Diese Inversion der Zinskurve ist schlimmer als frühere

Mittlerweile haben es alle mitbekommen: Die Zinskurven haben sich in vielen Ländern “invertiert”. Damit ist gemeint, dass die Zinsen für zehnjährige Anleihen unter dem Niveau für zweijährige liegen. Gemeinhin – aufgrund historischer Erfahrung – als klarer Indikator für eine bevorstehende Rezession gesehen. In den USA war es das tägliche Thema in den Wirtschaftssendungen und TV-Sender haben sich alle Mühe gemacht, die Risiken kleinzureden und die Privatinvestoren in die Märkte zu treiben. So zumindest mein Eindruck bei meinem kürzlichen Aufenthalt.

John Authers nimmt sich in seinem exzellenten, kostenfreien Bloomberg Newsletter des Themas an. Ich finde es immer wieder faszinierend, ihn zu lesen und denke, er ist ein herber Verlust für seinen früheren Arbeitgeber FINANCIAL TIMES (FT) und ein tägliches Muss für jeden, der sich mit Geldanlage beschäftigt.

- “The most widely watched part of the U.S. Treasury market’s yield curve has finally inverted. (…) Should we care? And, if so, why should we care?” – bto: Ich finde, es ist gut, diese Frage nochmals erklärt zu bekommen.

- “Historically, yield curve inversions have been reliable early indicators of a recession. (…) But we only have a sample of seven recessions to study, and the circumstances in all those inversions were slightly different. (…) What is most notable this time is the drop in longer-dated bond yields (…) The 30-year Treasury yield hit an all-time low(and) its recent decline is shocking in historic terms.” – bto: Das ist das Entscheidende. Es ist so gesehen dramatisch, andererseits angesichts der weltweit ohnehin schon sehr tiefen Zinsen wiederum nicht so überraschend. Dachte ich zumindest.

- “This is the 7th time in 35 years that 30-year yields have declined by such a large degree over a 10-day span.

- Oct 1987 – The week after stock market crash

- Jun 1989 – The week the Fed started easing (recession 13 months later)

- Feb 2000 – Tech bubble (Mar 2000)

- Nov 2001 – In recession

- Dec 2008 – The depths of the Great Recession

- Aug 2011 – The week after the U.S. lost its AAA rating and a 20% correction in the S&P 500″

- Aug 2019 – ???” – bto: Das ist natürlich eine nicht so schöne Auflistung.

- “The sharp drop in the 30-year yield brings us to another reason that is being cited to treat this inversion differently from its predecessors. This was, in the obscene-sounding vocabulary of the bond market, a ‘bull flattener.’ (…) this means that this inversion came as a result of long-dated yields coming down (a bullish event if you own bonds when this happens), rather than because short-dated yields went up, which would be a ‘bear flattener.’ (…) bear flatteners are more common. The explanation for this is that recessions usually come as the Federal Reserve raises short-term rates. This time, the Fed stopped tightening eight months ago, and rates have been heading down all year. So if anything, this inversion does look different from its predecessors, but scarier.” – bto: Das stimmt. Die Märkte selber signalisieren “Deflation und Rezession”. Oder aber es ist wirklich nur die Flucht aus der Negativwelt in Europa und Japan.

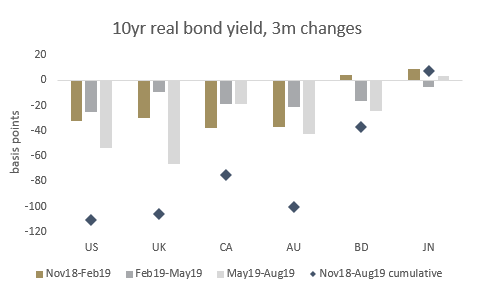

- Sodann verweist Authers auf den Aspekt, dass die Zinsen stärker gefallen sind als die Inflationserwartungen und wir es deshalb mit negativen Realzinsen zu tun haben. “Declines in real yields show specific anxiety about future growth among investors. And the last few months have seen a remarkable and coordinated drop in real yields around the world.” – bto: Das ist die Eiszeit. Eindeutig.

Quelle: Bank Mellon, Bloomberg

- “(…) the other precedents (…) without exception, happened with rates at higher levels. There is no precedent for yields this low, and therefore there is no precedent for an inversion at such low rates. This is a caveat that has hung over the financial world for a decade. Many things look alarming and unsustainable, but we simply have no experience to say whether they can be sustained with rates this low.” – bto: was die Optimisten dazu veranlasst, zu sagen, dass es diesmal anders ist. Dazu gehört dann auch Janet Yellen – wir erinnern uns, frühere Fed Chefin und berühmt für ihre Aussage, dass es keine Finanzkrise mehr in unserer Generation geben würde. Sie sagte im TV: “(…) I would really urge that on this occasion it may be a less good signal. The reason for that is there are a number of factors other than market expectations about the future path of interest rates that are pushing down long-term yields.” – bto: Na, dann ist ja alles gut!

- “(…) an inverted yield curve has real world effects (…). Banks make their money by borrowing for the short-term from depositors and lending at higher rates for the longer term. When those rates invert (or merely flatten), it becomes far harder for them to make profits. They have less incentive to lend, and they have less capital with which to withstand any risks. The inverted yield curve has quite rationally spurred a tumble for bank stocks in the U.S. and particularly in the euro zone. Banks are arguably less important to the U.S. economy than they were a generation ago; they are still central to the European economy, and further problems for European banks will create problems for the U.S.” – bto: Und die Banken sind ohnehin in Europa nicht von der Krise genesen.

- “That leads to yet another argument to ignore this latest yield curve inversion: that the pressure on the U.S. market at this point is largely from beyond American shores. Europe is in the midst of a deflation scare, and investors there are rushing to get yield wherever they can – which means buying Treasuries. (…) this makes sense but only to a point. Post-globalization, it is far harder for the U.S. to ignore events elsewhere in the world. The dollar is a critical point of pressure. If its economy remains strong, its currency will be bid up and that will dent American companies’ profits and render American exporters less competitive.” – bto: Und ein starker Dollar erhöht die Probleme all jener, die sich in US-Dollar verschuldet haben, aber in anderer Währung ihr Geld verdienen. Vor allem in den Schwellenländern. Das hat gewisse Margin-Call-Aspekte.

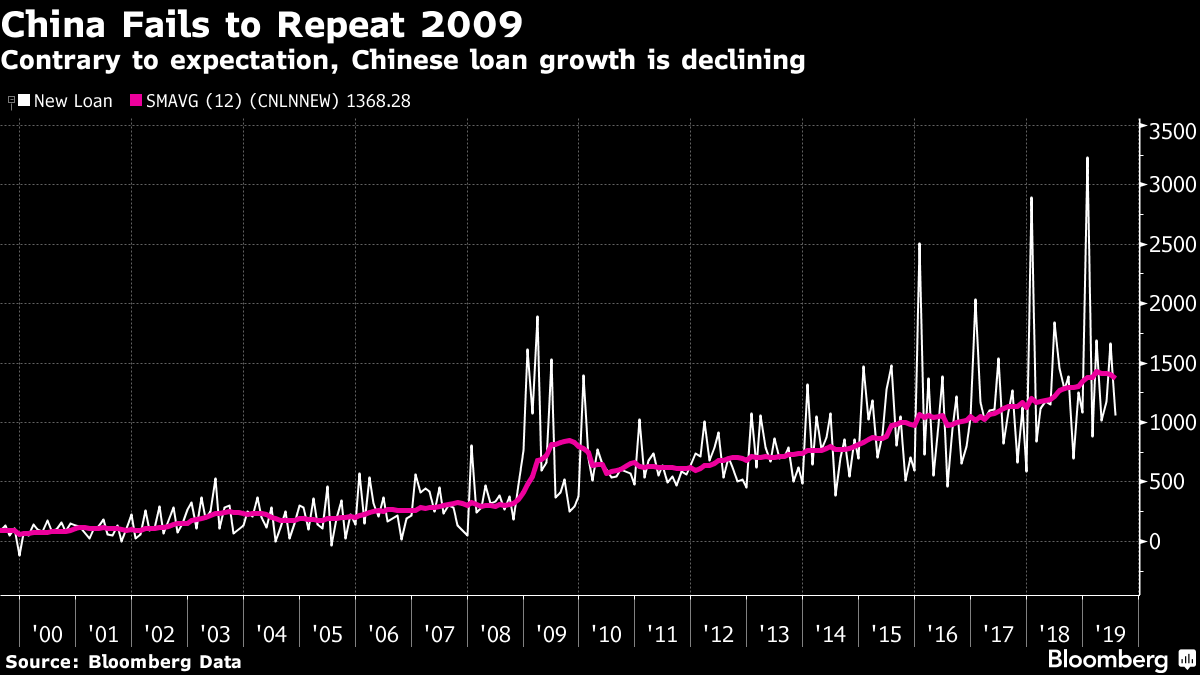

- “China was critical in allowing the rest of the world to escape from the recession that followed the Global Financial Crisis. The huge stimulus it announced in late 2008, in the form of extra loans, fired up the global economy. A the beginning of this year, investors’ working assumption that another big stimulus was on the way from China, to avert the risk of slowing. But the data (…) showed almost the opposite. If we look at a 12-month average (to avoid the distorting effects caused by China’s shutdown for the lunar new year), we see that new loan growth is actually slowing. This is nothing at all like the huge stimulus of 2009.” – bto: womit China der Welt nicht hilft. Warum auch, wenn es doch von den USA gerade unter Druck gesetzt wird?

Quelle: Bloomberg

“Does all of this prove that a recession is inevitable? No, nothing can do that. But it would be wise to take this yield curve inversion seriously, and act on the assumption that the chances of a recession have greatly increased. We should care about the inversion, and we should care because it will affect the world we live in.” – bto: Gerade für die Eurozone wird das ein Desaster werden. Trotz Helikoptern und MMT. Madame Lagarde kann eben auch kein Wachstum erzeugen.

Ich frage mich, ob in einer Zeit alles dominierender und manipulierender Notenbanken, Marktgesetze von früher, wie z.B. invertierte Zinskurven überhaupt noch eine Aussagekraft haben?

@ Zweifler

„Ich frage mich, ob in einer Zeit alles dominierender und manipulierender Notenbanken…“

Bei „Dominanz“ kann ich Ihnen folgen, aber hinsichtlich des Vorwurfs der „Manipulation“ durchdenken Sie doch einfach mal diese Aussage von Authers:

„Banks make their money by borrowing for the short-term from depositors and lending at higher rates for the longer term. When those rates invert (or merely flatten), it becomes far harder for them to make profits.

Und genau aus diesem Grund senkt die Zentralbank REAKTIV die Leitzinsen, um auf diese Weise den REALwirtschaftlichen Bedingungen Genüge zu tun. Sie passt auf diese Weise die Refinanzierungskosten der Geschäftsbanken an und passt somit REAKTIV auch die kurzfristigen Zinsen an die Realität an. Die Aussagekraft ist also mehr als eindeutig. Und dies ist wohl auch so bei der Bundesregierung angekommen. Immerhin scheint die schwarze Null nicht mehr sakrosankt zu sein und man bereitet sich auf Schlimmeres vor.

Das Thema „Manipulation der Zinsen“ ist eine Fiktion aus der Mottenkiste des simplifizierenden Monetarismus, der nicht nur durch den deutschen Mainstream kolportiert wird. Mark Blyth spricht hier von „Stupid Economic Ideas“. Und davon gibt es eine ganze Menge. Hier nochmals die detaillierte Begründung mit weiteren Links zum Nachlesen: https://zinsfehler.com/2013/09/06/allmachtsfantasien-zur-zinssetzungshoheit/

LG Michael Stöcker

Die deflationäre Entwicklung ist unübersehbar.

Hier die aktuelle Entwicklung in der EU:

https://www.inflation.eu/inflation-rates/europe/current-hicp-inflation-europe.aspx

Wir sind jetzt von Juli 2019 zu Juli 2018 bei 1,02 % (HICP)

Kein Wunder, dass bei der EZB über neue Finanzierungsfazilitäten nachgedacht wird.

Hier:

https://www.bloomberg.com/news/articles/2019-08-16/why-ecb-will-stuff-free-money-into-bank-pockets-again-quicktake

China kann nicht zuschauen und senkt ebenfalls die Zinsen.

Hier:

https://edition.cnn.com/2019/08/19/investing/china-interest-rate-cut/index.html

Erschreckend ist der GLOBALE Gleichlauf deflationärer Tendenzen.

Die 64.000 $-Frage lautet:

Hilft es der Weltwirtschaft, wenn sich jeder selbst zu helfen versucht?

@Herrn Dietmar Tischer:

Gegenfrage: Schadet es der Weltwirtschaft, wenn jeder sich um seine eigenen Ungleichgewichte kümmert?

Meine Meinung dazu ist: Es gibt keinen eleganten schmerzfreien Ausweg aus jahrzehntelanger Verschuldung und teilweiser Fehlallokation, auch wenn es einen gewissen Unterschied macht, ob man stark oder weniger stark kooperiert. Es gibt win-win-Situationen und loose-loose-Situationen, bei denen Selbsthilfe nützlich oder schädlich sein kann. Es gibt aber auch win-loose-Situationen, bei denen es einfach einen Sieger und einen Verlierer gibt. Und dann ist der Kooperierende der Dumme, z.B. wenn zwei Nationen Handel treiben und eine das geistige Eigentum schützt und die andere faktisch nicht.

@ Susanne Finke-Röpke

>Gegenfrage: Schadet es der Weltwirtschaft, wenn jeder sich um seine eigenen Ungleichgewichte kümmert?>

Es kommt darauf an, WIE man sich um seine eigenen Ungleichgewichte kümmert.

Meine Auffassung:

Man verbessert nicht schon dadurch seine Lage, dass man vernünftig miteinander kooperiert und insoweit auch seine eigenen Ungleichgewichte einbezieht.

Aber man verschlechtert sie dadurch auch nicht notwendigerweise weiter.

Dagegen schadet es der Weltwirtschaft und bei der internationalen Verflechtung auch dem eigenen Land, wenn man eine Handelspolitik wie Trump betreibt.

bto: “womit China der Welt nicht hilft. Warum auch, wenn es doch von den USA gerade unter Druck gesetzt wird?”

Der Handelsstreit mit den USA dürfte für die Chinsen nicht der einzige Grund für ihre Zurückhalteung sein. Der Verschuldungsstand dort ist so, dass eine weitere Neuverschuldung in dem prozentualen Maßstab wie 2008 / 2009 vermutlich gar nicht ohne Weiteres möglich ist, ohne massive binnenwirtschaftliche und innenpolitische Risiken einzugehen. Selbst nach der evtl. Beendigung des Handelskonflikts werden die Chinesen beim Thema Neuverschuldung wohl vorsichtiger sein müssen als vor 10 Jahren.

Einer der besten Beiträge von bto in diesem Jahr. Weiter so!

Große Investitionsprogramme müssen her. Der Staat kann extrem viel investieren, wenn er es nur macht: Rüstung, Bau, Familienförderungen, usw.

Der Mut zu neuen Schulden muss her.

@Hanserich:

Der Mut zu neuen Schulden klingt angesichts des Investitionsstaus und der niedrigen Zinsen erst einmal verlockend, da die Inflationsrate derzeit überschaubar ist. Ich denke, dass es politisch aber leichter durchzusetzen sein wird, wenn die drohende Eigenkapitalklemme der europäischen kommerziellen Banken die nächste Rezession ausgelöst hat (bzw. umgekehrt die nächste Rezession die Eigenkapitalklemme). Wenn der auch hier geschätzte Dr. Krall recht hat, sind dann nach 2020 sowieso Maßnahmen der Geld- und Fiskalpolitik nötig. Und dann dürfte auch ein längerer Aufbauprozess planbar sein.

@ Hanserich

Es muss kein Mut zu neuen Schulden her.

ZWANG wird quasi automatisch zu neuen Schulden führen.

Mit dem Geld aus der Neuverschuldung werden nicht große Investitionsprogramme finanziert.

Warum auch – Investitionsprogramme wählen nicht.

Mit einer neuen Verschuldung werden überwiegend Sozialleistungen finanziert und etwa auch das Kurzarbeitergeld, wenn die Konjunktur einbricht.

@Hanserich

Wer kann denn noch Rüstung, Bau, Familie usw.

Die Mittelverwendung im Bundeshaushalt können Sie sich ja in der bevorstehenden mehrtägigen Haushaltsdebatte antun, wenn Sie diese noch ertragen können.

Ein Fahrradweg von Geesthacht nach Hamburg beginnt nach 11 Jahren Planung und Koordinierung mit Konkretisierung.

Die Realwirtschaft im Bau mit den Beschäftigten kann ohne die Osteuropäer die Arbeit einstellen. Ein weiterer heißer Sommer und die A7 macht Plopp, Plopp, Plopp und der Verkehr Nord Süd kann Dauercampen mit LKW-Direktverkauf an Fußgänger. Und über Militär braucht nichts mehr gesagt werden. Schule ist eh durch.