Liegt der Höhepunkt der Inflation hinter uns?

Am 8. Mai 2022 geht es – erneut – um die Geldpolitik in meinem Podcast. Zu Gast ist Professor Ottmar Issing, der erste Chefvolkswirt der EZB und ein wirklicher Kenner der Materie.

Zur Einstimmung einige Beiträge.

John Authers fasst bei Bloomberg den Stand der Inflationsdebatte zusammen:

- Zunächst der Hinweis, dass das Wachstum der Geldmenge bereits seit geraumer Zeit rückläufig ist: “After an extraordinary expansion in 2020, year-on-year changes in both the euro zone and the U.S. are back to normal ranges, though still toward the top. Extreme growth is over, and will continue to slow from here.” – bto: Und damit entfällt ein wesentlicher Treiber für höhere Inflation.

- “Chris Watling of Longview Economics Ltd. in London suggests that falling monetary aggregates in combination with rising rates mean that the steps to crush inflation have already been taken. For him the real question is: ‘Did Powell and the Fed have their `U.S. Treasury Accord’ moment earlier this year when they switched to a hawkish stance and started aggressively to bring money supply growth under control? And, with that, have they already been somewhat successful?’ His answer is yes, and he adds: ‘Typically, a central bank has two jobs: i) To control the money supply (and therefore inflation); and ii) to act as lender of last resort. The history (of wars, pandemics, and multiple monetary systems) shows that, if the central bank chooses to control inflation, it’s more than capable.’” – bto: Das ist angesichts der hohen Verschuldung und der Blasen im Finanzsystem ein schwieriger Weg, der durchaus zu einer Rezession führen kann.

- “In taking this view, Watling shows an unfashionable confidence in the ability of central banks to clean up their own mess, and more importantly he suggests that there is enduring truth in monetarism, famously summed up by Milton Friedman with the contention that inflation is always and everywhere a monetary issue. Money supply, more than anything else, in other words, drives prices.” – bto: Das denke ich auch, und es ist ein erhebliches Problem, dass die Notenbanken so überrascht waren, dass es zu Inflation kommt. Denn die Geldmenge ist so stark gestiegen, dass es zu Inflation kommen musste.

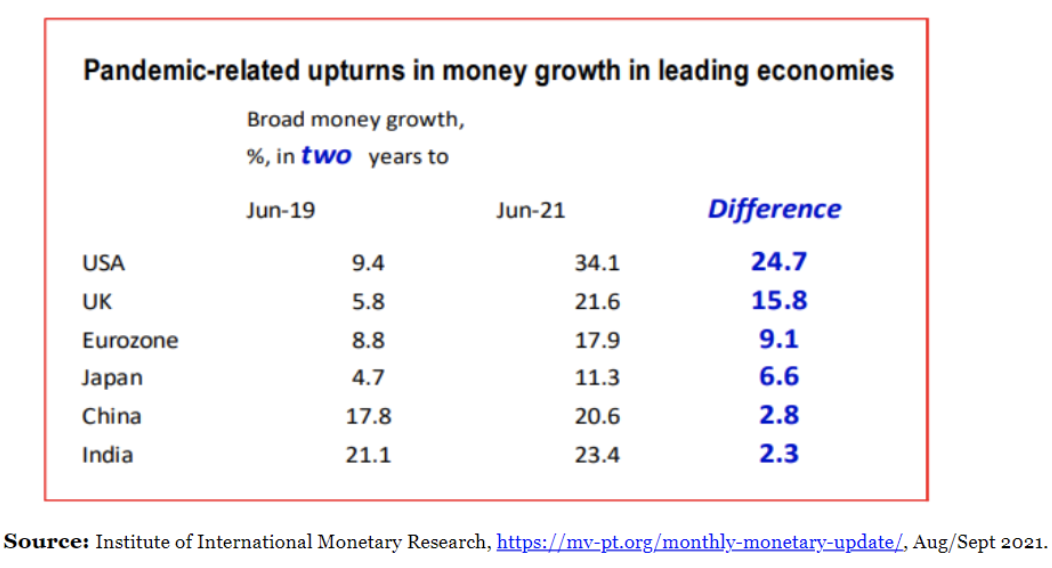

- “The British economist Tim Congdon (vor einigen Monaten zu Gast in meinem Podcast) is confident that he is in the process of being proved correct. Exhibit might be that the economies that really opened the monetary spigots two years ago now have a serious inflation problem, and those that didn’t don’t. For a reminder, this is how money growth accelerated over the main pandemic period:” – bto: ein durchaus eindeutiges Bild.

Quelle: Bloomberg

- “The orthodox counterargument to this is that some nonmonetary factors have obviously moved inflation as well. The shift in spending from services to goods and the huge supply chain interruptions caused by Covid-19 and then by the war in Ukraine come to mind.” – bto: Das stimmt, aber es ist eben doch die Mehrnachfrage, die durch die Inflation angeheizt wird.

- “But the monetarists can respond that there are still pockets of inflation unrelated to those factors. To quote Congdon’s latest newsletter: The increases in house prices on the Federal Housing Finance Agency’s ‘purchase-only’ index was 18.2% in the year to January. As yet, no meaningful cooling of the housing market has occurred, as the increase in the FHFA index in the three months to January was 4.1%, with an annualised rate of increase of 17.4%. Now comes the polemical point. It is plainly daft to attribute the remarkable increase in the price of houses – many of which were built a few decades ago – to energy prices, price movements in second-hand cars and lumber, the international shipping market and so on in 2020 and 2021. The correct interpretation is surely that rapid money growth sparked asset price inflation, which motivated a boom in aggregate demand, which took output far into over-heating territory, which led to soaring inflation in goods and services (…) Today’s supply shortages are a symptom of inflation, not a cause.” – bto: Das leuchtet ein, aber es ist bereits passiert und damit nicht mehr zu korrigieren. Also doch einfach auslaufen lassen?

- “Even if inflation is a monetary problem susceptible of a monetary cure that is already being administered, the peak might not yet be in. Friedman showed that monetary policy acts with a significant lag. The extra demand for wages, in particular, is still working its way through the system.” – bto: Man blicke auf die Forderungen in der aktuellen Tarifrunde.

- “Much hope has been put in ‘base effects’ as April, May and June of last year all saw very high rises in prices. However, Congdon points out that from July to September monthly inflation was much lower — 0.45%, 0.33% and 0.42% respectively. He goes on: The underlying rate of inflation in the USA – driven by domestic labour costs, above all – is now well above these figures. Suppose that the monthly CPI increases in July, August and September are ¾%, which seems reasonable. Then the annual rate of increase for September – announced in October – will be about 1% above that for June – announced in July.” – bto: Andererseits warnt Congdon aber auch davor, zu stark auf die Bremse zu steigen.

- “As some are already stating as fact that inflation has peaked, this prediction would mean horrible things for asset markets if it came true. It also implies that the monetary policy must be steadfast and aggressive. Many people in markets now are hoping that the monetarists are wrong.” – bto: Es ist gut denkbar, dass die Zinserhöhung in einen Abschwung hinein erfolgt. Dazu ist das Wachstum der Geldmengen bereits zu gering.

Der unentgeltliche Newsletter von John Authers kann bei Bloomberg abonniert werden.

@DT

“Für Deutschland heute würde ich sagen:

Die Bringschuld des sich Informierens wird NICHT hinreichend wahrgenommen, aber auch nicht so sehr vernachlässigt, dass ein unmittelbares Desaster bevorsteht.”

Bringschuld des sich Informieren einzufordern, bringt in Deutschland relativ wenig, da das Informations-Desaster von vielen ja nicht erkannt wird.

Die Informationen kommen so konform als Einheitsbrei daher , dass der “normale” Durchschnittbürger/Leser die ANDERE Seite nicht mehr mitbekommt.

Nicht jeder hat die Zeit (Rentner) oder die Muse (Hobby,Interesse usw.) sich in vieleThemen gleichzeitig einzulesen, zu vergleichen und abzuwägen.

Bei der Klimadiskussion ist ja der vorauseilende gehorsam des journalistischen Zeitgeistes langsam so fanatisch geworden und beinahe wieder dort gelandet ….wo Goebbels den Journalismus einvernahm und zu nutzen wusste.

Man lese:

https://klimajournalismus.de/charta/

Für Leute die die Zeit haben:

Bei einem der nächsten medialen Berichte über ein Klimathema, einfach mal den AutorIn mit der “UnterzeichnerInnen-Liste ” vergleichen….und vieles wird KLAR.

Nebenbei zum Thema “Atomkraft-Berichterstattung”:

Im “Newsletter” wird auch propagiert, WARUM man als KLIMAJOURNALIST auch GEGEN Atomkraft sein muss….bzw. “Was und wer hinter der aktuellen Pro-Atom-Kampagne steckt”..!

@Christian Anders

“Bei dem Flassbeckartikel kann ich das sehen, wie es gemacht wurde und deshalb kann ich nachvollziehen und bewerten, ob logische Fehler da sind oder nicht. Das macht die Ergebnisse nicht automatisch richtig. Aber es macht weniger wahrscheinlich, dass sie falsch sind.”

Flassbeck’s Aussagen sind wirklich schön präsentiert und auch nachvollziehbar .

Aber das Problem bei Flassbeck ist halt immer, dass sich “seine Wirtschaft” in der REALEN und GLOBALE WIRTSCHAFT eben nicht so steuern und umsetzen lässt, wie in seinen theoretischen Ausführungen und daher zur “Lösung” nur bedingt taugen.

Das gleiche ist bei den Leuten aus der “Klimaecke” ja leider ebenfalls der Fall.

Es nützt eben NICHTS, wenn man die Daten/Probleme/Erkenntnis usw. kennt und beschreibt, aber diese sich dann in der REALEN WELT nicht Umsetzen lassen… um das Problem abzuwenden/einzudämmen bzw. zu lösen.

Ein Beispiel wie man Problem benennt und mit “Lösungen” vergleicht ,hat Stephen Emmott , mit seinem Buch “10 Milliarden” (2013) , gemacht.

Zuerst benennt er die Grundursache der ganzen Misere : “Überbevölkerung”

Dann all die Auswirkungen (Klima,Ernährung usw.) und auch die “theoretischen Lösungen” , die man heute ja so gerne aus der “Klimaecke” propagiert (“grüne Energie”, Atomenergie, Verzicht ,Klimadiktatur…usw.) .

Diese vermeintlichen “Lösungen” vergleicht Er dann mit deren REALISTISCHEN UMSETZUNG ….und abschliessend kommt noch seine REALISTISCHE Schlussfolgerung:

Die REALSTISCHE Schlussfolgerung als kurzer Satz ganz am Schluss…

https://www.youtube.com/watch?v=SxralGndOAk

Nebenbei:

Wäre interessant, ob Sie vielleicht jemanden aus der “Klimaecke” kennen ,der ebenfalls die Ehrlichkeit bzw. Meinung hat und diese auch öffentlich äussert…das eine REALISTISCHE Lösung/Umsetzung des Klimaproblems/Klimaziele…schlicht nicht möglich ist.

@weico

Huch! Sie schreiben etwas, dem ich zum größten Teil zustimmen kann. Was ist denn nun los?

Ich kommentiere deshalb ergänzend statt widersprechend:

„Aber das Problem bei Flassbeck ist halt immer, dass sich “seine Wirtschaft” in der REALEN und GLOBALE WIRTSCHAFT eben nicht so steuern und umsetzen lässt, wie in seinen theoretischen Ausführungen und daher zur “Lösung” nur bedingt taugen.“

Das ist eben, weil Flassbeck wissenschaftlich methodisch argumentiert. Er analysiert die Mechanismen (Wissenschaft) und leitet DARAUS ab, was man tun sollte, wenn man bestimmte Ziele erreichen will (logische Schlussfolgerung für konkrete Handlungen, ist keine Wissenschaft mehr).

Es ist wichtig zu verstehen, dass eine mögliche Unumsetzbarkeit der Schlussfolgerungen die Analyse nicht falsch oder unwissenschaftlich macht. Wissenschaft an sich ist dafür da, Fakten und Zusammenhänge, die nun mal gegeben sind, zu entdecken und zu beschreiben. Umsetzbarkeit ist kein Kriterium, dass sie interessieren darf, wenn sie wirklich Wissenschaft sein will.

Den anderen Fall können Sie in der VWL doch täglich beobachten: „Wissenschaftler“, die entlang der Machbarkeiten argumentieren und dabei (zwangsläufig) auf wissenschaftliche Kriterien nicht zurückgreifen können und deshalb gar keine Wissenschaft betreiben. Sie betreiben diffizile Flickschusterei im Rahmen des für Machbar gehaltenen und sind somit Ingenieure. Sie betreiben aber keine Wissenschaft.

Es ist aber ein (großes!) Problem, dass sie unter Wissenschaft firmieren und sich auch selbst so sehen. Denn das erhebt die Flickschusterei in den Rang von Erkenntnis über Fakten und Zusammenhänge – was einfach falsch ist. Aber zu Lehrbüchern führt, in denen falsche Fakten als Ergebnis von Wissenschaft dargeboten werden.

Eklatant ist, dass die Flickschuster vorgeben, dieselben Ziele erreichen zu wollen, die auch Flassbeck beschreibt, wozu er dann aufgrund seines Vorgehens zwangsläufig sagen muss: SO wird das nix!

Da ist er ja bei weitem nicht der einzige.

Wenn nun aber seine Analyse irrelevant ist, ist das halt der Kern eines Problems. Sie ist deshalb nicht falsch, einfach weil Relevanz kein Kriterium ist, das Dinge nach richtig oder falsch einteilen könnte.

Immer schon in der Menschheitsgeschichte waren unwahre Ansichten hochrelevant. Nothing new here.

„Es nützt eben NICHTS, wenn man die Daten/Probleme/Erkenntnis usw. kennt und beschreibt, aber diese sich dann in der REALEN WELT nicht Umsetzen lassen… um das Problem abzuwenden/einzudämmen bzw. zu lösen.“

Flickwerk, das keine Probleme löst, weil es sich nicht nach einer richtigen Analyse richtet (oder richten kann), bringt was? Eben. Mit der Ansicht bliebe nur zu sagen, dass es halt nicht geht.

„Wäre interessant, ob Sie vielleicht jemanden aus der “Klimaecke” kennen ,der ebenfalls die Ehrlichkeit bzw. Meinung hat und diese auch öffentlich äussert…das eine REALISTISCHE Lösung/Umsetzung des Klimaproblems/Klimaziele…schlicht nicht möglich ist.“

Aber sie IST ja möglich. Technisch. Wie man in einer komplexen globalen Welt die Lösungen in nötiger Schnelligkeit implementiert, weiß keiner, den ich kenne und weiß oft selbst nicht, dass er es nicht weiß. Da gibt es Ideen über Ideen und kaum einer denkt über die sozialen Innovationen nach, die nötig wären, das in gegebener Zeit weltweit umzusetzen.

Wissenschaftler können – wie Flassbeck – Ihnen sagen, was sie machen MÜSSTEN um Ziel X zu erreichen. Als logische Konklusio aus der Wissenschaft. Einschätzungen darüber, ob das was wird, ist nicht ihr Job.

Überflüssig zu sagen, dass diese Trennung öffentlich nicht konsequent durchzuhalten ist. Jeder Wissenschaftler, der z. B. in einer Talkshow seine Arbeit präsentiert, kann nicht nicht Politik betreiben, völlig unmöglich. Soll er zu der erwartbaren Frage: Was SOLLTEN wir tun?, immer konsequent schweigen?

Aus dem x mal verlinkten „follow the science“ Video die Kernbotschaft, Zitat:

Science does not tell you, you shouldn‘t pee on high voltage lines. It says urine is an excellent conductor.

Trotztdem wird auch jeder Wissenschaftler auf die Frage, ob man drauf pinkeln sollte, sagen: NEIN!

Und damit die Wissenschaft verlassen haben. Über die Umsetzbarkeit bei diesem Rat wird er sich genau keine Gedanken machen. War ja auch gar nicht die Frage.

Für Umsetzbarkeit sind am Ende die Regierungen und Institution verantwortlich (zu denen ich „den Markt“ zähle, whatever that is). Nicht die Wissenschaft.

Und möglicherweise ist dieses komplexe und von niemandem voll verstandene Netz nicht fähig, gewisse zeitkritische Lösungen zu erarbeiten.

Dann sind halt einige oder sogar viele irgendwann „fucked“. Aber doch nicht ALLE!

@Christian Anders

“Aber sie IST ja möglich. Technisch.”

..falls Technisch wirklich möglich ,dann KEINESWEGS in der kurzen Zeit bzw. dem Ziel, die die Klimaecke (zur “Rettung der Welt”) immer propagiert.

Schlussendlich spielt es aber eh keine grosse Rolle für die Mehrheit der Menschheit Der grosse Tenor wird dann eh lauten : “I think we’re fucked,”

@ weico, @ Christian Anders

In Ergänzung zu dem, was ich weiter unten @ Christian Anders geschrieben habe.

weico:

>Aber das Problem bei Flassbeck ist halt immer, dass sich “seine Wirtschaft” in der REALEN und GLOBALE WIRTSCHAFT eben nicht so steuern und umsetzen lässt, wie in seinen theoretischen Ausführungen und daher zur “Lösung” nur bedingt taugen.

Christian Anders als Antwort darauf:

Das ist eben, weil Flassbeck wissenschaftlich methodisch argumentiert. Er analysiert die Mechanismen (Wissenschaft) und leitet DARAUS ab, was man tun sollte, wenn man bestimmte Ziele erreichen will (logische Schlussfolgerung für konkrete Handlungen, ist keine Wissenschaft mehr).>

Beispielhafte konkrete „Auflösung“ mit Überschneidungen zu abstrakten Ausführungen @ Christian Anders:

Flassbeck argumentiert WISSENSCHAFTLICH, wenn er anhand der Saldenmechanik FORDERT, dass die Löhne in Deutschland angehoben werden SOLLTEN, um ein Gleichgewicht in der Eurozone herzustellen.

Die Löhne in Deutschland werden nicht so angehoben – in der Vergangenheit jedenfalls –, weil es den Arbeitnehmern angesichts der Globalisierung, d. h. der Investitionsalternativen außerhalb Deutschlands, vorteilhafter erschien, mit Lohnzugeständnissen die Sicherheit ihrer Arbeitsplätze zu erhöhen, als sie durch maximal mögliche Lohnvereinbarungen zu gefährden.

Dies ist EMPIRISCH vielfach belegt – Kündigungsschutz für Lohnverzicht.

Schlussfolgerung:

Was Flassbeck fordert, ist zwar nicht falsch, aber IRRELEVANT – dies nicht als wissenschaftliche ERKENNTNIS und FORDERUNG, sondern verstanden als EMPFEHLUNG an die Arbeitnehmer bzw. die Gewerkschaften als ihre Vertreter.

Flassbeck hat zwar immer große Zustimmung unter Linken gefunden, weil er WISSENSCHAFTLICH begründet hat, was erfolgen MÜSSE, aber es hat praktisch niemanden im realen Wirtschaftsleben interessiert, nachdem Lafontaine, dessen Staatssekretär er war, das Handtuch geworfen hatte.

Wir haben hier den interessanten Fall, dass nicht mit Sabine Hossenfelder BELEHRT werden muss „Follow the science is nonsense“, sondern GELERNT worden ist mit Blick auf die eigenen INTERESSEN, dass „follow the science is too expensive, therefore it’s nonsense to follow it“.

Das widerspiegelt die REALITÄT des Wirtschaftens.

Es ist das RELEVANTERE Feld der Wirtschaftswissenschaft.

@DT

Ich verstehe Sie vollkommen. Mein Einwand wäre nur, dass diese hier, Zitat:

„Es ist das RELEVANTERE Feld der Wirtschaftswissenschaft.“

keine Wissenschaft beschreibt, sondern Sozialwesenklempnerei. Damit stelle ich nicht die Relevanz in Abrede, sondern die Wissenschaftlichkeit.

„Wissenschaft“ wird hier oft in einer Marketingfunktion betrieben, um Eingriffe als konklusiv aus einer Theorie heraus zu begründen.

Ob diese Theorie überhaupt die Anforderungen an eine „gute“ Theorie erfüllen (wir kennen sie und oft ist das nicht der Fall), wird dabei gar nicht mehr diskutiert – jedenfalls nicht in relevanter Position.

Wir merken: Das Relevante kann falsch sein und das Richtige irrelevant. Die Dissonanz, dass man so seine Ziele irgendwie meist verfehlt, wird mit der grandiosen psychischen Selbstbetrugsfähigkeit, die allen Menschen innewohnt, einfach wegignoriert und umgedeutet. Auch mithilfe von Wissenschaft, die keine ist, wenn es denn nur so geht.

Wenn das der Lauf ist, den die Menscheit als Einheit gedacht gehen WIRD, weil Menschen nun mal so SIND, wird es immer wieder Zeitpunkte geben, an den einige/viele/die meisten f***** sind. Und zwar ohne Masterplan im Hintergrund, ganz wichtig.

That‘s Life! Oder?

@Christian Anders

“Wir merken: Das Relevante kann falsch sein und das Richtige irrelevant.”

Dieser Satz beschreibt leider sehr treffend auch die Aussagen vieler “Wissenschaftler” aus der “Klimaecke” .

Ein Beispiel von solchen Dauer-Peinlichkeiten, Empfehlungen usw. …..vom “Head of Earth System Analysis at Potsdam Institute for Climate Impact Research” …

https://twitter.com/rahmstorf

@ Christian Anders

Völlig d’accord.

Denn ALLES ist LIFE oder LIFE ist ALLES – auch die Wissenschaft, dem Mainstream nach jedenfalls.

Denn es wird IMMER und ÜBERALL das verfolgt, was als INTERESSE gilt, wobei wenige Ausnahmen die Regel bestätigen.

O.T. dazu:

Meine sich verfestigende Einsicht, je länger ich darüber nachdenke:

Es ist EVOLUTIONÄR so bedingt, d. h. wir können aus dem „Käfig“ unserer naturgeschichtlichen erfolgten Konstitution NICHT heraus.

Dazu als elementare Erkenntnis, dass wir unserem individuellen Bewusstsein nach RATIONALES Verhalten wollen können, aber viel zu oft NICHT danach zu HANDELN vermögen.

Warum nicht?

Ganz banal gesagt:

Weil wir unserem Gehirn NICHTS befehlen können – es setzt die Bereitschafts- bzw. Erregungspotenziale für Handeln außerhalb der Kontrolle durch unser Bewusstsein (lt. EMPIRIE der Neurologie).

Wir sind die Sklaven unserer Gehirne.

Wahrscheinlich haben wir NUR deshalb als Gattung überlebt.

@weico @DT

weico

Sie haben das mit der Relevanz und der Richtigkeit nicht verstanden. Weder Flassbeck noch Rahmstorf werden kritisiert, weil sie Irrelevantes sagen würden, sondern die „kritischen Kreise“ werfen ihnen vor, unwissenschaftlich zu arbeiten und deshalb falsche Fakten zur Begründung ihrer Position anzuführen. Dabei sind die kritischen Kreise selbst diejenigen, die keine Wissenschaft betreiben und mit falschen Fakten unterwegs sind.

Bei Rahmstorf kann ich das fachlich voll beurteilen, sowohl ihn als auch die Qualität seiner Kritiker. Bei Flassbeck nicht, aber ich erkenne das Muster wieder.

Welche öffentliche Kritik gibt es denn, die sinngemäß sagt:

„Alles richtig, aber wegen x y z halt nicht relevant da undurchführbar.“?

Es gibt sie nicht.

Weil man dann ja zugeben müsste, logischen Folgerungen aus Fakten nicht folgen zu KÖNNEN, wegen Umständen, die man nicht benennen möchte oder nicht benennen kann, weil man sie gar nicht erkennt.

Das haben SIE beim Thema „Wissenschaft zum Klimawandel“ doch selbst immer wieder demonstriert.

a) Richtige Fakten, aber unbrauchbare Schlussfolgerungen und

b) Falsche Fakten, also falsche Schlussfolgerungen

a) und b) sind völlig unterschiedliche Kritiken völlig unterschiedlicher Qualität mit völlig unterschiedlichen Konsequenzen für den Kritiker, was seine Argumentation betrifft.

Begreifen Sie das?

DT

Wenigstens Sie verstehen jedes Wort. Brauche ich immer als Gegenprobe, ob ich total unverständliche Sätze produziere.

“Bei Rahmstorf kann ich das fachlich voll beurteilen, sowohl ihn als auch die Qualität seiner Kritiker….

Welche öffentliche Kritik gibt es denn, die sinngemäß sagt:

„Alles richtig, aber wegen x y z halt nicht relevant da undurchführbar.“?

Es gibt sie nicht.”

Nochmals:

Ein Blick auf den Inhalt SEINES “Dauergetwitter’s” ,sagt eigentlich schon ALLES aus, über den “Wissenschaftler” Rahmsdorf .

https://twitter.com/rahmstorf

@weico

„Nochmals“

Sie müssen sich nicht wiederholen, dass Sie meinen Kommentar überhaupt nicht verstanden haben ( wegen können/wollen ) hatte Sie beim ersten Mal schon demonstriert.

Ich kann Ihnen Leitfragen mitgeben:

a) Was lesen SIE denn aus dem Getwitter von SR heraus?

b) Was folgt daraus IHRER Meinung nach für die von ihm in wissenschaftlichen Publikationen oder Fachartikeln dargelegten FAKTEN?

c) Haben SIE versucht, sich die physikalischen Zusammenhänge klar zu machen, auf denen die menschengemachte Erderwärmung basiert und mit diesem Wissen eine eigene Position gesucht?

d) Haben Sie Ihr Faktenwissen aus c) mal getestet durch Fragen an Leute mit Ahnung oder Diskussionen mit solchen?

Also: HIER am Blog lassen Sie nichts dergleichen erkennen, sondern zeigen eher, dass Sie die BRINGSCHULD (D. Tischer) scheinbar gar nicht erbringen WOLLEN, weil Sie eine kuschelige Position eingenommen haben, die Sie niemals räumen MÖCHTEN.

@weico

Wie beim Großinquisitor; man lässt die Masse dumm und unfrei. Dafür ist sie (vorläufig) glücklich. Ist die Welt nicht schön? Zumindest wäre sie es, wenn die bösen nur nicht wären.

Zum letzten Satz: Wer wird “we” sein? Nicht alle werden “fu….”. We gut sehen Sie die Chance, dass wir (EU-Bewohner mit Kirchenhintergrund) davon kommen?

Ich sehe die Chance als gut. Wir sind eben auch die Basis der Mächtigen, das Bevölkerungswachstum ist bei uns gelöst. Die Domestizierung ist beim sprechenden Affen unserer Breiten weit fortgeschritten und wird wohl demnächst Nahe Vollendung streben.

Vgl. Blumenbach 1795: “man… is far more domesticated… than any other animal…”

@Namor

“Zum letzten Satz: Wer wird “we” sein? Nicht alle werden “fu….”. We gut sehen Sie die Chance, dass wir (EU-Bewohner mit Kirchenhintergrund) davon kommen?

Ich sehe die Chance als gut. ”

Stephen Emmott spricht auch dieses EU-Thema kurz an.

Sinngemäss: Europa wird dann wohl zur militärischen Hochburg werden, um sich vor der Migratiionsmassen zu schützen.

Ergo und um bei der REALITÄT zu bleiben: Die EU sollte schon JETZT sehr stark in Frontex und in seine Aussengrenzen investieren…wenn sie nicht überrannt werden will.

@ Namor

>… man lässt die Masse dumm und unfrei.>

Wirklich?

„Man“ lässt niemanden für dumm, unfrei oder irgendetwas anderes.

Vielmehr:

Die Masse hat eine BRINGSCHULD, sich zu informieren und daraufhin zu bestimmen, wie „frei“ sie sein will.

Das Problem ist, dass sie in großer Zahl ihre Bringschuld nicht erkennt, sozusagen „nicht auf dem „Schirm hat“ und sich aus durchaus verständlichen Gründen daher auch nicht damit beschäftigt, dass sie eine hat und wie sie wahrzunehmen ist.

Sie beschäftigt sich daher auch nicht mit den FOLGEN, die eintreten KÖNNEN, wenn sie sich nicht informiert hat.

Umso größer ist der Jammer, wenn die Folgen sich als Desaster unsäglichen Ausmaßes herausstellen und dafür bitter bezahlt werden muss – auch mit dem Leben anderer.

Das hat es in der Geschichte immer wieder gegeben und gibt es auch jetzt:

Nazi-Deutschland und, selbstverständlich unter anderen Bedingungen, heute in Russland.

Für Deutschland heute würde ich sagen:

Die Bringschuld des sich Informierens wird NICHT hinreichend wahrgenommen, aber auch nicht so sehr vernachlässigt, dass ein unmittelbares Desaster bevorsteht.

Wir laufen m. A. n. jedoch SCHLEICHEND in eines hinein, welcher Art es auch immer sein mag.

Immer wieder gedankenlos ANDERE für irgendwelche Übel verantwortlich zu machen, ist bereits ein INDIKATOR, dass wir auf dem Weg ins Desaster sind.

@Stoertebekker

“Gibt’s denn hier niemanden mehr, der schon bei der Überschrift zuckt?”

Doch .

Aber es zuckt halt nur wenig, weil man dank dem KAPITALismus ja relativ wenig betroffen ist bzw.ja auch davon profitieren kann.

Ihre Sichtweise wir ja von Flassbeck geteilt .

https://think-beyondtheobvious.com/stelters-lektuere/liegt-der-hoehepunkt-der-inflation-hinter-uns/#comment-249758

Darin legt er auch die Profiteure dar und wie sich die “gefühlte Inflation” in eine “richtige Inflation” entwickeln kann.

Da die jetzige “Inflation” sicherlich ,durch den Ukrainekonflikt, Corona-Auswirkungen usw. noch länger andauern und noch nach Oben gehen wird, besteht (laut Flassbeck) ja folgende Gefahr:

“Alles, was sie jenseits der goldenen Lohnregel an zusätzlichen durchschnittlichen Lohnerhöhungen durchsetzen, werden die Unternehmen in den Preisen weitergeben. Und dann droht eine wirkliche Inflation, also Preissteigerung auf breiter Front, die von der Notenbank sehr schnell mit hohen Zinsen bekämpft wird und unweigerlich zu steigender Arbeitslosigkeit führt.”

Dann, wenn die Zinsen richtig steigen, werden auch die Probleme des masslosen “Gelddruckens” bzw. “Schulden/Kredite” so richtig zum Vorschein treten…und die ganze Inflation/Rezession dann so richtig “anfeuern”…. !

Fazit:

Anschliessend geht die ganze Expertendiskussion, über den “Anfang” dieser “Inflations-Debakels”, wieder von Neuem los….usw.

@weico

Na, die letzten Tage ist endlich mal inhaltlich Schwung in der Diskussion.

LOHN-PREIS-SPIRALE ist auch wieder so’n THEORETISCHes Ding.

KLAR spielt die eine Rolle. Ich hab aber mit einer Industrie zu tun, da sind die Lohnkosten <10% von den Fertigungskosten (und Durchschnittskosten pro Mitarbeiter von 100k locker zu tragen) Deshalb

a) wenn man darüber ein Inflationsszenario bauen will, bitte erstmal die Lohnkosten (die relevanten, nicht die in China) als Kostenanteil am Produkt bestimmen. Beim Friseur ist alles klar, von Dünger bis iPhone wäre ich mir da nicht so sicher.

b) diese Theorien stammen aus Zeiten, als wir mehr NATIONAL- als INTERNATIONALökonomie hatten. Und zusätzlich noch mehr Lohnkostenanteile in den Produkten. Die Automatisierung hat die Welt verändert und tut es immer weiter.

Ich weiß es nicht, aber ich gehe für industrielle Volkswirtschaften (nicht service-lastige!!) nicht so schnell über diese Brücke.

@Stoertebekker

“LOHN-PREIS-SPIRALE ist auch wieder so’n THEORETISCHes Ding.”

Ernsthaft? Sie bezweifeln, dass es Lohn-Preis-Spiralen in der Praxis gibt?

Schauen Sie sich mal die wirtschaftliche Entwicklung in Großbritannien in den 1970er Jahren an, da sehen Sie eine Lohn-Preis-Spirale wie aus dem Bilderbuch. Und damals war Großbritannien sogar noch viel mehr industrialisiert als heute, Thatcher hat in den 80ern ja einen großen Teil der alten Industrie in UK plattgemacht (und das war kapitalintensive Industrie, insbesondere Bergbau und Stahlindustrie) und den wirtschaftlichen Schwerpunkt auf Dienstleistungen verschoben.

“Ich weiß es nicht, aber ich gehe für industrielle Volkswirtschaften (nicht service-lastige!!) nicht so schnell über diese Brücke.”

Mit Ihnen darüber zu diskutieren ist so, wie wenn es ein Problem im Raketenbau zu erörtern gibt und Sie dann ernsthaft den Satz “Gravitation ist auch wieder so ein theoretisches Ding” sagen.

Wenn Sie jenseits der üblichen deutschen Klischees keine Ahnung von Großbritannien haben, aber sich mit der Geschichte des Landes von 1945-2000 ein bisschen beschäftigen wollen, dann empfehle ich Ihnen “Britain since 1945: The People’s Peace” von Kenneth O. Morgan. Da braucht man nicht viel Vorwissen, aber bekommt auf 650 Seiten einen tiefen Einblick in die politische und wirtschaftliche Entwicklung des Landes und dann können Sie sich endlich auch plastisch die sich aus einer immer schneller drehenden Lohn-Preis-Spirale ergebenden Konflikte vorstellen, wenn Sie bei den Kapiteln über die 1970er Jahre angekommen sind. Das hat schon seinen Grund, weshalb ich in unserer aktuellen Situation seit ein paar Monaten regelmäßig “Winter of Discontent” in meinen Kommentaren erwähne.

Es ist wirklich so. Glauben Sie mir nicht einfach so, sondern recherchieren Sie es ruhig selbst.

@Stoertebekker

Ich entdecke einen Denkfehler. Sie können nicht Lohnkosten individuell pro Unternehmen betrachten. (10%)

Lohnkosten stecken in allen Vorprodukten, eine Kette bis hinunter zu den Rohstoffen. Und sollten diese mit deutschen Maschinen gefördert werden, kämen sogar „rein deutsche“ Lohnkosten als Feedback zurück.

Eigentlich sind alle Kosten am Ende Lohnkosten, wenn man die Unternehmerprofite als Lohn der Unternehmer mit einschließt. Also 100% über die ganze Wertschöpfungskette.

Gleichzeitig gehen die Preise aller Serviceleistungen hoch, denn die Dienstleister wollen auch leben. Dass der Friseur kein Vorprodukt für BASF herstellt, ist indirekt auch falsch, denn die BASF-Mitarbeiter lassen sich auch die Haare schneiden. Usw. usf.

DESHALB sind ja auch Lohnstückkostenentwicklung und Teuerungsrate die für jede Volkswirtschaft am engsten korrelierten Größen, die man in der VWL finden kann. Stabil über Jahrzehnte.

Es ist tatsächlich so, dass eine Lohn-Preis-Spirale ein plausibles Szenario ist, wenn man mit Löhnen auf externe Schocks so reagiert, dass man versucht die Teuerung durch die Arbeitseinkommen auf breiter Front einzufangen. Und auch ein empirisch evidentes.

@R Ott, @Ch Anders

Mir scheint es geht mehr darum, mich bei irgendwas zu ertappen als über die Argumente zu reden.

a) ich habe NICHT negiert, dass es Lohn-Preis-Spiralen gibt. ich habe sie bei Dienstleistungen unmittelbar erwähnt, ich habe sie für immer stärker automatisierte Industrien hinterfragt. (@R Ott)

b) wenn eine Bodenschatzförderkonzession 50% meiner Kosten ausmacht, kann ich nicht 100% meiner Kosten auf Lohn zurückführen (@Ch Anders)

c) ich habe darauf hingewiesen, dass die Theorie in einer Zeit weniger automatisierter Produktion UND noch stärker nationaler Volkswirtschaften entstanden ist – und sie für diese Zeit auch akzeptiert (@R Ott) Damit ist Ihr M Thatcher-Beispiel BESTÄTIGUNG für meine Argumentation. Ich habe davon gesprochen, dass diese Theorie HEUTE nix weiter ist als ein altes theoretisches Konstrukt. Ich habe NICHT über die Erklärkraft von vor 50 Jahren geredet.

d) ich habe darauf hingewiesen, dass es um die RELEVANTEN Löhne geht, also Löhne in unseren westlichen Volkswirtschaften, wenn wir über eine entsprechende Spirale bei uns reden. Die Löhne in China spielen für diese Betrachtung keine Rolle. Wenn 80% der Wertschöpfung eines Produkts in China stattfindet, dann rede ich über 20% verbleibende Kosten, von denen ein Bruchteil (Lohnkosten) relvant wird. (@beide)

e) Wenn sich die BASF-Mitarbeiter die Haare zu erhöhten Preisen schneiden lassen, erhöht das ihre Lebenshaltungskosten. Wenn Sie dann über ihre (friedliche) IGBCE moderate Lohnerhöhungen (3-5%) durchsetzen, erhöht das die Kosten für die Produktion von Harnstoff um 0,5%, da 10% Lohnkosten im Harnstoff. (@Ch Anders). Habe übrigens gerade Harnstoff getankt 1,76 € pro l. Beim letzten Mal (vor 6 Monaten) 0,99 € pro l.

Sie wollen immer wieder über die Logik des Argumentierens reden (@Ch Anders). Und @D Tischer et al. mögen da ja mitmachen.

Mir geht es aber darum, über die Argumente zu reden und zwar mit Bezug zur HEUTIGEN REALEN Welt, nicht zur durchgerechneten und auch nicht zur vergangenen. Hab hier schon zig mal angemerkt, dass mir die ökonomischen Theorien zu sehr in der NATIONALEN Betrachtung verhaftet sind und die Globalisierung der Wirtschaft nicht mitgemacht haben. Und das fällt uns bei diesen Betrachtungen immer und immer wieder auf die Füße.

Und noch eins. Ich behaupte ja gar nicht, dass Lohn-Preis-Spiralen nicht beobachtbar sind. Ich habe lediglich zum Denken anregen wollen, dass diese so schnell hingeworfenen Argumente vor allem historisch bedingt beobachtbar waren – in nationalen Ökonomien ohne massive globale Wertschöpfungskettenvernetzung und bei deutlich weniger automatisierten Industrien. Automatisierungseffekte lassen sich, glaube ich, im Übrigen mit einer Verzögerung von >10 Jahren beobachten.

@ Stoertebekker

Ich hänge mich in diese Diskussion nicht rein mit einer Bewertung dieser oder jener Ihrer oder anderer KONKRETER Aussagen, die hier getroffen worden sind.

Ich bleibe an diesen beiden Sätzen von Ihnen hängen:

1) >Mir geht es aber darum, über die Argumente zu reden und zwar mit Bezug zur HEUTIGEN REALEN Welt, nicht zur durchgerechneten und auch nicht zur vergangenen.>

und

2) >Sie wollen immer wieder über die Logik des Argumentierens reden (@Ch Anders). Und @D Tischer et al. mögen da ja mitmachen.>

Was Sie bitte verstehen SOLLTEN:

Die AKZEPTANZ Ihres Argumentierens mit Bezug zur HEUTIGEN REALEN Welt, d. h. ob richtig oder falsch ist, was sie behaupten, hängt nicht nur davon ab, ob bestimmte Ihrer Aussagen zur heutigen realen Welt richtig oder falsch sind, sondern AUCH von der LOGIK ihres Argumentierens, auf dem Sie ja BESTEHEN.

Aussage 2) kann daher NICHT im Gegensatz zu Aussage 1) stehen.

Vielmehr:

Entspricht Ihr Argumentieren NICHT der Logik des Argumentierens, d. h. dem ALLGEMEIN anerkannten, weil UNIVERSELL bewährten Verfahrens der ERKENNTNISGEWINNUNG, was daraufhin als ungültiges Argumentieren bezeichnet werden MUSS, ist das, was Sie argumentativ behaupten, NICHT akzeptabel (für alle, die auf dem allgemeinen Verfahren beruhend ein „seriöses“ Verständnis von Erkenntnisgewinnung haben).

Daher:

Wenn Christian Anders, ich oder wer auch immer nachweist, dass ihre ARGUMENTATION nicht korrekter Logik entspricht und Sie daher FALSCH argumentieren, dann ist ihre Erklärung ungültig, d. h. nicht AKZEPTABEL.

Heißt:

Sie müssen sich klar machen, dass Ihre vielfach richtigen AUSSAGEN über die heutige reale Welt etwas anderes sind, als auf Basis dieser Aussagen – auch unstrittig richtiger Aussagen – zu ARGUMENTATIV gewonnene Aussagen zu gelangen.

Wenn Sie sich dies klar gemacht haben, dann verstehen Sie auch, warum Christian Anders und ich mitunter Ihre Aussagen so ernst nehmen, dass wir sie der „Killer-Beurteilung“ gültige oder ungültige Logik unterwerfen (und dabei keinesfalls “automatisch” richtig beurteilen).

Diese Beachtung kann nicht jeder an diesem Blog beanspruchen.

Denn bei zu vielen sind schon die AUSSAGEN über die heute reale Welt UNSINN, so dass die argumentative Beurteilung überflüssig ist.

@D Tischer

Das verstehe ich schon. Ich verstehe dann nur nicht, dass nicht gesagt wird, welche Argumentation aus den Aussagen zur Realität denn folgen würde. Wenn meine Argumentation logisch falsch ist, kann man den Fehler ja korrigieren und von dort weiter diskutieren.

Stattdessen werden ANDERE Aussagen über die Realität eingeführt, nicht empirisch hinterlegt und dann ein Fehler meiner Argumentation unterstellt. Siehe Lohnkostendiskussion mit @Ch Anders.

Was bringt das? Wir diskutieren dann, ob alle Kosten Lohnkosten sind, die von mir eingebrachte Unterscheidung in Lohnkosten in D/außerhalb EU wird nicht aufgenommen und so entfernen wir uns immer weiter vom Hauptthema (peak der Inflation überschritten?) 🤷♂️

Und da ich Sie schon mal dran habe – eine kurze Reaktion auf meine Erklärung zur Inflation im geschlossenen System bei gleicher Angebots-/Nachfragesituation wäre nett gewesen. Wenn Sie mir vorwerfen, dass ich’s nicht erklären KANN, ich’s dann aber tue, könnten Sie ein „ja, ok“ oder „nein, weil“ unterbringen.

Naja, läuft hier wie es läuft. Aber wenn das so weitergeht, mach ich mich bald vom Hof.

@Stoertebekker

„Wenn meine Argumentation logisch falsch ist, kann man den Fehler ja korrigieren und von dort weiter diskutieren“

Habe ich doch genau so? Wiederholung:

Die Inflation ist ein aggregiertes Phänomen, Ihre Einzelsicht als Unternehmer auf ihre einzelne Lohnkostenseite deshalb qua Logik ein ungültiges Argument.

Richtig wäre die Perspektive des Systems, in welchem Inflation gemessen wird. In dieser Perspektive sind ALLE Kosten Lohnstückkosten + Vorleistungen + Unternehmergewinne.

Vorleistungen folgen derselben Kette. Es gibt zusätzlich Rückkopplungsschleifen in der Weltwirtschaft.

Dies ist erstens plausibel und erfährt zweitens empirische Stützung durch die extrem hohe Korrelation von Lohnstückkostenentwicklung und Preisentwicklung aggregiert über ganze Nationen.

Ihr Ansatz der Teilkostenrechnung war aus Unternehmersicht verständlich, für das vorliegende Phänomen aber unplausibel und unlogisch.

Mich würde interessieren, OB und falls ja, WIE sich Ihre Argumentation ändern würde, wenn Sie meine Prämisse als gegeben auffassen würden.

Das ist alles.

Begründung: Sie müssen nicht „irgendeine“ Argumentation finden, die zur Empirie passt, sondern die, die logisch kohärent ist, aller Empirie entspricht und möglichst viel Erklärkraft hat. Erklärkraft bedeutet, aus wenig Input viel Output korrekt ableiten zu können – das ist Ockhams Rasiermesser.

Beispiel: Kreationismus erklärt die Entstehung der Welt logisch kohärent und empirisch adäquat mithilfe des Tricks, jede Empirie der Schöpfung einfach zuzuschreiben.

Man sieht, nicht „irgendeine passende Begründung“ wählen, sonst landen wir im Extremfall so wie im o. g. Beispiel ( das nur illustrativ ist, auf dem Weg sehe ich Sie nicht ).

@ Stoertebekker

Sie machen es sich zu einfach.

>Ich verstehe dann nur nicht, dass nicht gesagt wird, welche Argumentation aus den Aussagen zur Realität denn folgen würde.Stattdessen werden ANDERE Aussagen über die Realität eingeführt, nicht empirisch hinterlegt und dann ein Fehler meiner Argumentation unterstellt.>

Wenn andere Aussage über die Realität eingeführt werden – darin sind auch Sie ein Meister, wenngleich nicht der einzige -, dann hat dies, unabhängig davon, ob sie empirisch belegbar sind oder nicht, NICHTS mit der Logik (Gültigkeit) Ihres Argumentierens zu tun.

Es bedeutet, wenn die Einführung im Sinne der KLÄRUNG erfolgt:

Ihre Aussage zur Realität ist nicht richtig, die Realität ist eine andere.

Das ist erst einmal nicht weiter als eine Behauptung, über die zu streiten ist. Es betrifft die Prämisse der Argumentation, nicht deren Logik.

Es bedeutet, wenn die Einführung im Sinne des AUSWEICHENS erfolgt:

Ich komme in Schwierigkeiten mit Ihrer Aussage und schiebe

daher eine andere drunter.

Dann ist es eigentlich sinnlos weiter zu diskutieren (hier am Blog viel zu oft der Fall, auch weil m. E. n. erkenntlich ABSICHTLICH nicht gelesen oder verstanden werden will, was der andere sagt).

>Wenn Sie mir vorwerfen, dass ich’s nicht erklären KANN, ich’s dann aber tue, könnten Sie ein „ja, ok“ oder „nein, weil“ unterbringen.>

Ich habe mir den betreffenden Dialog noch einmal angeschaut.

Es hat ein wenig gebraucht, bis wir uns verständigen konnten, aber als Sie Folgendes sagten:

> Ich komme von den realen Phänomenen und beobachte die Situation vor und nach der Verteilung von Helikoptergeld, vor und nach Erhöhung der Energiekosten, vor und nach Maßnahmen der FED, vor und nach Produktionsproblemen.>,

habe ich Ihnen geantwortet:

>Genau das mache ich doch auch – da sind wir doch gar nicht auseinander.>

Ich meine, dass man dies als ein o.k. verstehen kann.

Und nur zur Ergänzung, um darzulegen, wessen es bedarf, damit ich zustimmen kann:

Nach diesem Satz hatten Sie gesagt:

Die Verteilung von Helikoptergeld ist genau so eine zusätzliche Staatsverschuldung wie jede andere auch. Warum um alles in der Welt soll die Verwendung DIESER Verschuldung eine andere Wirkung haben als die Verschuldung für Rüstung, …>

Es geht beim Thema Inflation NICHT um die WIRKUNG dieser ART des sich Verschuldens, sondern darum, ob und gegebenenfalls was die ÄNDERUNG an Konsumentennachfrag bezüglich VOR und NACH der Verteilung von Helikoptergeld bewirkt.

Erst DANN, als Sie „ÄNDERUNG“ letztendlich auch gemeint haben mit „vor und nach der Verteilung von Helikoptergeld“ konnte ich Ihnen zustimmen.

Erkennen Sie wenigstens an, dass ich mit Ihnen keine Spielchen veranstalte, sondern einem ANSPRUCH genüge, unter den ich nicht gehen will.

Ich gestehe aber auch gern ein, dass es nicht einfach ist, mit mir zu diskutieren, wenn man für DIESES Diskutieren zuvor im Leben nicht mit einer hinreichenden Dosis von Unerbittlichkeit GEQUÄLT worden ist.

@beide

Grundsätzlich diskutiere ich mit Ihnen ja noch ganz gern. Gibt andere Kandidaten, bei denen ist die Vernagelung auch mit Kneifzange oder Kuhfuß nicht mehr zu lösen.

Vielleicht einigen wir uns darauf, dass Ihr Anspruch an eine Diskussion ein anderer ist als meiner. Dass ich die Aussagen nicht immer völlig durchdekliniert aufschreibe, wie für eine wissenschaftliche Arbeit nötig, weiß ich und hab ich mehrfach bestätigt. Dann wäre es nett, wenn wir diese Schleife nicht jedes Mal laufen müssten. Wenn Sie nicht anders können/wollen bzw. das für wichtig halten, muss ich damit halt umgehen.

Mir geht es um ein besseres VERSTÄNDNIS der Welt und dafür sind die Beiträge und Verlinkungen von Stöcker meist sehr anregend und auch Ihre gelegentlich (zB CO2-Diskussion, Hossenfelder). Die Diskussion um Logik ist es allerdings nicht. Kann und will ich Ihnen aber nicht verwehren. Werde diesbezüglich trotzdem regelmäßig mein Missfallen kundtun.

Hätte bzgl. Lohn-Preis-Spirale eine Diskussion richtig/falsch um die Argumente

– entstanden in Zeiten weitgehend geschlossener Ökonomien (damit Wertschöpfung komplett im eigenen Land)

– in komplett globalen Wertschöpfungsketten mit zig unterschiedlichen Lohnentwicklungen nicht analysierbar

– bei Anteilen deutscher Lohnkosten am Produktpreis con 10-20% kaum aussagekräftig

– Automatisierung verändert die Wirkung der Spirale

– Zeitverzögerung der Messbarkeit der Automatisierung

– usw.

deutlich zielführender gefunden als die Diskussion darum, ob nun zB alle Kosten als Lohnkosten betrachtet werden können. Oder ob eine auf Lohnerhöhung basierende Preiserhöhung im Einzelunternehmen als relevant für die Inflationsdiskussion betrachtet werden kann.

(Woran sich dann doch wieder die Frage der chinesischen Löhne vs der deutschen, der Zeitpunkt der Herstellung der Maschine [in inflationären/deflationären Zeiten] usw. anschließen, um die Frage der Wirkung einer HEUTIGEN Lohn-Preis-Spirale zu diskutieren.)

PS Ich mach‘s mir überhaupt nicht einfach. Diese ganze Schreiberei nur um zurück zu meinem Thema zu kommen (VERSTÄNDNIS der Welt) strengt an und ist gefühlt verschenkte Lebenszeit. Ich verfolge offenbar ein komplett anderes Ziel als Sie.

PS2 @D Tischer. Es ging mir bei ok/nicht ok um das Bäckerbeispiel, also den Mechanismus der Inflation bei gleichem Angebot und gleicher Nachfrage im System.

@ Stoertebekker

Ich erkenne an, dass Sie Ihre Position hier am Blog so deutlich beschrieben haben.

Es ist VÖLLIG legitim, das Ziel zu verfolgen, das sie verfolgen wollen.

Ich will Ihnen noch nicht einmal ein anderes empfehlen, geschweige denn, Sie dahin drängen.

Christian Anders, so vermute ich, auch nicht.

Kurzum:

Wenn es Ihnen um ein besseres Verständnis der Welt geht und Sie der MEINUNG sind, dass die Beiträge und Verlinkungen von M. Stöcker DAFÜR sehr anregend sind, dann ist das völlig in Ordnung und von mir/uns nicht zu kritisieren.

Im Gegenteil:

Ein besseres Verständnis gewinnen zu wollen, ist penetranter Rechthaberei allemal vorzuziehen.

Gleichwohl sollten Sie mir/uns zugestehen können, dass wir ANDERE Maßstäbe haben, wenn es um das Verständnis der Welt geht, d. h. ERKLÄRUNGEN, die verstehen lassen wollen, nicht nur an Beiträgen und Verlinkungen bemessen, sondern daran, ob diese neben anderem auch gültiger Argumentationslogik entsprechen.

Dazu nochmals:

Das ist KEINE Marotte, sondern entspricht dem, was nach allgemeingültigen Standards im seriösen Wissenschaftsbetrieb als eine notwendige BEDINGUNG erfüllt sein muss, um Aussagen bzw. Auffassungen ein „ist wahr“ überhaupt zuerkennen zu können.

Kurzum:

Nichts gegen eine besseres Verständnis, aber was mich und Christian Anders betrifft:

ALLES für das RICHTIGE Verständnis.

@ Stoertebekker Ihr Namensvetter hat vor rd. 600 Jahren durch seine Raubzüge auch für Rohstoffknappheit gesorgt, dass der eine oder andere Preis begehrter Ware drastisch anstieg. So gesehen haben wir gewisse Parallelen zum heutigen Geschehen. Würde man so verfahren wie mit dem damaligen Piraten und seinen Kumpanen, könnte sich das schnell beruhigen. Wird es aber auch dann nicht, weil die Ursache der Misere weniger bei der Piraterie liegt, mehr bei der Gestaltung von anfälligen Produktionssystemen.

Die heute am lautesten schreienden Ökonomie“experten“, bastelten vor vielleicht zwanzig Jahren noch frischstudiert und 25-jährig mit exotischen Exceltools die globalisierende Zukunft des Wirtschaftens. Sie rechneten vor, wie phantastisch die Preisgestaltung mit fernöstlichen Zulieferungen gelingt. Nur, die Risiken eines 25.000km-Transportes quer über die Ozeane hatten sie nicht auf dem Excelschirm. Schon gar nicht ahnten sie, dass man dem entfernten Geschäftspartner nicht einfach auf die Finger hauen kann, wenn er sich kurz mal andere Abnehmer sucht.

Inzwischen fehlt es an der Stecknadel, um die Socken zu stopfen. Welch eine Überraschung, dass die restlichen Exemplare besonders teuer werden. Wer kann das dem Schneider, der sie jahrelang in der Schublade aufbewahrte, verdenken.

So empfindlich gestalten nur Unternehmen ihre Existenz, die Risiken gewohntermaßen sozialisieren, bei phantastischen Managergehältern versteht sich. Last sie untergehen, das bereinigt das Geschäft für die Cleveren, die weniger schreien, dafür konsequent die Chancen nutzen wollen.

Es sei denn, die Ökonomie“experten“ dürfen ihr Spiel weiter treiben, dann steigen eben die Preise uferlos und das eine empfindliche (Wirtschafts-)System wird durch ein ebensolches ersetzt. DAFÜR spricht einiges. Bis diesen Leuten das Excel-Spielzeug weggenommen wird und klarer Verstand einsetzt. Vom und beim ausgepressten Steuerzahler, der diesen ganzen Unfug tragen muss.

Danke für die (empfundene) Unterstützung.

Auch wenn ich als Unternehmer sagen muss „Solche Wellen sind zu reiten“ Punkt. Alles andere ist unternehmerisch grob fahrlässig. Man muss nur rechtzeitig absteigen oder einen Plan B haben. Und das unterscheidet die Herausragenden von den Anderen.

@ Stoertebekker “Alles andere ist unternehmerisch grob fahrlässig”. Alles andere ist zwar menschlich verständlich, aber nicht “unternehmerisch”. Unternehmer zeichnen sich durch Verantwortung für sich selbst, ihr Unternehmen und die Mitarbeitenden im Unternehmen aus. Nichtunternehmer zeichnen sich dadurch aus, dass sie es bei der Verantwortung für sich selbst belassen und sie im Übrigen sozialisieren, also andere für eigene Dummheit zahlen lassen. Zum Unternehmertum gehört das (regelmäßige) Durchstehen von Durststrecken und das passenden Nervenkostüm dazu. Zur Dummheit zählt auch, keinen Plan-B für solche Phasen zu entwickeln und nur von Expansion zu träumen. Und: Unternehmer kreischen nicht lauthals, wenn es eng wird, sondern arbeiten – weil vorbereitet – konzentriert.

@JürgenP

Bin ja grundsätzlich bei Ihnen. Allerdings war ich auch schon kurz vor einer Insolvenz in Eigenverantwortung und in massiven Liquiditätsengpässen. Daher ist und bleibt die Verantwortung für sich, seine Mitarbeiter und letztlich auch die Kunden, die die Produkte/Leistungen schätzen, die Erzielung von Umsatz.

Wie das geht, bestimmt IMMER der Markt. Und wenn da eine Welle durchläuft, muss man die mitmachen. Verantwortungsvoll, ja. Mit Plan B, ja. Aber sich gegen den Strom zu stellen, ist der sichere Untergang. Meistens jedenfalls.

(Schweizer Uhrenindustrie in den 70ern – mechanische Uhren FAST tot. Wer nicht digital gemacht hat, hat nicht überlebt. Die, die digital gemacht haben, konnten nach Abflauen der Welle WIEDER mechanisch bauen. Die, die tot waren, blieben es.)

Gibt’s denn hier niemanden mehr, der schon bei der Überschrift zuckt? Niemanden, der in der produzierenden Welt unterwegs ist und die Knappheiten an Rohstoffen erlebt, der die Ausfälle von Produzenten verkraften muss, der immer höhere Preise für die letzten Bigbags bezahlt und sich möglichst viel aufs Lager legt (weg von lean zu resilient production)?

Wenn die drastischen Preissteigerungen den Höhepunkt überschritten haben, waren es vielleicht gar keine inflationären Anpassungen? Sondern ein langsames Zurechtruckeln von Supply-Demand-Ungleichgewichten?

Durch a) Corona (keine Produktion/Supply-Chain-Themen), b) Energiekostenexplosion (zu geringes Angebot) führt zur Einstellung der Produktion in energeieintensiven Bereichen, c) sonstige Faktoren wie zB Stillstand großer Teile der Chemie-/Energieproduktion durch Frost in Texas in 2021.

Wo bleibt denn das viele Geld, wenn die Preise wieder fallen?

@Stoertebekker: Keine Sorge, die Preise fallen nicht.

Warum?

1. Die Lohn-Preis-Spirale hat in den USA gerade erst begonnen und in Deutschland ist sie gerade erst am Horizont der Tarifverhandlungen der IG Metall schemenhaft zu erkennen. Keine Ahnung, wer die stoppen soll.

2. Der Greenspan-Put gilt weiterhin. Wenn die Kapitalmärkte in den USA in die Knie gehen, lockert die FED die Zinspolitik erneut und macht mal wieder eine Kehrtwende. Europa hängt hinten dran.

3. Die Energiewende funktioniert nur in kleinen Teilbereichen; im Wesentlich wird Energie immer knapper. Flatterstrom aus PV und Wind ersetzt keine Kohle und Kernenergie bei Dunkelflauten.

4. Die Demographie ist in entwickelten Ländern negativ und in einigen Entwicklungsländern positiv; das hält die Lohnkosten bei den Landarbeitern (z.B. Ananas, Kakaobohnen, Kaffeeplantagen, etc.) niedrig und treibt sie bei allen Industrieprodukten und Dienstleistungen wie Software.

5. Der Ost-West-Konflikt (USA und EU vs. Russland / China / evtl. Indien) erschwert die Arbeitsteilung in den nächsten Jahren massiv und fängt gerade erst richtig an.

6. Die kommerzielle Kernfusion lässt auf sich warten. Leider.

7. Die natürlichen Ressourcen sind an vielen Stellen langsam aufgebraucht. Das reicht vom Grundwasser in Südspanien über die Ölfelder der Nordsee bis zum Eisengehalt in den einschlägigen Erzminen. Nichts ist davon ausgenommen: Fischgründe, Gasblasen, Goldadern – die guten Fundorte sind überall schon ausgebeutet.

8. Die technologische Revolution der Digitalisierung ermöglicht aus unerfindlichen Gründen weniger Produktivitätsfortschritte als es sein müssten. Warum ist angeblich unklar. Vielleicht, weil Facebook, Netflix und Gaming der Volkswirtschaft nur schaden, während Amazon und Google auch nicht viel effizienter sind als früher Quelle und Brockhaus? Ich weiß es nicht. Selbstfahrende LKWs und Taxen wären ganz sicher ein Produktivitätsfortschritt.

9. Die Fortschrittsgläubigkeit ist im Westen perdu. Wie man sie wiederbeleben kann? Keine Ahnung.

10. Die politische Klasse und ihre Wähler im Westen haben sich an die Gelddruckerei gewöhnt, selbst in früher zurückhaltenden Ländern wie Deutschland und den Niederlanden. Ohne einschlägige Negativerfahrung einer zu hohen Inflation ist ein Umdenken unrealistisch.

Habe ich was vergessen?

@ Frau Finke-Röpke

>> “Habe ich was vergessen?”

Nein, die Liste dürfte schon stimmen. Aber ich kann es nicht lassen, was anzuflicken:

Alle 10 Punkte für sich genommen bedingen künftig höhere Kalkulationszuschläge. Und die gehen als Multiplikatoren in die kombinierte Rechnung ein, denn die meisten Punkte tun gleich an mehreren Stellen weh.

Und wenn es nur jeweils 10 % je Punkt sein sollten, so ist 10^1.1 eben rd. 2.6.

corrigendum zu vorhin: 10 x 1.1^10 = 26

@SFR

Jede Wette, dass die Preise für Basischemikalien (alle Kunststoffe, Säuren&Laugen, you name it) wieder fallen. JEDE Wette.

Da gibt’s Zyklen (Kapazitäten kommen hinzu, fallen weg; neue Nachfrage entsteht) und die hat bisher noch niemand abschaffen können, auch wenn das schon mehrfach postuliert wurde.

Diese Preisanpassungen ziehen sich dann durchs gesamte System. Dass wir am Ende wegen zB höherer Energiekosten über dem Niveau von Vor-Corona landen, dürfte sicher sein. Aber auch das ist normal – was 1999 1 DM war, war 2019 mindestens 1 €.

Wenn Sie davon ausgehen, dass die Preise nicht fallen, kann ich Investments in Chemieunternehmen wärmstens empfehlen. Bei Risikoaversion wie @R Ott vielleicht nicht in erneuerbare-Energien-gefährdete, ich hol mir bei denen aber regelmäßig eine nette Dividende ab. >3-5% Dividendenrendite.

@Stoertebekker

“Wo bleibt denn das viele Geld, wenn die Preise wieder fallen?”

Im reinen KGS entsteht Geld im Rahmen der geldpolitischen Operationen der Zentralbanken durch Hinterlegung zentralbankfähiger Schuldtitel, die endliche Laufzeiten haben. Diese Kredite müssen prolongiert werden, sonst verschwindet das Geld endgültig in der ZB und wir erleben sofort die Deflation. Die Kreditketten dürfen nicht reißen!

“Kreditgeld kann heute nur kaufkraft- und ergo preiswirksam vermehrt werden, nachdem Kredite (verbrieft) unterwegs sind, die ihrerseits bereits kaufkraft- und preiswirksam WAREN. Sie haben also ihre Schuldigkeit an den Realmärkten bereits getan und werden nur noch monetär abgewickelt.”

“Diese Abwicklung kann niemals Preise zweimal beeinflussen: Einmal beim Kreditieren selbst und dann nochmals bei deren Abwicklung. Diese Doppelbetrachtung ist müßig. Auch auf Prolongationen (oder Schuldübernahmen durch andere, siehe Staat “stützt” Unternehmen oder Bank Concurso AG) zu starren ist sinnlos. Mit einem verlängerten Kredit kann niemand nochmals kaufen.”

“Die einzige Möglichkeit, Inflation zu fabrizieren ist Nettozusatzverschuldung, die über die Kapazitätsgrenzen hinaus nachfragt. Da die weit und breit nicht in Sicht ist (Verschuldungsgrenzen, Kreditfähigkeit usw.) geht’s halt nur noch im altbewährten Stil: Das GZ muss zusätzlich und das kreditfrei fabriziert werden – also Notenpresse direkt in Staatshand und Knopfdruck.”

https://archiv.dasgelbeforum.net/ewf2000/forum_entry.php?id=245195

In diesem Link erfahren wir noch einmal etwas über die ‘Preisrevolutionen’ mit der Erkenntnis:

“What goes up, must come down.”

Viel Spaß beim Studium der debitistischen Zusammenhänge.

@ Johann Schwarting

Der Betrug der Lügen beginnt mit der Einbuchung und Auszahlung des Kredits durch Privatbanken, weil die Hypotheken auf Pfänder für sie bereits neuer Kredit sind und die Tilgung de zukünftigen Eigentümers die Betrugsdoppelzahlungen.

Nach 1971 ist jetzt somit eine vollständig Vermögensausbuchung auf Hochtouren und die Bürger sollen für Sinnlosesten Wahnsinn der Kreditausreicherallianz Zentralbank + Privatbanken Wiederbeschaffungszeitwerte dümmster Provenienzen abdrücken.

Der Untergang dieser dreieinhalbfachen Abzocke geschieht durch Betrachtung der Zerstörer im Zentralismusrausch, die überhaupt nicht wissen was sie auswendig gelernt haben.

https://www.bitchute.com/video/XKfDDDtmDhpy/

Wie oft wurde dieser Mörser kreditiert in Deutschland?

@Tom96

“Wie oft wurde dieser Mörser kreditiert in Deutschland?”

Solange die Kapitaldienstfähigkeit gewährleistet ist, kann der Kredit revolviert und prolongiert werden.

Ein Bekannter von mir ist nach der Liquidierung seiner spekulativen Immobilienanlage aus den 1970er Jahren auf einer Restschuld sitzengeblieben, die revolviert und prolongiert wird und deren Kapitaldienstfähigkeit unter Einschränkung anderer persönlicher Möglichkeiten, die ja auch(vor)finanziert werden müssen, gelingt.

Ich denke, dass die nächste Fortsetzung in Machtsystemen unvermeidlich ist, obwohl wir es schaffen, das Geldrätsel zu lösen und die Frage zu beantworten, warum gewirtschaftet wird.

Macht → Abgaben → Geld → Wirtschaften mit Geld, Preis und Zins

Also: Aufbau von Schulden des nicht leistenden Schuldner Staat → Inflation → Sachwerthausse → Umschlag der Inflation in die Disinflation, sobald die Kosten der Fortsetzung der Inflation ihre Erträge übersteigen → Sachwert-Crash → sinkende Zinssätze und ergo automatisch sich ergebende Finanztitel-Hausse → Exzess dieser Hausse in der bekannten Manie → Finanztitel-Crash → deflationäre Depression

“Nach 1971 ist jetzt somit eine vollständig Vermögensausbuchung auf Hochtouren …”

… mit dem Ziel, dass “alle assets [werden] über kurz oder lang in den ZBs landen MÜSSEN, womit dem Vollsozialismus auch auf diesem Wege nichts mehr aufhalten sollte.”

Der Debitismus spult eben sein Programm ohne politische Einwirkung ab.

https://archiv.dasgelbeforum.net/ewf2000/forum_entry.php?id=155864

Zwar zum Thema “Inflation”, aber off-topic zum heutigen Blog.

Im vorletzten Economist gab es einen Artikel zur Diskrepanz in der Priorisierung von Inflation zwischen der allgemeinen Oeffentlichkeit und Experten/Oekonomen. Lt. Artikel verabscheut die Bevoelkerung Inflation, waehrend die Experten die Kosten von Inflation, sofern es sich nicht um ausser Kontrolle geratene Hyperinflation handelt, als eher gering einschaetzen.

Der Economist stellt dann die Frage, ob man auf die Experten hoeren sollte oder die “psychologischen” (wohl ein Euphemismus fuer: eingebildete) Kosten der Bevoelkerung miteinbeziehen sollte in politische Entscheidungen.

Mich wuerde als erstes interessieren, warum es zu dieser Diskrepanz in der Einschaetzung von Inflation kommt. Das waere auch ein interessantes Thema fuer bto.

Hypothesen:

1. Je komplexer das System, auf das sich die Expertise bezieht, desto weniger verlaesslich sind Experteneinschaetzungen, weil sie viele Zusammenhaenge ausblenden (muessen).

2. Die von Experten gemessene Inflation unterscheidet sich von der “praktisch erlebten” Inflation, der sich die Bevoelkerung ausgesetzt sieht.

3. Inflation hat (Um-) Verteilungseffekte, die von Oekonomen meistens vernachlaessigt werden, aber in der Bevoelkerung real erfahren werden.

4. ?

@ R. Peter

>> “4. ?”

4. Der grosse stakeholder kann ausweichen, der kleine nicht!

@Rolf Peter

Viel simpler. Dass Sie den Artikel ausgerechnet im transatlantischen Londoner Bänker-Wochenmagazin “Economist” gelesen haben, müsste Sie eigentlich auf die richtige Fährte bringen.

Ökonomen, “Experten” und die sonstigen Mietmäuler arbeiten meistens für Akteure, die verschuldet sind (Banken, Hedge Fonds, Regierungen, usw.) und folglich davon profitieren, wenn ihre Schulden weginflationiert werden.

Also ist es ihre Aufgabe, eine Rechtfertigung für Inflation zu konstruieren und sie möglichst attraktiv und harmos erscheinen zu lassen.

@ Rolf Peter

Hypothesen: 1. Je komplexer das System, auf das sich die Expertise bezieht, desto weniger verlaesslich sind Experteneinschaetzungen, weil sie viele Zusammenhaenge ausblenden (muessen).

Einschätzungen sind unter Komplexitätsbedingungen nie „verlässlich“ (im Sinne von zutreffend). Die Trefferquote von „Experten“ hängt von der Expertise des Experten ab. Ist er Experte eines bestimmten Fachgebietes, so ist sein Wissen zwangsläufig darauf begrenzt. Er weis von immer weniger immer mehr und kurz vor gar nichts gibt’s bei manchen noch den Nobelpreis.

Allerdings gibt es einen Nobelpreisträger, dessen Expertise darin besteht, unter Komplexitätsbedingungen eben nicht die Zusammenhänge auszublenden, sondern ganz im Gegenteil: sie methodisch richtig zusammen zu bringen. Es handelt sich um Klaus Hasselmann. Er war Direktor des Instituts für Geophysik und Planetarische Physik an der Universität Hamburg und erhielt 2021 den Nobelpreis für seine Expertise zum Verständnis komplexer physikalischer Systeme.

Bereits in den 90er-Jahren entwickelte er eine Methode, die den Effekt menschengemachter Treibhausgase auf die globale Durchschnittstemperatur zeigen konnte. Seine Experteneinschätzung ist offensichtlich – methodenbedingt – verlässlich.

Vielleicht kann er statt „Klima“ auch „Inflation“ … für Herrn Habeck einschätzen.

@JürgenP

“Die Trefferquote von ‘Experten’ hängt von der Expertise des Experten ab. Ist er Experte eines bestimmten Fachgebietes, so ist sein Wissen zwangsläufig darauf begrenzt.”

(…)

Klaus Hasselmann. Er war Direktor des Instituts für Geophysik und Planetarische Physik an der Universität Hamburg und erhielt 2021 den Nobelpreis für seine Expertise zum Verständnis komplexer physikalischer Systeme.

(…)

“Seine Experteneinschätzung ist offensichtlich – methodenbedingt – verlässlich. Vielleicht kann er statt „Klima“ auch „Inflation“ … für Herrn Habeck einschätzen.”

https://imgur.com/gallery/9ZOgqGO

Naja, ich weiß nicht. Sie halten Ihn offenbar für einen “Experten für alles”, weil er Geohysiker ist, aber wäre er nicht noch viel geeigneter, wenn er sich darüber hinaus noch als Frau identifizieren würde? Frauen leiden ja bekanntlich am meisten an der Inflation und auch am Klimawandel (und sowieso an allem), dieser Zusammenhang kann kein Zufall sein. :D :D :D

@ RO Frauen bekommen kein Nobelpreis für das Verständnis komplexer Systeme. Das haben die sowieso. Anders bei Männern (Manni – Flanke – Kopf – Tor, Panzer – Bummbumm – Sieg). Das Frauen bei dem Zustand schwer leiden ist klar. Die zwei, drei männlichen Ausnahmen bekommen dann einen Nobelpreis. Sicherlich verdient. Haben Sie auch schon einen?

@JürgenP

Ich möchte den Nobelpreis für “Literatur” gewinnen und dann Wärmepumpen-Berater werden…

@John Authers

“Die richtige Interpretation ist sicherlich, dass das rasche Geldmengenwachstum eine Inflation der Vermögenspreise auslöste, die einen Boom der Gesamtnachfrage auslöste, der die Produktion weit in den Bereich der Überhitzung brachte, was zu einer rasanten Inflation bei Gütern und Dienstleistungen führte (…) Die heutigen Versorgungsengpässe sind ein Symptom der Inflation, nicht ihre Ursache.”

Zuerst muss grundsätzlich geklärt werden – was vielen Autoren nicht bewusst ist -, dass gilt: Mit Kredit wird gekauft und mit Geld wird gezahlt. Ohne Kredit kein Kauf und ohne Kauf kein Preisniveau.

Da im reinen KGS alles Bargeld nur aus der ZB erscheinen kann, nachdem ihr Kredittitel angedient wurden, sind sämtliche Preise nur aufgrund von Krediten vorstellbar: Entweder von neu vergebenen oder von bereits existenten. Diese können zediert werden oder mit Hilfe der ZB aus späteren Fälligkeiten in frühere verwandelt sein. Inflationen haben ihre Ursachen in Kreditsummen und nicht in Geldsummen.

Würden ab morgen alle nur ihre finanziellen Verpflichtungen, die sie zu früheren Käufen und zur Schaffung eines früheren Preisniveaus genutzt hatten, begleichen, gäbe es überhaupt keine Käufe mehr und das Preisniveau ginge gegen Null.

Werden die Kredite nicht abgelöst, indem die Waren geliefert werden, kommt es zu Inflation. Diese muss so sicher enden, wie jede Aktienmanie ebenfalls enden muss: Ende, sobald die Kosten der Fortsetzung die Erträge dieser übersteigen.

“Der Kredit, der aller Fristigkeit zugrunde liegt, schafft es daher, zunächst die Preise in die Höhe zu treiben (für eine Einheit, sich im Kredit ausdrückenden, Monetäres gibt es erst 3, dann 2, dann nur noch eine Einheit Reales o.ä.). Sobald jedoch das Geben und Nehmen von neuem Kredit nachlässt oder gar zurückgeht, läuft es in die Gegenrichtung (erst 1 Einheit Reales, dann 2, dann 3 usw.). Die alten Kredite stehen jetzt zu ihren Terminen an und müssen wieder – jetzt als ‘Schulden’ – aus der Welt.”

“Die allgemein – und zwar rasant – gestiegene Verschuldung weltweit ist oft genug hier dargestellt worden. Wir sollten aber nicht übersehen, dass diese nicht einfach ‘stehen’ bleiben kann und das war’s. Sie drängt unerbittlich zu ihren Fälligkeiten. Dieser Prozess kann zwar durch Zwischenhochs (‘new credits’) mit entsprechender Preiswirkung unterbrochen werden. Beendet werden kann er aber nur durch Zahlung bzw. durch Bankrott.”

https://archiv.dasgelbeforum.net/ewf2000/forum_entry.php?id=263047

Prof. F.W. Meyer: “Der Fuchs muss immer aus dem Bau.”

Der Beitrag von John Austers KRANKT daran, dass er bis auf einen Nebensatz die Inflation auf NUR die Geldmenge zurückgeführt.

Als Kronzeuge dafür wird Milton Friedman aufgerufen:

>… there is enduring truth in monetarism, famously summed up by Milton Friedman with the contention that inflation is always and everywhere a monetary issue.>

Inflation immer und überall eine Frage des Geldes bzw. der Geldmenge:

Diese Aussage ist RICHTIG, wenn/weil die Geldmenge die NACHFRAGE determiniert und diese AUCH das Preisniveau.

Es ist aber als MONKAUSALE Erklärung falsch, wenn/weil AUCH das ANGEBOT das Preisniveau determiniert.

Friedman ist zu entschuldigen, weil er das AUSMASS der Globalisierung und die damit entstandenen Abhängigkeiten der Güterherstellung seinerzeit nicht auf dem Schirm haben konnte.

Wer z. B. hätte es vor Monaten für möglich gehalten, dass China mit einem KOMPLETT-Lockdown Shanghais u. a. den Güterverkehr nach USA und Europa dermaßen lahmlegt, wie es der Fall ist?

Ich hätte es nicht geglaubt.

Kurzum:

Wenn es um Inflation geht, ist DIFFERENZIERUNG ist angesagt.

Ich bin gespannt, ob Issing im Podcast Gelegenheit gegeben wird, zu Inflationsfaktoren JENSEITS der Geldpolitik der Notenbanken Stellung zu beziehen.

@DT „Wer z. B. hätte es vor Monaten für möglich gehalten, dass China mit einem KOMPLETT-Lockdown Shanghais u. a. den Güterverkehr nach USA und Europa dermaßen lahmlegt, wie es der Fall ist?

Ich hätte es nicht geglaubt“.

Warum nicht. Wenn China seine bescheidenen 25 Mio. Stadtbürger für ein paar Monate einsperrt und damit die Weltwirtschaft gut begründbar („Corona“) an den Abgrund treiben kann, so ist dieser Schritt doch nur logisch. Und billiger als ein dusseliger Angriffskrieg mit schrottreifen Panzern ist die Aktion auch noch.

@ JürgenP

Was meine Gläubigkeit in diesem Fall betrifft, gibt es zwei Punkte:

a) Das MASS der Auswirkungen auf die Weltwirtschaft via blockierte Logistik, d. h. der Ausfall des größten Containerhafens der Welt habe ich mir nicht vorstellen können.

Ein optischer Eindruck:

https://de.statista.com/infografik/27339/fracht–und-tankschiffe-im-hafengebiet-von-shanghai/

b) Ich habe es nicht für möglich gehalten, dass China SICH so sehr SELBST schwächt mit dem Komplett-Lockdown. Das betrifft nicht nur seine Wirtschaft, sondern auch die Stabilität des Landes. Die Betroffenen werden die alles andere als zimperlichen Maßnahmen, mit denen sie behandelt werden, der Kommunistischen Partei des Landes nicht so einfach auf der Habenseite verbuchen.

Kurzum:

Ich glaube zwar, dass China kein großes Mitleid mit dem hat, was anderswo in der Welt vonstattengeht, aber so klug ist, nicht die anderen Länder, die es braucht, zu schwächen.

China will erklärtermaßen die Nr. 1 der Welt werden, aber MIT und nicht GEGEN die anderen.

Da die Volkswirtschaftslehre ja ein weites Feld von Experten hat.. im Vorfeld mal eine Meinung von der Gegenseite.

Wie Hr. Issing war Hr. Flassbeck ja ein Schüler/Mitarbeiter beim “Saldenmechanik-Papst” Wolfgang Stützel.

Interessant dabei: Heute haben die Beiden vielfache eine total konträre Meinung zu den meisten Themen.

https://www.relevante-oekonomik.com/2022/05/02/die-preise-und-die-marktwirtschaft/

In der Türkei steigt die Inflation und die Zentralbank senkt die Zinsen.

https://www.welt.de/wirtschaft/article238563859/Inflation-in-der-Tuerkei-steigt-auf-70-Prozent.html

Jede ZB hat halt ein anderes “Rezept”….

@weico: Hat die türkische Zentralbank eigentlich ein Inflationsziel? Eventuell hat sie einfach nur eine andere Aufgabenstellung als FED oder EZB?

@Wolfgang Selig

“@weico: Hat die türkische Zentralbank eigentlich ein Inflationsziel? Eventuell hat sie einfach nur eine andere Aufgabenstellung als FED oder EZB?”

Die türkische ZB ist ja zum Spielball vom “kleinen Sultan” geworden . Man müsste dazu wohl Erdogan befragen.

Ansonsten hat sie ja ähnliche Ziele, wie die meisten ZB’s.

https://www.tcmb.gov.tr/wps/wcm/connect/EN/TCMB+EN/Main+Menu/Core+Functions/Monetary+Policy

@Herr Selig

“Hat die türkische Zentralbank eigentlich ein Inflationsziel?”

Formaljuristisch gesehen schon, aber wie kommen Sie auf die Idee, dass das noch irgendjemanden interessiert? Wer in der Zentralbank nicht das macht, was Erdogan will, fliegt raus. Damit ist die Zieldiskussion beendet.

Aus dem türkischen Zentralbankgesetz:

“Fundamental duties and powers

Article 4- (As amended by Law No. 4651 of April 25, 2001)

The primary objective of the Bank shall be to maintain price stability. The Bank shall

determine on its own discretion the monetary policy that it shall implement and the monetary

policy instruments that it is going to use in order to maintain price stability.

The Bank shall, provided that it shall not conflict with the objective of maintaining price

stability, support the growth and employment policies of the Government.

The fundamental duties and powers of the Bank shall be as follows:

(…) ”

https://www.tcmb.gov.tr/wps/wcm/connect/d6ac47f4-379f-43da-bf2b-7ad855dca0ff/The_Law_on_the_Central_Bank_of_the_Republic_of_Turkiye.pdf

Die EU hat auch beispielsweise eine No-Bailout-Klausel, Sie wissen ja, wie ernst die genommen wird…

Wenn Staaten oder Staatenbünde zu Shithole-Countries degenerieren, dann existieren viele Gesetze und Regeln nur noch auf dem Papier – so ist nun einmal der Lauf der Welt.

@weico

“Da die Volkswirtschaftslehre ja ein weites Feld von Experten hat… im Vorfeld mal eine Meinung von der Gegenseite.”

Als ich [Paul C. Martin] anfing, über VWL/BWL nachzudenken, besuchte ich Prof. F.W. Meyer an der Uni Bonn (Fach: Wirtschaftspolitik), ein aufrechter Ordo-Liberaler aus der Eucken-Röpke-Schule, enger Freund Ludwig Erhards und erster Vorsitzender des Rates der ‘Fünf Weisen’, den es ja bis heute gibt.

Sagte der: “Junger Mann, dies Fach ist das schönste auf der Welt; denn erstens wird immer zweimal verbucht, also nie geht was verloren, zweitens kann man immer das Gegenteil beweisen, drittens muss der Fuchs immer aus dem Bau.”

https://archiv.dasgelbeforum.net/ewf2000/forum_entry.php?id=5730

@weico

Wissenschaft ist an sich ja eine Methode, kein Ding. Nun kann VWL diese Methode nicht genau so anwenden wie NW. Aber: Sie kann diese Methode und ihre Kriterien so weit anwenden, wie es eben geht. Sie muss das tun, um sinnvolle ERgebnisse zu erzielen.

Bei dem Flassbeckartikel kann ich das sehen, wie es gemacht wurde und deshalb kann ich nachvollziehen und bewerten, ob logische Fehler da sind oder nicht. Das macht die Ergebnisse nicht automatisch richtig. Aber es macht weniger wahrscheinlich, dass sie falsch sind.

Bei dem, was ich von Issing bis jetzt gelesen und gehört habe (natürlich wenig des Gesamtwerks), finde ich seltener logischen Flow, dafür oft Lücken an relevanten Stellen, die nach der wissenschaftlichen Methode eigentlich gefüllt gehören.

Ich bin gespannt auf den Podcast, ob es da anders wird.

@ Christian Anders

>kann ich nachvollziehen und bewerten, ob logische Fehler da sind oder nicht. Das macht die Ergebnisse nicht automatisch richtig. Aber es macht weniger wahrscheinlich, dass sie falsch sind.>

Der letzte Satz – Ihre Schlussfolgerung – ist richtig bezüglich des „weniger wahrscheinlich“.

Er besagt aber nichts über das, was auch bedeutsam ist:

Die RELEVANZ von Aussagen bzw. Auffassungen.

Was richtig ist, kann auch IRRELEVANT sein.

Die Saldenmechanik, auf die sich Flassbeck bezieht, ist richtig, aber irrelevant.

Denn NIEMAND im Wirtschaftsleben und in der Politik orientiert sich an den volkswirtschaftlichen Salden.

@Dietmar Tischer

Es ging nicht darum, ob er relevant ist, sondern ob seine Analyse stimmt. Von einer falschen aber relevanten Analyse haben wir auch mehr Schaden als Nutzen.

Entscheidend ist die Frage, ob die relevanten Vorgehen die Ziele erreichen können, die sie vorgeblich erreichen sollen.

Meiner Meinung nach können Sie das nicht, wenn sie die Mechanismen falsch verstehen, weil sie das Denkkorsett des Machbaren (aka real Relevantem nutzen).

Dazu habe ich oben ausführlicher in einer Antwort an @weico geschrieben.

@ Christian Anders

War mir schon klar, um was ging.

> Entscheidend ist die Frage, ob die relevanten Vorgehen die Ziele erreichen können, die sie vorgeblich erreichen sollen.>

Das ist EINE entscheidende Frage.

Eine andere ist:

Ist das tatsächlich stattfindende Vorgehen, mit dem REALE Ziele erreicht werden sollen, ein Vorgehen, das Flassbecks richtiger Analyse nach ERFORDERLICH ist?

Wenn nicht, ist die richtige Flassbecks Analyse IRRELEVANT für die Erkenntnis des sich real Vollziehenden.

in den letzten 20 jahren waren konjunkturell gute jahre dabei.

in diesen jahren hat die NB`s und andere lenker, es nicht geschaft, ohne viel zusätzliches neu-druck-geld, die wirtschaft am laufen zu halten, – bzw. sie haben es garnicht ernsthatf versucht.

bereits vor unden 20 jahren waren 4 $ notwendig um 1$ wirtschaftswachstum zu erzielen.

heute sind wir wohl in den bereichen zwischen 10 und 20 $.

eine reduzierung der geldmenge, mit gleichzeitiger zinsanhebung, lässt schnell die wirtschaft an die wand fahren.

da gibt es kaum spielräume.

auch eine reduzierung der geldmenge, oder die zinsen anzuheben, führt in die gleiche richtung.

die gesamte kapitalgröße weltweit hat einen umfang erreicht, in dessen die wirtschaft kaum noch die zinsen dafür erwirtschaften kann.

damit führt sich dieses geld- und wirtschaftsystem selbst in den unvermeidlichen exetus.

die weltweite wirtschaft war bereits vor corona und uraine-krieg, nicht mehr auf gesunden weg und wachstum.

jetzt kommen (und sind bereits) gigantische neu kredite notwendig um das ding nicht vorzeitig abstürzen zu lassen.

der wiederaufbau der ukraine könnte zwar die wirtschaft etwas beflügeln, aber

nur mit dem preis einer noch viel höheren verschuldung und den daraus entstehenden weiteren zinslasten.

die geldmenge kann nicht großartig zurück gefahren und die zinsen können nicht der inflation enstsprechend hoch gefahren werden, ohne die wirtschaft und gesellschaft in den vorzeitigen kollaps zu treiben.

es bleibt die frage, wieviel zeit können die steuerungen durch die NB`s noch uns geben, bevor der kollaps über uns endgültig herein bricht?

ein vergleich zu den 80 und 90er jahren, wo die hohen zinsen die inflation zurück geholt haben,

ist m.m. nicht mehr möglich, weil die wirtschaft extrem fragil geworden ist und gleichzeitig die globalisierung rückwärts rollt.

es ist die zeit da, wo die wirtschaft und gesamte gesellschaft sich gegen extreme stürme/tsunami`s vorsorgen und sichern sollte. blos wie?

jedes sparen verschlechtert die wirtschaftliche lage.

enteignungen, währungsreformen?

@ Freund foxxly

>> “die gesamte kapitalgröße weltweit hat einen umfang erreicht, in dessen die wirtschaft kaum noch die zinsen dafür erwirtschaften kann.”

Ja, wenn es Kapital wäre oder würde, aber es ist nur Geld und nicht einmal mehr das.

Monopoly ist dagegen jetzt wirklich ein Kinderspiel, was so nicht beabsichtigt war bei seiner Erfindung.

>> “Liegt der Höhepunkt der Inflation hinter uns?”

Ich höre Pfeifen im Wald!

@Bauer

Mit der knallharten Zinserhöhung um 0,50% in den USA (bei offiziell 8% Inflation…) wird letztendlich der Stempel zum Endsieg gesetzt werden. Ab jetzt kommt alles ganz schnell wieder in Ordnung, Sie Defätist. ;)

@ R. Ott

>> “Sie Defätist”

Bin ich nicht, ganz im Gegenteil. Aber ich habe schon mehr gesehen als Sie und es beherzigt. Im allgemeinen reagiere eher zu früh als zu spät

@Bauer

“Pfeifen im Wald” könnte man zweideutig verstehen.

Pfeifen im Sinne von dümmlichen, ungeschickten Menschen im Wald der Volkswirtschaftslehre oder Menschen, die aus Angst im Wald pfeifen.

Was hören Sie nun wirklich?

@Bauer

“Pfeifen im Wald” könnte man zweideutig verstehen.

Pfeifen im Sinne von dümmlichen, ungeschickten Menschen im Wald der Volkswirtschaftslehre oder Menschen, die aus Angst im Wald pfeifen.

Was hören Sie nun wirklich?

@ Zweifler

>> “Was hören Sie nun wirklich?”

Deutlich Orientierungslosigkeit und daraus entsteht Angst. Wer weiss noch, wo Norden ist?

@ Bauer

>Wer weiss noch, wo Norden ist?>

MUSS das noch einer wissen, wenn er ein Handy hat und GPS ihm den

Weg zum ZIEL anzeigt?

Wenn schon Angst, würde ich sagen:

Vielen Menschen dämmert es, dass sie zwar Ziele anstreben können, aber sie nicht erreichen werden – mitunter sogar auf der Strecke dahin liegenbeleiben.

@ D. Tischer

>> “MUSS das noch einer wissen, wenn er ein Handy hat und GPS ihm den

Weg zum ZIEL anzeigt?”

Sie sind typisch ein Kind der Neuzeit. Tief im Wald gibt es weder Internet noch GPS.

GPS-Signale lassen sich auch stören, diese Technik beherrscht zum Beispiel “Putin”…

@Herr Tischer

“Vielen Menschen dämmert es, dass sie zwar Ziele anstreben können, aber sie nicht erreichen werden – mitunter sogar auf der Strecke dahin liegenbeleiben.”

Die spannende Frage ist, was sie dann mit dieser Erkenntnis machen:

Die unrealistischen Ziele aufgeben? Oder verbissen die Anstrengungen vervielfachen, koste es, was es wolle?

@ Richard Ott

Die spannende Frage lässt sich leicht beantworten:

Ein erheblicher Anteil derer, die ihre Ziele nicht erreichen, werden ihre Anstrengungen vervielfachen, um sie dennoch zu erreichen – durch DRUCK auf den Staat mit TRANSFERS rüberzukommen, weil sie sonst die Loyalität zu diesem Staat aufkündigen würden.

Funktioniert bestens.

Betrachten Sie den Heil von der SPD: