Das Ende der Globalisierung?

Im Podcast am Sonntag (11.12.2022) geht es erneut um die Zukunft der Globalisierung. Zur Einstimmung gibt es heute und morgen interessante Beiträge zum Thema. So machen sich Journalisten der FINANCIAL TIMES (FT), gemeinsam mit Adam Tooze, Gedanken über die Zukunft der Globalisierung. Kernaussage: Der vorläufige Höhepunkt liegt hinter uns. Nun, das kann niemanden überraschen und ist eine Tendenz, die mit der Finanzkrise begann. Dennoch ist es lohnend, die Konsequenzen zu durchdenken:

- „In September 1981, it was recently pointed out to us, few people would have recognized that we were at the high water mark for interest rates or appreciated how transformational figures such as Reagan, Thatcher, and Volcker would turn out to be. Grand theses about the direction of history sell books but age badly. Understanding the present is hard enough.“ – bto: Es war ein historischer Wendepunkt, der zu Liberalisierung, aber letztlich auch zu Finanzialisierung mit allen negativen Nebenwirkungen führte.

- „(…) there are a number of big changes taking place simultaneously, and the pace of many of those changes appears to have been accelerated by the pandemic and Russia’s war in Ukraine. To an extent, this is obvious. Brexit, the election of Trump, the collapse of the TPP, rising tensions between China and the US, the 40-year high in inflation — all this is in front of our noses. Yet it is not obvious how much any of this will actually affect the way trade is done, markets operate, or capital is priced.“ – bto: Es ist nicht klar, ob es sich um eine Trendwende oder eine kurze Pause im bestehenden Trend handelt. Wenn es eine Trendwende ist, wird sich das Umfeld massiv ändern und damit auch die Lage an den Finanzmärkten.

- „Unhedged’s guess is that there will be meaningful impacts. The world of the past several decades has gained from low rates, low inflation and growing global ties under liberal-democratic hegemony. We think that world is on its way out, and put the key changes into four categories: geopolitical shifts, the rise of populism, the energy transition, and demographics.“ – bto: Damit wird es jenen, denen es in den letzten Jahrzehnten gut erging, schlechter gehen.

- „In geopolitics, borders are hardening. The US and China are pulling apart in fits and starts, especially where technology is concerned — with US restrictions on Huawei, and threats to revoke US listings of other Chinese tech firms matching China’s long standing limits on US tech giants operations in China.“ – bto: Ja, die Zeiten, in denen die Amerikaner einfach die Produktion nach China verlagert haben, sind zu Ende.

- „US foreign direct investment in China peaked in 2008 at $21bn and has since fallen to $9bn as of 2020. Chinese FDI flows to the US have also stalled. American businesses in China report lost sales, consumer boycotts and suffocating uncertainty — some of which is Washington’s doing.“ – bto: Es gibt die Spaltung.

- „The Ukraine war and the sanctions regime that have followed will bring this balkanization into the financial realm, as the sanctioning of Russia’s central bank puts other regimes, including China’s, on notice. Martin Wolf recently wrote in the FT about what might result from the ‚weaponisation‘ of reserve currencies.“ – bto: Siehe bto-Beitrag vom 4. April 2022.

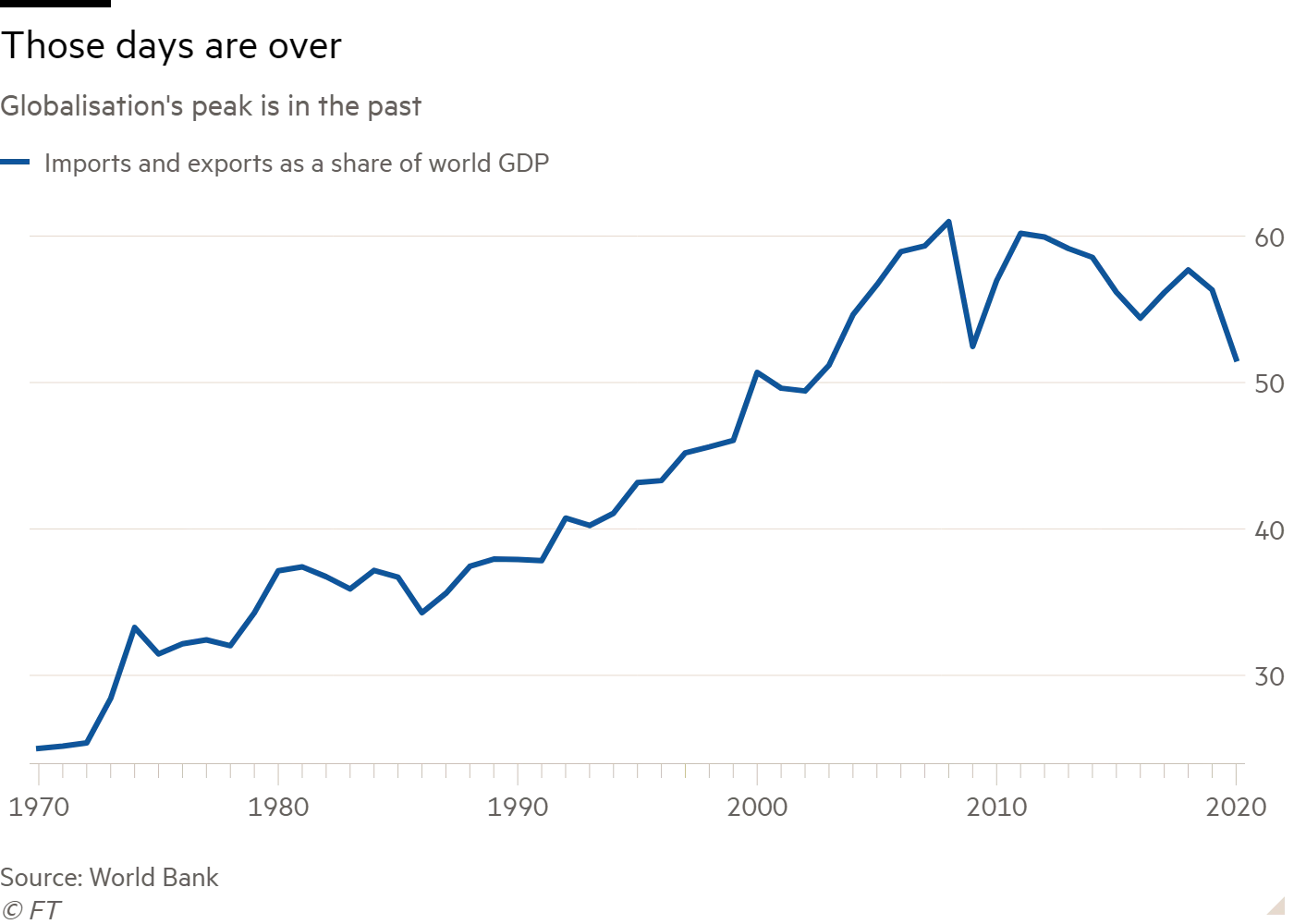

- „Even before the war, trade as a portion of global GDP had been flatlining. Recent flare-ups will reinforce a pattern that was already in place.“ – bto: Und das lag nicht nur an Donald Trump.

Quelle: FINANCIAL TIMES

- „A more balkanized word, potentially split along a democratic/authoritarian axis, will not enjoy the deflationary benefits of a more unified one. Michael Hartnett of Bank of America — perhaps Wall Street’s leading adherent to regime change view — thinks that it also heralds a shift in stock market leadership: With the balkanization of the global financial system and internet, you don’t get the benefits of scale [tech thrives on]. Then liquidity dries up [as policy tightens and rates rise]. What kills a bull market in tech is saturation and regulation … for national security reasons regulation tightens, at the same time as rates go up, so valuations should go down, and the stuff that is most egregiously overvalued is damaged the most. That happened already for unprofitable tech, and we have not seen it yet for profitable tech … tech is going to be the worst performing sector in the 2020s.“ – bto: Rohstoffe dürften das beste Investment sein.

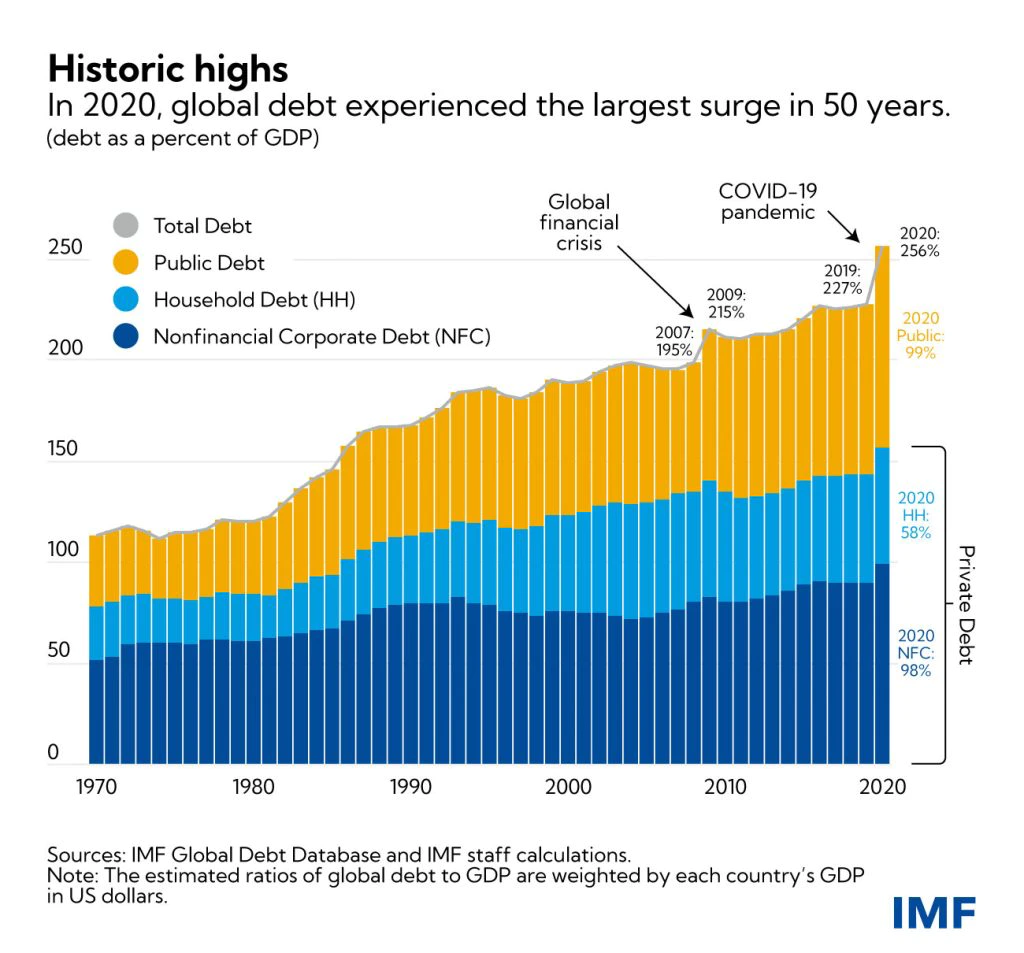

- „The post-pandemic manifestation of populism in politics is the addition of fiscal profligacy to the easy monetary policies that have characterised the decade since the financial crisis. Debt has spiked, and the policial temptation to deploy fiscal alongside monetary stimulus, after combination proved its power in the pandemic, will not prove easy to resist.“ – bto: Vor allem, wenn man wie in der EU / Eurozone andere hat, die dafür bezahlen!

Quelle: Internationaler Währungsfonds (IWF)

- „Historic public debt loads are not in themselves catastrophic. But combined with rising interest rates, debt-servicing burdens around the world will grow. Some governments will face a nasty choice — fiscal austerity or fully monetising the debt. The former will probably hurt growth; the latter could stoke inflation. Both are likely to be unpopular, and could further embolden populists playing to real anxieties. A financial crisis can’t be ruled out.“ – bto: Das alles ist aber auch die direkte Folge des Umfelds der letzten Jahrzehnte und somit einer der Treiber.

- „The energy transition is proving to be inflationary in two respects: investment in it is driving the price of hard commodities, while oil prices rise due to weak supply, driven by environmental policies, investor demands for high returns, and possibly the simple exhaustion of easily accessible reserves in the ground.“ – bto: So ist es. Diese Politik wird die Inflation nach oben treiben und damit die sozialen Spannungen deutlich verschärfen.

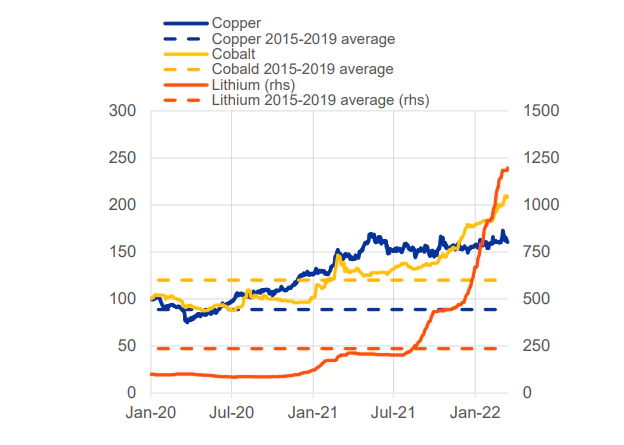

- „Isabel Schnabel of the ECB provided a good summary of the first inflationary effect in a speech about policy responses to greenflation: Most green technologies require significant amounts of metals and minerals, such as copper, lithium and cobalt, especially during the transition period. Electric vehicles, for example, use over six times more minerals than their conventional counterparts. An offshore wind plant requires over seven times the amount of copper compared with a gas-fired plant. No matter which path to decarbonisation we will ultimately follow, green technologies are set to account for the lion’s share of the growth in demand for most metals and minerals in the foreseeable future. (…) She provides this eye-popping chart of percent changes of key ‘green’ metal prices.“ – bto: Das wirft die Frage auf, ob Atomkraft wirklich so schlecht ist. Denn sie braucht deutlich weniger Ressourcen und Fläche.

Quelle: Europäische Zentralbank (EZB)

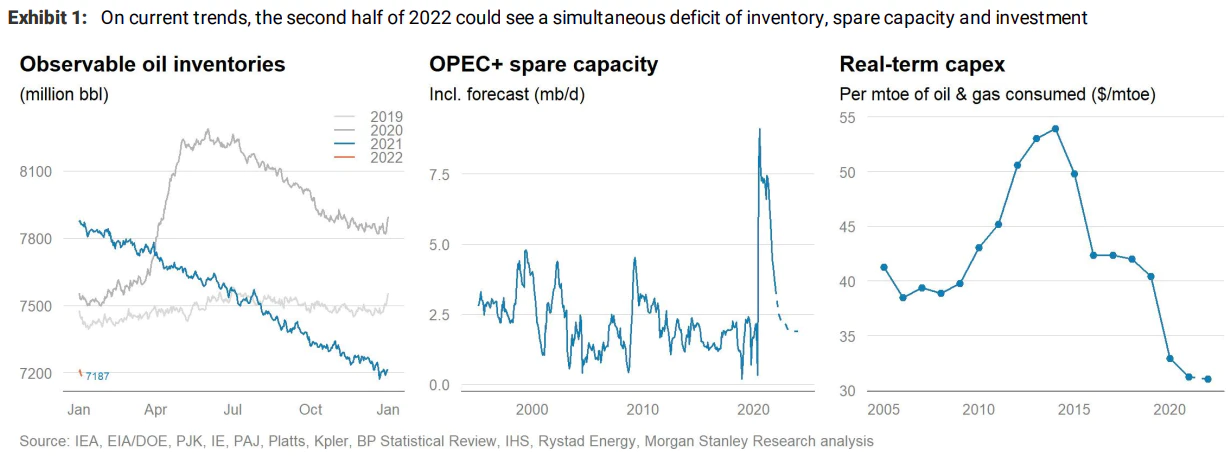

- „The likelihood of lasting upward pressure on oil prices is neatly described in this graph from Morgan Stanley, showing historically low inventories above ground, diminishing spare capacity among Opec countries, and low investment.“ – bto: Der Chart hat es in sich. Man kann eigentlich jeden Kursrückgang nur dazu nutzen, mehr Ölaktien zu kaufen.

Quelle: Morgan Stanley

- „Many of these emerging trends point towards either higher interest rates or higher inflation, or both. Demographic changes, specifically the ageing of the global population, could well exacerbate those effects. This argument’s most well-known proponents are the economists Charles Goodhart and Manoj Pradhan. (…) The Goodhart/Pradhan view is controversial, but there is no doubting the scale of the demographic shift that is taking place, with China at the forefront of it. It will matter, even if we are not sure how.“ – bto: Beide Seiten der Argumentation habe ich ausführlich bei bto beleuchtet.

- „(…) we are arguing is that geopolitical tension, populist fiscal policy, the energy transition, and an ageing world are all important, all coming to a head simultaneously, and are all discontinuous with the low rate, low inflation, high integration, hegemonically liberal-democratic world we have enjoyed since 1980s. That era does seem to be dying, even if we can’t be sure yet what era is being born.“ – bto: Das stimmt, und zwar auch ohne den Krieg in der Ukraine.