“We are witnessing the third biggest bubble created by a central Bank”

Heute Morgen habe ich die FANGs diskutiert, hier nochmals die Erinnerung daran, dass es die Notenbanken sind, die uns die Probleme eingebrockt haben (und weiterhin einbrocken):

- “In its scramble to reflate the biggest asset-bubble in hopes of inflating away the $233 billion in global debt, which at 318% of world GDP has never been higher, the Fed took a wrong turn somewhere, and instead of successfully sending ‚inflation‘ assets into the stratosphere, it successfully ‚reflated‘ deflationary assets.”

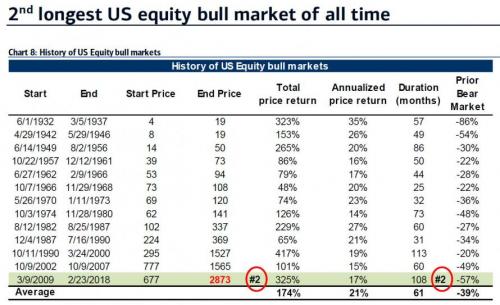

- “(…) we are now in the second longest US equity bull market of all time…”

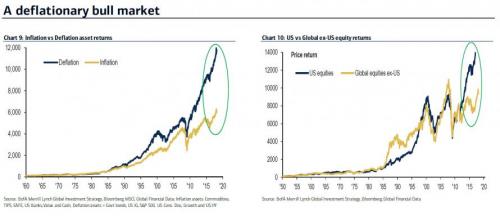

- “(…) the bull market leadership has been in assets that provide scarce ‚growth‘ & scarce ‚yield‘. Specifically, the ‚deflation‘ assets, such as bonds, credit, growth stocks (315%), have massively outperformed inflation assets, e.g., commodities, cash, banks, value stocks (249%) since QE1. At the same time, US equities (269%) have massively outperformed non-US equities (106%) since launch of QE1.” – bto: Das hatten wir hier schon mal, ist aber eine nette Erinnerung.

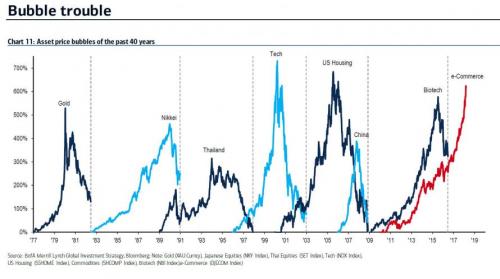

- “And, as happens every time the Fed tries to manage asset prices, it has blown another bubble. As BofA’s Michael Hartnett writes, the ‚lowest interest rates in 5,000 years have guaranteed a melt-up trade in risk assets‘, which Hartnett has called the Icarus Trade since late 2015, and points out that the latest, ‚e-Commerce‘ bubble, which consists of AMZN, NFLX, GOOG, TWTR, EBAY, FB, is up 617% since the financial crisis, making it the 3rd largest bubble of the past 40 years, and at this rate – assuming no major drop in the 6 constituent stocks –the e-Commerce bubble is set to become the largest bubble of all time over the next few months.” – bto: angefeuert von den Notenbanken, die irgendwann vor den Scherben des eigenen Tuns stehen werden.