung der letzten Jahre, der auch unnormale Folgen hat.

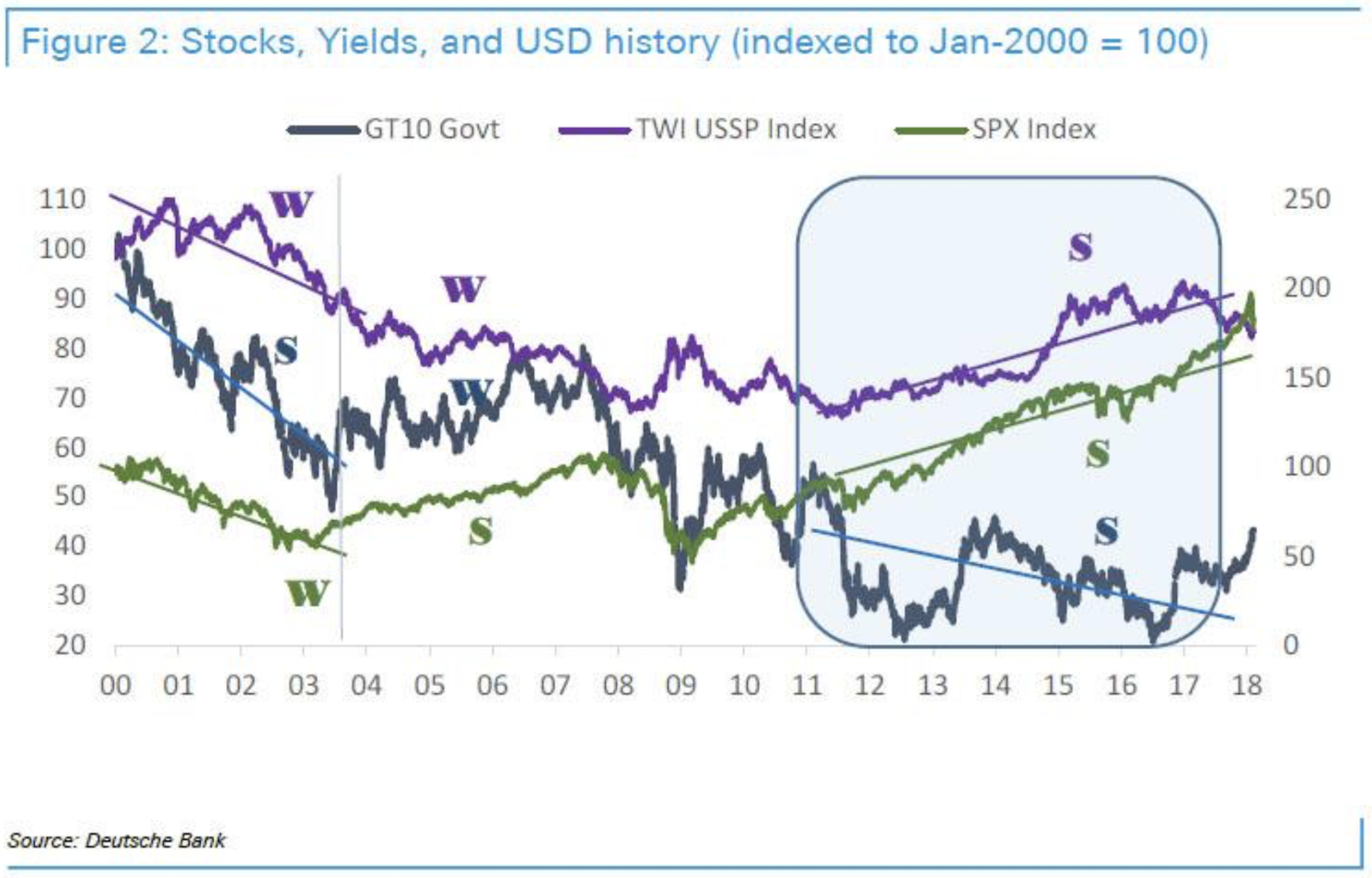

- “Kocic shows this regime change in the following chart, which illustrates a longer history of the three “vexing” assets in question, the USD (in terms of TWI index), S&P levels and 10Y UST yield, indexed to their Jan-200 levels. The letters S and W stand for strong and weak.”

Quelle: Deutsche Bank, Zero Hedge

- “(…) typically, stocks, bonds and currency cannot all rally at the same time for a prolonged period of time. Generally, they support each other conditionally: For two of them to rally, one has to sell off (and the other way around). This is seen in the picture during first decade of this century. 2011 signals a structural shift to a new regime.” – bto: Wir hatten dank der Geldpolitik die “Alles-Blase”.

- “Between 2011 and 2016, the three assets supported each other unconditionally – they rallied simultaneously. This was a result of continued QE against the background of threat of sovereign risk overseas, which created positive externalities for both USD and US stocks, and it represents the other side of the state of exception created by the extended influence of central banks.” – bto: Und man muss schon ein großer Optimist sein, wenn man denkt, dass das (vorübergehende?) Ende dieser Politik keine Wirkung auf die Märkte hat.

- “The central bank ‚state of exception‘, figuratively, is what allows the market to continue existing in its current state of metastability, as traders realize that central banks are “aligned” with their interests and against those of the broader economy, while pushing risk assets higher no matter the threat of runaway inflation, at least until the market itself becomes so unstable its folds in on itself, challenging the central bank put, a preview of which we saw on February 5.“ – bto: Wenn also die Inflation ein Problem für Wall Street wird, dann ist es ein relevantes Problem auch für die Fed.

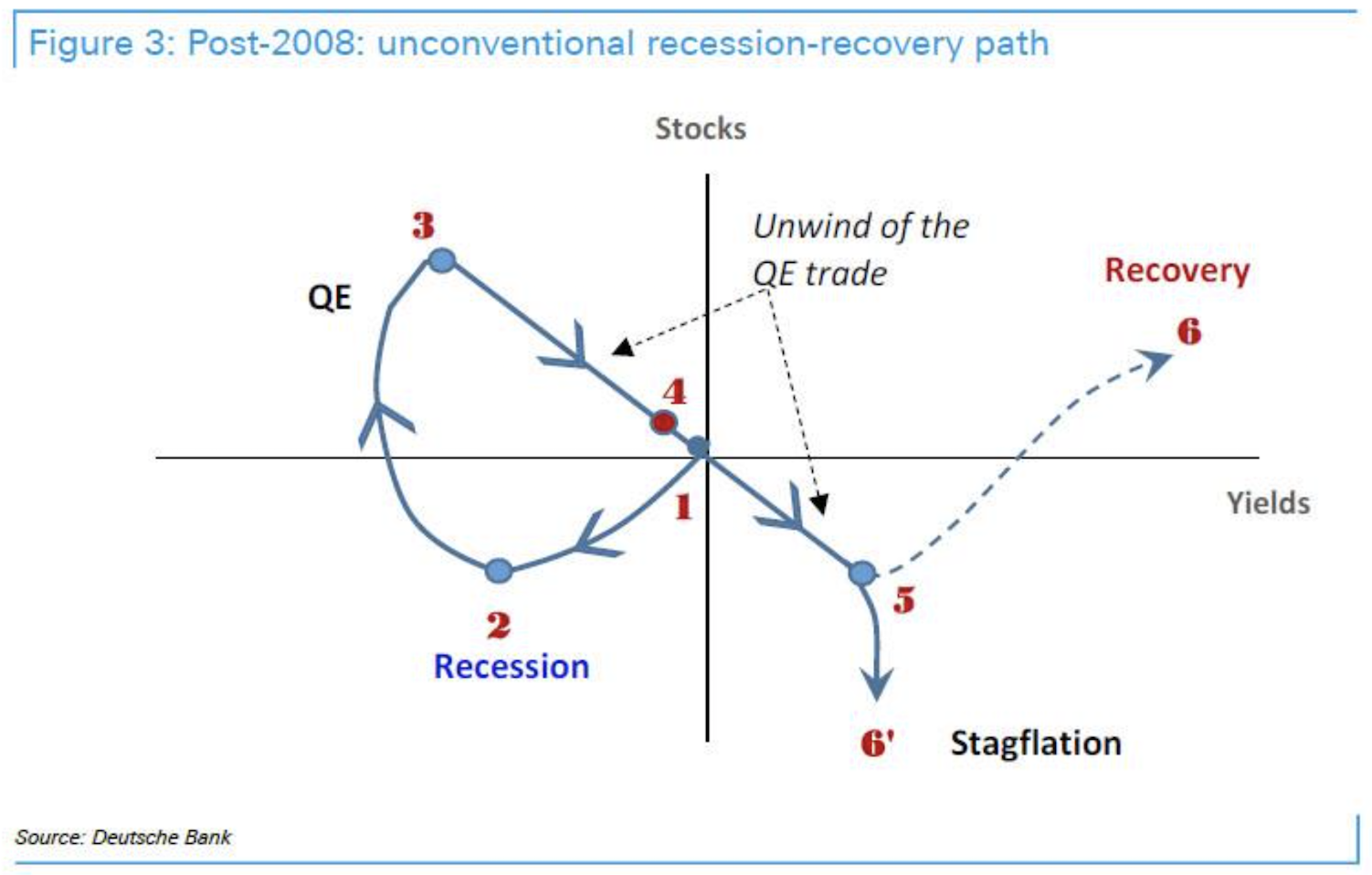

- “Of course, the events of February 5, which sent volatility exploding, prompted the only question that matters: just what will the unwind of 9 years of unconventional central bank policies look like. Or to quote Kocic, where should one go if instead of every asset class being bought, there is a tsunami of selling instead. In the chart below, the credit strategist illustrates the the historical recession/recovery path since 2008, and the critical bifurcation that lies ahead:”

Quelle: Deutsche Bank, Zero Hedge

- “Last time we saw a recovery from a conventional recession was about 14 years ago. Things are different this time. Both the 2008 financial crisis and subsequent policy response were highly unconventional, and therefore there is no reason to expect that recovery and unwind of the policy response should be conventional either.” – bto: Das finde ich durchaus einleuchtend.

- “With that in mind, Kocic offers the following walk-thru of next steps: (the recession) starts, as usual, with a selloff in risk assets and a rally in bonds (1 & 2), but as the crisis deepens and QE gets deployed (3), the action moves (and stays) on the off-diagonal where both bonds and equities rally. Unwind of QE now becomes essentially a de-risking move — it goes against the grain of recovery.” – bto: was der Kern des Problems ist. Eigentlich ist der Aufschwung selbsttragend. Jetzt aber bekommt er den Gegenwind zu spüren und droht deshalb zu kippen.

- “Currently, we are heading towards point 4, beginning to catch sight of the bifurcation point (5) from which the market could either sink into the “stagflationary” trap (6: everything: stocks bonds and currency, sell off) or move to the 1st quadrant if the Fed and Congress manage to engineer a turn around and we get catapulted towards what looks like a traditional recovery.” – bto: Und nur wenn wir den “traditionellen” Aufschwung bekommen, ist auch die Eiszeit-These widerlegt.

- “Inflation is producing an Icarus effect: Although negative convexity of inflation is a far OTM risk, it is significant even at remote distances from the strike, due to its enormous size. The accumulation of relatively illiquid long-dated bonds on retail balance sheets is at toxic levels and a substantial rise in inflation, to which there is no adequate policy response, could threaten to trigger a bond unwind that the market would be unable to absorb.”

- “Having UST bonds with strong dollar or high real yields will be more attractive than holding US stocks, which means accelerated de-risking and higher volatility in the stock market. Higher inflation, on the other hand, would be supportive for equities and could cause another leg of selloff in bonds.” – bto: deshalb die zwei Szenarien, auf die wir uns als Investoren einstellen müssen.

- “What complicates things is that the behavior of real rates at this point is also a function of expected inflation: Higher inflation warrants a more hawkish Fed and therefore pricing in higher real rates. The reaction of stocks is a non-linear function of inflation – although risk assets might “like” higher inflation, this would remain true only up to a certain point.” – bto: also am Anfang gut, wegen des vermuteten Inflationsschutzes. Danach immer schlechter.

Das führt dann zu folgender Zusammenfassung:

- “Unwind of stimulus is a mirror image of the QE trade. It is a de-risking mode and, as such, it goes against the grain of recovery. This is in sharp contrast with conventional unwind of the recession trade, which is the risk-on mode.” – bto: was irgendwie einleuchtet. Statt im Aufschwung mehr Risiken einzugehen, muss man das Risiko reduzieren, weil das monetäre Umfeld nicht mehr passt.

- “Risk is asymmetrically distributed between rates and risk assets. There are two distinct paths to higher rates (through higher real rates or wider breakevens). They mean two different things for bonds and stocks. For bonds, the distinction between these two paths is a matter of degree between a mild and a moderate selloff. For equities (and USD), on the other hand, the effect is binary – it means a difference between a modest rally and a substantial selloff.” – bto: Wenn wir höhere Inflation bekommen, kommen die Aktien unter Druck – was dann allerdings zur Rezession führen könnte.

- “Volatility plays an essential role in the policy unwind. It is one of the key decision variables in the process of portfolio risk rebalancing — higher volatility causes complications. However, unlike traditional recoveries, which are collinear with the unwind of the recession trade — and, as such, volatility-reducing – the unwind of financial repression is withdrawal of convexity supply and a vol-enhancing mode.” – bto: Es ist dann alles anders. Risiken müssen abgebaut werden, je mehr die Wirtschaft sich normalisiert, was per Definition der Wirtschaft wiederum schaden würde.

Fazit: “With every new installment of stimulus unwind, it seems as if things are moving in reverse, but not to where we left them, rather towards what appears to be an unknown and unfamiliar destination. This is proving to be a highly unconventional tightening cycle and recovery. After years of forced hibernation, brought about by suspension of traditional trading rules by the central banks, the markets are facing a painful process of re-emancipation. This is causing considerable confusion and anxiety.” – bto: Ich habe mir nur gedacht, dass es wirklich die Ableitung der Ableitung ist, in der wir nun denken müssen. Eigentlich kommt jetzt noch hinzu, was wir glauben, was die anderen Marktteilnehmer glauben, was die anderen glauben … Unsicherheit dürfte jedenfalls garantiert sein.

→ Zero Hedge: “‚Everything Changed In 2011… What Comes Next Is Painful‘: Deutsche”, 17. Februar 2018