Zur Party bei den Junk Bonds

Ein weiterer Blick auf die verzerrende Wirkung der Geldpolitik, diesmal von David Stockman. Es ist alles irgendwie bekannt. Es lohnt sich aber, die Fakten nochmals in Erinnerung zu rufen:

- “The financial system is loaded with anomalies, deformations and mispricings—-outcomes which would never occur on an honest free market. For example, the junk bond yield at just 2% in Europe is now below that of the “risk-free” US treasury bond owing solely to the depredations of the ECB.” – bto: Ja, wir können es gar nicht oft genug sagen!

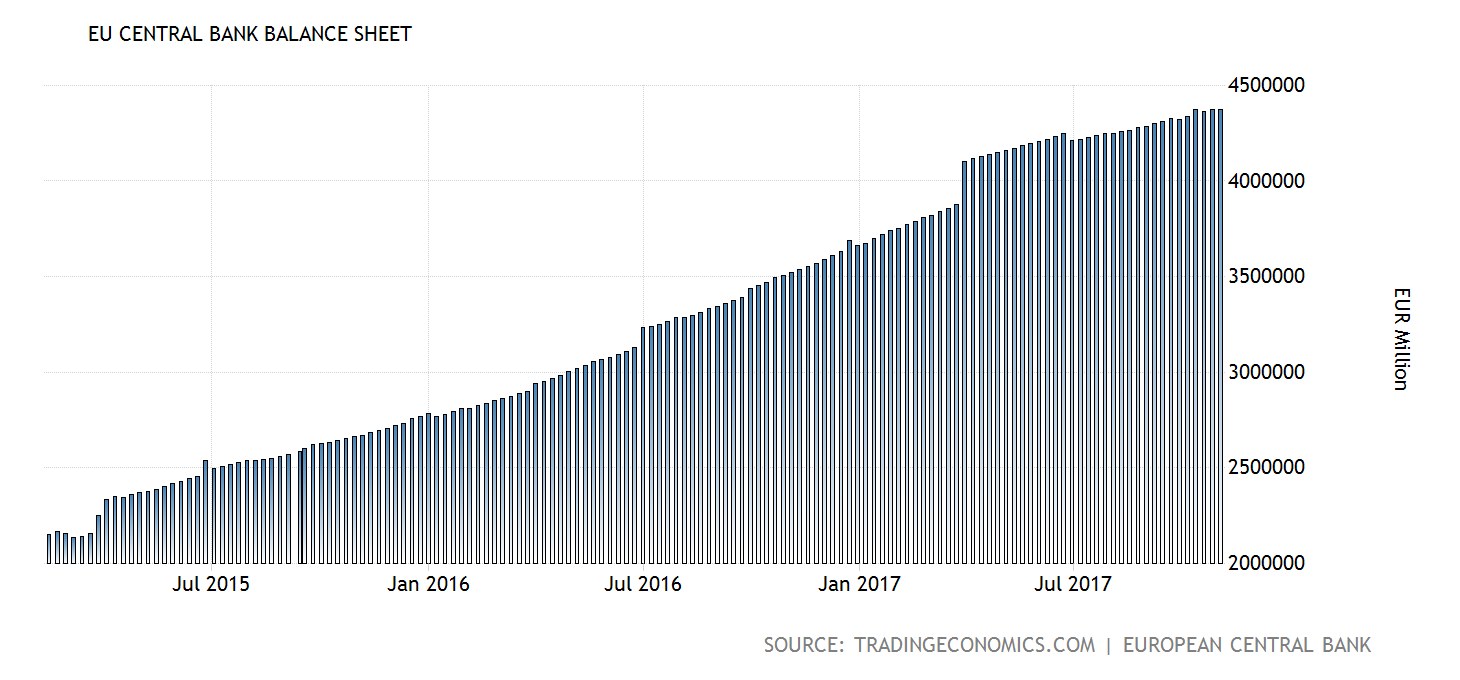

- “Indeed, madman Draghi has purchased $2.6 trillion of securities since launching QE in March 2015, and during the interim has actually bought more government debt than was issued by all the socialist governments of the EU-19 combined!” – bto: auf dem Weg in die Monetarisierung!

- “The ECB’s printing press became so parched for government debt to buy that it has ended up owning more than $120 billion of corporate bonds. In some recent cases, the ECB has actually taking down 20% or more of new corporate issues—an action that surely leaves the fastidious founders of its Bundesbank prodecessor turning in their graves.” – bto: was aber erlaubt, dass Bayer Monsanto übernimmt. Also führt die staatliche Subventionierung dazu, dass einzelne profitieren.

- “In turn, the ECB’s Big Fat Thumb on the investment grade scale stampeded fund managers into the junk market in quest of yield, especially for BB rated paper which makes up 75% of the European high yield market. So doing, these return hungry managers have crushed the the yield on the Merrill Lynch junk bond index, driving it down from 6.4% in early 2106 to an incredible 2.002% last week.” – bto: und das für riskante Anlagen!

- !In fact, the current lunatic euro-trash yield is completely off the historical charts. Euro-junk rarely yielded under 5% in the past, and had spiked to upwards of 10% at the time of Draghi’s “whatever it takes” ukase, which, in turn, was modest compared to the 25% blow-0ff high during the depths of the financial crisis.” – bto: Aber die Risiken sind weg, garantiert doch die EZB allen Zombies ewiges Leben?

Quelle: David Stockman

- “(…) by attracting tens of billions of yield-seeking capital into radically mispriced securities in pursuit of the giant windfalls depicted above, the ECB has not only set-up speculators for massive losses, but also badly distorted the macro-economy in the process. (…) Europe’s business sector has become populated with debt-ridden zombies which survive only because their interest carry costs have essentially been eliminated. Consequently, the free market’s essential function of pruning the deadwood and re-allocating inefficiently used resources has been stopped cold on much of the continent.” – bto: Aber darum geht es doch im großen Projekt der Illusionierung.

- “(…) North American issuers estimated to place more than $125 billion in the euro-debt market during 2017—including upwards of $20 billion of high yield bonds. The pitifully low yield on these issues, in turn, has been arbed across the Atlantic, meaning further suppression of rates in the New York dollar markets.” – bto: Auch die Ausländer freuen sich über das billige Geld von der EZB – nur konsequent.

- “Not only has the absolute yield level on junk been badly distorted by the ECB’s heavy handed buying (it now owns upward of 12% all euro-area corporate bonds), but the all important spread against the risk free rate has also been crushed. In recent months it actually broke through 150 basis points, representing half the level prevailing as recently as June 2016.” – bto: was für eine Entwicklung! Es hat sich für die Spekulation auf jeden Fall gelohnt!

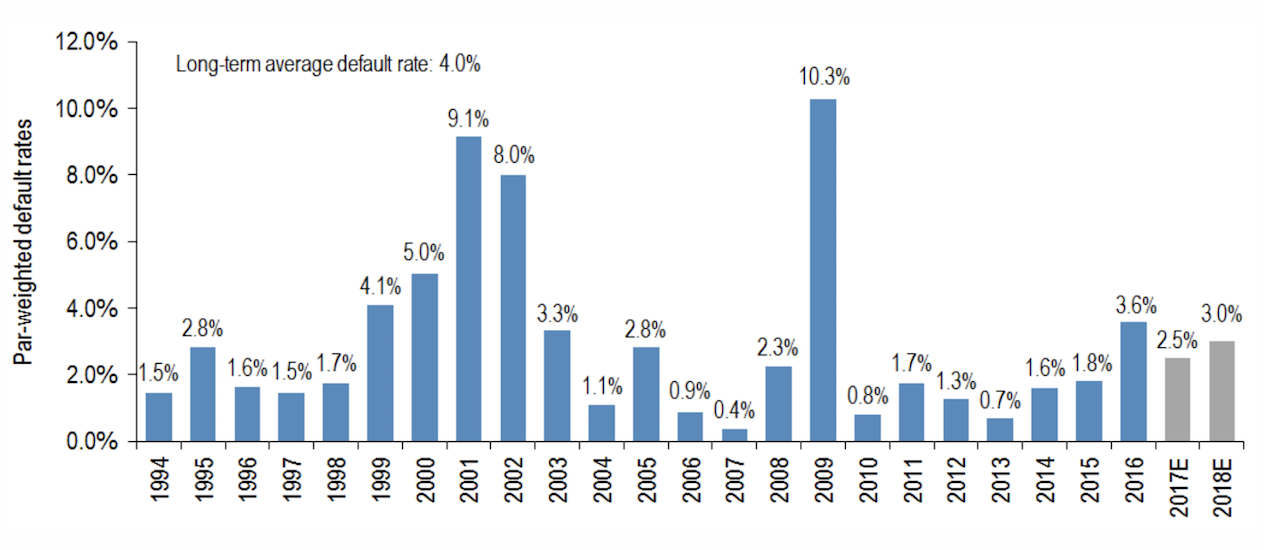

- “(…) credit loss rates have plunged into subterranean levels—so what’s to worry? Arguably, even today miserly 5.6% yield in the US junk market more than covers inflation and realized default rates of 2-3% recorded during recent years.”

- “This extend and pretend ‚refi‘ cycle is identical to what happened to the subprime mortgage market prior to the housing crash. Default rates were unusually low as long as the cripples could be refinanced, but when new mortgage funding dried up Warren Buffett’s famous aphorism about naked swimmers exposed by a receding tide came true in spades.” – bto: Die Frage ist nur, was es auslöst?

Quelle: David Stockman

- “The world’s $4 trillion junk debt market is the next poster boy for exactly that kind of springing default surge. If you look at maturity schedules, in fact, you see a huge bow-wave building-up from 2018-2022. Subtract seven years for the standard bond term and you get exactly the valley in default rates shown below for 2011 thru 2016. That is, the refi machine was working overtime.” – bto: ein schöner Zyklus, der von der Fed noch angefacht wurde.

- “Before the markets could be fully purged of the rotten credits which had built up earlier, the Fed flooded Wall Street with liquidity in 2001-2003 and again in 2008-09, thereby igniting a bid for deeply discounted junk as measured by yields that hit 20% or higher.” – bto: Es ist ein sich immer mehr verstärkender Zyklus.

- “The Fed is out of dry powder and stranded close to the zero-bound, as is the ECB, the BOJ, the BOE and most other central banks. Accordingly, this time there will be no massive central bank reflation and no consequent rip-your-face-off rally in busted junk.” – bto: Oder fehlen Stockman und mir nur die Fantasie? Könnte es doch irgendwie gehen?

- “Yet in the absence of extend and pretend refi, defaults will rise significantly, thereby triggering capital flight from the junk market. And then there will follow a downward spiral of busted maturities and even further increases in the default rate.” – bto: Stimmt, SOFERN es zu der Entwicklung kommt.

- “Needless to say, restoration of honest price discovery on Wall Street is not going to happen any time soon with a “low interest guy” in the Oval Office and another one soon to take the helm at the Fed. Indeed, Jerome Powell voted for the destructive financial repression described above 44 consecutive times during his tenure on the Fed since early 2012.” – bto: Klar, wer will denn auch einen deflationären Kollaps riskieren?

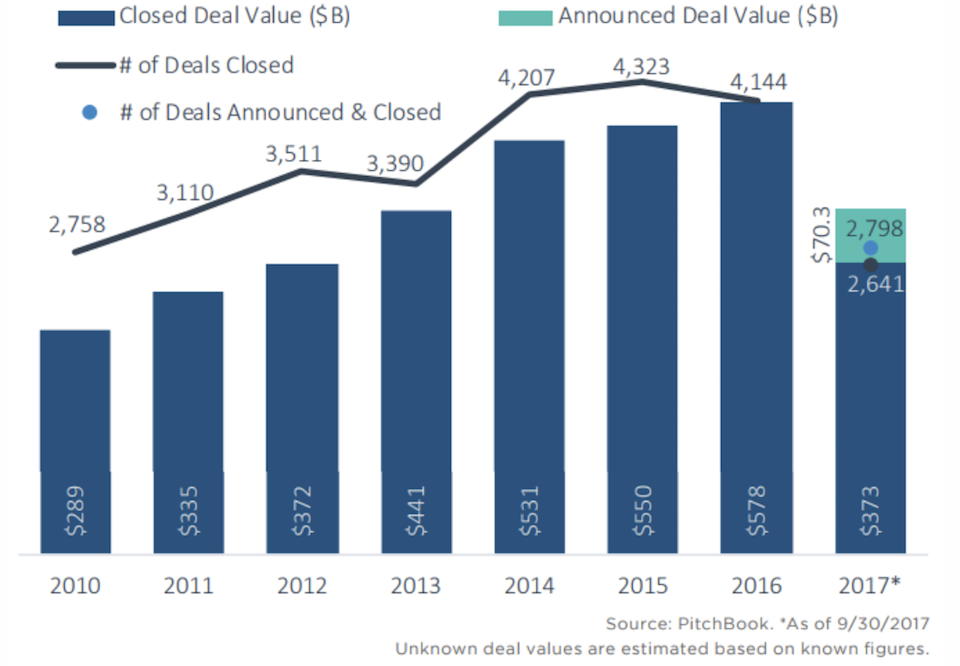

- “Not surprisingly, LBO volumes have been steadily building—although the number of companies left in America that have not been squeezed lean and mean by existing options chasing managements are few and far between. In fact, an increasing share of buyouts are second and third generation LBOs—–the work of private equity punters swapping their debt mules.” – bto: was ebenfalls nicht gesund ist.

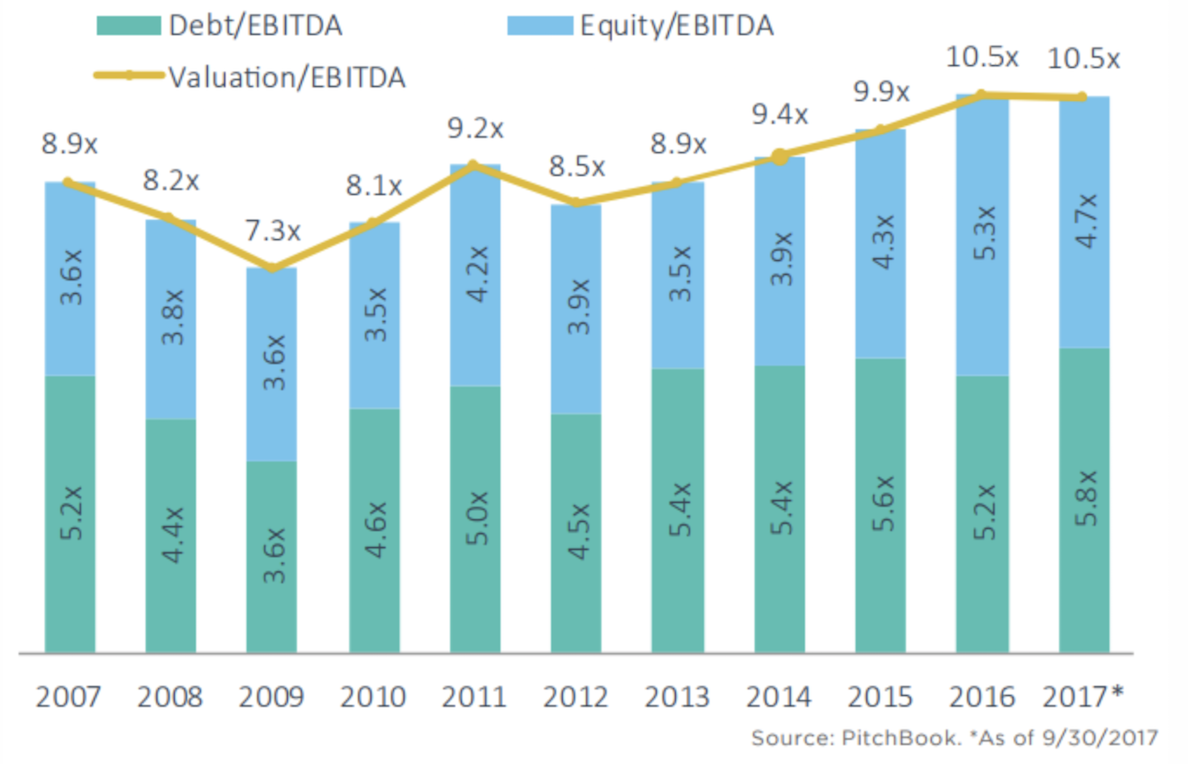

- “And they are doing so at the highest prices in history— (…) Stated differently, the private equity boys are pricing deals based on the artificially low cost of the junk debt in their capital structures—plus an equity multiple that assumes that current stock market bubble will never correct. Indeed, as shown below, the equity multiple of 4.7X is now 30% higherthan it was back in 2007 on the eve of the last great bubble collapse.” – bto: was eindeutig ein Warnzeichen ist.

Quelle: David Stockman

- “The present world of monetary central planning and relentless financial repression has produced endless deformations and anomalies that would not exist on the free market. They are therefore not sustainable in the present world, either, because at the end of the day even central banks cannot defy the laws of economics and sound finance indefinitely.” – bto: Das wird sich weisen. Denke, es ist eine Frage der Zeit.

→ Contra the Corner: “Mind the Junk—-This Ain’t Your Grandfather’s Capitali