Das Rätsel steigender Aktienbörsen

Es ist eine Frage, die mir immer wieder gestellt wird: Warum steigen die Aktien weiter, wenn doch die Privatinvestoren mehr verkaufen, die Wirtschaftsaussichten sich verschlechtern und die Gewinne stagnieren oder rückläufig sind. Dem Rätsel ging auch die Société Generale (SocGen) nach und Zero Hedge verdanken wir, dass wir Zugriff darauf bekommen:

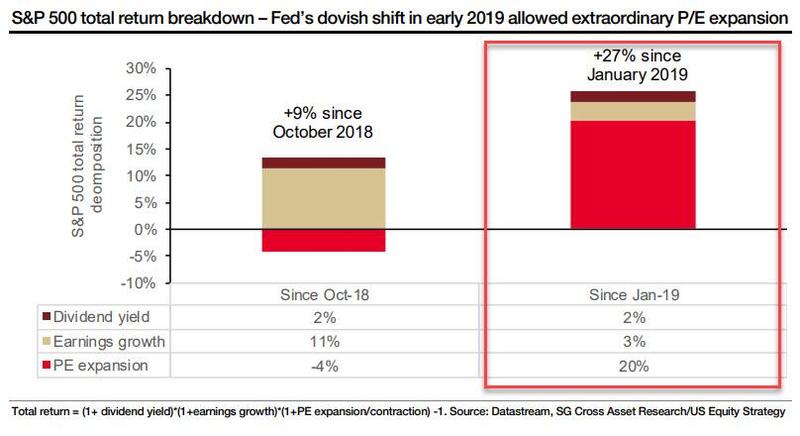

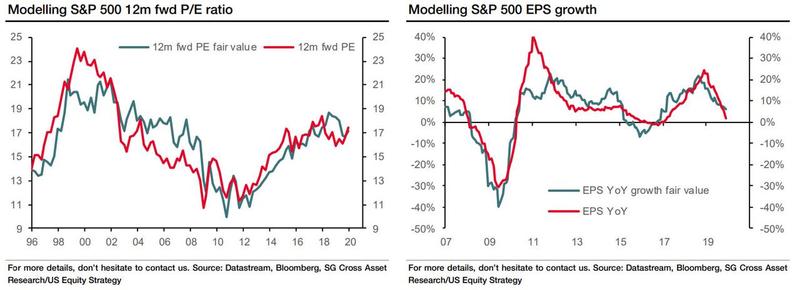

- “(…) if one looks at a breakdown of S&P 500 total returns, we can make two observations: First, since October 2018, the market’s performance has been driven entirely by earnings growth, while P/E has been a negative contributor: end-2018 recession fears and Fed tightening are factored into the numbers. Second, and more importantly, the Fed’s dovish shift in early 2019 facilitated an extraordinary P/E expansion. Indeed, as shown in the chart below, since January 2019, the biggest contributor by far to S&P returns has been PE expansion.” – bto: also von der Bereitschaft, am Markt höhere Preise zu bezahlen:

Quelle: SocGen, Zero Hedge

- “Of course, 2019 was a year in which both the Federal Reserve and the European Central Bank eased monetary policy, pushing long-term real interest rates down about 100bp in the US and 50bp in the Euro area. About how much did this lift risky assets? A standard approach based on the equity risk premium concept would say that central bank intervention accounted “for almost all of the price return since the start of the year.” That’s not us, that’s Goldman.” – bto: Es wirkt also. Billiges Geld führt zur Inflation an den Aktienmärkten.

- “(…) to have a view on asset returns in 2020 one has to understand what caused the market’s impressive 24% increase in 2019. Here, as SocGen notes, the question to ask is ‘what drove this P/E expansion since the start of the year, apart from the Fed’s dovish shift? And is that sustainable? Buybacks and a lack of market liquidity played a major role.’” – bto: weil die Unternehmen mit immer höheren Schulden die eigenen Aktien zurückkaufen.

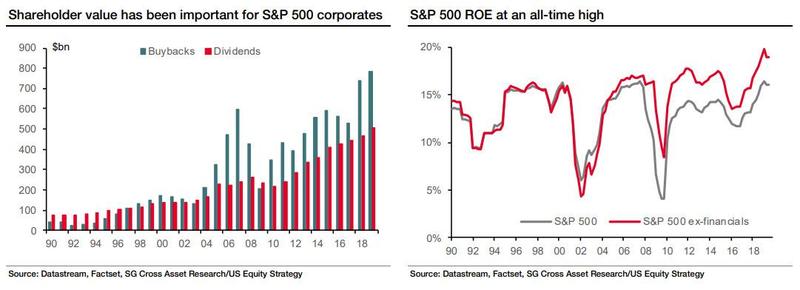

- “(…) SocGen notes that Trump’s late-2017 Tax Cuts Tax Cuts and Jobs Act marked a shift and contributed massively to the wave of share repurchases over the past two years. The amounts steadily increased to a record high in 2Q19 – equivalent to a 3.2% buyback yield, which comes on top of a 2.2% dividend yield. Meanwhile, the S&P 500 return on equity is currently at an all-time-high.”

Quelle: SocGen, Zero Hedge

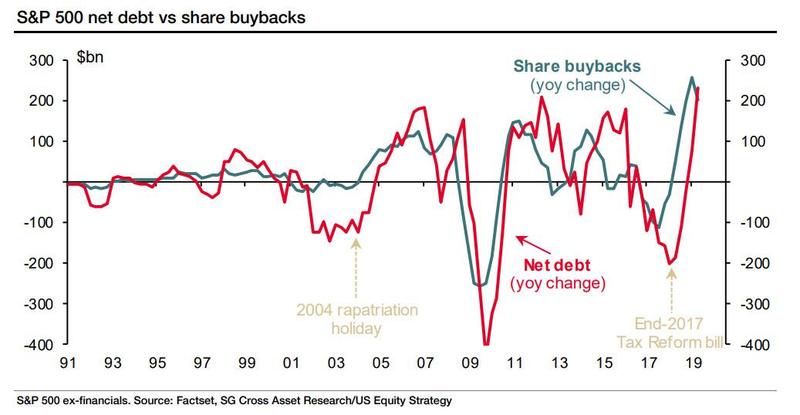

- “(…) the vast majority of these buybacks were funded by new debt issuance, most of it in the BBB bucket. Ironically, none other than former NY Fed president Bill Dudley was lamenting last week the ‘BBB-Bulge’, warning that trillions in fallen angles could soon flood the junk bond market. They certainly can, and the irony is that the next bond crisis will be the result of massive issuance to fund buybacks, which in turn sent stocks to all time highs and boost management cash compensation to record levels. Needless to say, the reverse will not be pleasant for equities.” – bto: Es sei denn, es gäbe den Startschuss für MMT …

Quelle: SocGen, Zero Hedge

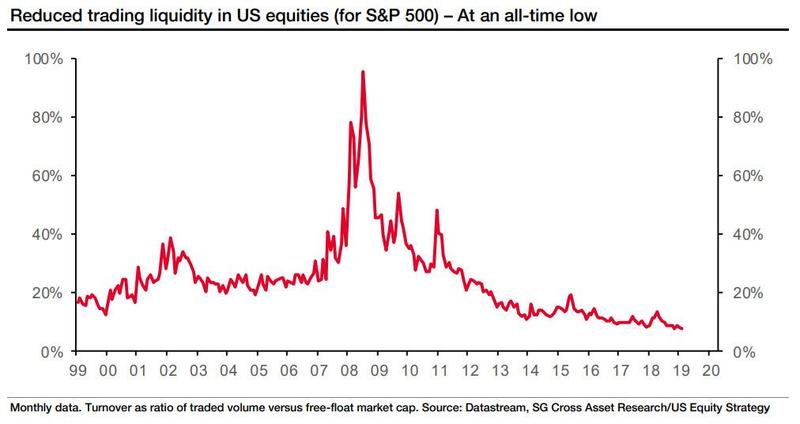

- “Besides ruinous central bank policies encouraging management teams to go out and issue record amounts of debt which they can then use to repurchase stock, there is another reason behind the year’s tremendous, if euphoria-less, ascent: ‘the lack of market liquidity, as measured by S&P 500 turnover – the ratio of trading volume vs free float market capitalization – has exacerbated the impact of share repurchases on US equities’, according to the French bank. Indeed, trading volume has been on a downtrend since 2008, and Socgen expect this to continue.” – bto: nach dem Motto, die Nachfrage traf auf wenig Angebot, weil nicht ausreichend gehandelt wurde.

- “The implication is simple: one substantial buyback program, like say Apple’s latest $75 billion stock repurchase authorization, (after it bought back $100 billion in 2018) has an outsized impact not only on the price of AAPL stock, but the entire market too. That’s precisely what has happened in a year which started with AAPL cutting guidance, only to soar 86% since.” – bto: Es ist doch schön, wenn durch die Buybacks nicht nur die eigene Aktie profitiert, sondern gleich alle.

Quelle: SocGen, Zero Hedge

- “(…) retail investors are more likely to shift from a risk-off mode to a risk-on mode next year, by reversing this year’s equity fund selling and by reducing drastically this year’s extreme bond fund buying. Such a dramatic flow shift would be equivalent to another Great Rotation, i.e. a repeat of the abrupt shift away from retail investors accumulating bond funds to buying equity funds seen previously in 2013. In other words, 2020 would be the year of Great Rotation II, in a repeat of 2013 the year of Great Rotation I.” – bto: Also müssen die Privaten einsteigen, damit die Profis die Gewinne mitnehmen können. Wie immer.

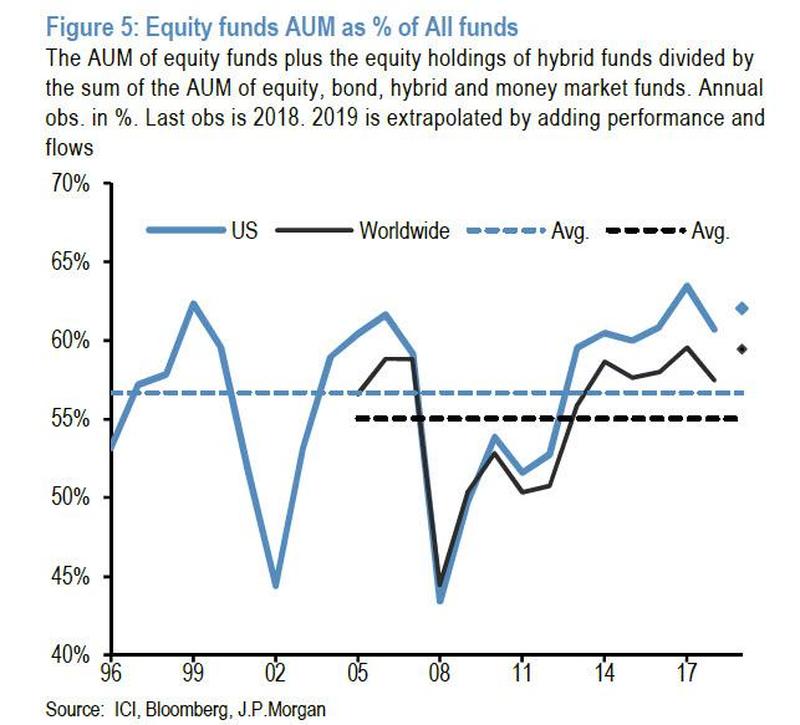

- ABER: “(…) contrary to conventional wisdom, investors already have near record equity exposure: (…) This implies that retail investors are entering 2020 with only modestly lower equity position relative to the highs of Q3 of 2018 or end 2017. In addition, the current equity position is very close to the two previous equity market peaks of 2007 or 2000.” – bto: Alle sind investiert trotz der Verkäufe in diesem Jahr. Wer soll dann noch kaufen – außer den Notenbanken??

Quelle: SocGen, Zero Hedge

- “So for JPM’s Great Rotation II thesis to play out next year, retail investors would need to accept equity weightings that are even higher than the previous equity market peaks of 2007 or 2000. If they do, this would represent a structural change in retail investors’ asset allocation, perhaps justified by structurally lower cash and bond yields vs. equity yields, compared to the previous 2007 and 2000 cycles.” – bto: denkbar bei einer Kaufpanik.

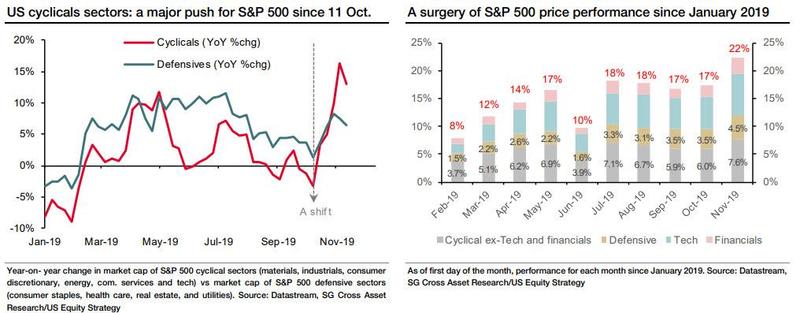

- “Paraphrasing JPM in a slightly less politically correct way, there is an unprecedented need for institutions to dump their stock holdings on retail investors, and only a reversal in retail outflows can help push stocks to new all time highs in 2020. (…) That is JPM’s take on 2020. What about SocGen’s? (…) SocGen on Friday suggest, for the market to have material upside in 2020, it will be key for the leadership to shift from defensives to cyclicals, as the global economic outlook shifts to an optimistic one. Alas, that would also mean that bond yields would surge well above 2%, effectively planting the seeds of the market’s own destruction, because the higher yields rise, the more likely central banks will be to turn hawkish again, and so we would go back to a Q3 2018 scenario.” – bto: Gut möglich, dass die Notenbanken das anders sehen und bewusst die Zinsen trotzdem tief halten.

Quelle: SocGen, Zero Hedge

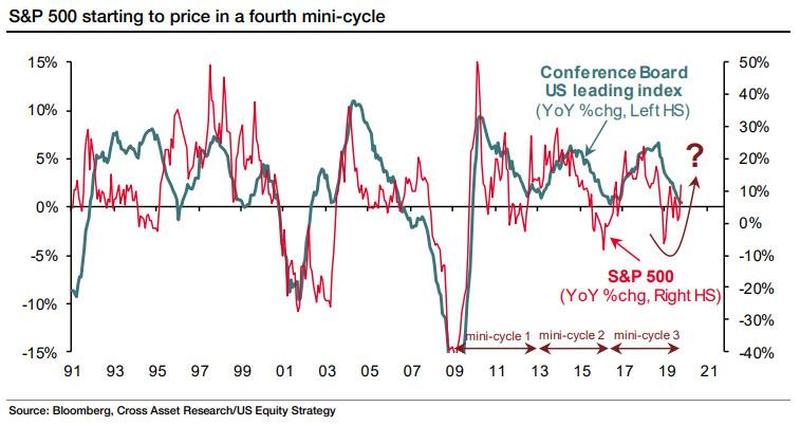

- “Rotation aside, SocGen also points out that if one looks at the Conference Board US Leading Economic Index, the US has undergone three mini-cycles since the 2007 Great Financial Crisis (GFC).

Quelle: SocGen, Zero Hedge

- “Putting all of this together, SocGen believes that we are facing two possible scenarios in 2020:

1) a mild recession in 2020, which is the bank’s central scenario, with two quarters of negative GDP growth in 2Q and 3Q, at a respective -0.7% and -0.8%, with full-year GDP growth at +0.7%; or

2) the start of a fourth mini-cycle. The bank considers here the latter scenario and its potential impact on the S&P 500. Given the characteristics of the previous three mini-cycles – the French bank determines the exact dates by looking at the US Leading Economic Index and the UST 10y bond yield – and finds they last 3.5 years on average. In other words, should there be a fourth mini-cycle thanks to the massive central bank liquidity injection in 2019, the current economic cycle would be extended to 2023-24.” – bto: PARTY! Das wäre doch wirklich super und sollte auch der Eurozone etwas helfen. - “It would also put the recent S&P meltup in its proper context, because from a price perspective, SocGen believes that ‘the lessons of previous mini-cycles could support a melt-up in the S&P 500 to 3,400.’ However, for that to be sustainable, the French bank believes there will be a need for earnings to grow next year, as the divergence between fundamentals (E) on the one hand, and market anticipations and low interest rates (P/E) on the other, cannot be that wide. For now, that appears unlikely.

Quelle: SocGen, Zero Hedge

- “The bottom line is simple: ‘so much liquidity has been injected in the stock market over the past years, it is now almost impossible to withdraw it.’ It also means that the Fed can no longer afford even a modest drop in the market (as we saw in Q4 2018) because (…) it would lead to contagion effect to the real economy and would cultminate with a full-blown economic depression, one with catastrophic consequences for the status quo, and the Fed itself.” – bto: Ja, wir sind gezwungen, immer mehr die Märkte aufzupumpen, um die Depression zu verhindern.

- “(…) central banks are henceforth perpetually trapped into injecting liquidity at even the slightest sign of trouble, as the alternative – after 10 years of constantly bailing out the market – is unthinkable. The alternative? A recession, or a bear market, would likely be the trigger event that ends the fiat system as we know it, one intermediated by central banks.