Klimapolitik: keine Kompetenz bei Notenbankern

Überall wird gefordert, dass die Notenbanken endlich die Politik gegen den Klimawandel unterstützen sollen. So auch in der FINANCIAL TIMES (FT):

- “We are facing a climate emergency that demands collective action and central banks must undergo another transformation, perhaps an uncomfortable one, to play their part in dealing with it. By reshaping their interventions in asset markets, they can accelerate reductions in carbon emissions and change the cost of capital to address hidden climate risks in the financial system.” – bto: Das schreibt kein Geringerer als der Chief Executive of Fidelity International.

- “Rather than waiting for governments to agree on legislation, investment programmes or carbon taxes, central banks can act now to reflect better the cost of climate change in the cost of capital and to change the behaviour of businesses, increasing it for emitters and lowering it for investment in carbon reduction.” – bto: Ich halte das für ausgemachten Blödsinn. → Die EZB und der Klimawandel

- “And separately, central banks could raid the macroprudential toolkit to impose additional capital requirements on activity that contributes to emissions. Central banks could consider expediting work on a ‘green’ Basel framework of bank capital measures as the next logical step, once they complete the foundational work of stress testing and developing a globally consistent taxonomy of green investments.” – bto: Allwissende Bürokraten agieren hier für einen guten Zweck. Ich kann es mir schon vorstellen.

Was für ein unrealistisches Ziel das ist, zeigt John Authers bei Bloomberg schön auf:

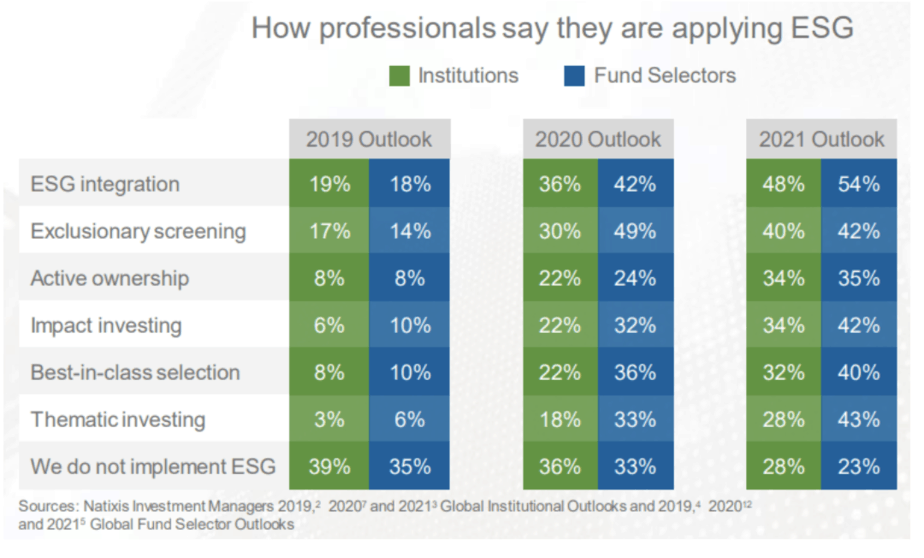

- “The money flowing into ESG ETFs has been impressive, while a survey of big institutions and fund selectors for Natixis SA shows a sharp increase in the numbers claiming to use ESG criteria when they allocate capital.” – bto: Das sagt erst mal nichts, nur, dass es ein gutes Geschäft ist.

Quelle: Bloomberg

Quelle: Bloomberg

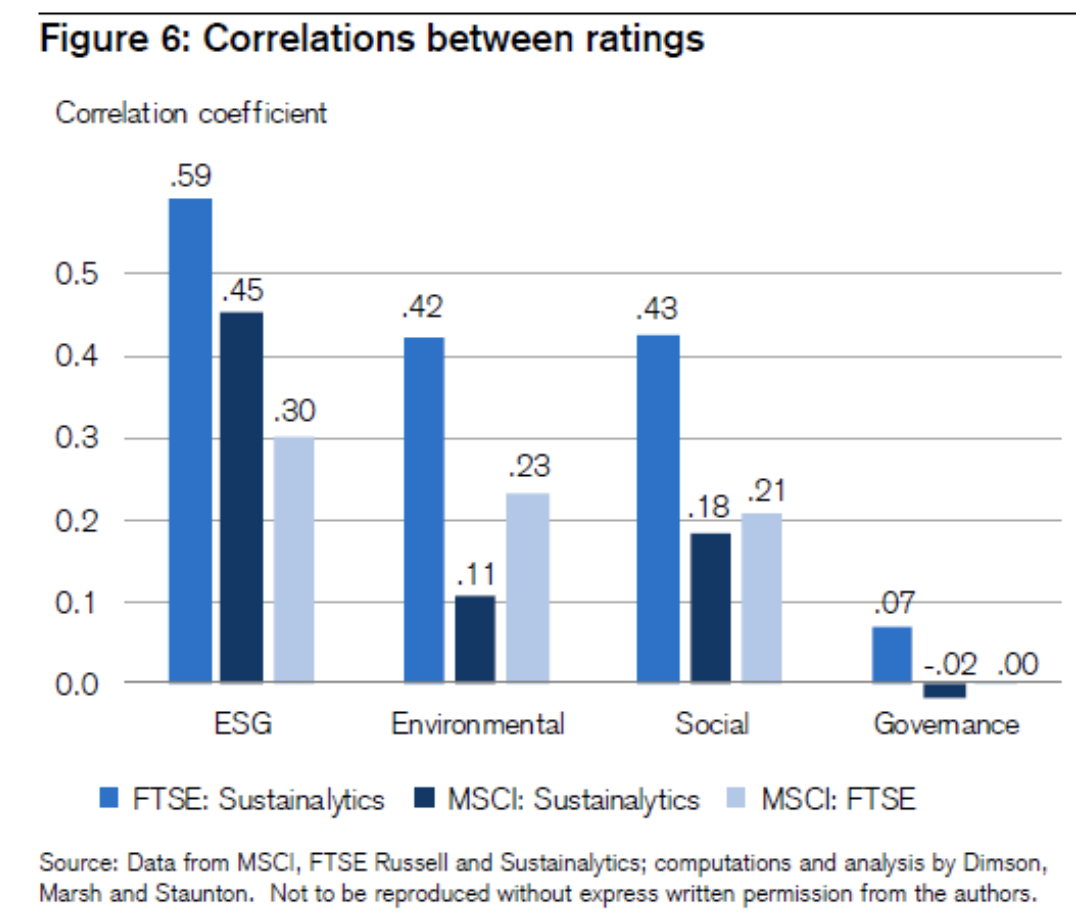

- “The ratings being used for ESG indexes are almost comically varied. In governance, in particular, there is almost no agreement between the main companies currently offering ESG ratings. The correlation between their choice of companies that score well on governance is almost zero, meaning that one rater’s opinion is of no guidance at all in guessing what another’s will be. (…) the following graphic, produced by the British academics Elroy Dimson, Paul Marsh and Mike Staunton for last year’s Credit Suisse Global Investment Returns Yearbook, in a Points of Return last year, and it remains relevant. It shows the degree of correlation between ratings from FTSE Russell, MSCI and Sustainalytics, all companies that offer ESG ratings for use in indexing.” – bto: Es ist schon witzig. Und darauf basierend sollen nun Notenbanken Vorteile gewähren? O. k., die EU will das mit der sogenannten Taxonomie ändern. Aber es wird immer ein Stückwerk bleiben.

Quelle: Bloomberg

- “All of this suggests that it is dangerous to attempt to use passive investing to encourage good behavior just yet. Companies are unclear as to exactly what they are being asked to do and how they are to be judged. Further, they will be tempted to “game” the evidently flawed metrics. Such issues also call into question how much government policy should incorporate climate risks. If the data are this unclear, for example, is there really a good case for monetary policy to include climate goals? As monetary policy is decided by people with expertise in monetary economics, and not necessarily climate science, they would be particularly vulnerable to relying on unreliable metrics.” – bto: So ist es. Wir haben dann marktferne Bürokraten, die einschneidende Entscheidungen treffen, die aber nicht unbedingt dem hehren Ziel dienen.

@Thmoas M.: “Wenn also die CO2-Produktion weltweit nicht schnell genug sinkt und die Erderwärmung weiter steigt, weil nicht alle Staaten mitmacht, legt Deutschland noch eine Schüppe drauf bei der Beschneidung der Freiheiten und der Teuerung?”

Fragen wir doch mal die Richter, ob sie das so gemeint haben. Zitat aus dem Urteil:

“Der Klimaschutzverpflichtung aus Art. 20a GG steht nicht entgegen, dass Klima und Erderwärmung globale Phänomene sind und die Probleme des Klimawandels daher nicht durch die Klimaschutzbeiträge eines Staates allein gelöst werden können. Der Klimaschutzauftrag des Art. 20a GG hat eine besondere internationale Dimension. Art. 20a GG verpflichtet den Staat, eine Lösung des Klimaschutzproblems gerade auch auf überstaatlicher Ebene zu suchen. Der Staat könnte sich seiner Verantwortung nicht durch den Hinweis auf die Treibhausgasemissionen in anderen Staaten entziehen. Aus der spezifischen Angewiesenheit auf die internationale Staatengemeinschaft folgt vielmehr umgekehrt die verfassungsrechtliche Notwendigkeit, eigene Maßnahmen zum Klimaschutz tatsächlich zu ergreifen und für andere Staaten keine Anreize zu setzen, das erforderliche Zusammenwirken zu unterlaufen.”

https://www.bundesverfassungsgericht.de/SharedDocs/Pressemitteilungen/DE/2021/bvg21-031.html

@Kai+Ruhsert

Hach, manche Klassiker werden von Zeit zu Zeit immer wieder aktuell:

“…Und es mag am deutschen Wesen

Einmal noch die Welt genesen.”

(Das sind die Schlusszeilen aus dem Gedicht “Deutschlands Beruf”, das schon 1861 geschrieben wurde…)

Die Argumentation hier bringt mich aber auf noch ein interessantes Problem:

“Der Klimaschutzverpflichtung aus Art. 20a GG steht nicht entgegen, dass Klima und Erderwärmung globale Phänomene sind und die Probleme des Klimawandels daher nicht durch die Klimaschutzbeiträge eines Staates allein gelöst werden können. Der Klimaschutzauftrag des Art. 20a GG hat eine besondere internationale Dimension. Art. 20a GG verpflichtet den Staat, eine Lösung des Klimaschutzproblems gerade auch auf überstaatlicher Ebene zu suchen.”

Blöderweise steht in Artikel 23 GG, dass auch die “Verwirklichung eines vereinten Europas” ein Staatsziel unserer Bundesrepublik ist:

“(1) Zur Verwirklichung eines vereinten Europas wirkt die Bundesrepublik Deutschland bei der Entwicklung der Europäischen Union mit, die demokratischen, rechtsstaatlichen, sozialen und föderativen Grundsätzen und dem Grundsatz der Subsidiarität verpflichtet ist und einen diesem Grundgesetz im wesentlichen vergleichbaren Grundrechtsschutz gewährleistet. (…)”

https://www.gesetze-im-internet.de/gg/art_23.html

Was macht die Bundesrepublik eigentlich, wenn Staaten wie Polen, Tschechien, Ungarn, Rumänien oder Bulgarien die europäische “Klimaschutzverpflichtung” ablehnen und im Extremfall irgendwann mit EU-Austritt drohen weil sie ein Null-Emissions-Ziel aus grundsätzlichen strategischen (Polen), wirtschaftlichen (Tschechien) oder rein finanziellen Gründen (Rumänien und Bulgarien) ablehnen?

Wenn man den Standpunkt des Bundesverfassungsgerichts ernst nimmt, müsste es dann die Staatsziele “Klimschutzverpflichtung” und “Verwirklichung eines vereinten Europas” gegeneinander abwägen und für Deutschland eine Kompromissposition vorschreiben, die dann von der Regierung umgesetzt werden müsste. Da sind schon ganze EU-Gipfel an weniger komplexen Problemen gescheitert! Ich glaube nicht, dass das Bundesverfassungsgericht dazu in der Lage ist, solche Fragen vollständig zu begreifen und sinnvolle politische Lösungen dazu vorzuschreiben.

Da überschätzen aktivistische Richter sich selbst, fatalerweise angefeuert von den Grünen und den Umweltverbände als grüne Vorfeldorganisationen mit Verbandsklagerecht.

@Richard Ott: “Ich glaube nicht, dass das Bundesverfassungsgericht dazu in der Lage ist, solche Fragen vollständig zu begreifen und sinnvolle politische Lösungen dazu vorzuschreiben.”

Die Formulierung des Gerichts, die deutsche Regierung dürfe durch Nichtstun “anderen Staaten keine Anreize zu setzen, das erforderliche Zusammenwirken zu unterlaufen”, ist hinreichend vorsichtig, um die Annahme zu begründen, dass es sich diese Kompetenz nicht anmaßt.

WELT-Redakteur Daniel Wetzel hat m.E. einen anderen, wirklich relevanten Kritikpunkt gut herausgearbeitet: “Der richterliche Glaube, gerade die nachfolgende Generation sei stärker belastet als die gegenwärtige, ist wissenschaftlich nicht gedeckt. … Damit dürfte Klimaschutz für die kommende Generation eher billiger und einfacher werden. Das Bundesverfassungsgericht hat dies nicht beachtet und eine höchst dynamische Szenerie rein statisch nach dem Istzustand bewertet – und daraus eine grundgesetzwidrige Benachteiligung kommender Generationen abgeleitet. Eine höchst fragwürdige Sichtweise.”

Quelle: Die Verfassungsrichter liegen bedenklich falsch

https://www.welt.de/wirtschaft/plus230753435/Klimaschutz-Urteil-Die-Verfassungsrichter-liegen-bedenklich-falsch.html?sc_src=email_580071&sc_lid=46872586&sc_uid=5WUYx0zR9P&sc_llid=14804&sc_cid=580071

@Kai Ruhsert

“Die Formulierung des Gerichts, die deutsche Regierung dürfe durch Nichtstun “anderen Staaten keine Anreize zu setzen, das erforderliche Zusammenwirken zu unterlaufen”, ist hinreichend vorsichtig, um die Annahme zu begründen, dass es sich diese Kompetenz nicht anmaßt.”

Die Bundesregierung tut aber nicht “nichts”, sondern nach Auffassung des Verfassungsgerichts zu wenig oder zu langsam.

Das ist genau die Anmaßung der Kompetenz in der Bewertung von Maßnahmen, die Sie fälschlicherweise beim Gericht nicht sehen.

@Richard Ott: Sie hatten behauptet, die Richter hätten den Fall nicht vorhergesehen, dass andere EU-Staaten sich dem Nullemissionsziel verweigern.

Doch das haben sie sehr wohl: Dann solle Deutschland mit diesen Staaten eine Lösung “suchen”. Mehr verlangen die Richter gar nicht – wohl wissend, dass dies sinnlos wäre. Im Inland jedoch solle die deutsche Regierung mit (aus Sicht des Gerichts) verstärkten Anstrengungen weitermachen.

Die Kritik an der Forderung nach (unsinnig) genauen Zielbeschreibungen für die Zeit nach 2030 ist berechtigt. Aus diesem Urteil jedoch Naivität über die zu erwartenden Konflikte mit anderen Ländern herauszulesen – nun ja, wenn Sie’s denn unbedingt wollen…

@ Dr. Stelter

Ich glaube, dass das Karlsruher Urteil die POLITISCHE Basis der Energiewende GRUNDLEGEND verändert.

Die Konsequenzen sind noch nicht fassbar, aber offensichtlich SEHR weitreichend.

Hier am Blog scheint ein gewisses Interesse an den Implikationen der mit dem Urteil angestoßenen Entwicklung zu bestehen.

Vielleicht könnten Sie irgendwann einmal einen gestandenen Verfassungsrechtler für ein Podcast-Gespräch gewinnen, der die DIMENSION des Urteils erläutert.

Mein erster Eindruck ist, dass wir es bei diesem Urteil mit einem PARADIGMENWECHSEL der obersten Rechtsprechung in diesem Land zu tun haben.

Wenn die Ahnung nicht trügt, ist heute eine Ladung DYNAMIT abgekippt worden.

@ DT: “Wenn die Ahnung nicht trügt, ist heute eine Ladung DYNAMIT abgekippt worden”.

Nach meiner Einschätzung trügt Ihre Ahnung nicht.

Das Verfassungsgericht hat eine Vorgehensweise beendet, die seit Jahrzehnten auf vielen Gebieten dazu führt, dass die Bewältigung von Folgen von Entscheidungen in die Zukunft verschoben werden. Es hat mit seiner normativen Entscheidung das eingefordert, was zu den grundlegenden Anforderung des professionellen Managements komplexer Systemen gehört, nämlich das Aufstellen und Fortschreiben von zeitoffenen strategischen Grundlagen des Handelns. Es hat gleichzeitig normativ festgeschrieben, dass es den nachfolgenden Generationen nicht zuzumuten ist, desaströse heutige Fehlentscheidungen auszubaden.

Die Inhalte sind zweitrangig und hängen sicherlich am Zeitgeist. Heute ist es das, was man unter Klimaschutz versteht.

Es ist ein Methodenwechsel angesagt, denn der Blick ist nun – normativ fundiert – aus der Zukunft in die Gegenwart zu richten. Ein Blick im Übrigen, der der gewohnten Sichtweise von mittelständischen inhabergeführten Unternehmen sehr entspricht.

Minister Altmaier reagierte wie er reagieren musste: in seiner Denkweise, die dem Gegenteil der normativ festgestellten Anforderungen entspricht. Es genügt eben nicht mehr, kurzerhand “gemeinsam” die Zukunft beschließen, indem ein paar unpassende Gesetze geändert werden.

Mit dem Wechsel der Methodengrundlage wird auch ein Wechsel der Managements verbunden sein, das für “zukunftsgesteuerte” Entscheidungen führt. Mit anderen Worten: das Land hat nach Jahrzehnten die Chance, die Demokratie weiterzuentwickeln und endlich zukunftsfähige Entscheidungsstrukturen zu schaffen. Denn ohne die Bevölkerung wirklich und wahrhaft mitzunehmen, lässt sich der Anspruch des Verfassungsgerichtes nicht erfüllen.

“Es hat gleichzeitig normativ festgeschrieben, dass es den nachfolgenden Generationen nicht zuzumuten ist, desaströse heutige Fehlentscheidungen auszubaden.”

Für die junge Generation war diese ein desaströses Eigentor. Wird die Entscheidung ernst genommen, eröffnet dies den nächsten “Klimarettungsfonds”. Zu den 750 Mrd. EUR neuen Schulden der EU werden noch Billionen neuer Schulden aufgenommen werden müssen. Ein Segen für die Finanzindustrie jetzt, ein Fluch in 30 Jahren, wenn Rückzahlungen und Tilgungen anstehen.

Interessant wäre eine Extrapolation der Staatsverschuldung unter diesen, neuen Bedingungen. Die Schuldenbremse wird man streichen können oder man definiert den Klimanotstand als ewige Ausnahme. Eigentor.

Faszinierenderweise scheint JürgenP aus seiner Interpretation des Urteils keine normative Festschreibung abzuleiten, “dass es den nachfolgenden Generationen nicht zuzumuten ist, desaströse heutige Verschuldungspolitik auszubaden”…

@ JürgenP

Ich will am Blog kein Dauerthema aus dem Urteil des BVerfG machen.

Deshalb vorerst nur noch folgende Bemerkung dazu.

Soweit es darauf dringt, dass die Zukunft in den politischen Entscheidungen mit gedacht werden muss, habe ich keine Probleme damit.

Denn das ist NOTWENDIG.

Eine Gesellschaft kann nicht nur konsumieren und sich dann die Augen reiben, wenn sie SPÄTER merkt, dass sie aufgrund nicht erfolgter Investitionen praktisch irreversibel arm geworden ist.

Das DYNAMIT des Urteils ist für mich vielmehr dies:

„Dabei nimmt das relative Gewicht des Klimaschutzgebots in der Abwägung bei fortschreitendem Klimawandel weiter zu.“

Es kann NICHT sein, dass irgendjemand nach Karlsruhe geht und dort feststellen lässt, dass Gesetze des Bundestags das Klimaschutzgebot nicht GENÜGEND gewichten, weil der Klimawandel zugenommen hat.

Denn es ist POLITISCH und NICHT gerichtlich darüber zu entscheiden, wie der Klimawandel eingeschätzt wird und vor allem, WELCHES Ziel mit einem Klimaschutzgebot erreichen werden soll.

Wenn die Gesellschaft mehrheitlich der Meinung ist, dass der Bau von Dämmen an der Nordseeküste das Ziel eines Klimaschutzgebots sein soll – eine Maßnahme der SCHADENSBEGRENZUNG –, dann sollte in Karlsruhe NICHT damit argumentiert werden können, dass die Erderwärmung, d. h. der Klimawandel ZUGENOMMEN habe, und derartige politische Mehrheitsentscheidungen gekippt werden können.

Ich halte die Implikationen obigen Satzes des Gerichts daher für sehr, sehr PROBLEMATISCH.

Die Frage ist, OB und WIE – wenn überhaupt – er sich mit dem GG vereinbaren lässt, oder hier das Gericht hier zu weit gegangen ist.

@ DT: „Denn es ist POLITISCH und NICHT gerichtlich darüber zu entscheiden, wie der Klimawandel eingeschätzt wird und vor allem, WELCHES Ziel mit einem Klimaschutzgebot erreichen werden soll“.

Ich stimme Ihnen zu. Die Angelegenheit wird wohl sonst ziemlich kompliziert.

An die Politik richtet sich durch das Urteil der Anspruch, mögliche Folgen in gegenwärtige Entscheidungen so einzubeziehen, dass merkelsche Alternativlos – Spontanentscheidungen aus verfassungsrechtlichen Gründen der Vergangenheit angehören dürften. Aber auch jeder Dorfbürgermeister wird sind an potenziellen Folgen seines Handelns für nächste und übernächste Generationen messen lassen müssen.

Allerdings, und da wird es auf der Sachebene interessant, müssen Gerichte sich darauf einstellen, zukünftige Folgen in der Zukunft aus gegenwärtigen Entscheidungsgrundlagen auf ihren potenziellen Eintritt rechtlich bewerten.

Ein Gericht muss also heute rechtlich fundiert entscheiden, dass wegen Zutun oder Unterlassen einer Bundes- oder Dorfregierung – also einem Managementfehler der Kategorie „Zukunftsfähigkeit“ – in zig Jahren die noch ungeborene Bevölkerung ein unakzeptables Zukunftsproblem haben könnte.

Diese Art von gerichtlichen Entscheidung ist von einer formaljuristischen Prüfung und Bewertung von noch so komplizierten gesetzlich geregelten Abläufen vollkommen zu unterscheiden.

Die „neue“ Managementperspektive des Verfassungsgerichtes ließe sich auf viele Probleme anwenden. Allerdings ist m.E. jetzt schon klar, dass eine fundierte juristische Basis für derartige Überprüfungen durch Amts-, Land- und Oberlandesgerichte erst noch erfunden werden muss. Auch für den Klimaschutz, denn großes Geschrei ist noch keine Rechtsbasis.

Wie muss man sich den gerichtlichen Vorgang bei einer vergleichsweise einfachen Prüfung vorstellen, zum Beispiel bei einer noch recht jungen deutschen Eiche, die die eine Partei für den schönen neuen Badesee abholzen, während die andere sie für die Sauerstoffversorgung der übernächsten Generation erhalten möchte.

Das wird entschieden wie bisher auch: durch Abwägung von Interessen nach Sitzverteilung im Parlament.

Es sei denn, die Gerichte übernehmen in Zukunft auch politische Funktionen und retten, auf welcher Basis auch immer, pauschal die Zukunft.

Dann haben wir aber ein anderes demokratisches System.

@ Gnomae: „ Für die junge Generation war diese ein desaströses Eigentor“.

Ja und Nein. Ja, weil die Entscheidung als willkommener Anlass genommen werden könnte, die nächste Serie der Fehlentscheidungen loszutreten. Gemeint sind strategieloses und übereiltes Handeln – diesmal in Sachen „Klimaschutz“ – in der von dieser Regierungskoalition gewohnten Weise.

Nein, weil insbes. die junge Generation die Chance hat, sich dieser Planlosigkeit bei der nächsten Wahl dauerhaft zu entledigen. Mal schauen, ob eine Partei das zum Thema macht und auf gerichtsfeste Zukunftsfähigkeit durch echte Mitwirkung setzt.

@JürgenP

“Es sei denn, die Gerichte übernehmen in Zukunft auch politische Funktionen und retten, auf welcher Basis auch immer, pauschal die Zukunft. Dann haben wir aber ein anderes demokratisches System.”

Dann haben wir ein anderes politisches System, in der Tat. Ein demokratisches wäre es vermutlich nicht mehr.

Im Iran gibt es als Institution, allerdings religiös und nicht klimapolitisch, übrigens den “Wächterrat”, bestehend aus 6 islamischen Geistlichen und 6 Juristen. Der überprüft sämtliche Beschlüsse des Parlaments automatisch auf Vereinbarkeit nicht nur mit der iranischen Verfassung (das entscheiden alle 12) sondern auch mit den “Kriterien des Islam” (da sind nur die 6 Theologen gefragt, und die werden natürlich vom Obersten Religionsführer, dem Ajatollah, persönlich ernannt)…

@ RO „Wächterrat”

Der Wächterrat im Iran versteht sich auch als demokratisch legitimiert. Genauso wie der Raketenfreund in Asien. Aber, ich weis nicht, wo Sie die Intuition, diese Feinfühligkeit für diese Art von Zusammenhängen, hernehmen: aber beim „Wächterrat“ beschleicht mich, jetzt wo Sie das schreiben, auch ein komisches Gefühl. Großfinanzwächterrat, Coronawächterrat, Klimawächterrat, Generationengerechtigkeitswächterrat – schlagkräftig besetzt mit wirklichen Experten und Expertinnen. Entscheidungen ohne großes BlaBla mit aufgeblasenen Hinterbänklern. Kann es so etwas in Zukunft geben oder gibt es das schon, und wir merkeln das nur nicht?

@JürgenP

“Feinfühlig” bin ich nun wirklich nicht, eher wie ein Gaffer, der bei politischen Unfällen einfach nicht wegsehen kann, egal wie groß das Gemetzel ist und wie weit das Blut spritzt. Und der Rest ist dann nur noch das Erkennen von immer wiederkehrenden Mustern, auch über Ländergrenzen hinweg.

Einen ersten Anlauf zur Etablierung eines Mini-Wächterrates in Deutschland hatten wir übrigens schon. Aus Branding-Gesichtspunkten sollte der aber “Rat für Generationengerechtigkeit” heißen und nur ein aufschiebendes Vetorecht haben:

“[Der Sachverständigenrat für Umweltfragen] schlägt im Gutachten einen zusätzlichen „Rat für Generationengerechtigkeit“ vor. Das neue Gremium soll „mit Möglichkeiten zur Stellungnahme“ an Gesetzgebungsverfahren beteiligt werden, wenn künftige Generationen betroffen sind. Zudem soll es ein „suspensives Vetorecht in Bezug auf Gesetzentwürfe im Falle schwerwiegender Bedenken“ erhalten. (…) Der Generationenrat könnte „im Falle schwerwiegender Bedenken hinsichtlich der möglichen Auswirkungen eines Gesetzes auf künftige Generationen oder evidenten Widersprüchen zur Nachhaltigkeitsstrategie das Gesetzgebungsverfahren anhalten, um so eine vertiefte Diskussion in Öffentlichkeit und Parlament auszulösen“, heißt es im Text. „Nach einer dreimonatigen Reflexionsphase entscheidet der Gesetzgeber darüber, ob und wie er den Einwendungen Rechnung tragen will.“”

https://www.welt.de/politik/deutschland/article200886116/Umweltrat-Ein-Oeko-Veto-gegen-den-Bundestag.html

@Hr. Tischer

Besonders kurios finde ich, dass es sich um ein Ziel handelt, das Deutschland nur in kleinen Teilen beeinflussen kann. Wenn also die CO2-Produktion weltweit nicht schnell genug sinkt und die Erderwärmung weiter steigt, weil nicht alle Staaten mitmacht, legt Deutschland noch eine Schüppe drauf bei der Beschneidung der Freiheiten und der Teuerung?

Ich hab mir das Urteil in Teilen durchgelesen. Es hat freilich eine hohe Stringenz. Allerdings schwebt die Logik m.E. bezugsrahmenfrei im Denkraum. In der Praxis interessiert mich: Wie kommt die exportierende Industrie in Deutschland klar mit steigenden Energiepreisen und CO2-Kosten? Wie kommen Bürger mit kleinen Einkommen klar mit steigenden Heizkosten, Verbraucherpreisen und gleichzeitiger sinkender Mobilität? Was ist der gesellschaftliche Impact, wenn man zur Erreichung der Ziele auch massive Freiheitseinschränkungen befürwortet und gleichzeitig das Leben erschwert?

Nicht gerade ein Rezept für Wohlstand zukünftiger Generationen. Mal gucken, was die Politik wirklich darauf basierend anstellt. Kann je nach Mix der Regierung abenteuerlich werden.

Ihre Einordnung zum Aushebeln der demokratischen Willensbildung ist hochinteressant. Leider gibt es im Grundgesetz keinen Artikel 20b und 20c:

b) Der Staat schützt auch in Verantwortung für die künftigen Generationen die Produktionsbasis materieller und energetischer Versorgung…

c) Der Staat schützt auch in Verantwortung für die künftigen Generationen die soziale Struktur…

Dann könnte man aus Karlsruhe noch feiner gewichten…

@Thomas M.

Das Problem kommt daher, dass unser Grundgesetz in den letzten Jahrzehnten mit immer neuen Staatszielen überfrachtet wurde. Das gibt dem Verfassungsgericht erst die Rechtsgrundlage dafür, sich in irgendwelche Fragen einzumischen, die originär politisch und nicht juristisch sind. Hier ein hübscher Abriss aus dem Archiv der Bundestag-Webseite:

https://www.bundestag.de/dokumente/textarchiv/2013/47447610_kw49_grundgesetz_20a-213840

Wenn Sie sich auf diese Logik einlassen wollen (was ich für eine schlechte Idee halte, aber aus ganz grundsätzlichen Überlegungen heraus), dann müssen Sie darauf drängen, auch die “Sicherstellung einer stabilen Energieversorgung” als Staatsziel in das Grundgesetz zu schreiben.

Dann werden zukünftige Anhörungen beim Bundesverfassungsgericht zum Thema “Klima” richtig unterhaltsam…

@ thomas m 21:53

für mich hat der richterspruch einen komischen beigeschmack,

als ob es ein konzept gäbe, deutschland zu schaden?

merkel hat es 16 jahre lang bereits hinbekommen!

es gibt halt immer zwei seiten:

jemand, der etwas fordert oder will, und

jemand, der bereit ist diese forderung (gern) zu erfüllen.

“für mich hat der richterspruch einen komischen beigeschmack,

als ob es ein konzept gäbe, deutschland zu schaden?

merkel hat es 16 jahre lang bereits hinbekommen!”

Das BVerfG hat messerscharf geurteilt auf Basis des Grundgesetzes, der international verpflichtenden Verträge, die eingehalten werden müssen und des selbst festgelegten

Klimaziels / Begrenzung der Erderwärmung.

Beschlossen haben diese Gesetze einschließlich der GG-Änderung in Art. 20a u.a. der Deutsche Bundestag und der Bundesrat mit den jeweils erforderlichen Mehrheiten. Auf EU-Ebene entsprechende Parlamente, auf internationaler Ebene entsprechende Gremien.

Das BVerfG hat schlichtweg festgestellt, dass diese Vorschriften rechtsverbindlich sind und von Deutschland eingehalten werden müssen. Natürlich hat dies die Politik so nicht ihren Bürgern kommuniziert, welche enormen Konsequenzen dies hat.

Deutschland muss sich radikal deindustrialisieren, auf private PKW’s müssen alle verzichten, es gibt zwingend einen enormen Wohlstandsverlust.

Wie Kaiser Wilhelm der II. schon sagte: “Ich glaube an das Pferd. Das Automobil ist eine vorübergehende Erscheinung.”

@Gnomae

“Das BVerfG hat schlichtweg festgestellt, dass diese Vorschriften rechtsverbindlich sind und von Deutschland eingehalten werden müssen. Natürlich hat dies die Politik so nicht ihren Bürgern kommuniziert, welche enormen Konsequenzen dies hat.”

Mein Eindruck ist, dass das nicht nur ein Versäumnis in der “Kommunikation” der Politiker ist, sondern ein grundsätzlicheres Problem: Viele Parteipolitiker, auch diejenigen in Parlamenten und sogar diejenigen mit Regierungsverantwortung, finden es mittlerweile bequemer, kontroverse politische Entscheidungen nicht selbst zu treffen, sondern irgendwo anders hin auszulagern, entweder zur EU oder zum Verfaussungsgericht oder von der Länderebene auf die Bundesebene. Dann sind sie nämlich selbst nicht schuld, wenn es schiefgeht und müssen sich auch keine eigenen Gedanken über komplexe Probleme machen, was ja sehr anstrengend ist. Aber wozu brauchen wir dann überhaupt noch so viele Politiker, wenn die selbst nichts mehr entscheiden wollen und auch politische Konflikte am liebsten vermeiden möchten?

Zuletzt ist mir das bei der Debatte im Bundesrat über die “Corona-Notbremse” aufgefallen. Etliche Länder-Ministerpräsidenten haben sich in ihren Redebeiträgen über das Gesetz beschwert, aus ganz verschiedenen Gründen. Und dann trotzdem zugestimmt, obwohl in solchen Fällen eigentlich die Anrufung des Vermittlungsausschusses der vorgegebene Weg gewesen wäre, um die Konflikte zwischen Bundestag und Bundesrat auszuräumen.

Solche Wurstigkeit und Konfliktscheue hat halt Konsequenzen, wenn sie auf aktivistische Verfassungsrichter oder eine machtgierige Hygieneführerin im Bund oder einen nur allzu gerne weiter wuchernden bürokratischen Moloch in Brüssel trifft.

@ Thoma M.

Ich werde das Urteil lesen.

Was sich generell abzuzeichnen scheint, wird jetzt zum MANIFESTIERTEN Mechanismus zumindest in der Klimafrage. Wenn man nicht den nach meinen Wünschen hinreichend großen INTERESSENIMPAKT hinkriegt, dann KLAGT man.

Heißt bezüglich der Beispiele, die Sie benennen:

Die LEBENSPRAKTISCHEN Belange werden immer WENIGER durch Konsens-Entscheidungen bestimmt – also, etwas idealistisch formuliert: Die Betroffenen an einen Tisch, sehen wo jeweils der Schuh drückt und dann KOMPROMISSE schließen, mit denen JEDER leben kann – , sondern auf dem KLAGEWEG durchgesetzt.

Das heißt dann:

Entscheidungen OHNE Befriedung, sondern Durchsetzung MIT Diktat.

Ich halte das für FATAL, weil es die gesellschaftlichen Konflikte verschärfen wird:

Man geht nach Karlsruhe und lässt dort die ANSPRÜCHE hochschrauben, mit der VERPFLICHTUNG für die Entscheider, sich daran zu halten.

Habe heute Folgendes zum Thema gehört:

Richtiges Urteil, weil die Politik bei den Entscheidungen auch die ZUKUNFT mit in den Blick haben muss.

RICHTIG, das muss sie – nicht nur, aber AUCH.

Das wird vor allem diejenigen freuen, die an die Zukunft des Landes denken und zu Recht besorgt sind.

Die Frage ist aber:

WIE?

Durch Urteile des BVerfGs ODER die Willensbildung der Mehrheit?

Ich verstehe schon, wenn die Jungen sagen:

Wir, bei denen es um MEHR Zukunft geht den Lebensjahren nach, sind in der MINDERHEIT und fallen durch den Rost, weil die mehrheitlich Alten uns mit ihren an nur noch wenigen Lebensjahren gemessenen Interessen ausbremsen.

Schwierig, keine LÖSUNG in Sicht.

Was aber ein VERNÜNFTIGER Konsens lösen könnte:

JA, es muss einen UMBAU der Gesellschaft geben unter Einbeziehung auch KLIMATISCHER Sachverhalte, aber wir müssen uns von der ABERWITZIGEN Vorstellung verabschieden, dass WIR das völlig UNREALISTISCHE Ziel der Carbonneutralität in 2050 erreichen MÜSSEN.

Am IRRSINN dieser ZIELSETZUNG hängt das VERHÄNGNIS, auf das wir m. A. n. zusteuern, mit dem heutigen Tag noch einmal ZIELSTREBIGER.

@@@ 08:03

ist es nicht komisch, dass ein verfassungsgericht mit deren verschärfung des klima-schutzgesetzes, praktisch den vorrang gibt vor allen anderen bisherigen gesetzes-beugungen und brechungen der regierung?

dieser aktuelle spruch hat jedenfalls großes potenzial die gesellschaft weiter kräftig zu spalten.

und zum anderen, kann ein verfassungsgesetz nichts durchsetzen, wenn die regierung es nicht befolgen will (zb. es gab sehr viel finanz-steuergesetze, welche einfach ignoriert wurden)

es wird den regierungen auch nichts anders übrig bleiben, dieses gesetz nicht vollständig zu befolgen.

sonst ist die deutsche wirtschaft komplett kaputt und die gesellschaft auf den barrikaten.

interessant könnten zukünftige diskussionen insofern werden, als, dass sie sich sehr viel mehr mit dem exponentiellen wachstumszwang, beschäftigen müssen.

sowie, warum sich die finazwirtschaft von der realwirtschaft zunehmend entfernt.

warum man mit diesen system niemals aus der verschuldung wachsen kann.

aber, vielleicht alles wertlos, wenn dies nur in deutschland geschied!

@Herr Ott

Sie bringen es auf den Punkt:

Die Verwässerung unserer Grundrechte durch politische Ziele, zudem durch solche, die durch staatliche Regelungen gar nicht erreicht werden können.

Für mich ist das Ursache und Symptom für den Weg, auf dem wir uns befinden: der Weg in die Gaga-Republik.

@jobi

“Die Verwässerung unserer Grundrechte durch politische Ziele, zudem durch solche, die durch staatliche Regelungen gar nicht erreicht werden können.”

Genau das ist der Knackpunkt: In die Verfassung hineingeschriebene Staatsziele sind rechtsverbindlich.

Und wenn da mehrere Ziele stehen, die in Konflikt zueinander oder in Konflikt mit den Grundrechten stehen, dann ist die Abwägung zwischen diesen einzelnen umzusetzenden Zielen beziehungsweise zu schützenden Grundrechten plötzlich Sache des Bundesverfassungsgerichts.

Ich halte es allerdings aus grundsätzlichen demokratietheoretischen Erwägungen für überhaupt keine gute Idee, Verfassungsrichter die Energiepolitk machen zu lassen – das können die einfach nicht (es heißt nicht umsonst “iudex non calculat”, und bei ingenieurstechnischen Fragen sind deren Verständnisdefizite noch viel schlimmer), und wenn sie es vermasseln, kann man sie auch bei weitem nicht so einfach wieder loswerden wie Bundestagsabgeordnete.

Ist aber natürlich klar, dass den Grünen diese Situation sehr gefällt – das würde sich aber schlagartig ändern, wenn die Verfassungsrichter irgendwann mal aktivistische Urteile zur Energiepolitik im Sinne der Rechten und nicht der Grünen fällen. Die wütenden Drohungen ans Bundesverfassungsgericht von den Linksextremisten mit viel Tagesfreizeit aus dem Berliner Hauptstadtslum nach dem Mietendeckel-Urteil waren ein kleiner Vorgeschmack darauf, wohin die Reise geht, wenn ein aktivistisches Verfassungsgericht immer weiter ins Zentrum des politischen Systems eines Landes rückt: https://twitter.com/Ma_Heller/status/1382731394409975811

Die Negativzinsen der Notenbanken führen zu einem gigantischen Ausmaß an zusätzlicher Umweltzerstörung und Ressourcenübernutzung.

Überall in meiner Region wird gebaut, betoniert und asphaltiert wie verrückt. Immobilien sind für Investoren längst zum Ersatz für Bundesanleihen geworden.

bto: “So ist es. Wir haben dann marktferne Bürokraten, die einschneidende Entscheidungen treffen, die aber nicht unbedingt dem hehren Ziel dienen.”

Früher hatten wir dafür in Deutschland einen Fachbegriff: sozialistische Planwirtschaft. Ist wahrscheinlich nicht woke, das 2021 zu erwähnen, aber die Erfahrungswerte damit sind m.E. eher bescheiden. Um es höflich auszurdrücken.

Die Lawine ist losgetreten.

Und schon sortieren sich die INTERESSEN, hier:

https://www.faz.net/aktuell/wirtschaft/klima-energie-und-umwelt/klimaschutzgesetz-entscheidung-entzweit-die-koalition-17318089.html?printPagedArticle=true – pageIndex_2

Daraus:

CDU:

>Wie Altmaier begrüßte am Donnerstag auch der frühere Bundesumweltminister und Anwärter auf den Parteivorsitz Norbert Röttgen (CDU) das Urteil des Verfassungsgerichts. „Es schlägt ein ganz neues Kapitel im grundrechtlichen Schutz der Bürger gegen freiheitsgefährdende Untätigkeit des Gesetzgebers auf“, sagte Röttgen am dem Nachrichtenportal t-online.>

Die Grünen:

>Kanzlerkandidatin Annalena Baerbock feierte den Richterspruch als historische Entscheidung. „Klimaschutz schützt unsere Freiheit und die Freiheit unserer Kinder und Enkel“, twitterte sie.>

FDP:

>Der Sprecher für Energiepolitik der FDP-Fraktion, Martin Neumann, stellte für die Liberalen klar: „Effektiver Klimaschutz und die Vermeidung von CO2 gelingt meiner Ansicht nach nur mit Markwirtschaft, Wettbewerb und einem funktionierenden Emissionshandel als zentralem Steuerungsinstrument.“>

Die Linke:

>Die Ko-Vorsitzende der Partei Die Linke, Susanne Hennig-Wellsow, bezeichnete das Klimaschutzurteil als „mutmachend“. Umso wichtiger sei es jetzt, umzusteuern. Es gehe um „gute Klimapolitik und soziale Gerechtigkeit, damit unsere Gesellschaft fit für die Zukunft wird.“>

Der Bund für Umwelt und Naturschutz (BUND):

>… der mitgeklagt hatte, nannte das Urteil „bahnbrechend“. Er lobte, das Gericht habe die 1,5-Grad-Grenze des Pariser Klima-Abkommens „letztlich für verfassungsrechtlich verbindlich“ erklärt.>

BDI:

>Wichtig sei jetzt, dass jetzt „gangbare Klimapfade bis 2050“ aufgezeigt würden, um CO2-Reduktionen vorzugeben. „Das schafft Klarheit und Planungssicherheit für Unternehmen, neue Technologien zu entwickeln und massiv zu investieren, und liegt im Interesse der Industrie.“

Klimaschutz und Freiheitsrechte ließen sich durchaus miteinander verbinden. Die Industrie trage durch Innovation und schnelle Marktfähigkeit CO2-freier Techniken genau dazu bei.>

Deutsche Energieagentur (Dena):

>„Ob es wirklich zielführend ist, heute schon jahres- und sektorspezifische Ziele für die nächsten zwei, drei Jahrzehnte festzulegen, würde ich in Frage stellen,“ sagte Dena-Chef Andreas Kuhlmann der F.A.Z. „Neue Technologien und Entwicklungen brauchen neben Druck auch Freiräume.“ Dennoch sei das Urteil sehr wichtig. „Klimaschutz ist so elementar, dass es ein Grundrecht ist.“>

Kölner Ökonom Axel Ockenfels:

>Das Verfassungsgericht lege nahe, dass Deutschland für sich genommen die globale Durchschnittstemperatur spürbar beeinflussen könnte. Und dass es im Interesse des Klimaschutzes und Deutschlands wäre, unilaterale Minderungsziele auf lange Sicht festzulegen. „Aus Sicht der Kooperationsforschung und Anreizforschung ist diese Einschätzung zweifelhaft“, sagte der Volkswirtschaftsprofessor der F.A.Z.

„Es gibt gute wissenschaftliche Gründe dafür, dass unilaterale Selbstverpflichtungen auf Minderungsziele für die ferne Zukunft der falsche Weg sind und sogar nach hinten losgehen können.“>

Auch Teil der Lawine:

Heute auf der HV der BASF hat der Vorstandsvorsitzene Herr Brudermüller von CO2-Reduktion und Ökostrom geschwärmt (geträumt?) WENN er weniger als 5ct/kWh kostet.

Da steht uns noch einiges bevor.

@Skeptiker

“Heute auf der HV der BASF hat der Vorstandsvorsitzene Herr Brudermüller von CO2-Reduktion und Ökostrom geschwärmt (geträumt?) WENN er weniger als 5ct/kWh kostet.”

Den wird er in Deutschland sicher nicht bekommen, aber es gibt ja auch weniger durchgeknallte Länder auf der Erde, wo man Chemiefabriken bauen kann.

Die Grün*innen kündigen stattdessen an, dass die Energieversorgung in Deutschland nach ihrer Machtergreifung “spannend” und “angebotsorientiert” werden wird. (DDR-Bürger kennen “Angebotsorientierung” noch als Leitprinzip bei der Versorgung mit Bananen und Orangen…)

https://twitter.com/Hallaschka_HH/status/1387802076009353217

„Klimapolitik: keine Kompetenz bei Notenbankern“

Geldpolitik: dito!

„Stimulus. Money injected into the economy. Accommodation. Easing. Science.

None of those words have ever applied to the program. Two decades later, the actual science is very clear on this point. Even studies conducted by the central banks who have used the tactic, those whose researchers are often palpably desperate to find and sugarcoat any gray area in order to shade it favorably in QE’s direction, these most charitable of reviews can only ever say at best the thing maybe helped lower interest rates a touch more than the market had/has.

Inflation? Economic growth? Recovery? Forget it. Government bond yields drop on liquidity and safety preferences and here comes the central bank to arguably lower already low rates a few bps more. If you’re wondering how this might help, you’ll have to get in line behind all the central bankers standing there already these last twenty years hoping to eventually figure that out.” https://alhambrapartners.com/2021/04/28/another-hundred-trillion-for-the-library/

LG Michael Stöcker

„“Rather than waiting for governments to agree on legislation, investment programmes or carbon taxes, central banks can act now…”

Herrlich, endlich diese lästigen demokratischen Entscheidungsprozesse umgehen können um massiv Geld zu drucken. Der feuchte Traum jedes Linksradikalen wird wahr. (OK, mag sein, dass ein rechtsradikaler Diktator auch gerne allein entscheidet, der braucht aber keine verklärenden Lügengeschichten zur Rettung des Weltklimas zur Tarnung. Wäre ehrlicher.)

>Such issues also call into question how much government policy should incorporate climate risks.>

Diese Frage erledigt sich für uns in Deutschland:

BVerfG, heutiges Urteil, Kommentar dazu:

https://www.faz.net/aktuell/wirtschaft/klima-energie-und-umwelt/verfassungsgericht-klimaschutzgesetz-reicht-nicht-weit-genug-17317543.html

Daraus:

>Künftig könnten selbst gravierende Freiheitseinbußen zum Schutz des Klimas verhältnismäßig und verfassungsrechtlich gerechtfertigt sein, erläuterten die Richter. Zwar müssten die Grundrechte abgewogen werden. Aber: „Dabei nimmt das relative Gewicht des Klimaschutzgebots in der Abwägung bei fortschreitendem Klimawandel weiter zu.“>

Was ich bereits vor dem Urteil gesagt habe, ist ab SOFORT höchstrichterlich LEGITIMIERT für die Gesetzgebung:

Es wird GRAVIERENDE Einbußen individueller Freiheit geben.

Weiter:

>Das Verfassungsgericht fordert nun, frühzeitig transparente Maßgaben für die weitere Ausgestaltung der Treibhausgasreduktion. Damit verbinden die Richter Entwicklungsdruck und Planungssicherheit. Verfassungsrechtlich unerlässlich sei dafür zum einen, dass weitere Reduktionsmaßgaben rechtzeitig über das Jahr 2030 hinaus und zugleich hinreichend weit in die Zukunft hinein festgelegt werden. Zum anderen müssten zwecks konkreter Orientierung weitere Jahresemissionsmengen und Reduktionsmaßgaben differenziert festgelegt werden.>

MASSGABEN festlegen über 2030 hinaus hinreichend weit:

Die VORGABEN kommen aus Berlin/Brüssel für so viel PLANUNGSSICHERHEIT, dass keine Zweifel bestehen werden, WO investiert werden MUSS, damit satt Profit gemacht wird.

>bto: So ist es. Wir haben dann marktferne Bürokraten, die einschneidende Entscheidungen treffen, die aber nicht unbedingt dem hehren Ziel dienen.>

Richtig erkannt.

Egal, ob marktferne Bürokraten die Entscheidung treffen oder nicht, Hauptsache ist:

ENTSCHEIDUNGEN werden GETROFFEN.

Es ist unerheblich, ob damit den hehren Umweltzielen gedient wird.

SOLANGE aufgrund der Entscheidungen satt GELD verdient wird, ist zumindest einem wesentlichen ZIEL gedient.

Die Notenbanken müssen keine Klimapolitik betreiben, sondern darauf achten, dass genug Liquidität im System ist.

@Herr Tischer

“>Künftig könnten selbst gravierende Freiheitseinbußen zum Schutz des Klimas verhältnismäßig und verfassungsrechtlich gerechtfertigt sein, erläuterten die Richter. Zwar müssten die Grundrechte abgewogen werden. Aber: „Dabei nimmt das relative Gewicht des Klimaschutzgebots in der Abwägung bei fortschreitendem Klimawandel weiter zu.“>

Was ich bereits vor dem Urteil gesagt habe, ist ab SOFORT höchstrichterlich LEGITIMIERT für die Gesetzgebung:

Es wird GRAVIERENDE Einbußen individueller Freiheit geben.”

Nicht zwangsläufig. Ebensogut könnte die Politik die hirnrissigen “Klimaneutralititäts-Ziele” aufgeben, dann wären die Freiheitseinschränkungen zu ihrer Realisierung unnötig.

Das Verfassungsgericht bestimmt nicht die Richtlinien der Politik, vergessen Sie das nicht. Selbst wenn die Verfassungsrichter persönlich an die Fiktion irgendwelcher “CO2-Budgets” glaubten, wären die keine Rechtfertigung für staatliche Freiheitseinschränkungen, wenn es staatlicherseits keine Selbstverpflichtung zu ihrer Einhaltung gäbe (wobei auch das schon eher kreativ aus dem Pariser Klimaabkommen herbeikonstruiert ist).

Mich berührt es übrigens sehr, dass die Verfassungsrichter sich so über mögliche zukünftige Freiheitseinschränkungen sorgen während gleichzeitig massive Freiheitseinschränkungen gegenwärtig in Kraft sind, aber zur Corona-Notbremse sind ja etliche Verfahren noch anhängig. ;)

Und als Richter in Merkels Staat muss man mittlerweile seine Worte auch in Urteilen vorsichtig abwägen, sonst macht die Staatsanwaltschaft eine nette kleine Hausdurchsuchung…

@ Richard Ott

>Ebensogut könnte die Politik die hirnrissigen “Klimaneutralititäts-Ziele” aufgeben, dann wären die Freiheitseinschränkungen zu ihrer Realisierung unnötig.>

Theoretisch: JA.

Aber diese Politik sehe ich nicht.

Der nächste Bundestag und die nächste Regierung werden MEHRHEITLICH Maßnahmen zur Erreichung der CO2-Neutralität 2050 FESTLEGEN wie vom BVerfG mit dem Urteil gefordert.

>Das Verfassungsgericht bestimmt nicht die Richtlinien der Politik, vergessen Sie das nicht.>

Ich muss da nichts vergessen, weil ich weiß, dass es so ist.

ABER:

Das BVerfG setzt den RAHMEN, in dem die Politik RICHTLINIEN bestimmen kann.

Und dieser Rahmen ist mit dem heutigen Urteil m. A. n. als quasi OFFEN gesetzt.

Ich bleibe dabei:

Die Politik wird Richtlinien verkünden und darauf bezogen Maßnahmen SETZEN.

Diese werden PRAKTISCH an den FOLGEN der Umsetzung gemessen.

Wenn – einmal angenommen – Massenarbeitslosigkeit drohen würde bei REALISIERUNG dieser Maßnahmen, dann würden sie NICHT (weiter) umgesetzt werden, weil dann ANDERE politische Kräfte an der Macht wären, die das verhinderten.

Dann würde auch das BVerfG wieder ANDERS urteilen.

Denn das BVerfG urteilt NIE gegen einen FIXIERTEN gesellschaftlich bedeutsamen Mainstream, wenn ihr Urteil diesen um 180° drehen würde.

Die NORMATIVE Kraft des FAKTISCHEN wäre in solchen Fällen so stark, dass die Mehrheit das Gericht nicht mehr beachten würde.

Es ist wie mit einer Währung:

Am Ende des Tages ist GLAUBWÜRDIGKEIT der WERT, an dem gemessen wird.

@ Dietmar Tischer

Sie haben das ganze Thema sehr richtig analysiert und auf den Nenner gebracht, zumindest in Deutschland und damit auch in der EU…

Ich finde erstaunliche Parallelen zwischen der Klima- und der Corona-Krise. Bei beiden ist das Priming/Framing ähnlich: wenn wir nicht eingreifen, kommt es zu einer Katastrophe. Und wir haben die Wissenschaften, die sich in einer Art „Konsensbildung“ auf das Ausmaß einigen. Wir haben gerade bei Corona gesehen, wie manche Modelle dramatisch von der Wirklichkeit (Faktor 5-10) abweichen.

https://www.aier.org/article/imperial-college-model-applied-to-sweden-yields-preposterous-results/

Ich hoffe, dass die Klimamodelle bessere Prognosewerte aufweisen….

Während in der Corona Krise als „Anchor“ die Fallzahlen definiert wurden, sind es in der Klimakrise der CO2-Ausstoß, noch weiter spezifiziert mit einem verbleibendem Restbudget (je nach Quellen zum Erreichen des 1,5 Grad Zieles unter 500 Gigatonnen CO2). Ich halte es für vollkommen unrealistisch, diese Budgets auch nur annähernd einhalten zu können. Alleine die derzeit bekannten Erdölreserven von 234 Milliarden Tonnen entsprechen in etwa einem CO2 Ausstoß von 710 Gigatonnen. Und Erdöl macht nur ca. 34% der fossilen Brennstoffe aus (Erdgas 20%, Kohle 40%). Also müssten wir weltweite Regeln aufstellen, dass Energielieferanten hoher Energiedichte (fossile Brennstoffe) ab einem Tag x nicht mehr gefördert werden dürfen. Vorausgesetzt natürlich, wir hätten bis dahin eine vollständige Substitution durch erneuerbare Energien erreicht.

„Die VORGABEN kommen aus Berlin/Brüssel für so viel PLANUNGSSICHERHEIT, dass keine Zweifel bestehen werden, WO investiert werden MUSS, damit satt Profit gemacht wird.“

Wieder richtig! Die Corona Krise hat uns aber auch gerade gezeigt, welche Kollateral-Schäden entstehen. Ich nehme wieder die Analogie zu Corona: wir haben hunderte Milliarden investiert, um ein paar Lebensjahre der älteren Bevölkerung zu retten, haben dabei aber die Existenz vieler „mitten im Leben“ stehender Anteile der Bevölkerung zerstört. Welche Zerstörung bzw. Kollateralschäden wird die Klimarettung hervorrufen?

„Die Notenbanken müssen keine Klimapolitik betreiben, sondern darauf achten, dass genug Liquidität im System ist.“

Auch wieder richtig. Und Corona hat gezeigt, dass es funktioniert…“Never change a winning formula”

@ Dietmar Tischer

“Die Notenbanken müssen keine Klimapolitik betreiben, sondern darauf achten, dass genug Liquidität im System ist.“

In der Tat. Sie müssen/sollten aber auch darauf achten, dass nicht zu viel Liquidität (aka Reserven) im System ist. Und sie sollten darauf verweisen, dass Überliquidität VÖLLIG unnütz ist, ja sogar schädlich, weil fundamental irreführend, wie man auch an den Argumenten hier am Blog immer wieder ablesen kann.

@Herr Tischer, seien wir doch realistisch, das System ist am A…

Es ist durch Ideologen, Opportunisten und Dummköpfe kompromitiert.

“SOLANGE aufgrund der Entscheidungen satt GELD verdient wird, ist zumindest einem wesentlichen ZIEL gedient. ”

Genau, die (zynische) Frage ist doch nur noch “wie verdiene ICH daran?” Umwelt/Klimagedöhns – ETFs kaufen?

@Hansjoerg Pf

“Wie verdiene ich daran [Klimawandelpolitik]”?

Wenn sie glauben, dass die Politik das mittelfristig durchsetzen und durchhalten kann (gegen die Bevoelkerung, Wirtschaft, globalen Wettbewerb), dann koennten sie mit CO2-Zertifikaten spekulieren.

Siehe zB klementoninvesting.substack.com/p/the-long-term-outlook-for-co2-as

Viel Glueck damit, Joerg

@D.T.

>Es wird GRAVIERENDE Einbußen individueller Freiheit geben.

Individuelle Freiheiten, die schon jetzt Ermessenssache sind:

– Meinungsfreiheit

– Bewegungsfreiheit

– Berufsfreiheit

– Gewerbefreiheit

– Religionsfreiheit

– Unversehrtheit der Wohnung

– Telekomunikations-, Brief-, Bankgeheimnis = Freiheit

Vor Massenimpfung war körperliche Unversehtheit auch ein Grundrecht, welches letzte Woche der europäische Gerichtshof für Menschenrechte gekippt hat. Dieser ist übrigens auch das mögliche Ziel der unzufriedenen Kläger des Urteiles von heute…..

Der Dreiklang aus Terror, InzidenzPandemie und Klimawandel – lässt keine andere Wahl.

@ Dagobert

Terror ist etwas anderes, als das, was bei uns ist.

In jeder Gesellschaft MUSS es Beschränkungen individueller Freiheit geben.

Worüber man diskutieren kann:

Welche aus welchem Grund für wen mit welchem Ziel.

Mit dem heutigen Urteil ist etwas gesetzt worden, was so meines Wissens noch NIE der Fall war:

Es wird AUSDRÜCKLICH ein RELATIVISMUS in den Prozess der demokratischen WILLENSBILDUNG eingeführt:

>Künftig könnten selbst gravierende Freiheitseinbußen zum Schutz des Klimas verhältnismäßig und verfassungsrechtlich gerechtfertigt sein, erläuterten die Richter. Zwar müssten die Grundrechte abgewogen werden. Aber: „Dabei nimmt das relative Gewicht des Klimaschutzgebots in der Abwägung bei fortschreitendem Klimawandel weiter zu.“>

Was heißt das „relative Gewicht nimmt zu“?

Es heißt z. B.:

Wenn eine ABSOLUTE Mehrheit von Bundestagsabgeordneten und die durch sie gebildete Regierung, also EINDEUTIGER demokratischer Mehrheitswillen, nach Ansicht von ein paar Leuten – einer MINDERHEIT – das Klimaschutzgebot, vermutlich ist CO2-Neutralität 2050 gemeint, NICHT angemessen GEWICHTET, gehen diese Leute nach Karlsruhe und lassen da NEU gewichten.

Also:

Das, was GEBOTEN erscheint, wird nicht MEHR nach gesellschaftlichen WOLLEN entschieden, sondern nach ANSICHT einer Handvoll von Richtern.

Die Befriedung enormer gesellschaftliche KONFLIKTE unterliegen damit nicht mehr der politischen KONSENSBILDUNG, sondern sie wird zukünftig durch Karlsruher DIKTAT hergestellt, wenn es ein paar Leute wollen.

Demnächst:

VORGABEN zur relativen GEWICHTUNG bei der RENTENGESETZGEBUNG aus Karlsruhe …

@Herr Tischer

“Terror ist etwas anderes, als das, was bei uns ist.”

Doch, Terror im engeren Sinne gibt es auch bei uns. Was war beispielsweise der LKW-Anschlag auf den Weihnachtsmarkt am Breitscheidplatz denn sonst?

Aber das nur nebenbei. Wenn ich lese, was Sie schreiben, haben Sie ja doch schon wieder vergessen, was ich Ihnen heute geschrieben habe.

“Das, was GEBOTEN erscheint, wird nicht MEHR nach gesellschaftlichen WOLLEN entschieden, sondern nach ANSICHT einer Handvoll von Richtern. Die Befriedung enormer gesellschaftliche KONFLIKTE unterliegen damit nicht mehr der politischen KONSENSBILDUNG, sondern sie wird zukünftig durch Karlsruher DIKTAT hergestellt, wenn es ein paar Leute wollen.”

Also nochmal: Die Richtlinien der Politik bestimmt nicht das Bundesverfassungsgericht, das macht der Bundeskanzler. Und die gesetzlichen und auch verfassungsrechtlichen Grundlagen der Politik bestimmen Bundestag und Bundesrat, das Bundesverfassungsgericht kann das Recht nur auslegen.

Wenn das Bundesverfassungsgericht meint, dass der deutsche Staat in seinem Handeln einem “Klimaschutzgebot” unterliegt und das zu inakzeptablen politischen Konflikten führt, dann muss Deutschland aus dem Pariser Abkommen austreten und gegebenenfalls sogar Artikel 20a des Grundgesetzes (“Der Staat schützt auch in Verantwortung für die künftigen Generationen die natürlichen Lebensgrundlagen und die Tiere im Rahmen der verfassungsmäßigen Ordnung durch die Gesetzgebung und nach Maßgabe von Gesetz und Recht durch die vollziehende Gewalt und die Rechtsprechung.”) streichen oder zumindest umformulieren.

Ich halte die Auslegung von Artikel 20a als “Klimaschutzgebot” für völligen Unsinn, weil der der deutsche Staat “das Klima” nicht “schützen” kann (Gedankenexperiment: Was soll der deutsche Staat denn konkret unternehmen, wenn irgendwann mal wieder eine Kaltzeit kommt und “Klimaschutz” ernsthaft eines seiner verfassungsmäßigen Staatsziele ist?) und das damit kein sinnvolles Staatsziel ist, aber wenn das Verfassungsgericht das anders sieht, muss man ihm gegebenenfalls die gesetzliche Grundlage für seine Argumentation entziehen, um rechtssicher seine Ruhe vor solchen aktivistischen Verfassungsrichtern zu haben.

Mit dem heutigen Urteil hat das Verfassungsgericht jedenfalls zukünftige politische Konflikte in diesem Feld massiv verschärft, was sich langfristig als schwerer Fehler herausstellen wird. Da liege ich mal nahe an Ihrer Einschätzung, kommt ja auch nicht allzu oft bei den hier diskutierten Themen vor.

@D.T.

Ich stimme Ihnen zu, nur möchte ich noch deutlicher sein.

Relativismus verträgt sich nicht mit Tatsachenwahrheit als zweifelsfreier Grundlage juristischer u.o. politischer Entscheidungen, wie die Wissenschaft bewegt man sich damit im Bereich von Glauben.

Ein Diktat von Richtern erwarte ich nicht, sondern das Wechselspiel aus Politik und juristischer Absegnung – und zwar in allen Fragen von Bedeutung.

Die dritte Säule der Gewaltenteilung ist damit abgebrochen, der Weg zum Verfassungsgericht für die verbliebene Opposition als Sisyphos Schleife versperrt.

Sollte sich der Verdacht über die Gefahr von Autoimmunerkrankungen im Zuge der Massenimpfungen erhärten, ist zumindest in Rentenfragen keine Verfassungsklage zu erwarten – die Betroffenen haben dann andere Sorgen.

Ich rechne damit, dass sich die Entscheider allesamt mit der Machtfülle überfordern und erwarte erhebliche Kollateralschäden, erst ökonomisch dann menschlich.

Für den Standort BRD / Europa verfinstern sich die Aussichten immer weiter.

@ Richard Ott

>Doch, Terror im engeren Sinne gibt es auch bei uns. Was war beispielsweise der LKW-Anschlag auf den Weihnachtsmarkt am Breitscheidplatz denn sonst?>

Sie wissen, dass es UNSINN ist so zu argumentieren.

Denn dann hätten wir in der ganzen Welt NUR noch undifferenzierten Terror.

>Also nochmal: Die Richtlinien der Politik bestimmt nicht das Bundesverfassungsgericht, das macht der Bundeskanzler.>

Ja.

>Und die gesetzlichen und auch verfassungsrechtlichen Grundlagen der Politik bestimmen Bundestag und Bundesrat,…

Ja, die GRUNDLAGEN, u. a. durch Ergänzungen und Änderungen des GG.

>… das Bundesverfassungsgericht kann das Recht nur auslegen.>

Nein.

Denn bei einer zugelassenen Klage MUSS es URTEILEN – und das ist nicht auslegen, sondern PRÜFEN anhand der GG-Normen –, ob das Recht, dass Bundestag und Bundesrat mit ihren Gesetzen schaffen, mit diesen Normen VEREINBAR ist bzw. mit welchen Änderungen es evtl. vereinbar ist.

NUR aufgrund derartiger Urteile kann das Recht WIRKSAM werden (Voraussetzung: es muss geklagt worden sein).

Wenn Karlsruhe NEIN sagt, muss es geändert und wieder geprüft werden oder es kann in der Tonne verschwinden.

>Wenn das Bundesverfassungsgericht meint, dass der deutsche Staat in seinem Handeln einem “Klimaschutzgebot” unterliegt und das zu inakzeptablen politischen Konflikten führt, dann muss Deutschland aus dem Pariser Abkommen austreten…>

Nein, sondern:

Wenn das BVerfG meint, dass bestimmte von der Regierung erlassene Klimamaßnahmen nicht mit dem GG vereinbar sind, dann MUSS Deutschland – in letzter Konsequenz – die Pariser Klimaziele AUFGEBEN, was de facto heißt: das Pariser Abkommen kündigen.

Der Punkt ist:

Das BVerfG prüft NUR mit Blick auf das GG.

Es prüft NICHT, ob Gesetze des Bundestags/Bundesrats zu politischen Konflikten führen.

Politische Konflikte müssen POLITISCH entschärft werden.

Dafür ist die Mehrheitsbildung ENTSCHEIDEND.

Wenn es z. B. eine Mehrheit gäbe, die bei der Verfolgung des Ziels Carbonneutralität 2050 nicht lösbare politische Konflikte in Deutschland sehen würde, könnte sie das Pariser Abkommen kündigen und nicht mehr gebunden sein, dieses Ziel zu erreichen.

Dafür braucht es kein BVerfG.

Es wird aber in der REALITÄT anders laufen, nämlich so wie es HEUTE bereits überall läuft:

ALLE bekennen sich zu dem Ziel und NIEMAND erreicht es.

Und das mit GERINGEM Effekt, aber ENORMEN Kosten.

Billiges Geld hat die Ökosysteme verändert, der Flächenfraß ließ die Grundwasserspiegel sinken. Versiegelte Flächen verdunsten weniger, was über die Wolkenbildung nicht nur die Erderwärmung sondern auch Starkregen verschuldet. Nicht erst seit der Nullzinspolitik von 2000ff Bsp: https://youtu.be/h_DOIo5ZnZU & youtu.be/U8-bSBPxMVg

Trivial ist was jeder nachvollziehen kann. Wissenschaft kann nur sein was niemand versteht und zu allem ermächigt, vor allem weiteren Zahlungen zur Beseitigung von Schäden der eigenen Politik.

Die unerschöpflichen Renditen aus diesem Kreislauf dem Kapitalismus anzulasten ist natürlich nicht trivial, auch wenn das Kollektiv haftet und niemand Verantwortung trägt.

@Alexander

Danke für den link-

dass täglich 130 Arten aussterben/ Überbevölkerung, Agro-Monsanto-Chemie-Industrielle Landwirtschaft , alles wird vertuscht durch die Tunnel- Fokussierung ” Erderwärmung” .

Biologie-Studenten( Uni-Freiburg, Dipolm-Studiengang) kennen nicht den Unterschied zwischen Reineclaude und Mirabelle, sie wissen nicht, wie man Hochstamm-Obstbäume schneiden oder pfropfen kann: Kenntnis und Linne- Bestimmung von Pflanzen nicht mehr Lehrinhalt, die Fachidioten der Zukunft verlassen hochdiplomiert als angehende Gentechniker die Universitäten.

Hoffnung gibt das 2007 publizierte Buch von Alan Weismann ” Die Welt ohne uns”:

https://de.wikipedia.org/wiki/Die_Welt_ohne_uns

Könnte sein, dass die Hintermänner des grossen Re-set die Wunschziele von Weismanns Thesen realisieren werden. Klima ist Vorwand, Weismann definiert die Ziele.

@Dr. Lucie Fischer

In diesen beiden Wochen blühen Schlehen, Zwetschgen, Kirschen, Mirabellen, Birnen, Äpfel und demnächst die Quiten. Anstelle das zu genießen rücken die Rasenroboter aus und mähen um die Säume der verlegten Unkrautvernichtungsfolien herum…..weil die Eigentümer keine Zeit zu verschwenden haben, sie müssen unbedingt ihr z.B. Radlpensum erfüllen – d.h. >10.000km 2021 erreichen….ohne E.Antrieb! Man will schließlich 100 Jahre alt werden….

Wir sind am Ende….und das merken Enkel wie Eliten, jeder wie er kann.

Es gibt keinen vernünftigen Grund einen Klimawandel aufzuhalten. Es existieren auch keine wissenschaftlich und statistisch stichhaltigen Modelle. Die meisten Grundlagen der Modelle sind ihrerseits mindestens Teilschätzungen. Es fehlen statistisch zuverlässige Datenerhebungen (z.B. bei Meereserwärmung etc. ) Dies bedeutet in der Folge, dass die Ergebnisse falsch sein müssen. Ferner ist das Klima höchst komplex und daher ohnehin nicht zuverlässig zu berechnen. Und auf dieser Basis werden Klimaziele beschlossen.

Dies bedeutet nicht, eine schonende Umweltpolitik zu betreiben. Dies kann man allerdings nicht nur durch Verbote, sondern durch die Einführung von neuer Technologie wie Filter etc. und eine vernünftige, damit verbundene Industriepolitik.

Wenn wir eine “climate emergency” haben, sollten auf jeden Fall die Klima-Aktivistinnen vorbildlich sein und auf sämtliche Kosmetika und Haarfärbemittel verzichten. Verzicht ist ohnehin die Kernpolitik der Klimaaktivisten (gilt aber nur für andere, nicht für Villen- und Privatjetbesitzer). Statistisch interessant wäre der Vergleich: Durchschnittliche Wohnungsgröße, Einkommensverhältnisse, Bildung der Grünen im Verhältnis zur Gesamtbevölkerung.

Im Grunde geht es um vier Dinge:

– Subventionen abgreifen,

– Bürger höher besteuern,

– Geld umverteilen zu Wählergruppen,

– Gesellschaft in Richtung internationaler Sozialismus umbauen.

““We are facing a climate emergency that ….”

Publikationen, die so oder ähnlich beginnen oder auf diese Aussage unkritisch stützen, lese ich schon längst nicht mehr aus guten Gründen.

Um es gleich vorneweg zu vermerken:

1. Ja, der Mensch, beinahe 8 Milliarden nun und täglich mehr, beeinflusst das Klima, und nicht nur das. Die Erde ist schlicht übervölkert.

2. Ja, das Klima ändert sich, aber das ist ein Fakt seit Millionen Jahren und somit nichts Neues. Der Mensch als höchstentwickelter Säuger hat sich bisher immer angepasst, auch an Lebensbedingungen, die weit über die im Raum stehenden Horrorszenarien hinausgehen.

3. Die wesentlich bestimmenden Faktoren für das Weltklima, nämlich die Sonnenstrahlung als Energiespender und die astronomischen Konstellationen, können vom Mensch gar nicht beeinflusst werden. Ebensowenig wie nicht auszuschliessende, da (selten) wiederkehrende Naturkatastrophen.

4. Die der Klimavoraussage zugrundeliegenden Rechenmodelle sind samt und sonders mangelhaft, da sie wesentliche Einflussfaktoren ausser Acht lassen und nicht einmal die erdgeschichtlich völlig unbedeutende Zeitspanne der letzten 200 Jahre zutreffend nachbilden können. Im übrigen sind sie alle gestrickt, dass sie nicht stabil sind, während die Erde offensichtlich ihr Klima +/- 20° konstant hält, seit es Warmblüter gibt.

5. Ich friere!

@Bauer

Es verwundert, dass ein erfahrener, reflektierter und naturwissenschaftlich gebildeter Mensch wie Sie einige Postionen der science-denialism Szene reproduziert, die nicht mal einfacher Logik standhalten.

„ Ja, das Klima ändert sich, aber das ist ein Fakt seit Millionen Jahren und somit nichts Neues. Der Mensch als höchstentwickelter Säuger hat sich bisher immer angepasst“

An langsamere Veränderungen. Die schnelleren, lokalen Änderungen hatten gravierende Auswirkungen. Was für eine Schlussfolgerung lässt sich auf die heutige Situation also ziehen? Auch gravierende Auswirkungen sind nicht schlimm, weil wir eh zu viele sind?

ad Punkt 3.: Dieser schließt nicht aus, dass es nicht andere, auch wesentliche Punkte gibt, die der Mensch beeinflusst. Der Punkt ist richtig, bloß irrelevant, solange man nicht zeigt, dass CO2 nicht so wirkt, wie von der Physik beschrieben.

ad Punkt 4.: Komisch: Klimamodelle, die das nicht können, gibt es zu Hauf. Sie werden aus den ernstzunehmenden Modellen genau deshalb rausgemendelt. Dass es keine Modelle gäbe, die das täten (die Rückschau abbilden), ist schlicht sachlich falsch.

„Im übrigen sind sie alle(sic!) gestrickt“

Nö!

Ich weise an der Stelle immer drauf hin, dass der Parameter der globalen Temperatur schon in den ganz alten Szenarien aus den 70ern richtig vorhergesagt wurde für heute.

@Christian Anders

“Klimamodelle, die das nicht können, gibt es zu Hauf. Sie werden aus den ernstzunehmenden Modellen genau deshalb rausgemendelt. Dass es keine Modelle gäbe, die das täten (die Rückschau abbilden), ist schlicht sachlich falsch.

(…)

Ich weise an der Stelle immer drauf hin, dass der Parameter der globalen Temperatur schon in den ganz alten Szenarien aus den 70ern richtig vorhergesagt wurde für heute.”

Keine Kunst, die vielen Modelle, die das jeweils nicht konnten, wurden ja “rausgemendelt”. Und wenn neue Messwerte reinkommen und die überlebenden Modelle nicht zu ihnen passen, dann muss man halt noch mehr “rausmendeln”, nicht wahr?

Man könnte auch süße kleine Äffchen die Ergebnisse würfeln lassen, aber das würde nicht genügend Anschein von Wissenschaftlichkeit produzieren…

@Ott

Dir korrekten Szenarien aus den 70ern waren die ersten und eine Zeit lang einzigen. Ziemlich kluge Äffchen…

Sie finden es also komisch, Modelle anhand vorhandener Daten zu testen und zu verwerfen, wenn nicht funktionierend?

Interessant. Ich habe noch gelernt, dass das ein sinnvolles Vorgehen ist.

@Christian Anders

Wenn man den Äffchen lange genug Zeit und unbegrenzt viele Versuche lässt und ihnen eine Schreibmaschine gibt, dann tippen sie sogar einen ganzen sinnvollen Roman…

Ein Beleg für ihr Können ist das aber trotzdem nicht.

@Hr Anders

Was halten Sie von “Jalousien” in der Umlaufbahn von geostationaeren Satelliten?

“3. Die wesentlich bestimmenden Faktoren für das Weltklima, nämlich die Sonnenstrahlung als Energiespender …, können vom Mensch gar nicht beeinflusst werden. Ebensowenig wie nicht auszuschliessende, da (selten) wiederkehrende Naturkatastrophen.”

Zum einen bringen ja schon die versch. Satellitenbetreiber eifrig kleine Verdunklungskoerper in die Umlaufbahn, zum anderen, was spraeche gegen das vorsichtige Einbringen von Styropor-Kuegelchen o.aehnl. ueber den +/- 20 Breitengraden?

Jedes % weniger Sonneneinstrahlung muesste doch zu weniger T-Erhoehung fuehren (vgl. Vulkanasche)? Oder wie sind da die Zusammenhaenge?

LG Joerg

@Ott

Ich wiederhole: Die ersten waren von Anfang an richtig, sogar, als sie die einzigen waren. Treffer im ersten Versuch.

Heute verwirft man, was empirisch nicht adäquat ist. Weil man das erkennt – anders als Affen, die nicht wissen, wann Buchstabensalat ein Roman ist. Die Methode hat einen Namen… wie war das gleich?

Ähm. Hm? Ach ja: Wissenschaftliche Methode. Das wars.

Sie diskreditieren, was Sie nicht verstehen. Schwaches Niveau, sogar für Sie. Schlechter Tag?

@Joerg

Dagegen spricht die Rückbaufähigkeit dieser Maßnahme. Meiner persönlichen Meinung nach.

@Hr Anders,

OK, dann nehmen wir einklappbare/schwenkbare Sonnensegel (gibt’s schon als Solarmodule?).

Wie ist das mit der physikalischen Beschattungswirkung?

Gibt’s da einen Vorteil/Multiplikator bei der installierten Flaeche in der Umlaufbahn (immerhin teuer) gegenueber der Beschattung auf der Erde durch die grosse Entfernung (immerhin 36.000km)?

Wie waeren die Groessenordnungen installierte Flaeche, % Sonneneinstrahlungsverminderung, Temperatur-Aenderung auf der Erde?

LG Joerg

@Joerg

Sorry, ich bin grad zu faul, es selber auszurechnen. Aber Sie nehmen theoretisch den Strahlungsantrieb von grob 3W/m^2 und müssen diesen gerechnet auf die Fläche der ganzen Welt durch Verschattung ausgleichen. Dabei absorbiert das System Erde etwa 240 W/m^2 Sonnenenergie.

(alles zeitgemittelte Werte über ein Jahr).

Sie rechnen also (Erdfläche*3)/240 und kriegen die Anzahl der zu 100% zu verschattenden qm. Im Schatten keine Fotosynthese. Überzeugt mich nicht.

Wieviel % Verschattung am Boden ein Element im Orbit liefert, ist ein geometrisches Problem, müsste aber recht effektiv sein.

Aber ganz überschlägig komme ich zum Schluss, dass das ganz schön viel Fläche wäre – Aufwands-Ertrags-Verhältnis sicher kein gutes. Plus andere Probleme.

Hm… ne, überzeugt mich nicht. Habe ich mich aber auch noch nicht ausführlich mit beschäftigt.

Herr Bauer,

es ist nichts zu machen, die “Klimaforscher” haben zweifelsfrei nachgewiesen, dass die anthropogen verursachte Klimakatastrophe stattfindet. Dieser Zirkus wird nun stattfinden. Mitmachen, Grün wählen und zuschauen, mehr ist nicht drin. Hauptsache, es kommt uns kein neues Dryas-Ereignis dazwischen, aber da wird den “Klimaforschern” sicher etwas einfallen, warum es auf einmal wieder kalt wird (vermutlich weil es wärmer wurde).

Ich finds super lustig, “ESG” wird das “Multimedia” der 2020er Jahre. Damit kann man als Konzern doofe linke Gesinnungsjournalist*innen schön bequatschen und ihnen erzählen, was sie gerne hören wollen und wobei sie sich gut fühlen und von den ebenso klugen Politiker*innen Subventionen abgreifen. Blackrock/Merz haben es schon begriffen:

“BlackRock Inc.’s iShares ESG Aware MSCI USA ETF (ESGU) includes stakes in Exxon Mobil Corp. and Chevron Corp., for example, while its biggest holdings are in tech companies under investigation for monopoly abuse. Stocks in Xtrackers MSCI USA ESG Leaders Equity ETF (USSG) include McDonald’s Corp., which has come under scrutiny for its treatment of employees.”

https://www.bloomberg.com/news/articles/2020-10-25/record-flows-pour-into-esg-funds-as-their-wokeness-is-debated

Ökologisch und sozial investieren in Ölkonzerne, geheimdienstfreundliche Big-Tech-Nutzerüberwachungsfirmen und McDonald’s, ist ja klar, die haben ja sogar schon ein grünes Logo. :D

….. eigentlich geht es bei dieser politik nur um einem fakt:

die notenbank soll durch die klimapolitik animiert werden, mehr geld zu drucken und so den machthabern aus politik und wirtschaft, den hintern retten und gleichzeitig mehr vermögen ermöglichen.

ist sowas nicht etwa ein “insich-geschäft” ? ist ja sowieso übliche praxis der machthaber, denn sie bestimmen die politik für ihre macht und dem eigenen vermögen.