Vor dem nächsten Minsky-Moment?

Fassen wir die Lage nüchtern zusammen. Zehn Jahre “danach” wird immer deutlicher, wir sind “mittendrin”. Und zwar wie. Die Pause dürfte nicht mehr so lange andauern, wie ein paar Charts der Nedbank zeigen, die Zero Hedge präsentiert hat:

- “As key signposts of the crisis aftermath, Nedbank first highlights the global velocity of money (the number of times a US dollar is used to purchase goods or services) which is currently at or near an all-time low, and certainly less than one.” – bto: Das zeigt, dass die Wirkung der Geldpolitik abnimmt. Es ist immer weniger wirkungsvoll, zusätzliches Geld und Schulden zu schaffen:

- “This collapse in dollar velocity – a culprit for moribund economic growth – has taken place despite the efforts of global CBs to lower interest rates to record-low levels and pump excess liquidity into the financial system. And while the low VoM reflects balance sheet constraints, subdued animal spirits and socioeconomic problems, it is mostly a function of global QE which has soaked up excess reserves and prevented money creation using the convention, commercial bank loan channel. ‚We believe that the excess liquidity pumped into the global economy drove asset prices higher, perpetuating the credit cycle at the expense of the global economy‘ Nedbank writes.” – bto: was unstrittig ist.

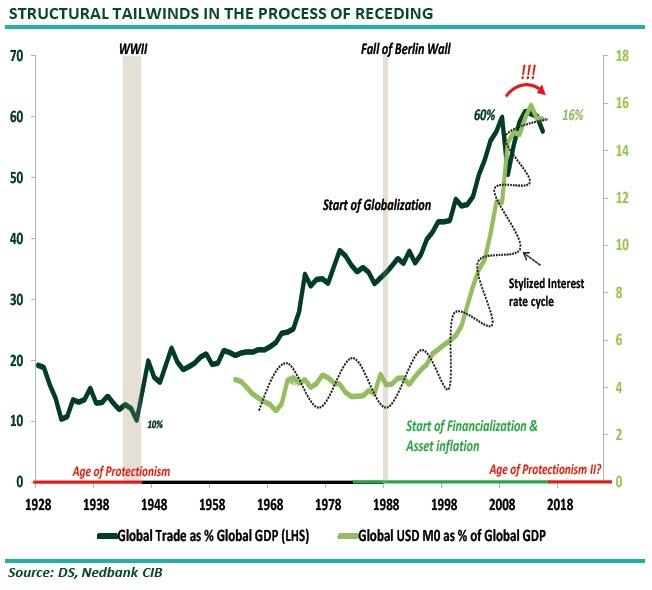

- “More important (…) is the reserve currency role of the dollar in today’s global economy: since the 1980s, the US economy (trade deficit) has supplied the world with a large US dollar monetary base (a cumulative total of $12 trillion in M0). As a result of the US dollar deluge, the the US dollar monetary base as a percentage of global GDP has grown from 3 % in 1980 to 16 % currently.” – bto: was wiederum nichts anderes bedeutet, als dass die US-Dollar-Schulden hochgegangen sind.

- “(…) globalization was largely a byproduct of this global dollarization, which combined with growth in the US dollar monetary base, was a structural tailwind for global trade and also for the financial system. (…) the role of the dollar was a boon for asset prices and the financial sector, as the monetary base kept growing without much concern from the authorities. On top of this, the world found new ways of creating leverage in the financial system (an unregulated shadow-banking system), which fuelled asset prices. However, after the GFC – and for the first time since the 1980s – both these structural tailwinds have lost momentum, becoming headwinds for the global economy and financial system.” – bto: Es ist schon beeindruckend, wie stark die USD-Geldmenge relativ zum Welt-BIP gewachsen ist. Ausgangspunkt war Loslösung vom Gold und Deregulierung.

- “(…) the reversal of globalization, and the rising role of geopolitics (protectionist policies from the US and China competing for hegemonic power) are likely to starve the world of US dollars, leaving the global economy and financial markets vulnerable to deflationary pressures.” – bto: weil alle sich verzweifelt Dollar beschaffen müssen, um ihren Verpflichtungen nachzukommen.

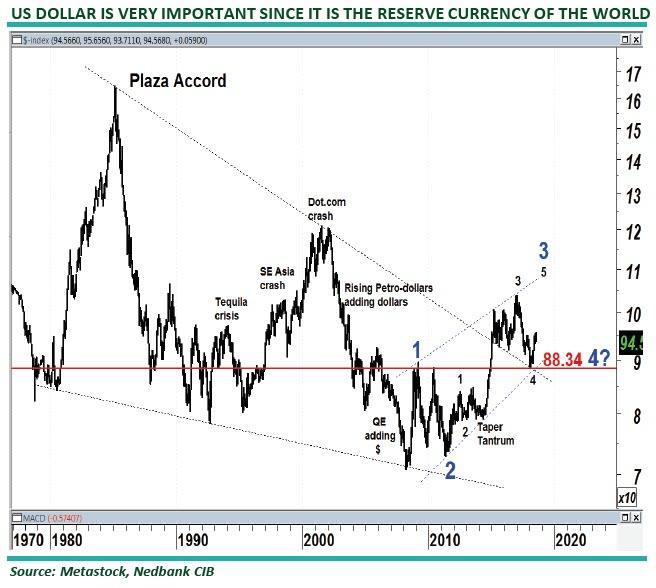

- “Closely tied to the dollarization of the world has been the relative price of the dollar. After the Plaza Accord which sent the USD to its all time high versus the rest of the world’s currencies following the Volcker fight with inflation in the early 80s, the dollar has been on a downtrend (likely due to its reserve-currency status) but with bouts of volatility amid the expansion and contraction in the US dollar monetary base.” – bto: was zur Frage führt, stehen wir vor einer Expansion oder einem Schrumpfen des relativen Anteils des Dollars? Vulgo: Wer “druckt schneller”?

Quelle: Zero Hedge

- “(…) a stronger US dollar has always indicated tighter financial conditions (the opposite has also been true). Generally, this is because of the US Federal Reserve’s tight monetary stance; however, we believe it has become slightly more complex in the aftermath of the GFC. While the dollar plunged in the aftermath of the financial crisis thanks to ZIRP and QE, the US dollar has been a bull market since 2012/2013 as the market started pricing in normalization of the Fed’s balance sheet; a side effect of this has been to slow down the growth of the USD monetary base. Ironically, as Nedbank notes, this is also when covered interest parity began to breakdown (also according to research from BIS). ‚We believe the lack of US dollars is the force behind the disconnect between currency and interest rate movements‘ for the dollar but also all other major currencies, Nedbank writes and make the following claim: We believe that movements in the US dollar (and other asset prices) ever since the slowdown in the global supply of US dollars are due to factors such as the pool of US dollars and the ‚quantum of money‘ circulating in the global financial system, rather than just the US Federal Reserve’s monetary policy.” – bto: Das wäre der Punkt mit der relativen Menge statt der absoluten.

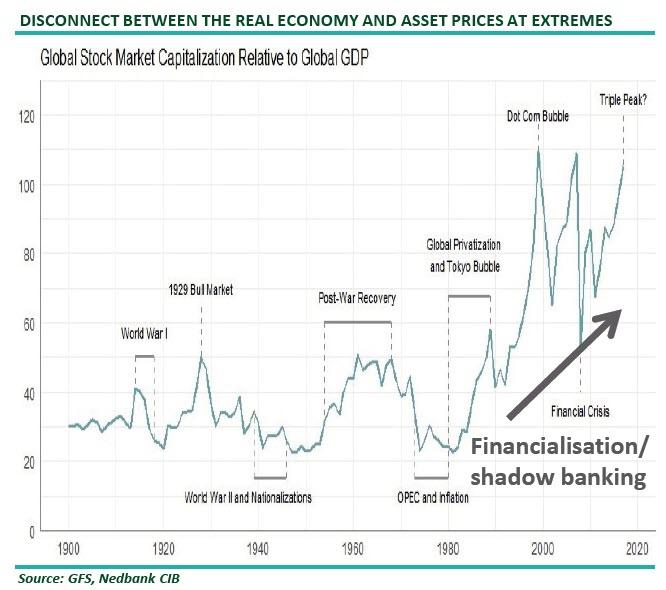

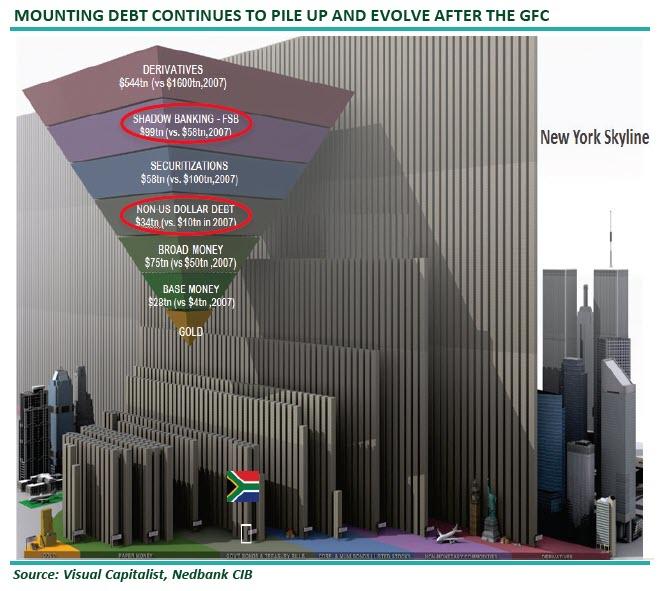

- “The blistering expansion in the value of financial assets also allowed excessive levering to take place in financial markets and, as a result, financial assets began to exceed the economy, ushering in a more volatile and vulnerable financial system (as BCA wrote recently, the total value of all financial assets has now climbed to $400 trillion, or five times the size of the global economy).” – bto: Das ist halt der Leverage-Effekt, der Spaß macht, solange die Assets im Preis steigen. Die Notenbanken haben einen guten Job gemacht, die Blase nochmals aufzupumpen. Coole Abbildung:

- “The result of all this is a positive feedback loop as most of the money today is being created against collateral (assets) which, coupled with rising assets prices, fuels further leverage in the system. Of course, when asset prices fall, credit creation slows rapidly – or goes into reverse – creating a liquidity squeeze in the financial system and the real economy, also known as a deflationary ‚crash‘. This has been the case for decades, but the build-up and crash in 2008/2009 was the most damaging to the global economy.” – bto: Klar, es ist der ultimative Margin Call.

- “(…) as a result of the credit cycle, changes in asset prices have become a major driver of the real economy – ‚the dog is wagging the tail.‘ Another way of saying this: don’t look for the next recession in the economy, look for it when the global central banks start shrinking their balance sheets, which as a reminder will begin some time in the fourth quarter.” – bto: Und da sehen wir – zumindest vorübergehend – einen Bremsversuch. Warum eigentlich? Nur, um wieder mehr auf das Gaspedal drücken zu können.

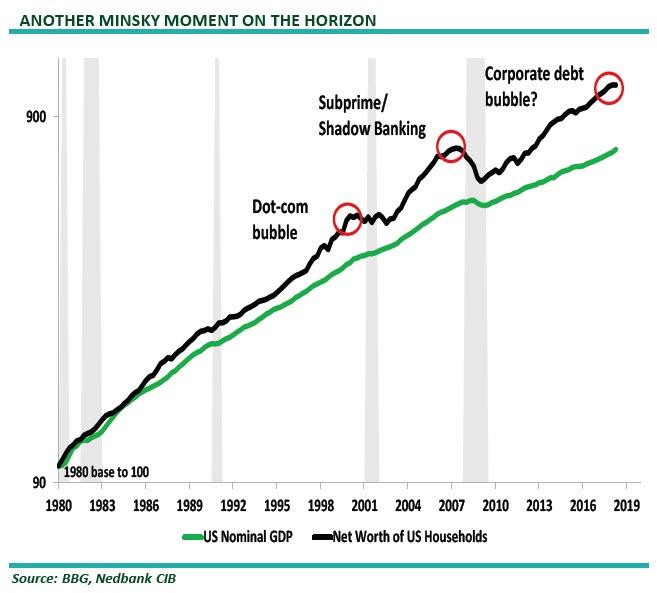

- “A consequence of this financialization is that since the late 1980s, the gap between net wealth (asset performance) and the real economy has been growing amid low interest rates and immense growth leverage in the financial system. As a result, every downturn starts in the financial markets (credit cycle) because of excess leverage, spilling over into the real economy.” – bto: Wir sind gefangen in einem Spiel, wo der Versuch, die kurzfristigen Schmerzen zu verringern, immer größere Schmerzen für die Zukunft vorzeichnet. Das Bild hatten wir schon bei bto.

- “While the mean reversion of this process is only a matter of time, Nedbank believes that the next downturn will be worse from a socioeconomic perspective because policies since the GFC have led to the wealth effect being concentrated in the top 90 %, with the rest of society still overburdened with balance sheet problems. This ties in to the point made recently by Ray Dalio who warned that when the next crisis hits, it will have a far greater social impact with potentially lethal results.” – bto: Und das macht mir wirklich Sorgen. Auch bei uns, wo die Politik die guten Jahre nicht genutzt hat, um uns abzusichern. Im Gegenteil: Die Folgen der letzten Jahre werden dann sehr schmerzhaft und offen zutage treten!

- “Which brings us to the last piece of the puzzle: the record levels of global debt, which continue to grow to alarmingly high levels in both the regulated and unregulated sectors (shadow-banking sectors). As the IFF recently disclosed, global debt (regulated) has now soared to USD247 trillion (318% GDP), more than USD96tn higher than a decade ago. Meanwhile, largely thanks to China, the shadow-banking system has grown from USD60tn in 2007 to the current USD99tn, according to the global FSB.” – bto: Alles bekannt, doch lets Party like its 1999 …

Quelle: Zero Hedge

- “Excessive debt levels and highly interconnected financial markets leave world economic growth and financial markets vulnerable to a sudden slowdown in credit creation and debt growth – the vicious credit cycle that feeds into the real economy.“

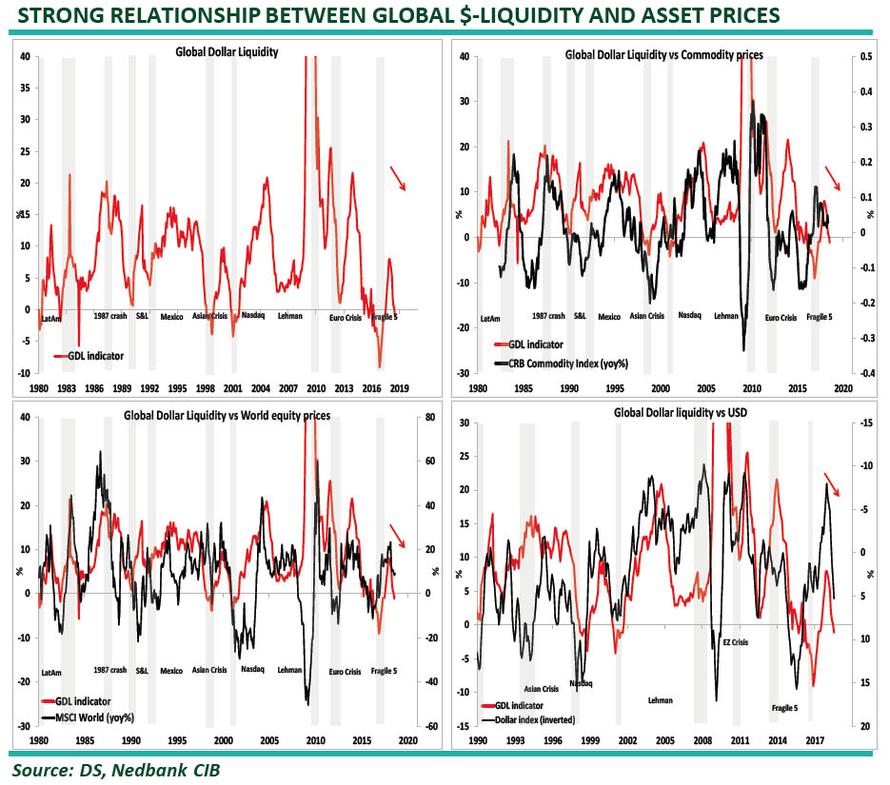

- “Nedbank posits that its various Global $-Liquidity indicators (shown in the chart below), which measure the change in the global US dollar monetary base, ‚are probably some of the most important macroeconomic drivers of the credit cycle, as measuring the different layers of the debt pyramid can be very challenging at the best of times.‘” – bto: ein einfaches Erklärungsmodell, das allerdings keinen guten Ausblick gibt:

- “(…) there is a risk that the lack of Global $-Liquidity will constrain and even add pressure to an already overleveraged global real economy and financial system, posing a real risk to the economic and asset performance outlook. In this environment, the bank recommends defensive income-generating assets, rather than growth-related assets amid the global deflationary forces persisting.” – bto: Klar, die hohe Verschuldung wirkt immer deflationär. Darin liegt die große Gefahr für Assetmärkte und Realwirtschaft.

→ zerohedge.com: “Why One Bank Sees A Global ‚Minsky Moment On The Horizon‘“, 17. September 2018