Chinas Schuldenfalle

Die Entwicklung in China gibt Anlass zur Hoffnung und Sorge zugleich, wie ich in der Diskussion heute Morgen zeigte. John Authers fasst es wie immer gut zusammen:

- “(…) many focus on the amount that China has been allowed to export to the rest of the world since joining the World Trade Organization in 2001. But trade relationships are two-sided. China’s role in the savage decline in U.S. manufacturing jobs is undeniable, but it also had a valuable role for the rest of the planet as the buyer of last resort. (…) China’s huge fiscal stimulus of late 2008 allowed import growth to resume, and was vital in stopping the Great Recession from turning into something much worse.” – bto: Das stimmt. Es war China, das mit massiven Konjunkturprogrammen die Weltwirtschaft stabilisiert hat.

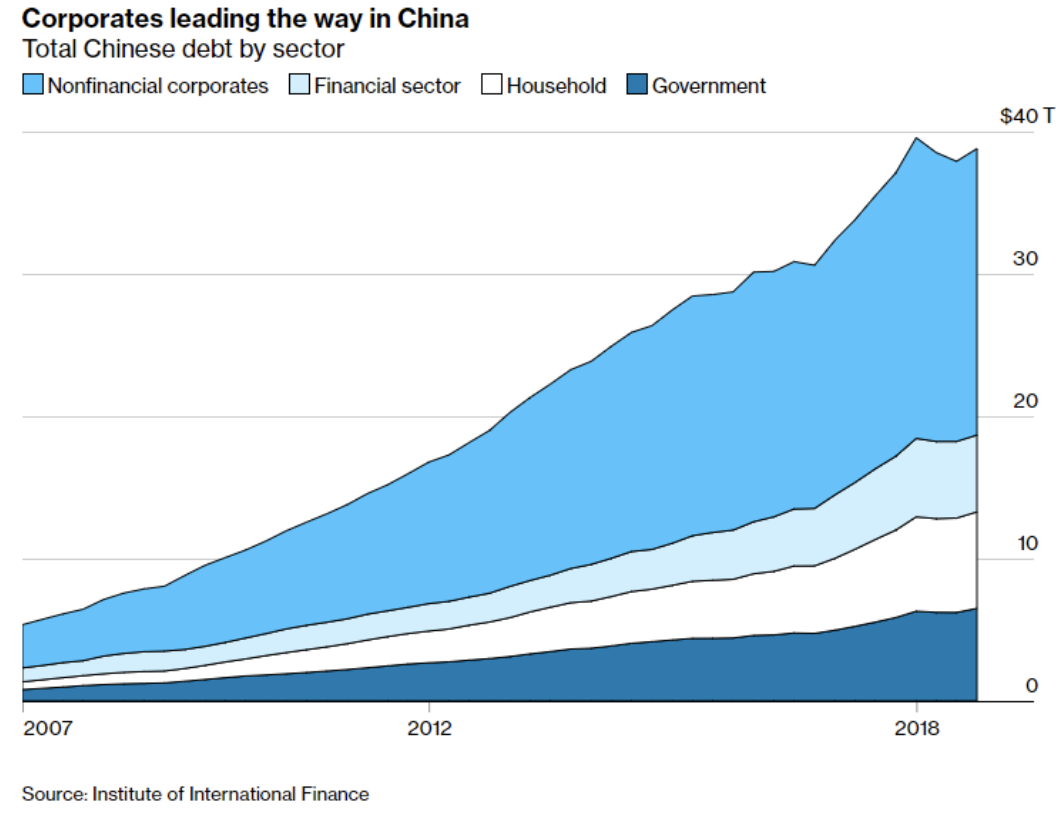

- “This is why so many care about Chinese credit, (…) At the end of last year, with China opening the credit taps again, risk markets around the world were able to rally in large part because of the belief that another Chinese period of reflation was on the way. (…) it is plain that investors badly want China to keep borrowing and pile on debt at an even faster rate.” – bto: weil es dann die Welt zieht.

- “If that is the short-term interest, however, there is a different longer-term interest, which is avoiding a massive credit crisis. (…) So in the short run there is a widespread interest in China continuing to borrow, and in the long run there is a fervent desire for the country to head off a debt crisis. How to reconcile these and avoid the debt trap?” – bto: Das ist wirklich eine gute Frage, die man übrigens auch mit Blick auf andere Regionen der Welt stellen könnte und sollte.

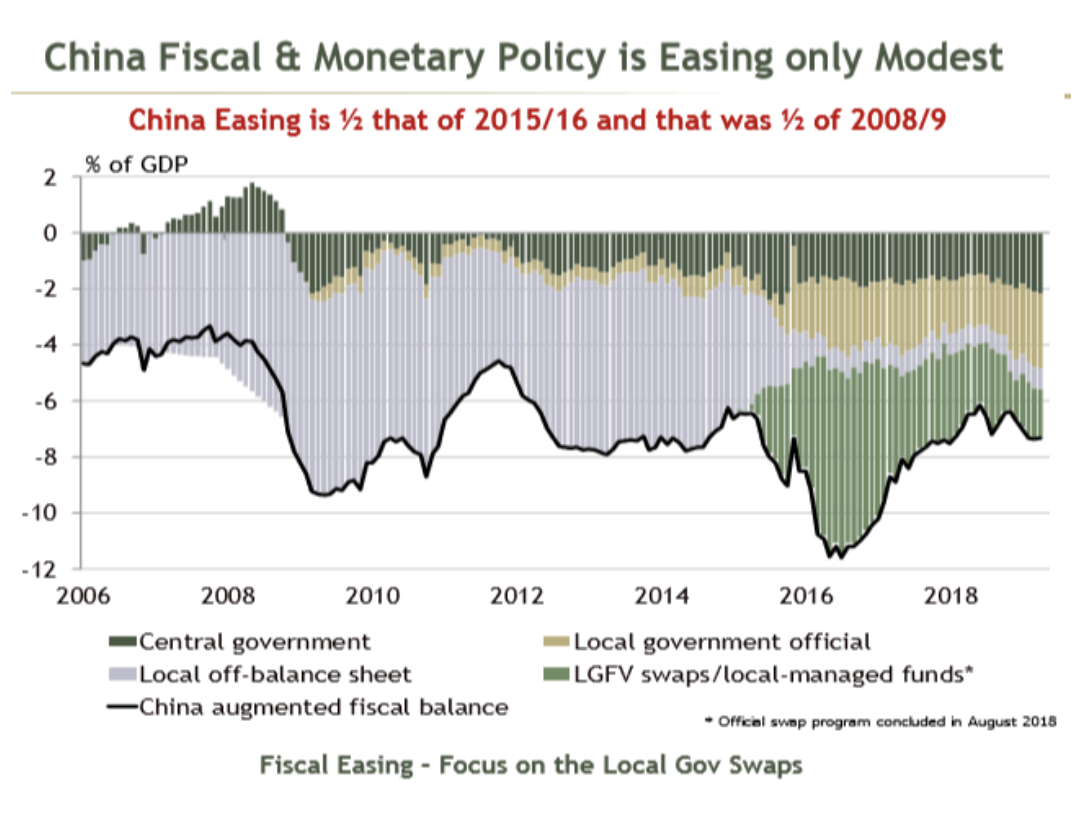

- “(…) President Xi Jinping has started to talk about financial security in the same way that he addresses national security, and that his assertion of authority has involved taking government control over debt. (…) This is important because the stimulus efforts of 2008 and 2016 were not primarily achieved with central government debt, but with local governments’ off-balance-sheet activity in 2008 and with swaps involving local government financing vehicles in 2016. (…) But armed with control over all forms of debt, both on- and off-balance-sheet, and at the local as well as the central government level, Xi has been able to reshape China’s credit landscape.” – bto: Ich muss gestehen, dass mich das nicht überzeugt. Das klingt so, als hätten die Führer Chinas eine Allmacht, die sie aber nicht haben.

- “China could become embroiled in a debt crisis arising from the increase in the burden of debt and the decline in capacity to shoulder it, but this does not seem a likely outcome. It is much more likely that debt will loom over the economy, manifesting itself as lower economic growth than as a crisis per se.” – bto: Das entspricht dem Szenario der sanften Landung, die bei uns auch nicht so richtig funktioniert.

- “(…) the following chart, compiled by Absolute Strategy Research of London, is very informative as it includes all forms of debt:”

- “There are two key takeaways. The first is that each measure of stimulus, when we look at the totality of debt as a proportion of GDP, has been far smaller than the one that came before it. The second is that the expansion of central government and official local government debt that aroused so much hope at the turn of the year was not about stimulating growth. Instead, it shows the hand of Xi in reducing vulnerability to a systemic crisis by ruthlessly reining in the excesses of the last two rounds of stimulus. Policy makers in the U.S. and Europe would have loved to have such power a decade ago. But the bottom line is that as China takes control over its financial system, its economy remains without the much hoped-for dose of stimulus.” – bto: Diese Sichtweise setzt voraus, dass man den Daten glauben darf. So stellt sich die Frage, was denn hinter LGFV swaps steht. Letztlich ist es auch eine Verschuldung der lokalen Regierungen, was mich zu dem Problem führt, dass ich der Beschreibung Authers zur Abbildung nicht folgen kann.

- “It is hard to imagine how the government can avoid the key challenge of the debt trap, other than by accommodating a proper and sustained deleveraging. (…) It looks as though just such a deleveraging is indeed being appropriately executed. Which is dreadful news in the short term for those hoping to avoid an economic slowdown both in China and the rest of the world.” – bto: was dann wirklich schlechte Nachrichten sind, vor allem, weil ich nicht an ein geordnetes Deleveraging glaube, schon gar nicht in einer Welt, in der die Exporte unter Druck sind.

Quelle ist wieder mal der exzellente kostenfreie Newsletter von John Authers, bei Bloomberg.