Was die Krise von Evergrande wirklich bedeutet

Die Welt ist ziemlich ruhig angesichts des sich abzeichnenden Margin Calls in China. O. k., wir haben ja eine sehr weit verbreitete Staatsgläubigkeit, aber selbst für China dürfte es nicht leicht sein, die längerfristigen Probleme so einfach zu lösen. Die FINANCIAL TIMES (FT):

- “There is much debate around the ‘Is this another Lehman?’ question — the implications for the Chinese (and global) financial system of an Evergrande restructuring. I personally side with those who think the Chinese government has deep enough pockets to bail out whoever it wants, and can therefore contain the wider repercussions of real estate losses that lie behind failures such as Evergrande. Whether it will is another question.” – bto: also erst einmal die (Selbst-)Versicherung, dass schon alles gut gehen wird. Vorerst.

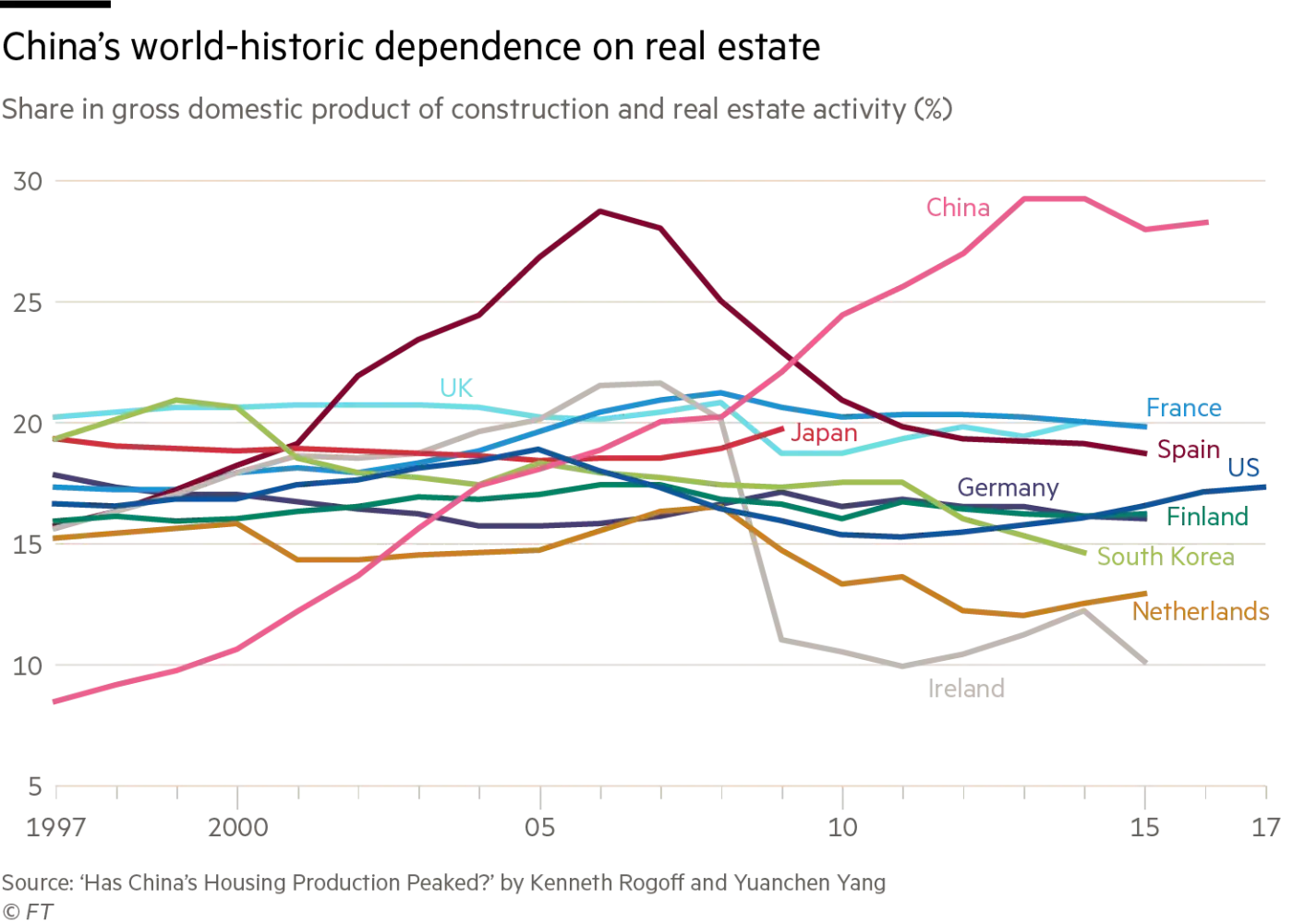

- “(…) 29 per cent of China’s gross domestic product is made up of real estate activities (construction and related services). That number comes from new research by Kenneth Rogoff and Yuanchen Yang. Their paper is worth reading in because it contains some really frightening statistics.

Quelle: FT

- As the chart above shows, China’s dependence on real estate is historically unprecedented — only Spain in 2006 came near. It is not just the share of output, but employment too: real estate and construction employ nearly 20 per cent of China’s urban workforce. Land sales account for one-third of local government revenue.” – bto: Daran hängt auch ein guter Teil der deutschen Exporte. Nur mal so, wenn jetzt die Politik wieder davon träumt, aus allen Problemen herauswachsen zu können.

- “China has one of the world’s highest housing vacancy rates, at more than 20 per cent. More than 90 per cent of urban households already own their home. In the researchers’ latest year of data (2018), 87 per cent of new home sales went to buyers who already owned a dwelling. Nationally, it would take about two years for all unsold housing to be sold at current sale rates.” – bto: Was für eine schöne Blase!

That leads to a couple of observations about the real Chinese economy — none of them reassuring, even if the purely financial fallout is contained.

- “The first is that China’s past growth may not be all that it seemed. On Rogoff and Yang’s numbers, real estate’s share of GDP increased by almost 10 percentage points (or about half the starting share) in the five years following the global financial crisis, and then stayed flat near 30. On a rough approximation, that means these activities contributed nearly half of China’s strong GDP growth in those years, and a continuing near-30 per cent or so of growth in the ensuing years.” – bto: Das bedeutet, die Politik hat Zeit gekauft. Nicht mehr und nicht weniger.

- “Given the signs of oversupply, one has to wonder about the actual economic value of those contributions to GDP. Did all this activity really added value — something that constitutes Chinese prosperity? Or was some of it more what we may call ‘pseudo-income’, which shows up in the numbers but does not reflect anything that is actually valuable so to speak on the ground? The stories about Chinese ‘ghost cities’ that have circulated for more than a decade — and more recently, reports of demolition of never-occupied buildings — suggest the answer is no. And given the sheer size of real estate’s importance, China’s real prosperity may be much lower than what growth rates and GDP levels have measured.” – bto: und damit die Stabilität der Führung und auch die Stabilität als Anker der Weltwirtschaft.

- “(…) there has clearly been a gross misallocation of capital and economic activity, which has created little or no economic value while there are great unmet needs. But fixing this — essentially ensuring better conditions for the rural poor — would have required the kinds of interventions in the economy, implying radical levelling of status and power differences, that most nominally communist dictatorships have been far too conservative to contemplate.” – bto: Genau diese Regierungen haben das Ganze doch unterstützt, denn es hat die Illusion von Reichtum gefördert.

- “Third, what happens next? It is very hard to fill the gap in economic activity that even a slight contraction in the real estate sector will leave if it shrinks permanently. Rogoff and Yang estimate that a ‘20 per cent fall in the housing sector and related activities (if one did occur), could lead to a roughly 5-10 per cent decline in the level of output’.” – bto: Ich denke aber, dass die Chinesen alles daran setzen werden, genau das zu verhindern. Das Problem dabei: Derartige Stabilisierungsmaßnahmen kaufen nur Zeit.

- “Chinese rulers have long wanted to ‘rebalance’ their economy. But towards what? Consumption is difficult to boost with extreme inequality and a large population in poverty — unless, again, the government is willing to be radical in overturning current social and economic hierarchies. Export-led growth of the size needed is China’s past but unrealistic as its future. So perhaps investment is still the right horse to back. If so, Beijing must find policies to promote the quality and not just the quantity of investment.” – bto: Und da sind sie doch auf gar keinem so schlechten Weg? Technologie hat in China eine Zukunft.