“The devil is in the detail of Rome’s new budget”

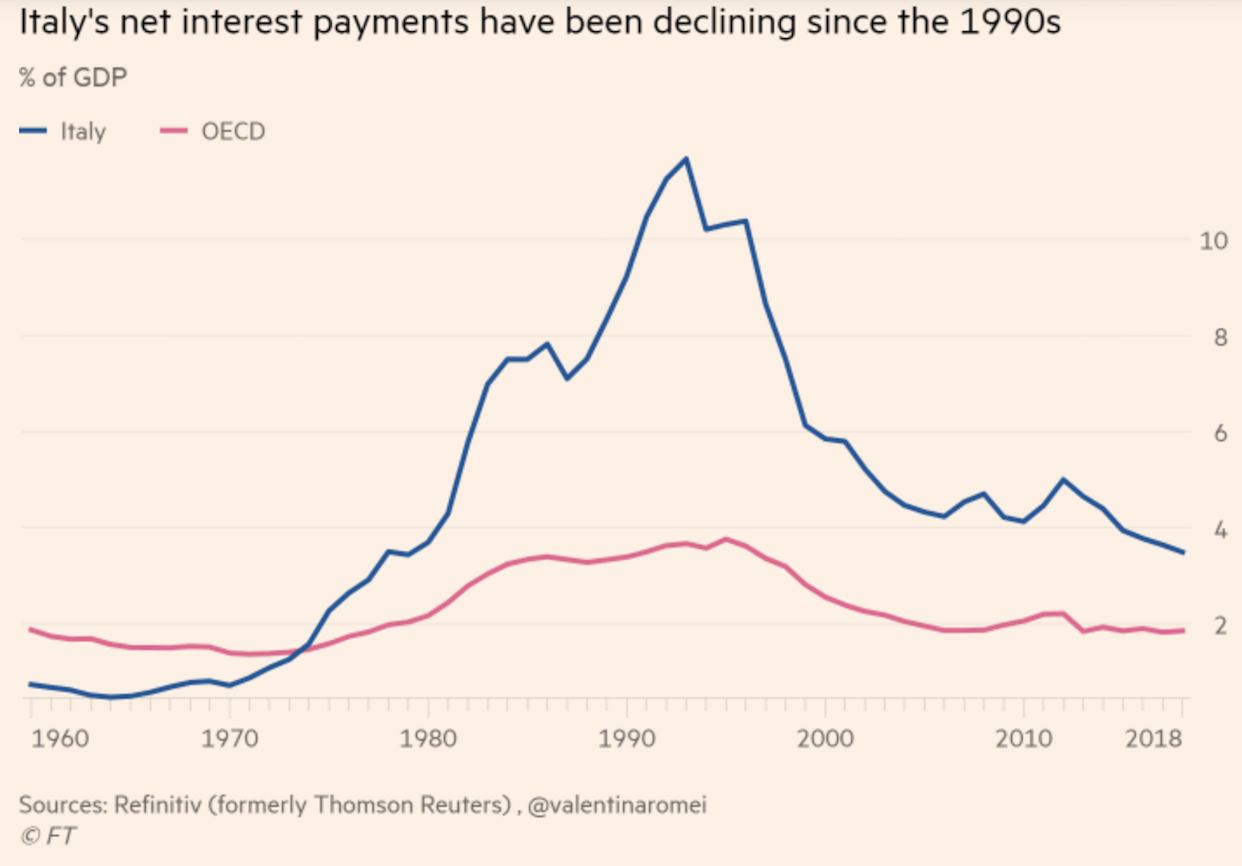

Heute Morgen haben wir gesehen, dass es theoretisch möglich ist, dass Italien aus den Schulden herauswächst. Praktisch, denke ich, ist es zu spät. Die Euro-Zinssenkungsdividende wurde verschwendet und im Unterschied zu Belgien nicht genutzt. Wie groß der Effekt war, zeigt dieses Bild aus den FT:

Die Zeitung kommentiert die Überlegungen der italienischen Regierung wie folgt:

- “The short answer is that the microeconomic aspects of the budget are worse than the macroeconomics. (…) Public debt is certainly high, but the budgetary cost of servicing it is the lowest in almost 40 years, as the chart below shows. What matters most for sustainability is the effect on growth.” – bto: Klartext: Wenn es zu mehr Wachstum führt, können wir auch mehr Schulden machen. Passt zu heute Morgen.

- “The key to our judgment on the macroeconomic impact on the budget must be whether we think the Italian economy is at full employment or not. While many observers seem to think this is the case, that is hard to believe when unemployment, though falling, remains more than 4 percentage points above the pre-crisis low. If there remains unused potential, extra stimulus to demand should feed through to short-term growth. For an economy as stagnant as that of Italy, a short-term growth boost is not to be scoffed at.” – bto: Nur wenn es dann so schnell verpufft, haben wir ein Problem.

- “For a deficit 1.8 percentage points bigger than previously planned, it foresees a boost to growth of 0.6 percentage points, or one-third of the deficit change. That is a very conservative take on the fiscal ‚multiplier effect‘ of government deficit spending on aggregate demand, especially in a currency union where monetary policy will not move to offset a single country’s fiscal stimulus. If the multiplier is this size, let alone bigger, Rome’s insistence that it can contain public finances through growth-friendly budget policy deserves a hearing. If the commission finds that it goes against EU fiscal rules, that says as much about the rules as about the budget.” – bto: Die Erfahrung der letzten Jahre spricht eindeutig dagegen, dass es funktioniert. Es wird ein Strohfeuer ohne bleibende Wirkung.

- “(…) the market reaction matters if the budget prompts investors to make financing costlier. This is a real risk, especially because the government’s commitments to deficit-cutting beyond next year are hard to trust. (…) But a higher bond spread could also directly affect private borrowing costs. If investors demand more to finance Italian banks — and they have been since the government took office — that cost will, at least in part, be passed on to the banks’ business and household clients.” – bto: und vor allem auf die Non-Zombies!

- “But the deeper worries concern not how much Rome wants to spend, but on what. I have been more sympathetic to the government’s priorities than many others, but there is much not to like in this budget. (…) it ‚looks like a ›Greatest Hits‹ album containing all the measures that have failed to spur growth in the past‘.” – bto: weil man eben die Wachstumsmisere, die strukturell ist, nicht durch Konjunkturprogramme lösen kann.

- “In this case, the tax and spending changes in the government’s budget do not target what is likely to promote growth. It does not reduce the high tax ‚wedge‘ between company labour costs and take-home pay that is one of the biggest hindrances to greater hiring. (…) None of this is catastrophic. But if the populists in Rome were going to pick a fight with Brussels over macroeconomics, they could at least have used it as an opportunity to get the microeconomics right in the process.” – bto: Das unterstreicht nochmals, was für ein Irrsinn die Währungsunion ist.

→ FT (Anmeldung erforderlich): “The devil is in the detail of Rome’s new budget”, 19. Oktober 2018