Liquiditätskrise am US-Repo-Markt als Krisensignal für 2020?

Die Liquiditätskrise am US-Repo-Markt war schon mal Thema bei bto:

→ The Repo Crisis of September 2019

Darin besprach ich die Funktionsweise des Marktes und zeigte auf, dass Engpässe an dem Markt für kurzfristige besicherte Refinanzierungen auf das gesamte Finanzsystem durchschlagen.

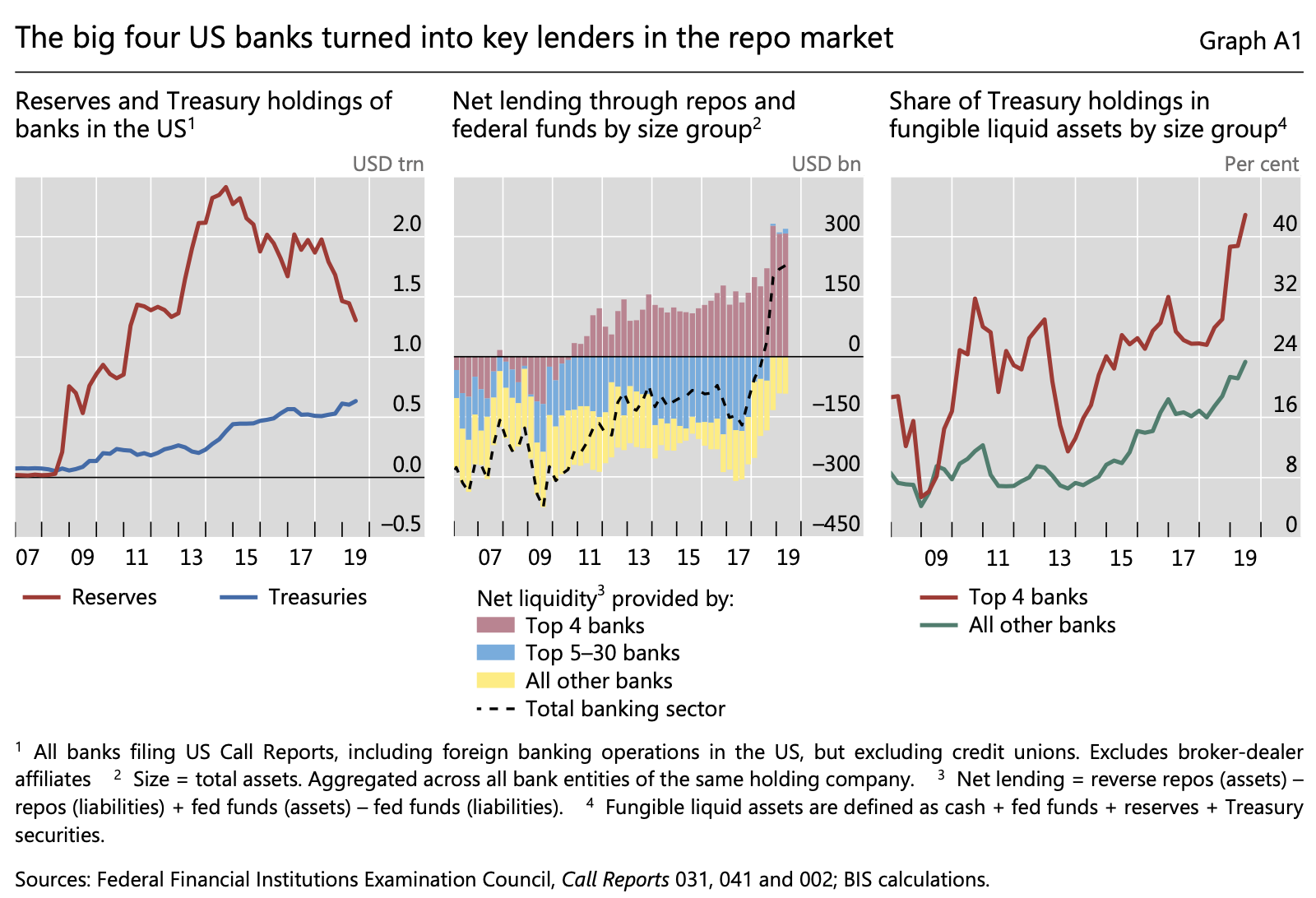

Mittlerweile ist das Thema tiefer beleuchtet worden. So zeigte die Bank für Internationalen Zahlungsausgleich in ihrem Quartalsbericht, dass der Markt von nur vier großen Banken abhängt. Frances Coppola hat das auf seinem Blog gut zusammengefasst (wie auch die FT meint):

- “Prior to 2008, banks maintained far lower levels of reserves than they do now, typically at or just above their reserve requirement. They borrowed reserves from each other in the unsecured interbank market to settle customer deposit withdrawals and securities transactions. The Federal Reserve intervened in the interbank market to maintain the average rate banks would charge for lending reserves (the Fed Funds rate) at the target level set by the FOMC (…) But after the crisis, all that changed. QE disconnected Fed reserve creation from banks’ need for reserves for settlement.” – bto: QE hat im Kern die Bankbilanzen aufgeblasen, was in den USA auch kein Problem ist, weil die Banken daran verdienen. Die Fed zahlt den Banken bekanntlich Zinsen!

- “But even with the Fed paying interest on excess reserves, the interbank market has become a shadow of its former self. Banks, their trust in each other permanently damaged by the crisis, now want other banks to post collateral against borrowed reserves. Most of the action has therefore moved to the repo market.” – bto: Das ist doch interessant. Selbst zehn Jahre nach Lehman Brothers ist das Vertrauen nicht da. Und da denkt mancher, die „Krise sei überwunden”.

- “The repo market isn’t solely, or even mainly, an interbank market. It intermediates funds across the entire panoply of financial institutions, including broker-dealers, insurance companies, pension funds, hedge funds, mutual funds (MMFs) and real-estate investment trusts (REITs), and some non-financial institutions such as large corporations and municipalities. Most of the funds that move around the repo market aren’t lent directly by banks. But all cash transactions in the repo market are intermediated by banks, without exception. Although the majority of players in the repo market aren’t banks, the cash that they lend each other simply moves from one bank to another. Mainly, it moves between four large banks – JP Morgan, Bank of America, Citigroup and Wells Fargo.” – bto: Mir war klar, dass die Exekution der Aufträge bei den Banken liegt, dass es aber so eine Konzentration gibt, war mir nicht so bewusst.

- “Thus, when an MMF lends cash to, say, an insurance company, the money simply moves from a demand deposit account at say Citigroup to a demand deposit at another bank, perhaps JPM. If Citigroup is short of reserves to settle this movement, it must borrow them from another bank or, as a last resort, from the Fed’s discount window. (…) now that reserves are scarcer, and liquidity requirements for big banks are much tougher, it’s quite possible that Citigroup might have to borrow cash in the repo market to replenish reserves lost due to its MMF customers lending cash in the repo market. Meanwhile, JPM ends up with more reserves than it wants, so it lends cash in the repo market, thus transferring reserves to another bank, perhaps Citigroup. I totally understand that this is confusing, but this is what happens when the interbank market becomes absorbed into a general collateralised market made up largely of non-banks. It helps to remember that regardless of who owns them, electronic dollars never leave the banking system.” – bto: Aber die Sicherheit wandert. Denn wer sich was leiht, muss Sicherheiten liefern. Und zwar gute, in Form von Staatsschulden.

- “If a market interest rate spikes, it means market participants don’t want to lend. That can be because they have stopped trusting each other, (…) It might signify that they have other uses for the money or the associated collateral, for example if they need to hold more of them because of tighter regulatory requirements. Or it might simply mean there is a market shortage of cash or collateral, so they prefer to hang on to what they have rather than lend it to others and risk paying much higher funding costs themselves.” – bto: Das Angebot an Sicherheiten ist tiefer als die Nachfrage, aus welchem Grund auch immer. Damit steigt der Preis. Und das wirkt sich natürlich auf andere Märkte aus.

- “This chart in a recent paper from the BIS shows a remarkable structural change in the composition of the interbank market:”

Quelle: BIZ

- “Since mid-18, the entire market has become dependent on funding from just four big banks. If those banks reduce lending to the market even slightly, the market suffers a heart attack. (…) The four banks collectively are acting as lender-of-last-resort to the market. They are effectively doing the job of a central bank. But they are not a central bank, they are commercial banks driven by their own profit motives – and those motives can be in conflict with the needs of the market. Furthermore, they are ultimately dependent on the Fed for cash liquidity. And the Fed has been blindly pursuing a monetary policy that diminishes the cash available to banks.” – bto: Gemeint ist, die Bilanz zu verkürzen wegen des Versuchs der Fed, das den Banken zur Verfügung stehende Bargeld zu reduzieren. Hier schlägt sich also der Entzug von Fresh Money nieder.

- “The total quantity of reserves in the system has been falling since 2015 due to the Fed running off its balance sheet: from mid-2018 onwards, reserves have been draining even faster due to higher debt issuance by the US Treasury, which the Fed has done nothing to offset. The BIS says that as reserves have become scarcer, and Treasuries more abundant, the big banks have reduced their reserve holdings in favour of Treasuries. But this means that they have less cash to lend. The repo market depends on them for cash, but they are becoming increasingly reluctant to lend it.” – bto: warum? Vermutlich, weil es sich nicht lohnt, angesichts der Möglichkeiten Staatsanleihen zu kaufen und zu halten.

- “(…) why does the market have such a need for cash? BIS suggests that part of the reason might be leveraged money market arbitrage trades by hedge funds, indirectly funded by MMFs, who are able to lend to these high-risk counterparties because the trades are executed through a central counterparty with banks taking the credit risk: ‘MMFs were concerned by potential large redemptions given strong prior inflows. Counterparty exposure limits may have contributed to the drop in quantities, as these repos now account for almost 20% of the total provided by MMFs.’ It seems that MMFs fear runs on their scarce cash. The whole picture is one of taps running dry as the Fed and the US Treasury between them drain the reservoir.” – bto: Es sind also hoch-geleveragete Spekulationen, die dahinter stehen. Wie immer bei solchen Deals kommt es zu massiven Problemen, wenn die Refinanzierung stockt oder teurer wird.

- “(…) the Fed is replenishing reserves in order to support a market that is populated by non-banks as well as banks. The BIS says that the rate rise was partly because MMFs pulled back from lending cash for sponsored repos. Rate rises caused by lenders becoming nervous help to limit leverage and prevent markets becoming overheated. Yet the Fed is intervening in the repo market to dampen rate rises. Why are we once again allowing the Fed to provide an implicit backstop for risky non-banks, thus enabling them to misprice risk and gorge on leveraged trades without fear of market penalty? Have we learned nothing from the past?” – bto: gute Frage, deren offensichtliche Antwort “nein” lautet, doch dazu später mehr.

Zunächst eine weitere interessante Ergänzung von GnS Economics (Dank an den Leser für den Hinweis!):

→ Repo Market Turmoil – Staring into the financial abyss

- “QE accustomed banks to holding large amounts of excess reserves, which provided a reliable source of interest income. When QT started to reduce reserves, they replaced them with another reliable source, Treasuries, which acted as a hedge on their balance sheet against riskier lending practices and securities holdings induced by QE programs. Obtaining a hedge against riskier assets and loans (loan portfolios in particular take a long time to adjust) becomes especially important, if the economic outlook is expected to worsen—as it is presently.” – bto: Denn es stimmt, die Banken haben von der Fed Zinsen bekommen, also eigentlich eine verdeckte Sanierungshilfe (so macht man das, EZB!). Nun kaufen die Treasuries, die allerdings nicht knapper werden, sondern mehr, dank der Schulden von Trump und dem Stopp von QE. Also so gesehen noch kein Grund für Liquiditätsknappheit. Außer, dass sie nicht bereit waren, gegen Sicherheit mehr zu verleihen?

- “QE has distorted both bank balance sheets specifically and the financial markets more broadly. (…) This leads us to another and potentially more worrying development: increased access to the repo-market by hedge funds to increase their leverage. They seem to have been getting short-term funding from the repo-market to buy U.S. T-bills, which they have then re-invested in the repo-market to obtain more short-term funding to buy T-bills, etc. Using this “leverage-loop” they have been able amass very high leverage ratios.” – bto: Das muss man sich wirklich einprägen. Ich habe für 100 US-Dollar Staatsanleihen, die ich zu 99 Prozent beleihe. Für die 99 Dollar kaufe ich weitere Staatsanleihen, die ich dann wiederum zu 99 Prozent beleihe. Da kommt ganz schön viel zusammen, relativ zum ursprünglichen Eigenkapital von 100.

- “(…) When the yields of practically every financial asset class are squeezed to near-zero (or less!) due to artificial liquidity from the central banks, leverage becomes the only way to obtain yield sufficient for fixed-income investors. (…) When the financial history of this era is written, it is fairly likely that historians will identify the onset of the global economic crisis as 16 September, 2019. It was the first clear sign of the potential for a violent unwinding of the massive speculative financial positions created by central bank meddling.” – bto: klare Aussage. Das billige Geld der Notenbanken und die tiefen Zinsen haben die Marktteilnehmer zu immer umfangreicherer Spekulation auf Kredit getrieben.

Nun könnte man meinen, okay, wieder so ein obskurer Blog, den der Stelter da zitiert. Wäre da nicht die FINANCIAL TIMES, die in genau die gleiche Richtung argumentiert:

- “This year end is on the way to seeing the worst financial disaster since the Y2K bug and the implosion of the world’s computers at the stroke of midnight on December 31 1999. (…) you can make a case that the Y2K crash did happen, except about three months later when the tech bubble popped.” – bto: Auch 2008 gab es Warnsignale für das, was kommen würde. Das Problem ist, diese sauber zu erkennen. Zu oft kann man schief liegen, vor allem auch unter dem Gesichtspunkt des Timings.

- “Thanks in part to the over-inflation of the tech boom and the Federal Reserve’s policy whiplash, the correction to the non-Y2K turned into a recession. Productive investment in the US never really recovered its animal spirits (…) Instead there has been a prolonged infantilisation of the capital markets and sector-by-sector over-leveraging.” – bto: die allgemeine Überschuldung des Systems, die von den Notenbanken immer weiter befördert wurde. Getrieben vor allem durch eine unproductive Verwendung der Mittel. Sagt die FINANCIAL TIMES.

- “If private markets fail to finance new debt, the Fed will almost instantly take their place. The most recent example is the response to the September volatility in the US GC repo, or general collateral repurchase agreement market for high-quality secured borrowings. There is now so little dealer capital relative to the size of the fixed income and currency markets, and so much economic sensitivity to even brief rate increases, that the Fed has become a neurotic parent.” – bto: wenig Sicherheit, weil zu kleiner Kapitalpuffer. Zu viele Schulden und deshalb in Summe enorme Anfälligkeit bei steigenden Zinsen.

- “A Treasury market problem would be great material for US politicians’ speechwriters. For the Republicans, the Fed is part of the deep state. For Democrats, the central bank would be a tool to enrich Wall Street further.” – bto: was übrigens klar macht, dass es mit der sogenannten Unabhängigkeit der Notenbanken schon bald zu Ende sein wird. Von rechts wie von links werden die Notenbanken unter Druck kommen und gegeben ihre sehr schlechte Rolle in den letzten Jahrzehnten, völlig zu Recht.

- “The more globalist funding market bears worry about foreign exchange swaps, through which non-US banks and their customers borrow in hedged dollars. A sweat-damped IMF Global Financial Stability Report released in October titled its FX swaps chapter: A Source of Financial Vulnerability. The IMF quaveringly pointed out: ‘US dollar-denominated assets of non-US banks amount to more than $12tn, compared with $10tn just before the crisis.’ More than $1.4tn of those non-US bank dollar assets are funded through FX swaps trades, which are short-term wholesale market derivatives. This is noticeably higher than the mid 2008 peak of $1tn for what is called the cross-funding currency gap.” – bto: Deshalb gibt es auch die Meinung, dass es Probleme ausländischer Banken – namentlich der japanischen – sind, die hinter den Engpässen am Repo-Markt stehen.

- “Any financial economist could prove, before the financial crisis, that the FX swaps market in its present size and form would be theoretically impossible. The ‘covered interest parity’ doctrine tells us that the cost of borrowing in one currency should be equal to borrowing in another currency when fully hedged against exchange risk. Perversely, though, hedged and secured dollar borrowing for large non-US banks has been more expensive than borrowing in home currencies such as the Canadian dollar for Canadian banks or the yen for Japanese banks. Yet there it is — theoretically impossible but bigger than ever.” – bto: Das habe ich im Studium auch gelernt. Der Terminkurs einer Währung entspricht dem Kassakurs zuzüglich der Zinsdifferenz zwischen den beiden Währungen, einfach, weil es Arbitragegeschäfte gibt, die dazu führen, dass es keinen Unterschied mehr gibt.

- “You can see why economists and regulators at the IMF and elsewhere are disturbed by FX swaps. Nevertheless, the trade is easy funding (most of the time) for non-US banks, and is a relatively profitable use of balance sheets for their American counterparts. If global markets go terribly wrong, then the users of FX swaps should be able to turn to their “home” central banks for back-up dollar funding, at a minimum semi punitive rate of 50 basis points over the overnight dollar swap rate.” – bto: Das setzt aber voraus, dass diese Notenbanken sich wiederum Dollar bei der Fed besorgen können. Sollte die Fed aus politischen oder anderen Gründen dies nicht leisten können, haben wir ein massives Problem.

- “Among the sellside analysts of money markets, including GC repo and FX swaps, is Zoltan Pozsar of Credit Suisse. Mr Pozsar previously worked for the New York Fed and the IMF. Mr Pozsar is among those who believe a funding crunch around year end will force the Fed to buy longer-dated US Treasuries, in the wake of a spike in yields and a general shortage of ready cash. The consequent flattening of the yield curve would reduce the incentives for non-US institutions to borrow through FX swaps. The Fed, the Treasury, other regulators and their political overseers would then have a reason (or excuse) to loosen the post-financial crisis balance sheet restrictions on large banks. That is the current shooting script.” – bto: also der Vorwand, um statt QT wieder voll in QE einzusteigen.

Doch kommen wir zum vorläufigen Fazit: Wir haben es offensichtlich mit einem Krankheitssymptom zu tun. Die Geldpolitik führt zu Verzerrungen im System, konkret immer mehr Risiken – höherer Leverage und mehr Währungsspekulation. Zugleich verknappen sich die Mittel im Repo-Markt wegen geänderter Zinserwartung und gestiegenem Angebot an Staatsschulden. Wie im Jahr 2000 könnte es sein, dass die Probleme erst Monate später wirklich aufbrechen. So oder so dürfte eine Zeit deutlich steigender Volatilität vor uns liegen.

→ FT (Anmeldung erforderlich): “Repo and swaps markets point to further volatility”, 13. Dezember 2019