Verlieren die Notenbanken die Kontrolle?

Kevin Duffy verdient sein Geld mit Wetten auf fallende Kurse (“short seller”). Im Interview mit the market spricht der Chef des Hedgefonds Bearing Asset Management über die Blase an den Anleihemärkten. Ein wichtiges Thema, wie ich finde – auch bei bto:

→ Bonds die größte Blase aller Zeiten?

Schauen wir uns die Argumentation an:

- “What’s behind the recent weakness in the bond market? – I think it’s exhaustion. This year, we’ve had this big sea change in terms of the central banks going back to easing and being more accommodative. Yet, the bond market is basically saying: no more! Easy monetary policy is not having the same stimulative effect as it had in the past.” – bto: Mag sein. Ich erwarte eher sinkende Staatsanleihenzinsen und steigende Zinsen auf Unternehmensanleihen.

- “The big mistake of our times is the great monetary experiment which started in August 1971 when the US went off the gold standard. Every bubble has a belief system, a unifying narrative. This time it’s that the central bankers are all powerful.” – bto: Sie haben sich den Ruf der Alleskönner seit den 1980er-Jahren auch redlich erarbeitetet … Immer wieder haben sie die Welt gerettet. Das ist doch was!

- “It’s this idea that there is a free lunch when it comes to printing money. That’s what Modern Monetary Theory is all about: We can have our cake and eat it, too. We don’t have to feel the pain of a recession or the pain of a severe bear market. Anytime we get close to a downturn, central banks can just print money. Of course, we know that’s sheer nonsense. There is no free lunch. Polices like negative interest rates and Quantitative Easing are doing damage to the underlying economic engine. They misallocate capital, discourage thrift and promote fast money over slowly building wealth.” – bto: Und vor allem züchten sie Zombies, die wiederum das Wachstum dämpfen und noch mehr Liquidität erforderlich machen.

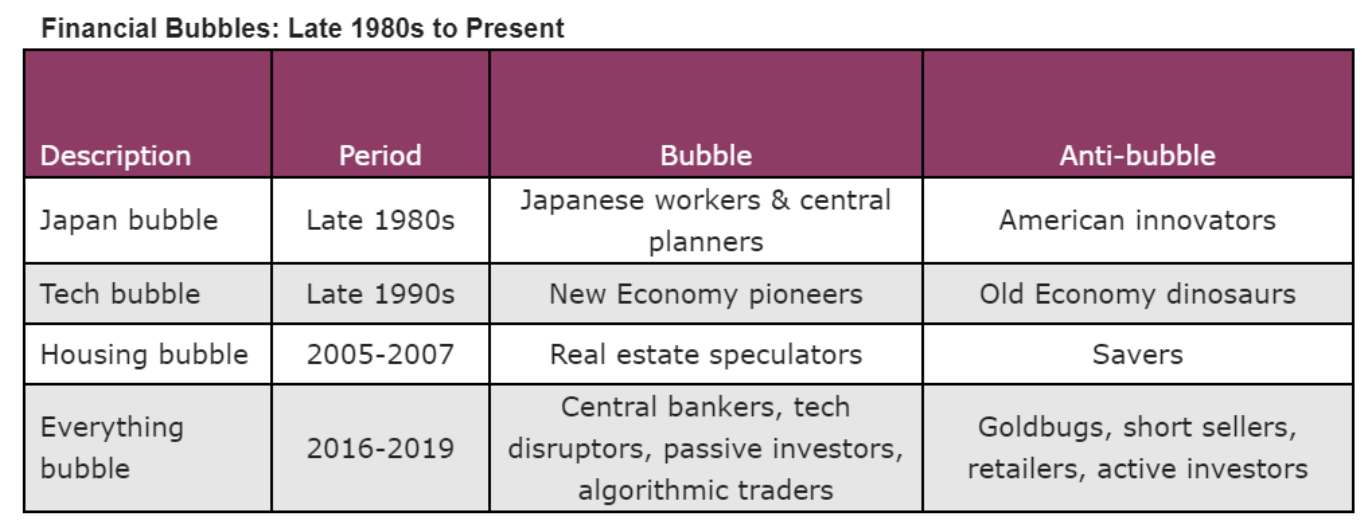

- “We know that the seeds of these bubbles are artificially low interest rates. The last two bubbles were sector specific: You had the tech bubble and then the housing and credit bubble. (…) This time, the center of the bubble is the bond market. You can even say at its core is the sovereign debt bubble. Then, you have all these other bubbles at the periphery: the high yield bubble, corporate bonds, auto finance, large cap technology, passive investing, private equity – bubbles everywhere. That’s what we’re looking at: Something on a much greater scale than anything we’ve seen before.” – bto: Die “Alles-Blase” stellt deshalb auch so eine große Gefahr dar.

- “One of the signatures of this bubble is the price insensitive buyer, with central bankers at the top of the list. The idea is that if the markets are on autopilot you might as well get rich by front running the central bankers and the index investors who are just blindly buying the index.” – bto: Und damit sind sie in den letzten Jahren sehr gut gefahren.

- “My thesis is that when this bubble bursts, gold should rally, while bonds and stocks should crash. Against this backdrop, it’s remarkable that gold seems to have bottomed right around late April when Bloomberg BusinessWeek came out with its ‘Is Inflation Dead?’ cover. Yet, this signal from gold was widely ignored and we got this blow-off in the bond market.” – bto: weil alle davon ausgehen, dass wir in die Eiszeit marschieren mit noch tieferen Zinsen und Deflation.

- “As short sellers, we were thrilled by the prospect that WeWork would go public and we’d get an opportunity to short it. The cracks in the IPO market are telling us that there are limits to easy money. That’s the common theme: we’re getting exhaustion.” – bto: Ich denke auch, dass WeWork zeigt, dass die Stimmung am Markt dreht. Es dauert, aber es passiert.

- “This Everything Bubble is much more difficult to short than a «normal» bubble since it’s so broad-based and persistent. I’m sure that will change. But honestly, as somebody who’s been doing this for a while, there are times I wish I had never discovered short selling. That’s what a major top feels like.” – bto: Richtig, erst wenn alle aufgegeben haben, ist Schluss.

- “(…) where do you see the most promising short opportunities? – In auto finance, in the passive bubble and in money losing companies like Tesla or Carvana. These are a few of the themes we’re betting against. But we’re scaling back and trying to stay focused on our best ideas. It’s kind of a circle the wagons, bunker mentality at this point.” – bto: Und mit Tesla haben nicht wenige viel Geld verloren, die auf fallende Kurse setzten.

- “Where do you see attractive investments? – (…)One of the things we know from past bubbles is that you often get anti-bubbles. This was clearly the case in the year 2000 when you had the new economy bubble on one side, and the old economy anti-bubble on the other side. When tech stocks peaked in March of 2000, a lot of the «boring» value stocks bottomed at the same time. (…) One of the reigning narratives is that Amazon is going to put all retailers out of business. This may be true in a lot of cases, particularly in the mall space. But there will be survivors who benefit from their competitors going bust. Many of these names went through massive bear markets over the past three years. That’s why it may pay off to rummage through the junk pile in the retail sector.” – bto: Dazu muss man aber sehr genau hinschauen – nichts für den einfachen Investor.

Quelle: the market

- “Precious metals and mining stocks are another example of an anti-bubble: Faith in central banking is at the heart of this bubble and precious metals are the inverse of faith in central banks. So we like gold and gold stocks. Admittedly, gold mining is not a good business since it’s very capital intensive and whenever there is a boom there tends to be tremendous waste. But if gold goes up further, these companies are going to benefit.” – bto: Und deshalb gehören sie in das Portfolio.

Und jetzt noch der Bonus für all jene, die an “grüne Investments” und Nachhaltigkeit bei der Geldanlage glauben (ich gehöre bekanntlich nicht dazu). “There is also a socially responsible investing aspect – along the lines of environmental, social and governance factors – to this bubble as the Millennials start to take over investing functions. It’s a filter that you have to be aware of. Certainly, Tesla appeals to this ESG crowd. Another example is Beyond Meat, which went public in early May and shot up nearly tenfold in less than three months. At its peak, the company was valued at $15 billion with just $200 million in revenue and barely about to turn a profit. Large bureaucratic companies in general have become bastions of political correctness willing to cater to the ESG crowd. On the other side, if you’re a small entrepreneurial company, you’re not hiring based on diversity quotas. You’re hiring the most competent people you can find since you don’t have time to collect a bunch of worthless statistics. I feel this will be the gift that keeps on giving for contrarian investors: You want to look for stocks that don’t neatly fit into the ESG screens. The obvious example is the energy sector, especially natural gas exploration and production stocks, which are severely depressed. Fossil fuel investments are strictly verboten in the ESG playbook. That’s an opportunity.” – bto: Yep. Die Blase platzt und dann bekommen wir ganz andere Themen als das Verbieten von Fleisch. Selbst in Deutschland.

→ themarket.ch: “‘Central Bankers Are Starting To Lose Control’” 19. November 2019

Ist die FED bald gezwungen QE4 zu starten?

“Treasury yields will spike”, Pozsar warns, identifying the trigger of forced sales of Treasuries around year-end as the FX swap market. It gets worse, because the selloff that is triggered by a freeze in the FX swap market will promptly lead to a crash in the bonds market, and spread from there, or as Pozsar puts it, “these funding market stresses will likely pull away capital and hence balance sheet from equity long-short strategies which could spill over into a broader equity selloff… during a Treasury selloff – that’s not the right kind of risk parity Christmas.”………………

That said, as Pozsar concedes in his conclusion “QE4 – as much as it makes sense – won’t happen unless the Fed’s hands are forced.”

By which he means there has to be a market crash for the Fed to do the one thing that can alleviate the banks’ terminal reserve problem.”

https://www.zerohedge.com/markets/its-about-get-very-bad-repo-market-legend-predicts-market-crash-days

Hört sich nach einer guten Einstiegsgelegenheit zum Jahresende an.

bto: “Yep. Die Blase platzt und dann bekommen wir ganz andere Themen als das Verbieten von Fleisch. Selbst in Deutschland.”

Das dachte ich nach dem Attentat auf dem Breitscheidplatz in Berlin zur deutschen Mehrheitseinstellung bzgl. ungeregelter Migration auch. Das war ein Irrtum von mir.

Ich denke, wenn jemand nach dem Platzen der Blase bis zum letzten Euro am ökologischem Sozialismus festhalten wird, dann die Deutschen, mit großzügiger Unterstützung von Frau Lagarde. War 1917, 1944 und 1988 (nur Ostdeutschland) mit anderen Ideologien in Deutschland auch schon so, wobei man fairerweise dazu sagen muss, dass wenigstens die militärischen Träumereien einer AKK in Nordsyrien derzeit nicht mehrheitsfähig sind und sich die politisch geforderten “Opfer” seitens der Bevölkerung auf finanzielle Verluste beschränken, was bei den beiden vorgenannten historischen Beispielen deutlich unmenschlicher war. Wobei ich zugeben muss, dass die Opfer von in den Medien sogenannten “Einzelfällen” das aus guten Gründen anders sehen können (https://www.politikversagen.net).

@Susanne Finke-Röpke

Danke für diesen Kommentar, nur selten liest man solch eine Stimme der Vernunft und des klaren Denkens.

Allerdings ist die Situation (west-) europaweit so, nicht nur in DE. Man denke an die Zustände in FR und GB. Ich vermute auch, dass die Stimmung der Bevölkerung zu diesem Thema von den MSM Medien in keiner Weise richtig dargestellt wird. Man hat es mit einer breit angelegten und absichtlichen Verfälschung zu tun, es wird hier tatsächlich ein Plan verfolgt der uns nicht offen dargelegt wird. Denn sonst wäre das alles gar nicht vorstellbar, kein Volk der Welt würde solche Zustände und Geschehnisse so kritiklos zulassen und sogar noch begrüßen (Bahnhofsklatscher und Teddybärenwerfer). Es ist wie kollektiver Suizid, von dem noch in hunderten Jahren in den Geschichtsbüchern zu lesen sein wird, vorausgesetzt, es gibt dann noch so etwas wie eine freie Welt und aufgeklärte, offene Gesellschaften.

Kommentare wie diese beiden würden in den Foren großer Zeitungen wie bspw. der “Welt” niemals freigeschalten.

Weshalb trotz solcher Umstände eine Fr. Merkel samt ihren Claqueuren als Hauptverantwortliche dieser Katastrophe wieder und wieder gewählt werden erschließt sich mir nicht.

Zur Frage, was denn nun der Hauptgrund für die niedrigen Zinsen in den letzten Jahren ist, wird immer wieder eine zunehmende Vermögensungleichheit aufgeführt.

Die Einkommensungleichheit und die Sparquote haben sich in Europa seit 2005 nicht signifikant geändert oder sind sogar gefallen.

Der private Konsum in der Europäischen Union schwankt seit 2010 auf hohem Niveau (ca. 60% höher als 2002) ohne Trend seitwärts.

Diese Variablen können also nicht die derzeitigen null oder gar negativen Zinsen seit 2010 erklären.

Hier eine Graphik zur Entwicklung der Vermögensungleichheit in verschiedenen Ländern:

„Abbildung E8 auf Seite 13:

Anteil des reichsten 1% am Privatvermögen weltweit, 1913–2015: Abnahme und Zunahme der Ungleichheit beim Privatvermögen“

https://wir2018.wid.world/files/download/wir2018-summary-german.pdf

Leider ist von Europa nur die Entwicklung für GB und F dargestellt.

Für diese Länder kann aber eindeutig festgestellt werden, dass seit 2000 keine signifikante Zunahme (Großbritannien) oder sogar eine Abnahme (Frankreich) festgestellt werden kann.

Somit können die aktuell niedrigen Zinsen in diesen Ländern (zumindest in GB) nicht mit einer zunehmenden Vermögensungleichheit (hin zu den 1%) begründet werden.

Wenn jemand einen besseren Chart findet, bitte mitteilen.

@ ikkyu

Es gibt doch ganz offensichtlich in der Wissenschaft keine komplett gesicherte Erkenntnis, welcher Aspekt mit genau welchem Anteil für die gesunkenen Zinsen verantwortlich ist. Warum glauben Sie, dass wir im Blog dieses Rätsel lösen können ?

Zudem ist doch m.E. extrem wahrscheinlich, dass in unterschiedlichen Zeiträumen seit 1980 ganz verschiedene Aspekte einen jeweils unterschiedlichen Anteil hatten. Die Gründe für die seit 2010 fallenden Zinsen dürften andere sein als im Zeitraum seit Mitte der 80er insgesamt. Zumindest in ihrer Gewichtung.

Da Sie aber in Ihrem Post u.a. auf den Zeitraum seit 2010 in Europa abstellen, folgt meine komplett unmaßgebliche Sichtweise.

Die Finanzkrise und die darauf folgende € Krise haben bei den Banken eine Bilanzrezession ausgelöst, die auf das Wirtschaftswachstum gedrückt haben und immer noch drücken. Dies dürfte deshalb seit 2010 ein wichtiger Grund für fallende Zinsen gewesen sein. Die EZB Politik hat in diesem Zeitraum m.E. durch ihre diversen Programme ebenfalls einen wichtigen Anteil.

Andere Zeiträume, andere Aspekte, zumindest andere Gewichtungen.

Die von Ihnen verlinkte Studie liefert doch schöne Anhaltspunkte für die Entwicklung seit Mitte der 80er bzw, Hinweise auf zukünftige Entwicklungen.

Zudem ist im längerfristigen Bild die Demografie, wie schon an anderer Stelle geschrieben, ganz offensichtlich nicht unwichtig.

Hier deshalb nochmals ein Zitat aus einem Braunberger Beitrag:

“Nahezu die Hälfte des Rückgangs des langfristigen realen Zinses um 3,6 Prozentpunkte seit dem Jahre 1980 lässt sich nach dieser Schätzung auf den demografischen Wandel zurückführen.”

Ja, die Studie muss nicht richtig sein…

Arbeiten Sie sich durch die nachstehende Studie, um die es bei dem Zitat geht. Wenn Sie dann zu der Auffassung kommen, die Studie ist kompletter Unsinn, dann lassen Sie es mich bitte wissen. Und mir geht es nicht darum, ob der Anteil nun “nahezu die Hälfte” oder nur 20% oder 33,12487285% ist. Wenn Sie der gut begründeten Auffassung sind, der Anteil der Demografie wäre (nahezu) Null, dann wäre es interessant.

https://www.frbsf.org/economic-research/files/4-Thwaites-demographic-trends-and-the-real-interest-rate.pdf

@ ikkyu

„Die Einkommensungleichheit und die Sparquote haben sich in Europa seit 2005 nicht signifikant geändert oder sind sogar gefallen.“

Sie dürfen in diesem Kontext aber nicht die unterdurchschnittliche Lohnentwicklung insbesondere im Süden außer Acht lassen. Insofern hat die Nachfrageschwäche als Argument für niedrige Inflationsraten und somit niedrige Zinsen durchaus ihre Berechtigung. Zudem muss im Prozess des Deleveraging zwangsläufig auch die Konsumnachfrage rückläufig sein und somit auch die Sparquote, da durch die Kredittilgung der einen das Geldvermögen der anderen sinken MUSS. Und wenn wir der Bundesbankstudie glauben schenken dürfen, dann hat ein großer Teil der Bevölkerung überhaupt kein Geld zum Vermögensaufbau übrig.

Ein weiterer wichtiger Grund für die niedrigen Zinsen sind mAn die hohen Überkapazitäten im Finanzsektor bei gleichzeitig sinkendem Kreditbedarf. Es ist ein Preiskampf, bei dem nicht alle überleben werden und viele massiv abspecken müssen. Dieser Prozess ist am Laufen.

LG Michael Stöcker

„bto: Mag sein. Ich erwarte eher sinkende Staatsanleihenzinsen und steigende Zinsen auf Unternehmensanleihen.“

Ich auch.

„bto: Und vor allem züchten sie Zombies, die wiederum das Wachstum dämpfen und noch mehr Liquidität erforderlich machen.“

Auch durch ständige Wiederholung wird ein Glaubensbekenntnis doch nicht zur Wahrheit. Fakt ist, es gibt lediglich für Deutschland seit 2009 einen signifikanten Rückgang der Insolvenzen. In Italien sind sie bis 2014 markant angestiegen und auch im Jahr 2018 immer noch mit 13.695 Insolvenzen deutlich höher als 2005 mit 5.518. Gleiches gilt für Frankreich, Spanien und Portugal (alle Zahlen zu finden bei Creditreform).

Die Theorie der Zombies ist selber eine Zombie-Theorie aus der Asservatenkammer der Österreichischen Schule, wie ich an diesem Blog bereits 2017 dargelegt hatte: https://think-beyondtheobvious.com/stelters-lektuere/zombies-vergiften-das-wasser-fuer-alle/#comment-31251

Und warum sind dann die Insolvenzen in Deutschland kontinuierlich gesunken? Nein, es liegt nicht am Zins, sondern an den hohen Leistungsbilanzüberschüssen. Der Rest von Euroland leidet weiter unter einer verfehlten Investitionspolitik.

Hier nochmals der Link zum Beitrag von Braunberger, den Herr Tischer schon gestern thematisiert hatte: https://blogs.faz.net/fazit/2019/12/09/geldpolitik-in-der-vierten-industriellen-revolution-11079/

Insofern: There is no such thing as zombie.

LG Michael Stöcker

Korrigenda: Die 5.518 für Italien sind nicht von 2005 sondern von 2007.

Meine Antwort auf Braunberger morgen 9.00 auf bto

Vielleicht kommen bei der nächsten wirtschaftlichen Krise ja die gott-gleichen Notenbanker selber in die Schusslinie:

https://moneyweek.com/516133/the-dangers-of-negative-interest-rates/

“But negative rates are a different thing altogether. While you can explain the problems they create in complicated ways, there is no need to do so.

Most people intuitively feel that negative interest is somehow unnatural.

If negative rates cause the next crisis by distorting capital allocation and encouraging unmanageable levels of debt, central bankers will discover that the real danger is to them personally.

The whole idea that they are politically independent good guys will come tumbling down.

Instead ordinary people will see them as dangerous creatives who set in motion an experiment they have no way of reversing or controlling.”

@ikkyu

“Vielleicht kommen bei der nächsten wirtschaftlichen Krise ja die gott-gleichen Notenbanker selber in die Schusslinie”

Naja, ob die Politik sie wirklich hängen lassen wird, so wie damals Roberto Calvi?

https://www.dw.com/de/prozess-um-den-tod-des-bankiers-gottes/a-1732416

@ ikkyu

„Most people intuitively feel that negative interest is somehow unnatural.”

Das sind auch die Folgen der säkularen Verblödung. In früheren Zeiten hatten die Menschen noch geglaubt, dass Zinsnehmen Sünde sei. Manche glauben das noch heute.

Unnatürlich ist auch bei der Zinsgeschichte nur eins: Dass der Mensch als grundsätzlich vernunftbegabtes Wesen nicht mit dem selbstständigen Denken beginnt, sondern einfach das nachplappert, was ihm andere vorplappern. Hier hat es der Großmeister des Vorplapperns getan. Das durfte nicht unkommentiert bleiben: http://wirtschaftlichefreiheit.de/wordpress/?p=19500#comment-191147

LG Michael Stöcker

@ M. Stöcker

Nach meiner Meinung ist das keine Verblödung sondern einfach gesunder Menschenverstand abgeleitet aus der täglichen Erfahrung der Menschen.

Die Leute merken eben, dass der negative Zins nur vom Staat und den großen Konzernen realisiert werden kann und sie selber bei der Bank einen positiven Zins für einen Kredit zahlen müssen.

Die negativen Konsequenzen des “money for nothing” dürfen sie aber dann ausbaden.

Wär es denn nicht “unnatürlich”, wenn jeder Bürger -auch ohne Sicherheiten- einen Kredit mit sagen wir mal -1% Zinsen aufnehmen könnte und damit nur durch Schuldenmachen (z.B. 10 Mio. €) ein schönes Einkommen so wie der Staat generieren könnte?

@ ikkyu

„Wär es denn nicht „unnatürlich“, wenn jeder Bürger -auch ohne Sicherheiten- einen Kredit mit sagen wir mal -1% Zinsen aufnehmen könnte und damit nur durch Schuldenmachen (z.B. 10 Mio. €) ein schönes Einkommen so wie der Staat generieren könnte?“

Ihre Frage zeigt mir, dass Sie nicht verstanden haben, dass wir zwei Geldkreisläufe haben. Schauen Sie mal bei der Bundesbank vorbei, die diese Sichtweise ganz neu in ihrer aktuellen Ausgabe nun endlich visualisiert hat: https://www.bundesbank.de/resource/blob/606038/3cffd54f7377c8b31467432691242af9/mL/geld-und-geldpolitik-data.pdf (Seite 78).

Die Negativzinsen gelten für den Geldkreislauf der Banken und NICHT für den Geldkreislauf der Privaten. Und bitte beachten: Kreditvergabe ist etwas VÖLLIG anderes als Geldverwahrung auf einem Konto bei einer Geschäftsbank. Die Bank benötigt nämlich kein Geld für die Kreditvergabe, sondern lediglich für die Refinanzierung. Und die klappt bei entsprechender Bonität IMMER.

„Nach meiner Meinung ist das keine Verblödung sondern einfach gesunder Menschenverstand abgeleitet aus der täglichen Erfahrung der Menschen.“

Aufgrund dieser täglichen Erfahrung heraus haben übrigens die Menschen früher geglaubt, dass sich die Sonne um die Erde dreht.

LG Michael Stöcker

@Hr. Stöcker: Was denken Sie, wird passieren, wenn Negativszinsen auf Firmenkonten und Privatkonten eine nennenswerte Zahl in nennenswerter Höhe treffen?

Meine Sicht: Es wird zu Vermeidungsverhalten und schlechter Stimmung kommen. Ein Teil wird in Konsum fließen, der noch größere Teil vermutlich in Assets, andere Währungen und/oder außer Landes. Wie das positiv für die Wirtschaft sein soll, erschließt sich mir nicht. Ich will freilich nicht ausschließen, dass auch die ein oder andere Investition getätigt wird – das sind dann freilich die, auf die man aktuell – warum auch immer – keinen gesteigerten Wert legt.

Ein Detail fehlt mir aber noch zum Verständnis: Können Nicht-EU-Banken Euro ohne Negativzinsen verwahren? Das würde die Flucht zumindest bequem machen.

Das Argument einer prozentualen Lagerhaltungsgebühr überzeugt finde ich nicht, weil da nur ein paar Bytes zu speichern sind. Das kann mit Flat Fee erfolgen – die klassische Bankgebühr halt. So würde es zumindest in einer Marktwirtschaft kommen.

Ne, man kann vielleicht als ZB-Policy negative Zinsen funktional sinnig modellieren, aber beim Bürger machen Zinsen <0 keinen Sinn – zumindest nicht in einer freien Gesellschaft. Mal ganz abgesehen von den möglichen Paradoxien (s. ikkyu-Beispiel).

@ Thomas M.

Ich verlinke aus Zeitgründen mal wieder auf einen meiner älteren Kommentare aus dem Jahr 2013, als man begann, über Negativzinsen zu diskutieren: https://blog.zeit.de/herdentrieb/2013/11/07/draghi-coup_6741?sort=asc&comments_page=2#comment-103728

LG Michael Stöcker

@Herr Stöcker

“Die Negativzinsen gelten für den Geldkreislauf der Banken und NICHT für den Geldkreislauf der Privaten.”

Na das wird die Leute bestimmt überzeugen. Doppelte Standards kommen immer gut an. ;)

@ Thomas M.

Ganz richtig, all dies ist mit dem „intuitiven Gefühl“ der Menschen, dass Negativzinsen „unnatürlich“ seien, verbunden.

Im maßgebenden Eingangsbeitrag von ikkyu hebt der Autor zu Recht darauf ab, dass für derartige Einsichten keine komplizierten Erklärungen erforderlich seien, wie z. B. solche über Geldkreisläufe.

Das Vermeidungsverhalten schaffen jedenfalls auch säkular Verblödete:

Sie nehmen das Geld vom Konto und bunkern es zuhause oder im Banktresor.

Schon EMPIRISCH belegbar:

https://www.handelsblatt.com/finanzen/anlagestrategie/trends/wegen-niedrigzinsen-deutsche-horten-immer-mehr-bargeld-im-schnitt-2800-euro/25282690.html

Die Summe des gehorteten Bargelds hat sich in den letzten 10 Jahren verdoppelt auf 235 Mrd. Euro.

Entsprechend musste die Bundesbank Scheine drucken lassen:

Sie hat derzeit 726 Mrd. Euro an Banknoten im Umlauf.

In 2009 waren es noch 348 Mrd. Euro.

Den Tresorherstellern geht es offensichtlich gut.

Schließlich müssen die Leute nicht nur Geldscheine, sondern auch ihr Gold verwahren.

So kurbelt man mit Negativzinsen die Realwirtschaft an…

Apropos zwei Geldkreisläufe mit verschiedenen Zinsen. Ähnlich hat Herr Stöcker bei dem von ihm verlinkten Beitrag zu Draghis Coup in der Zeit vom 7.11.2013 argumentiert. Angenommen:

a) die -0,5% werden nur auf Zentralbankgeld fällig und

b) die Banken buchen das 10-fache des Zentralbankgeldes als Kreditgeld auf die Konten ihrer Kunden

dann bräuchte es nur -0,05% auf die Kundeneinlagen damit die Banken die -0,5% der EZB bezahlen könnten. Haben aber nicht schon die ersten Banken begonnen -0,5% ab dem ersten Kundeneuro zu verlangen? Tolles Täuschungsmanöver um sich großzügig an den Kundengelder zu bedienen.

Apropos “negative Zinsen sind unnatürlich”. Wenn der positive Zins (auch) ein Ausdruck der Tatsache ist, dass die Zukunft unbekannter ist als die Gegenwart, so bedeutet der negative Zins, dass die Gegenwart unbekannter ist als die Zukunft – so gesehen ist das unnatürlich. Dass eine alternde Gesellschaft eine andere Zeitpräferenz hat, die negative Zinsen begünstigt, ist ein ebenfalls zu berücksichtigendes Argument.

@ M. Stöcker

“Die Negativzinsen gelten für den Geldkreislauf der Banken und NICHT für den Geldkreislauf der Privaten.”

Die Geldpolitik der Notenbank (Leitzins + QE-Programme) hat dazu geführt, dass sich Staaten und große Konzerne zu negativen Zinsen refinanzieren können.

Somit “gilt” diese Geldpolitik nicht nur für Banken, sondern hat auch Auswirkungen auf die Realwirtschaft (sonst wäre die Geldpolitik ja total wirkungslos und man könnte die Notenbanken abschaffen).

Merke:

Der Unterschied zwischen Praxis und Theorie ist in der Praxis größer als in der Theorie.

Und noch eine Bemerkung zum Braunberger:

In einer Antwort auf einen Kommentar hat er geschrieben, dass sich die Notenbanken bei der Festsetzung des Leitzinses an die Taylor-Formel halten.

Das ist jedoch in den USA seit 2010 nicht mehr der Fall.

Der von der FED festgesetzte Leitzins war in diesem Zeitraum regelmäßig 2% – 3% unter dem mit der Taylor-Formel berechneten “optimalen”-Leitzins.

Fazit:

Braunberger et al. are behind the curve!

Der Chart Taylor-Zins vs. FED-Zins:

https://www.researchgate.net/figure/Fed-Funds-Rate-and-Taylor-Rule-The-figure-plots-the-effective-federal-funds-rate-and-the_fig3_314680381

@Skeptiker

“Apropos „negative Zinsen sind unnatürlich“. Wenn der positive Zins (auch) ein Ausdruck der Tatsache ist, dass die Zukunft unbekannter ist als die Gegenwart, so bedeutet der negative Zins, dass die Gegenwart unbekannter ist als die Zukunft – so gesehen ist das unnatürlich.”

Ganz genau. Geldpolitische Quacksalber wollen uns ernsthaft weismachen, dass es völlig natürlich sei, lieber 1 Euro nächstes Jahr bekommen zu wollen als 1 Euro heute. So denkt aber kein normaler Mensch, man muss schon ordentlich gehirngewaschen sein, um diese Idee irgendwie für “natürlich” oder auch nur plausibel zu halten.

>Anytime we get close to a downturn, central banks can just print money. Of course, we know that’s sheer nonsense.>

Das ist kein Unsinn.

Denn natürlich können die Zentralbanken einfach Geld “drucken“.

Damit haben sie BISHER Stabilität sichern können.

Auch das ist eine Tatsache, denn DIE Blase ist NIE geplatzt.

Es hat lediglich TEIL-Entwertungen von Assets gegeben (siehe „Anti-bubble“ in der Grafik).

>„My thesis is that when this bubble bursts, gold should rally, while bonds and stocks should crash.>

Das ist ein alter Hut.

Interessant ist auch nicht die Frage, WANN die Blase platzt – damit müssen sich nur Short-Seller herumschlagen.

Interessant ist vielmehr die Frage, unter welchen BEDINGUNGEN es nicht mehr hilft, Geld zu drucken.

Das muss VOR dem Platzen der Blase sein.

Denn das Platzen der Blase ist die Bestätigung dafür, dass Gelddrucken nicht mehr gereicht hat.

@Dietmar Tischer

Es ist bekannt, dass ein Crash sehr schwer zu timen ist, um nicht zu sagen unmöglich. Man kann die Lage aber aufmersam beobachten und auf gewisse Signale achten.

– Immobilien: Ich hatte Interesse an einem Ferienhaus am Attersee und dieses Haus besichtigt. Alles OK, tolle Lage, schöner Seeblick, 600m2 Grund. Preis: EUR 850.000,-. Meines Erachtens für diese Grundstücksfläche ca. EUR 150.000 – 200.000,- überteuert.

Das Interessante daran: Dieses Haus ist immer noch am Markt, schon seit Monaten. Noch vor einem Jahr wäre es wohl innerhalb weniger Wochen verkauft worden. Ich sehe das auch an anderen interessanten Immos in Österreich, allerdings rede ich nicht von Wien oder Salzburg. Aber bspw. in Tirol sind Ferienhäuser und Wohnungen anscheinend gar nicht mehr so leicht zu verkaufen. Offenbar sind die Leute nicht mehr bereit, jeden Preis zu zahlen, ergo: mglw. nahendes Ende der Immoblase.

-Gold: Nahezu panikartige Versuche der Politik und der gleichgeschaltetenen, offenbar von der Politik abhängigen Medien, Gold schlechtzumachen und “schlechtzuschreiben” (Kann man nicht essen. Geldwäsche. Keine Zinsen. Unmoralisch, wegen Umweltzerstörung durch Abbau. Einschränkung des anonymen Kaufs. Abschaffung des Bargeldes… etc. etc.)

Für mich sind das Signale einer massiven Unterbewertung von Gold.

Lediglich bei Aktien ist eine Einschätzung sehr schwierig. Wenn im QE No. 4 der Turbo zugeschaltet wird und weitere Billionen USD und EUR die Welt fluten, werden Aktien wohl noch mal zu einem steilen, aber vielleicht kurzen Höhenflug ansetzen.

Mein Fazit: man kann den Zeitpunkt nicht voraussehen, aber man kann versuchen, mit einer guten Mischung richtig aufgestellt zu sein. Also zurücklehnen, abwarten und das Spektakel weiter beobachten.

Und es spricht definitiv nichts mehr für Produkte wie Lebensversicherungen, Bausparverträge u.ä.

@ Hoxworth

Sie widersprechen mir nicht und ich Ihnen auch nicht.

Es kann natürlich Panik ausbrechen und alle wollen verkaufen.

Ich sage nicht, dass die Notenbanken in JEDER daraufhin folgenden denkbaren Krisensituation erfolgreich stabilisieren können.

In den letzten Jahren habe ich meine Meinung allerdings dahingehend geändert, dass sie sehr viel bewirken können – und das sehr schnell und wohl auch sehr koordiniert.

Die Krisenszenarien – nicht Crash-Szenarien à la Krall – dürften sie sich sehr genau ausgemalt haben mit weit mehr fundierten Informationen, als in der Öffentlichkeit auftauchen.

Auf dieser Basis lässt sich durchaus berechtigt fragen:

Verlieren die Notenbanken die Kontrolle?

Die m. A. n. aber genauso wichtige, wenn nicht noch wichtigere Frage ist allerdings:

In welchen denkbaren Situationen sind die Notenbanken quasi IRRELEVANT, noch irgendeine Rolle zu spielen?

Im Bürgerkrieg, bei Chaos natürlich.

Ich denke aber auch schon früher, bei noch geordneten Verhältnissen, etwa diesem in der Vergangenheit diskutierten und nicht an den Haaren herbeigezogenen Szenario:

Eine dezidiert nationalistische italienische Regierung, mit Mehrheit an der Macht, will mit dem Mittel einer Zweitwährung aus der Eurozone austreten.

Klar, da wird gedroht, gelockt, geschachert etc.

Aber:

Sie kann es tun – und die EZB wird es nicht verhindern können.

Was folgt, wäre trotz Kapitalverkehrskontrollen etc. ein Desaster für die Eurozone.

Ob man das Crash nennen sollte oder nicht, ist dann noch das geringste der Probleme.

Danke für diesen Artikel, selber kennt man solche Leute wie Mr. Duffy ja nicht :)

Das von ihm skizzierte Szenario ist auch genau jenes, mit dem ich rechne:

Gold, Goldminenaktien, Rohstoff/ Bergbauaktien, Gas- und Ölaktien. Also Nicht-PC und absolut nicht “grün” :)

Allerdings warte ich schon >8 Jahre darauf, dass die Rechnung aufgeht.. aber wie heißt es so schön, die Hoffnung stirbt zuletzt.

Sehr gut ausgeführt! Was ich noch ergänzen möchte ist, dass man nicht unterschätzen darf, dass in der Finanzwelt immer wieder die gleichen Mechanismen greifen. In der aktuellen “everything-bubble” ist wieder der Druck entstanden, aus den Markteingriffen der Notenbanken Rendite zu ziehen – also aus dem Vertrauen auf den Dragi-Put beispielsweise. Dies geschieht wie immer mit Leverage, aber diesmal mit dem Unterschied, dass die Phase der Nutzung des Leverage diesmal weit länger als in anderen Blasen ist. Das diesmal nicht nur ein Player oder eine Idee verführt. Nein, diesmal sind es praktisch alle großen Nationen und alle großen Notenbanken, die diesen Leverage befeuern. Soweit, dass der Leverage an sich systemrelevant geworden ist. Im Platzen der “Everything-Bubble” werden wir uns noch die Augen reiben, welche Fehlallokation von Investitionen und vor allem welch abstruse Mechanismen und welch unvorstellbar marode Finanzkonstruktionen geschaffen wurden. Die Incentivierung der Marktteilnehmer ist einfach zu lang und zu stark gewesen. Ich maße mir nicht an, einen großen Überblick über die Fehlentwicklungen zu haben. Aber die Dinge, die ich allein im Private Equity oder auch im ETF-Bereich sehe reichen mir, um den Eindruck zu gewinnen, dass die Finanzkrise “erster Teil” lediglich eine Art Aufwärmprogramm eines Athleten vor einem Zehnkampf darstellte.

@The Big Big Short

Wir sehen die Bubble und die irrationale Euphorie doch sogar im Kunstmarkt: https://www.zerohedge.com/economics/see-you-after-jail-guys-art-world-stunned-after-man-eats-120000-banana-duct-taped-wall

Von der Stimmung her erinnert alles ein bisschen an 2007, damals hatten wir statt Bananen mit Klebeband aber immerhin noch einen diamantbesetzen Totenschädel. Vielleicht auch eine Spielart der Inflation, der Materialwert der dekadenten Sinnlos-Kunstwerke sinkt rapide. ;)

Ein Kommentar ganz ohne das S- bzw. Z-Wort! Was ist los mit Ihnen, Herr Ott?

Es ist in der Tat die Bubble – und zwar die Vermögens-Bubble – , die einen solchen Exzess überhaupt erst ermöglicht. Die NZZ findet aber sogar für einen solchen Schwachsinn noch eine Begründung: https://www.nzz.ch/meinung/kopie-von-geld-und-kunst-die-finanzkraeftige-elite-ist-ein-gluecksfall-fuer-die-heutige-kunstproduktion-ld.1524673

Was die NZZ hingegen verschweigt: Trickle down von den 0,1 % für die 0,1 %. Insofern KEIN Glücksfall für die „heutige Kunstproduktion“, sehr wohl aber ein Indikator für „spätrömische Dekadenz“.

LG Michael Stöcker

@Herr Stöcker

Ist doch schön, wir haben zumindest den gleichen Kunstgeschmack. Zumindest in der Hinsicht, dass wir die gleichen Dinge nicht mögen.