Unternehmensschulden steigen, um Aktienoptionen für die Mitarbeiter zu finanzieren

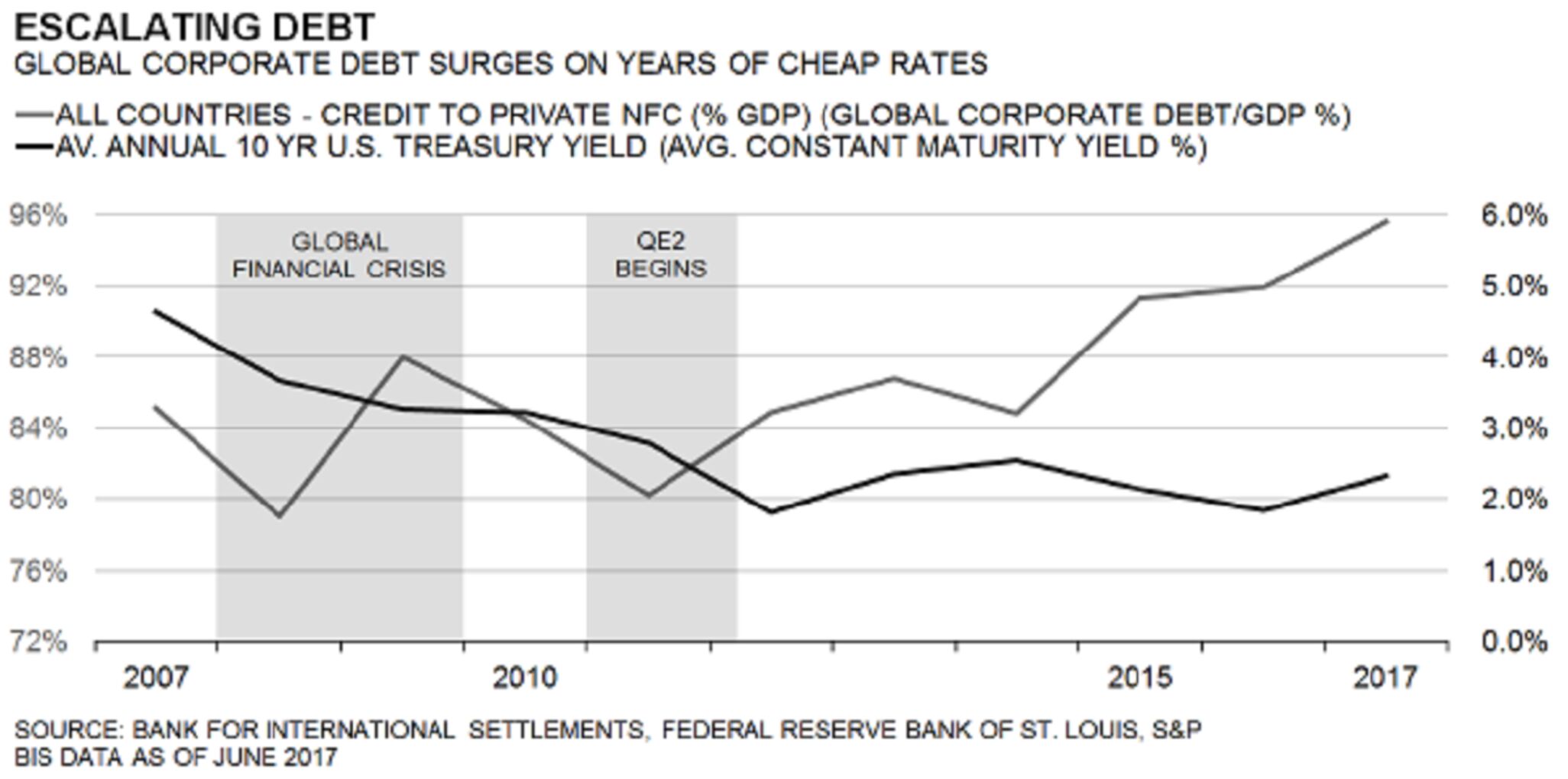

Schon seit Langem wird auf die Risiken der hohen Unternehmensverschuldung verwiesen. Hier eine erneute Erinnerung. Es handelt sich nicht um ein reines US-Problem. Weltweit haben die Unternehmen das tiefe Zinsumfeld genutzt, um die Schulden nach oben zu treiben.

- “‚Interest rates are already doing damage, people just haven’t noticed,‘ Andrew Lapthorne, the firm’s global head of quantitative strategy, said in an interview Tuesday. ‚Leverage in the U.S. is grotesque for this stage of the cycle. At the moment you’ve got peak leverage at peak prices. It’s not like you have to dig deep to find a problem.‘“ – bto: was natürlich die Anfälligkeit des gesamten Systems erhöht.

- “(…) risks to corporate balance sheets is a bigger problem at the moment, particularly in the U.S. and China. Lapthorne said he worries about volatility in debt because of the impact it can have on the economy, particularly how it weighs on businesses and the job market.” – bto: So ist es!

Quelle: SocGen, Bloomberg

- “Lapthorne doesn’t see buybacks as a panacea for markets. He said companies that announce them but don’t follow through outperform those that do. The average loss from share repurchases is about 5 percent, Lapthorne estimates. To him, the action of borrowing money to get a short-term boost in earnings-per-share is often motivated by executive compensation in the U.S.” – bto: was die Idiotie nochmals unterstreicht.

- “The performance differentiator in the U.S. stock market has been an aversion to buying companies with bad balance sheets,(…).” und “Instead of the usual market driver of economic growth, this bull market has been driven by valuation growth, (…).” – bto: sprich: höhere Preise, nicht so sehr steigende Gewinne.

Doch damit nicht genug. Die spannende Frage ist ja, was machen die Firmen mit den Schulden (eigene Aktien kaufen!) und führt das dann zu einer Reduktion des Umlaufs an Aktien? Die Antwort ist nein! Auch diese kommt von Andrew Lapthorne:

- “The total number of shares that are free floating has not reduced. Thus, with the denominator not reducing, buybacks have not, on their own, raised earnings per share and would not, on their own, be expected to raise share prices.”

Quelle: FT

- “Where has that money gone? There are various reasons to issue equity, but one of the most important is to issue shares that can back up options offered to executives as incentives. (…) it looks like the bulk of last quarter’s repurchases went on stock options (aka wages). To be clear, options can make it very easy for those holding them to become very rich, if the strike price of the option is sufficiently generous. And they tend to be offered only to those who are already being paid far more than others. In macroeconomic terms, this is not the most beneficial use of the tax cut, because the marginal propensity to consume of those who are already rich when they receive a windfall will be less than the marginal propensity to consume of those who are poorer. Money distributed to the rich is more likely to be saved and less likely to be spent. And of course in political terms it doesn’t seem very fair.”

→ ft.com (Anmeldung erforderlich): “Authers’ Note: Hunting for yields is getting easier”, 14. Mai 2018