“German economists rebut criticism over surplus”

Zweifellos wird der neue französische Präsident den Druck auf den deutschen Außenhandelsüberschuss erhöhen. Wie die FT hofft, vielleicht gemeinsam mit den USA. Regelmäßige Leser von bto wissen, dass ich unsere Überschüsse wegen der damit verbundenen Kapitalexporte (wie dumm ist es, in einer überschuldeten Welt Gläubiger zu sein?) ebenfalls sehr kritisch sehe.

Das kümmert deutsche Ökonomen nicht. Die bringen es mit ihrer Argumentation zugunsten unserer Überschüsse in die Kommentarspalten der Weltpresse. So die FT:

- “The Trump administration’s obsession with not just the overall deficit but each sectoral and bilateral deficit is the extreme aberration of a pre-existing concern: the belief that surplus economies’ governments can and should act to reduce their surpluses, and that failing to do so harms the deficit countries.” – bto: Es ist richtig, dass es den Ländern Nachfrage wegnimmt. Auf der anderen Seite gibt es auch mehr Kaufkraft über Kredite und Investitionen.

- “The German Council of Economic Experts, an official advisory body, addresses the criticism head on in itslatest forecast update. (…) The report makes a number of claims (…).” – bto: was dann auch die offizielle Verteidigungshaltung der Bundesregierung seien dürfte.

- “First, it suggests that policy cannot directly affect the net external balance of an economy. That is not true — while it is correct that the balance is determined by millions of uncoordinated decisions in a market economy, the government can clearly influence them. The question is whether it should and how.” – bto: Natürlich kann die deutsche Politik handeln. Zurzeit unterliegen wir einem kollektiven Export-Fetischismus.

- “Second, it estimates that much of the German surplus is a normal effect of structural causes, estimating significant contributions from the fall in oil prices, an ageing population and private sector debt reduction. These are important factors justifying national savings — to some extent. The last is the least convincing: if the German government does not want to borrow, should it not change tax systems and other structural policies to encourage more spending by the private sector?” – bto: Angesichts der tiefen deutschen Privatverschuldung ist es befremdlich, dass wir Deleveraging betreiben sollen.

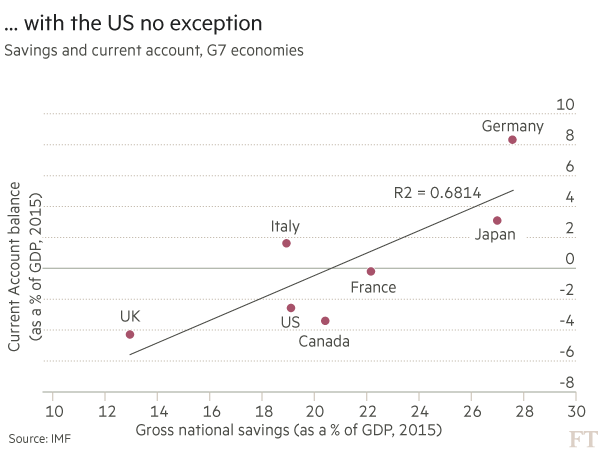

In einem anderen Beitrag zeigt die FT sehr schön, was der Treiber der Handelsüberschüsse ist: die Sparquote.

Quelle: FT

Soweit, so gut. Oder besser schlecht. Denn bekanntlich ist es nicht klug, in einer überschuldeten Welt Kredite zu geben.

- “Third, it argues that since the German economy is at full employment, it does not make sense to boost aggregate demand through looser fiscal policy. This is its strongest argument. But it does not justify no policy action. Even if total demand in the economy is close to what the economy can supply, policymakers should also consider the composition of that demand. Above all, they should try to stimulate more investment.” – bto: und auch selber mehr investieren. Man vergleiche nur die Qualität der Infrastruktur mit jener anderer Länder.

- “The German expert council points out that Germany’s trade surplus with most eurozone countries has fallen significantly since the crisis (except for France, where it has kept steady but stopped rising). (…) But they don’t matter in the particular sense that you can’t address an overall macroeconomic problem by looking piecemeal at bilateral balances.” – bto: Das stimmt. Wir wurden von den großen Importeuren gerettet.

- “Those who criticise surplus economies for ‚stealing other countries’ demand‘ (or ‚exporting deflation/unemployment‘) must surely also admit that whose demand you steal is indicated by whom you have bilateral surpluses with. And if so, surely those critics — in Europe especially — should welcome the fall in Germany’s bilateral surpluses with other eurozone countries. And the retort that the rebalancing is caused by recessions in the eurozone periphery, while no doubt true, is misdirected. If a rising surplus (not a high level, but an upward change) reduces demand, then surely a falling surplus cushions a drop in domestic demand in the trading partner.” – bto: Auch das stimmt. Was vergessen wird, ist, dass wir auch einer der Hauptgläubiger sind!

- “The experts point out that the US external deficit has lasted for decades, whereas the eurozone has tended to be in external balance except for the past few years. The German experts write, rightly at least in part, that this ›permanent borrowing from other countries is an expression of the United States’ ‘exorbitant privilege’ due to the US dollar’s role as a reserve currency‹. The need to run deficits if you want to supply the world’s reserve currency, well understood ineconomic theory, is something Donald Trump’s economic advisers ought to impress on the president.” – bto: Dieses Privileg bedeutet im Klartext: Die USA drucken grüne Zettel (oder eigentlich noch besser, schreiben Zahlen in den Computer) und bekommen dafür schöne Autos etc. Deshalb ist es in unserem Interesse, den Wahnsinn zu beenden. BITTE!

→ FT (Anmeldung erforderlich): „German economists rebut criticism over surplus“, 21. April 2017