“Albert Edwards: ‘There Is An Earthquake Happening In Government Bonds’”

Albert Edwards hatte ich gerade erst in der letzten Woche mit seinem Interview in der FINANZ und WIRTSCHAFT. Heute nun via Zero Hedge sein letzter Kommentar. Er bleibt sich auf jeden Fall treu:

- “One thing that amazes me about the current cohort of global central bankers is the lack of insight into the fact that their extreme loose monetary policy and financial repression may actually be making deflation in the real economy worse despite clearly succeeding in creating rampant inflation in financial assets.” – bto: Genauso ist es aber, weil sie die Zombies erhalten und die Blasen aufpumpen.

- “The foundering of the current economic cycle and the imminence of its likely end has rammed home to investors the clear failure of financial repression to generate anything other than the most feeble of economic recoveries and no sustainable cyclical upturn in economy – wide inflation – either in wages or in prices. This failure has nurtured the current trend towardseven looser monetary policy via the increasing influence of the Modern Monetary Theorists.” – bto: Klar, wir allen brauchen eine höhere Dosis Geld …

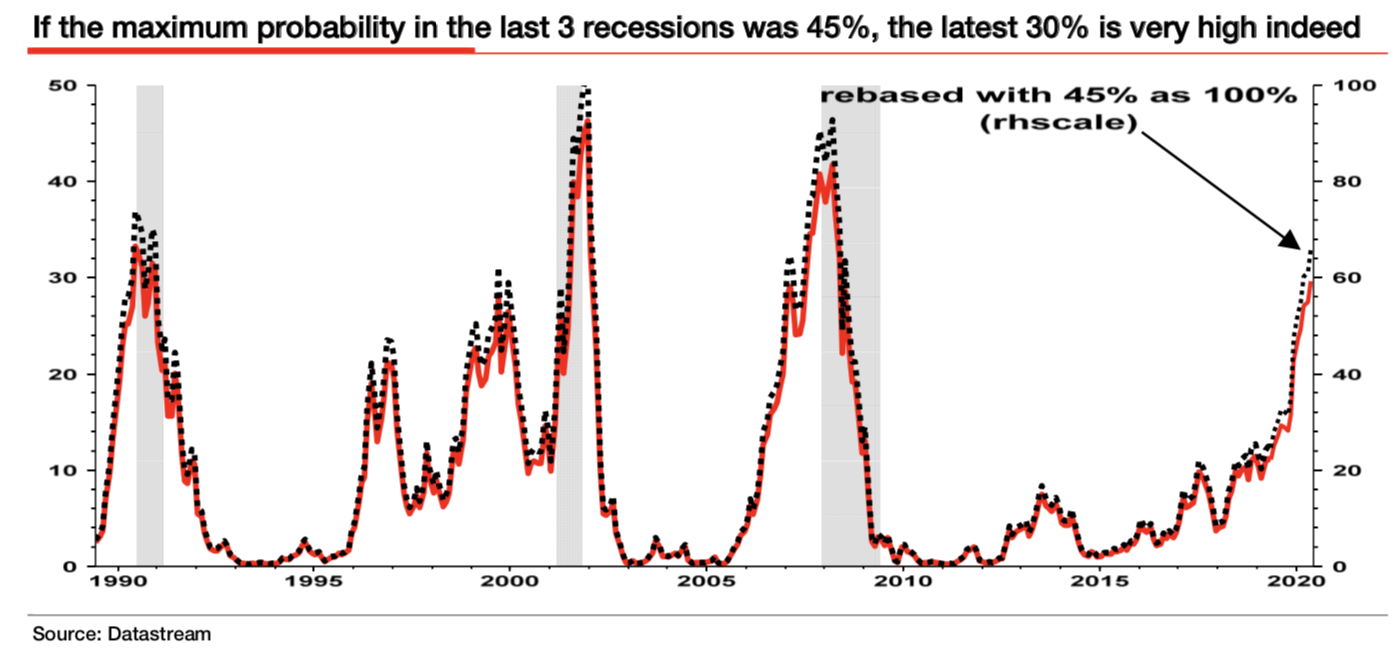

- “(…) the latest probability from the NY Fed model has reached 30% but as the NY Fed model only reached a high of 42% during the 2008 recession the deepest since the Great Depression isn`t it reasonable to rescale these probabilities? On that basis the current probability is above 65%.” – bto: simpel, aber richtig. Es ist doch naheliegend, das anzupassen.

Quelle: SocGen

Quelle: SocGen

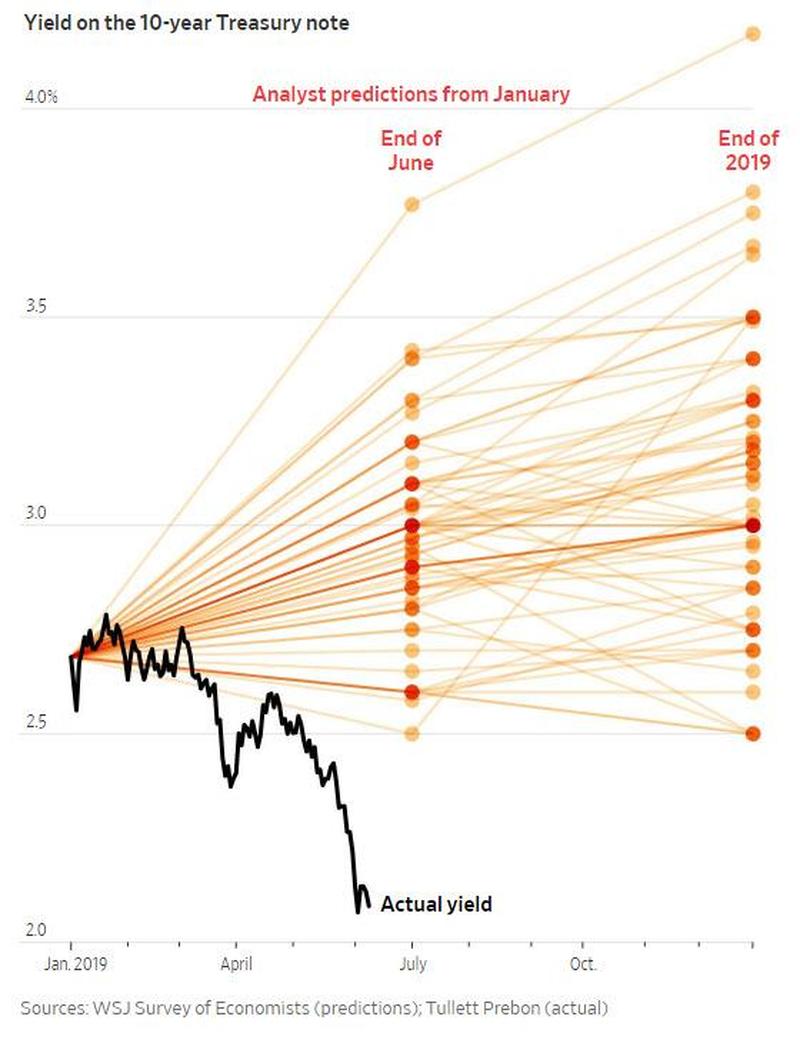

- “A key part of the Ice Age has been the prediction that US and European 10y government bond yields would fall to levels never previously seen – replicating Japan’s experience. We were told that this would never happen in the west because policymakers would not make the same mistakes Japan made! But with European yields plunging to new negative lows and the US yield curve giddy with inversion, the sceptics are now seriously contemplating the brave new world in which US 10y bond yields fall below zero.” – bto: Japan überall. Witzig war der Verweis auf einen Artikel im Wall Street Journal, der gezeigt hat, wie falsch die Auguren mit Blick auf die Zinsen lagen.

Quelle: Zero Hedge