Zur Besteuerung

Es gibt unstrittig einen Trendwechsel hin zu höheren Steuern. Wenn man die Diskussion von Michael Pettis gestern liest, kann man aus makroökonomischen Gründen nur dafür sein. Es gibt aber auch Auswirkungen auf die Asset-Märkte, die wir nicht vergessen dürfen. John Authers, früher FT, heute Bloomberg, zitiert aus einer Studie der Deutschen Bank zum Thema:

- “Rising taxes have not been a major source of market concern for two generations. The few tax increases that have been implemented have tended to be narrow and specific, billed merely as the reversal of prior tax cuts or sold politically as payments for specific and popular projects. Full-throated support for higher taxation, or for greater redistribution as an end in itself, has been lacking.” – bto: wenn wir mal von der Diskussion hierzulande absehen.

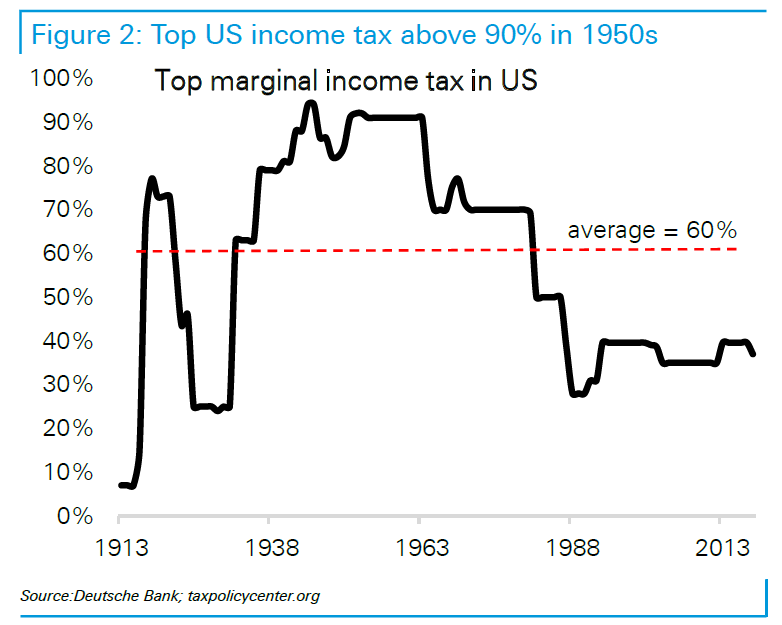

- “But that hasn’t been the norm historically. (…) the top marginal rate of income tax in the U.K. was 95 percent in 1966. (…) In the U.S. and the U.K., lower top marginal rates enjoyed in recent years have been a historical anomaly:” – bto: Das ist wichtig. Aber bevor man ruft, muss man auch schauen, ab welchem Betrag das galt. Sicherlich nicht beim 1,3-Fachen des Durchschnittseinkommens.

Quelle: Bloomberg

- “This chart comes from Deutsche Bank foreign-exchange strategist George Saravelos in a report ominously titled ‘Beware the taxman’. A top rate of 70 percent, as loudly proposed by youthful Democrats in Congress, would still be below the level that held for several decades of economic expansion after the second world war.” – bto: Das soll aber erst ab zehn Millionen gelten. Damit würden sich die bei uns nicht zufriedengeben.

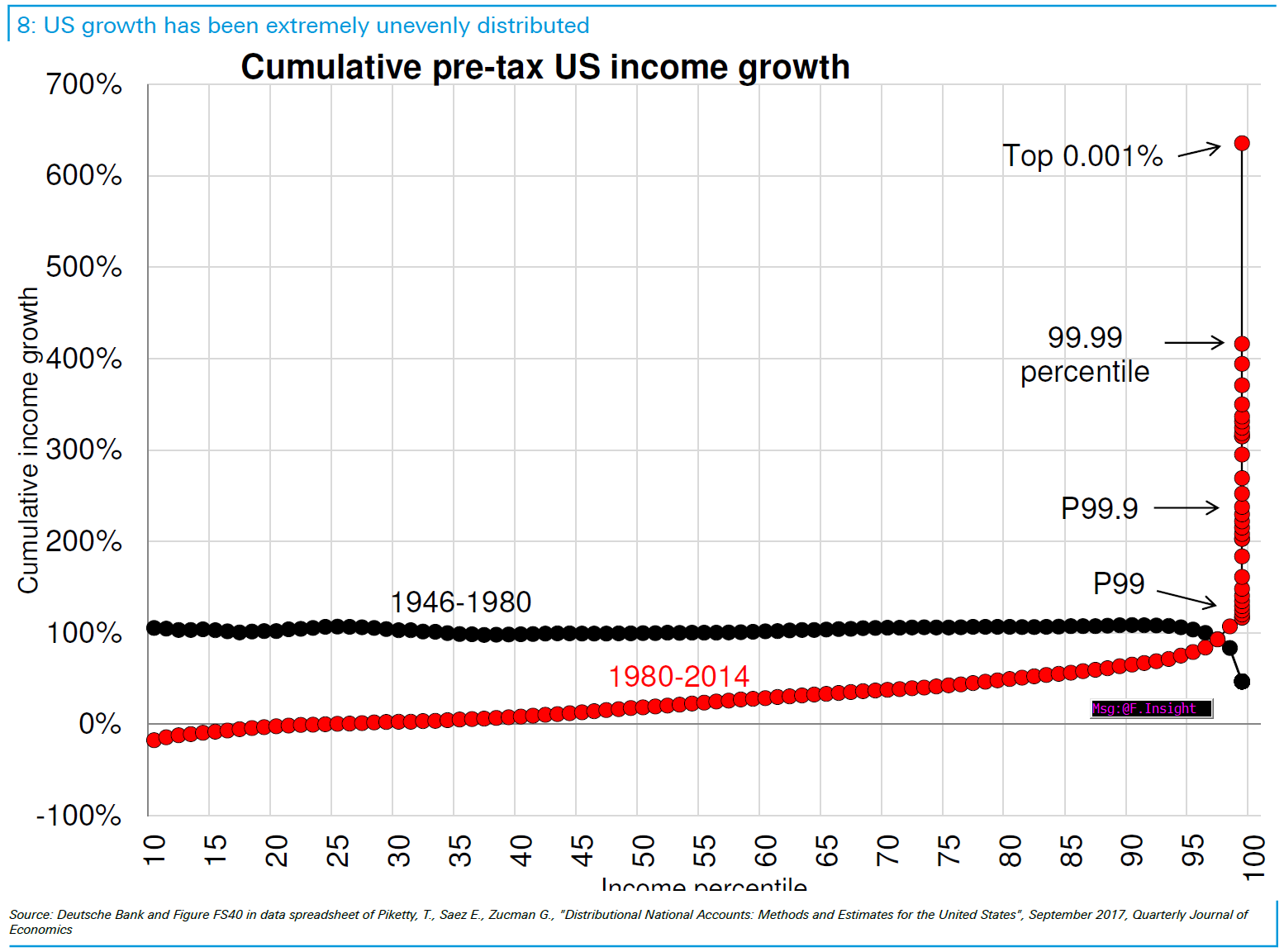

- “In terms of post-tax income, the 34 years to 1980 (when Ronald Reagan and the low-tax agenda arrived) saw virtually everybody in the U.S. double their income, apart from the very wealthy. The years since have seen almost half the population fail to register any growth in their income at all, while the very wealthiest have enjoyed extraordinary growth.” – bto: Da lohnt es sich natürlich, nach den Ursachen zu suchen. Das liegt an der Globalisierung, aber auch an der geänderten Besteuerung und der Tatsache, dass wir immer mehr Finanzgewinne erwirtschaften, getrieben vom billigen Geld.

Quelle: Bloomberg

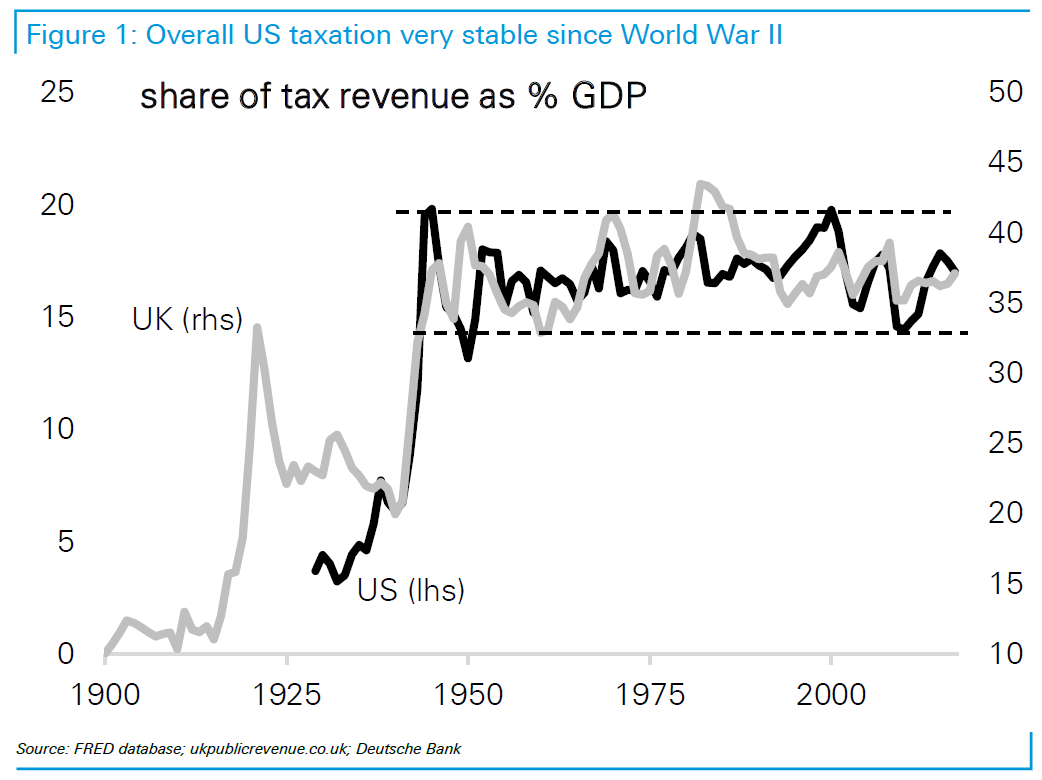

- “This generosity to the rich has, obviously, not helped those who are poorer very much. And it is hard to claim that it has aided economic growth. Most intriguingly, the Saravelos report shows that huge variations in top marginal rates have had a minimal impact on the actual burden of taxation as a whole. Tax as a proportion of gross domestic product was broadly unchanged before and after Reagan and (at a considerably higher level) in the U.K. before and after Margaret Thatcher:” – bto: Man muss halt anders besteuern und vor allem auch die Unternehmen wieder beteiligen.

Quelle: Bloomberg

- “(…) we can assume that any increase in the chances of high top marginal tax rates will be viewed as emphatically market-negative. (…) as the US 2020 presidential election comes into view and discussion around taxation picks up, the dollar may start to attract more risk premium. More fundamentally, we would view higher tax rates as a negative for the dollar. Any shifts in US tax policy towards a more redistributive direction are likely to involve higher taxation on asset owners and the beneficiaries of the very low current levels of corporate taxation. This is likely to discourage US capital inflows as well as depress asset valuations. To the extent that tax policy shifts income from high to low income households it would also depress the US saving rate leading to a wider current account deficit.” – bto: Und das ist spannend. Wir haben heute das Problem, dass der Staat wegen des Kapitalzuflusses so viel Schulden machen muss – siehe Argumentation Pettis. Das würde dann ja abnehmen. Also auch das Defizit?

- “Beyond these points, the money that goes into hedge funds and stocks in general tends to disproportionately come from lightly taxed wealthy Americans. If the political bandwagon for higher rates continues to gather steam, that will be a significant negative for U.S. assets over the next two years.” – bto: falsch. Wir stehen vor einem massiven Kurswechsel, nicht nur in den USA, sondern überall. Leider kommt das bei uns schon von den hohen Steuern.

→ bloomberg.com: “Let Me Tell You How It Will Be ’Cause I’m the Taxman”, 6. März 2019