Ist die US-Geldpolitik knapper als wir denken?

Am 8. Mai 2022 geht es – erneut – um die Geldpolitik in meinem Podcast. Zu Gast ist Professor Ottmar Issing, der erste Chefvolkswirt der EZB und ein wirklicher Kenner der Materie.

Zur Einstimmung einige Beiträge.

Wir reden immer von Zinsen, vergessen aber die Wirkung der Wertpapierkäufe, die ja ebenfalls eine Wirkung auf die Zinsen haben. Albert Edwards von SocGen hat dies kürzlich kommentiert:

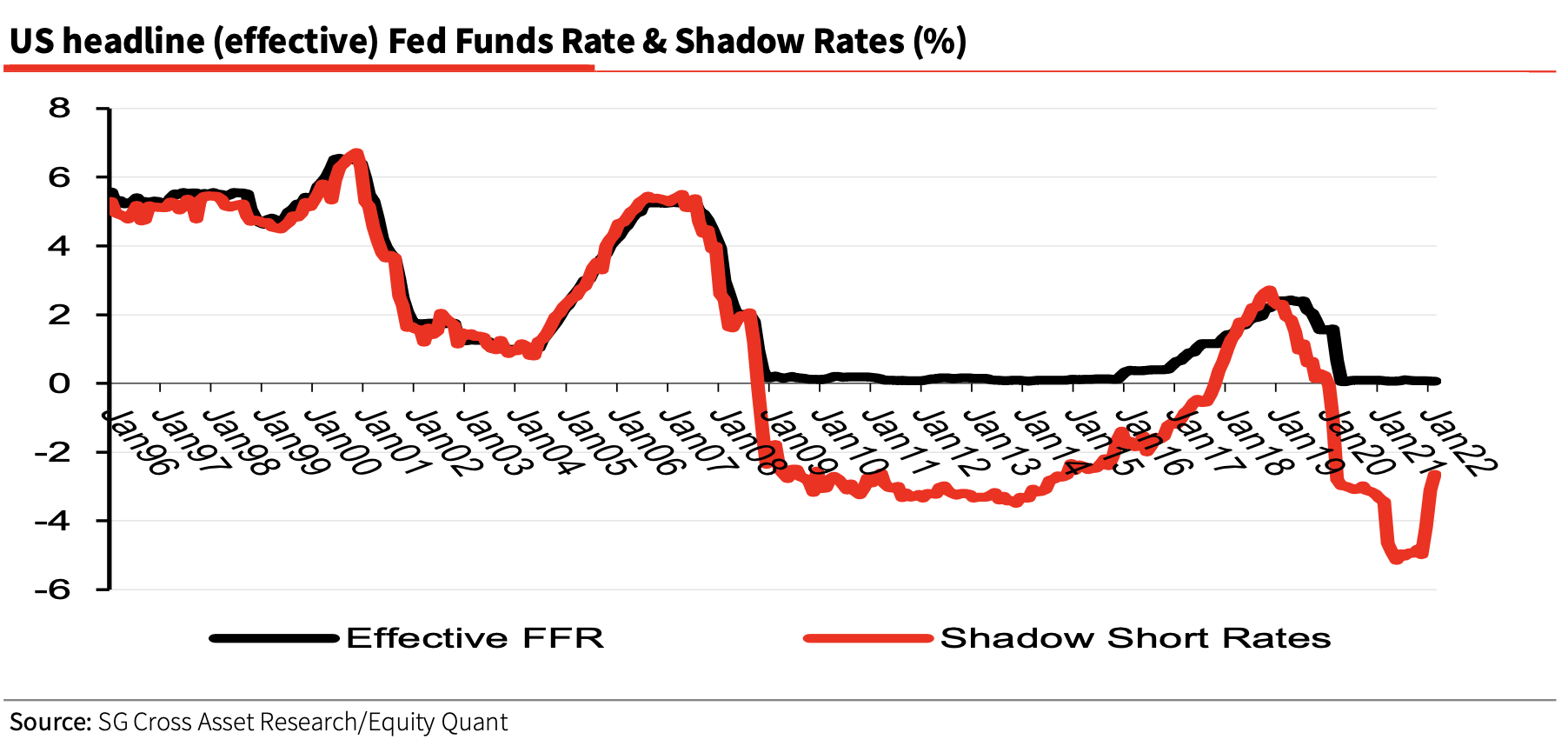

- “(In) May 2018 our New York-based Quant guru, Solomon Tadesse, published some exciting work. Basically, as the Fed eased policy aggressively in the wake of the Global Financial Crisis, the Fed Funds Rate (FFR) declined to zero. But the expansion of the Fed’s balance sheet (Quantitative Easing) effectively had the policy impact of driving the FFR below zero. (…) Solomon utilized cutting edge academic research to understand the QE/FFR trade-off by in effect ‘melding’ the billions of QE into the Fed Funds rate. Hence for most of the 2009-2013 period, although the headline FFR was at the zero floor, what is termed the ‘Shadow’ FFR had been driven down to the equivalent of minus 3% by the aggressive QE.” – bto: Also hat die Politik des QE eine Wirkung gehabt wie eine Zinssenkung.

Es lohnt die Methodik etwas genauer anzusehen:

- “The Shadow rate is the underlying ‘true’ nominal short rate that could have prevailed in the absence of the zero-bound condition. As noted, nominal interest rates cannot be negative naturally. In a seminal paper, Black (1995) argued that this is because cash or currency would provide a risk-free investment option available when nominal rates fall below zero. That is, holding cash/currency will be more attractive to an investor than accepting a negative nominal rate on a security. Thus, Black (1995) proposed that the observed non-negative nominal interest rate can be viewed as a call option on an underlying ‘true’ implicit rate, where the option is struck at 0%. That is, the nominal short rate, as a call option, will have either non- negative payoffs (when the implicit rate is positive) or zero (when the underlying implicit rate is negative). This implicit short rate (that can be both negative and positive) is what is called the shadow short rate. The observed short rate equals the Shadow rate when the former is non- negative. Following these insights, subsequent works have operationalised the concept of Shadow rates (see e.g. Krippner (2012), Bomfim (2003), Wu and Xia (2016)), generating estimates. While intuitive, actual implementation of the idea has been challenging as it requires estimating complex non-linear models that often involve numerical methods with the attendant computational burden.” – bto: Es ist also ein mathematisches Modell, das versucht, die Wirkung der Wertpapierkäufe auf einen effektiven Zinssatz zu erfassen.

Und hier die weiterführende Literatur:

- Black, F. (1995), Interest Rates as Options, Journal of Finance, pp1371–76.

- Bomfim, Antonio (2003), “Interest Rates as Options: Assessing the Markets’ View of the Liquidity trap”, Federal Reserve Board, working paper.

- Krippner, Leo (2012), “Measuring the Stance of Monetary Policy in Zero Lower Bound Environments,” Reserve Bank of New Zealand working paper.

- Wu, J. C. and Xia, F. D. (2016), “Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound,” Journal of Money, Credit and Banking, pp 253-91.

Kommen wir zurück zu heute:

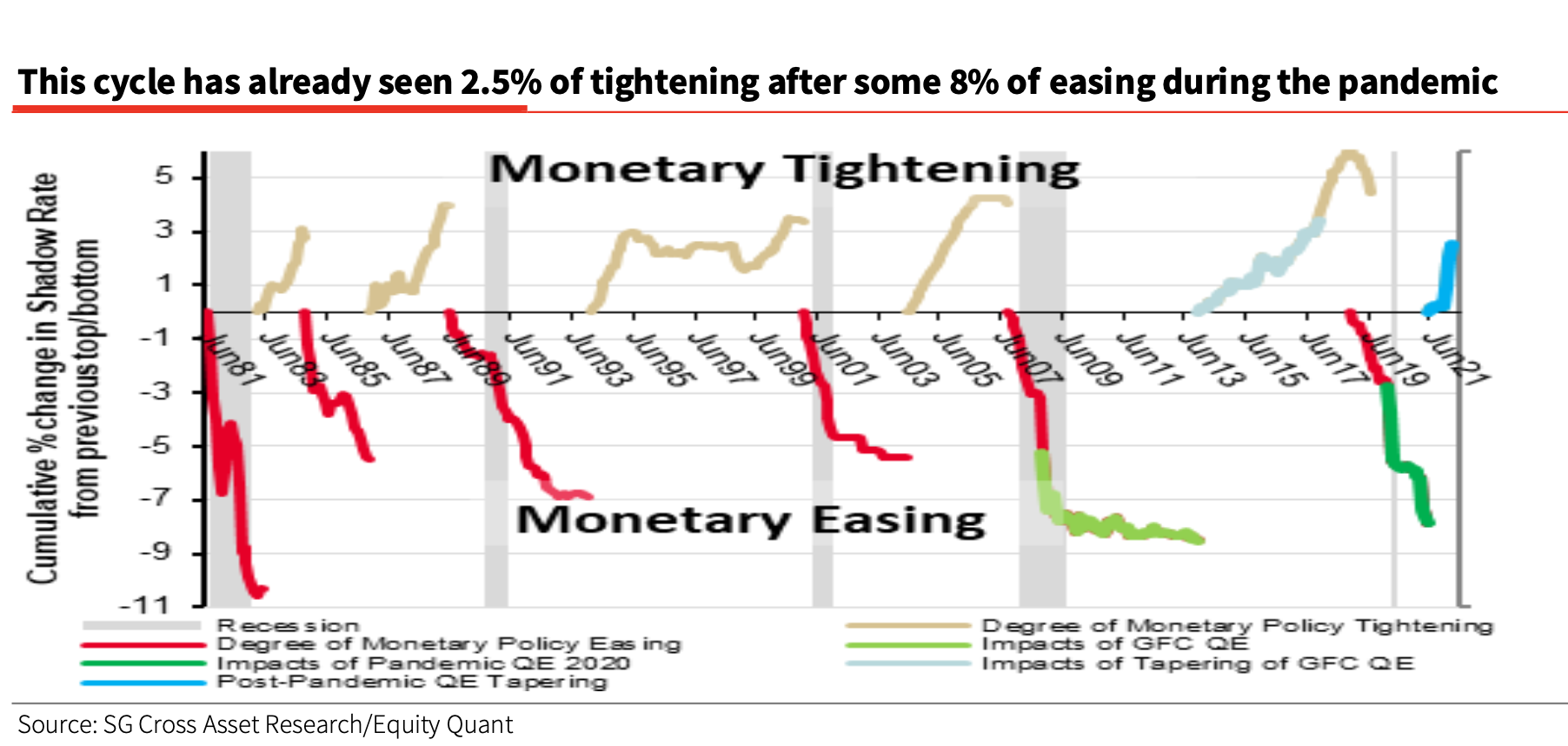

- “The purpose of Solomon’s May 2018 note was to examine the reverse situation. How much monetary tightening in the Shadow FFR would there be as the Fed throttled back on QE (aka tapering), and then as it began to shrink its balance sheet (QT), while at the same time hiking Fed Funds? By looking back at previous tightening cycles Solomon was then able to forecast in May 2018 that the Fed would likely stop raising Fed Funds at 2.5%. (…) But what is he saying now? In a sentence, he is saying the Shadow FFR has already risen by 250bp from minus 5%, and now with accelerated QT the headline FFR will likely top out at (or even below) just 1%.” – bto: Das wiederum ist auch gegen die allgemeine Erwartung. Die Zinsen werden also nicht so stark steigen – können sie auch nicht angesichts der hohen Verschuldung.

Quelle: SocGen

- “Hence combining the expansion of the Fed’s balance sheet from sub-$4 trillion at end 2018 to almost $9 trillion was the equivalent of the FFR falling to minus 5%! More recently the Fed ending QE combined with just one 1⁄4% hike in headline FFR means the Shadow FFR has already jumped from minus 5% to minus 2.5% – a 250bp hike.” – bto: Wir dürfen nicht vergessen, dass das in der Eurozone nicht der Fall ist.

- “(…) With inflation considered rampant, many investors believe the headline FFR will peak nearer 4%, despite recession fears mounting – eg Deutsche Bank is the first large broker to forecast a US recession. If Solomon’s models indicate the Fed will struggle to raise FFR to 1% or above, this is a huge divergence with consensus. You can see clearly in Solomon’s chart below how the recent 250bp Shadow FFR hike compares to the cumulative easing and tightening in previous Fed cycles.”

Quelle: SocGen

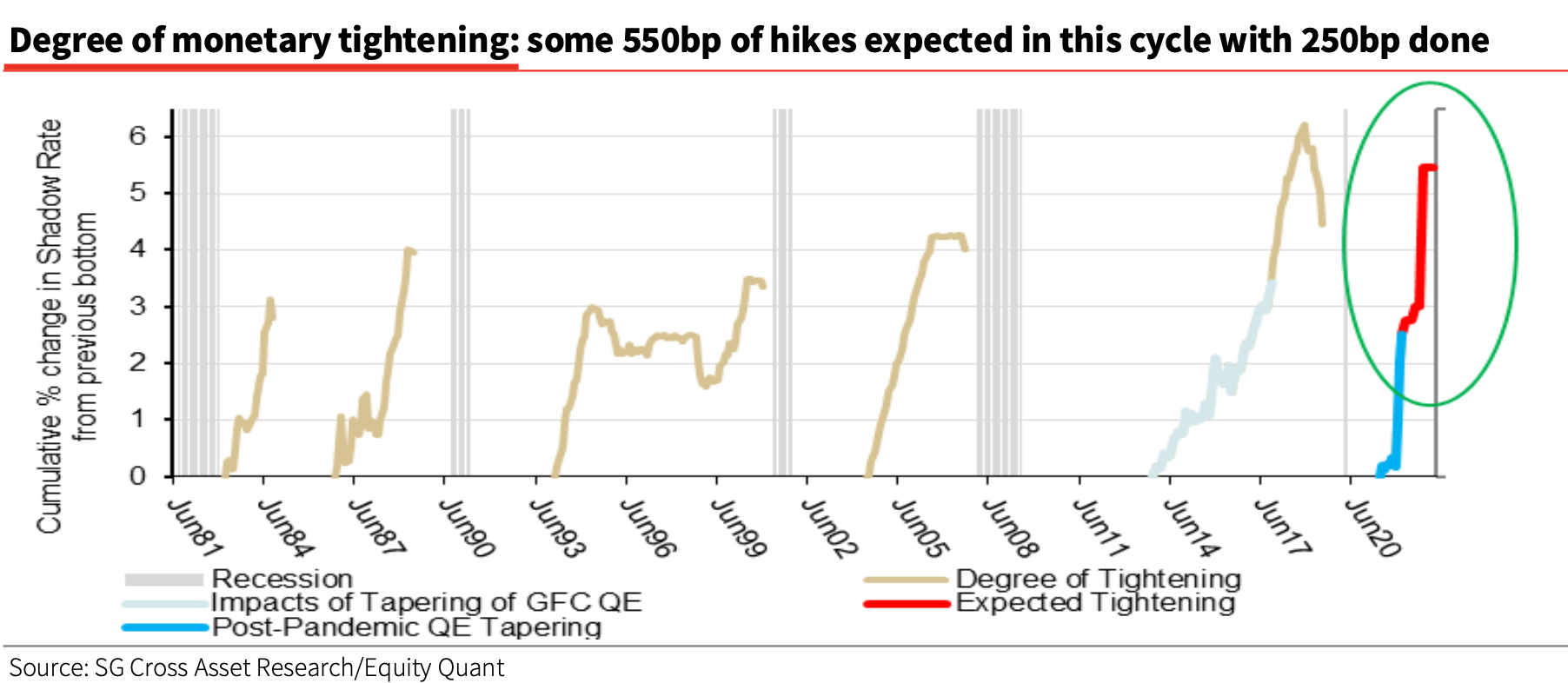

- “Solomon constructs a Monetary Tightening to Easing ratio (MTE, the ratio of the degree of tightening to the degree of easing in the preceding cycle). The charts below show how the MTE ratio declined in the 1980s as disinflation became the dominant theme. Hence since the mid-1980s the tightening cycle has topped out at around 70% of the previous easing cycle. Shouldn’t though, this ratio now return to 1.5x given CPI inflation has comprehensively overshot? Maybe.” – bto: Also sollten wir in eine Welt kommen, wo mehr gestrafft als gelockert wird? Angesichts der Verschuldungssituation nur schwer vorstellbar.

- “But one key reason why Solomon’s MTE ratio has been lower (at 70%) recently is that tightening cycles have been halted because financial market bubbles, created by excessive Fed easing, thenblow up and prevent the Fed from further tightening. And if we take the 70% MTE ratio above, Solomon calculates that the Shadow FFR will likely top out with 550bp of tightening (70% of the 800bp easing). (…) with the pace of QT likely accelerated, the actual FFR will struggle to get to 1% before the Fed needs to halt the tightening cycle. That is shocking.” – bto: Ja, das ist es. Es würde auch bedeuten, dass wir eine Rezession in den USA näher sind, als wir denken – und damit einer erneuten Lockerung der Geldpolitik.

Quelle: SocGen