Albert Edwards: Das war erst der Vorgeschmack

Albert Edwards, Erfinder der Eiszeit-These, ist regelmäßiger Gast bei bto. Ähnlich pessimistisch, ist er genauso wie ich immer wieder Gegenstand von Spott. So hat er wohl elf der letzten zwei Crashs korrekt vorhergesagt. → Albert Edwards mahnt (erneut)

Der Punkt ist, dass wir beide – und viele andere auch – die grundlegenden Probleme sehen, aber immer wieder unterschätzen, dass Notenbanken und Politik bereit sind, das System bis über die Grenze zu manipulieren. So mag es auch diesmal sein. Dennoch hier die neuesten Überlegungen von Edwards und da nicht öffentlich verfügbar über Zero Hedge:

- “Edwards posits that while he agrees that US corporate taxation is anomalously high, ‚it is the timing of the fiscal stimulus that is utterly ridiculous and will only accelerate the collapse of US financial markets as the Fed hikes rates even more quickly.‘ (…) Trump’s tax cuts will so overheat the economy, that the outcome will be another deflationary crash.” – bto: ausgelöst durch kollabierende Assetmärkte.

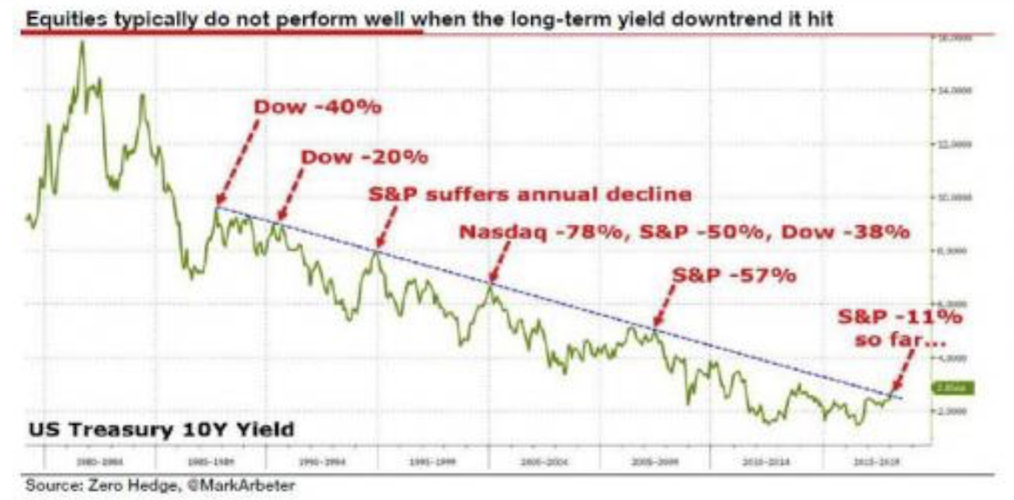

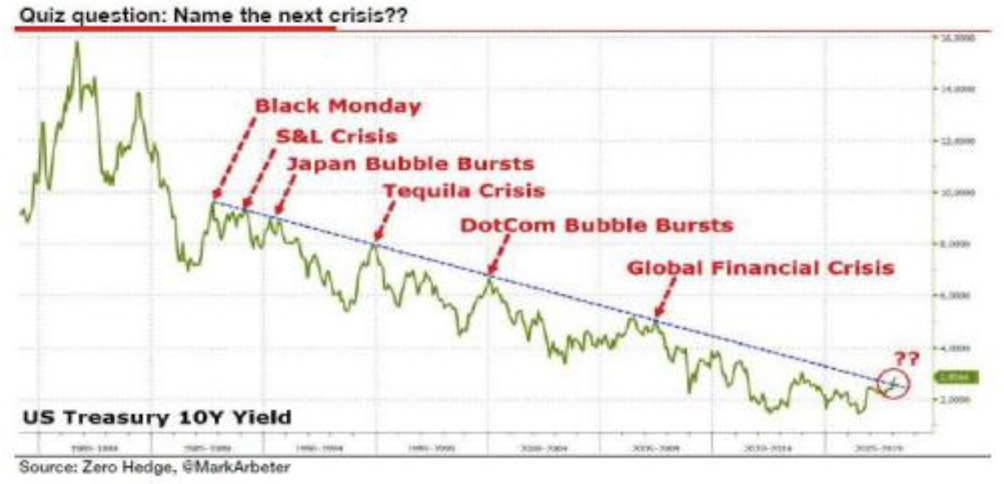

- “We are on the cusp of two key technical breakouts. Although most believe the US 10y has already broken above its long-term downtrend when it rose above 2.64%, our Technical Analysis team believe 3% is the proper breakout level to watch. Nevertheless as the chart below shows kissing this downtrend has typically been very bad news indeed for equity markets. How much do bond yields need to rise before equity markets break? After last week, I think we now know the answer; above 2.85% seems to be enough to cause equities to slump.” – bto: Und dazu dann das Chart, das zeigt, wie es immer zu Einbrüchen an den Börsen kam, wenn die Zinsen an den Trendkanal stießen:

Quelle: Zero Hedge, SocGen

- “One explanation I have seen cited as driving the dollar (and US bond prices) lower is the reckless fiscal stimulus that is being enacted in the US. Normally one will expect a loose fiscal policy and a tight(er) monetary policy to result in a stronger, not weaker dollar, but I have seen dollar weakness being attributed to the likely inflationary implications of the fiscal stimulus.” – bto: Ich denke, es ist einfach auch ein Zeichen exzessiver globaler Spekulation.

- “Trillion dollar deficits are just over the horizon, which will cause US government debt as a share of GDP to rise in the next several years to over 100 per cent. While debt levels alone cannot predict what will happen to bond yields, the markets fear that significant unfunded government borrowing—especially when the economy is doing well—will cause the Federal Reserve to carry on raising interest rates, in turn pushing bond yields higher. On current trends, this cyclical shift will eventually, maybe in 2019, puncture the stock market, corporate profits, and most likely the economy.” – bto: womit wir wieder bei dem Thema der steigenden Zinsen und damit verbundenen Problemen an den Märkten für alle Assets wären.

- “Whatever the arguments are in favour of tax reform in the US (and there are many), this is probably the singularly most irresponsible macro-stimulus seen in US history. To say it is ill-timed and ill-judged would be a massive understatement. (…) It will rapidly accelerate the end of the economic cycle.” – bto: Das Ende des Konjunkturzyklus wird zum Einbruch an den Märkten führen und damit deflationär auf die Realwirtschaft durchschlagen. Der Kernpunkt der Eiszeit-These.

- “Because of the starting point of US fiscal policy, I have a very high confidence that in the next, not so distant, US recession, the US general government deficit will soar way beyond the 13% the OECD say was the peak for 2009. A ruinous fiscal deficit in excess of 15% of GDP will be Trump’s legacy.” – bto: Dies wiederum spricht wirklich für einen schwachen Dollar –, nur wie wird es dann in Europa aussehen? Ich denke, nicht besser, weil die Weltwirtschaft sich einer erneuten Krise in den USA nicht entziehen kann.

- “(…) the risks to the equity markets from a further bond sell-off are twofold. First that the market raises its prediction of the number of Fed rate hikes it expects this year, and second and much more problematic, will there now be a re-appraisal of where Fed Funds are heading in the long-term?” – bto: Damit ist gemeint, dass es vielleicht doch keine “säkulare Stagnation” gibt und deshalb die Zinsen mehr steigen werden als bisher erwartet, also schneller und stärker. Und das wäre dann das Problem.

- “(…) wage inflation will begin to rise more quickly, driving market expectations of longterm Fed Funds higher. Just like the peak of the last two economic cycles, it will be the implosion of financial markets that causes the next recession. And President Trump’s grotesquely ill-timed fiscal stimulus will be identified in retrospect as a – if not the trigger.” – bto: Das wird wohl so sein. Die Grundlage für die erneute Krise wurde aber viel früher gelegt.

- “(…) here is the SocGen analyst’s conclusion: After some eighteen months of surprising to the downside, US wage and price inflation are rising briskly, putting intense downward pressure on financial markets. Yet another Fed-inspired financial Ponzi scheme now looks set to collapse into the deflationary dust. But the post-mortem will identify President Trump’s ludicrously timed fiscal stimulus as a key trigger for the collapse. A 15% deficit will be his legacy.“ – bto: und die wohl größte Krise des Systems. Die finale?