Coronomics: Inflationär? Ja bitte!

Ich denke, Leser von bto wissen, was meine Sicht auf die Lage ist: Wir bekommen die direkte Finanzierung der Staaten durch die Notenbanken, nur früher und radikaler als wir es vor ein paar Wochen noch gedacht haben. Die FINANCIAL TIMES (FT) sieht es positiv:

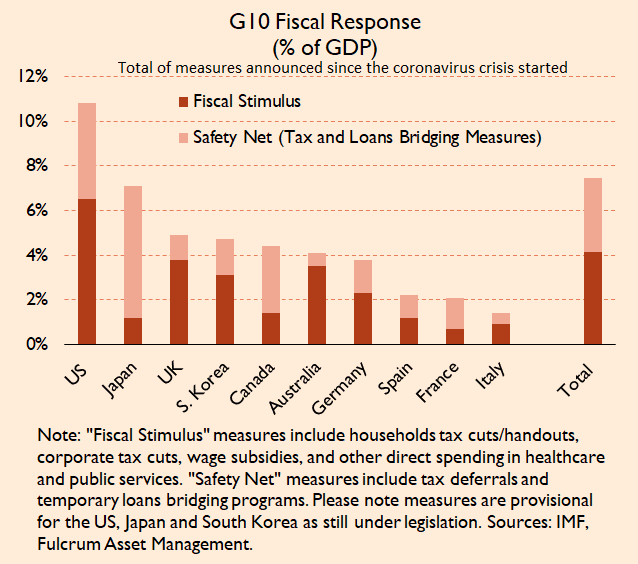

- „The increase in fiscal spending and loans in the US this year alone will reach more than 10 per cent of gross domestic product, larger than the rise in the federal deficit through 2008 and 2009. Although this is probably not as big as the financial stimulus implemented by China after the financial crash 12 years ago, most big economies could see government debt to GDP ratios rising by 10-20 percentage points.“ – bto: Ich halte das für zu tief geschätzt. Ich rechne eher mit 30 Prozent vom BIP, bei uns also 1.000 Milliarden Euro. Schon so sind die Zahlen beeindruckend:

Quelle: FT

- „The impact of central bank injections will be equally enormous. For example, the US Federal Reserve may finance part of the country’s fiscal stimulus by buying Treasuries. On top of that, its balance sheet will grow from purchases of mortgage bonds and packages of private loan assets. It would not be surprising if the Fed’s balance sheet increased by $2tn-$3tn this year, up from $4.2tn at the end of 2019. That is similar to the cumulative increase over the entire decade that followed the financial crash.“ – bto: Es ist eine Beschleunigung, die wir ohnehin erwarten mussten.

- „(…) many investors — and, privately, some policymakers — wonder if this degree of stimulus by the US and most other big economies is “affordable”, and whether it will cause government debt crises and a subsequent rise in inflation. (…) Fortunately, this is unlikely to be the case. (…) It is likely, given present economic conditions, that part of the rise in public debt ends up on central bank balance sheets for a very long time.“ – bto: Natürlich und da gehört es letztlich auch hin.

- „The good news is that this combination of fiscal and monetary stimulus will probably have larger ‘multiplier’ effects on economic activity than if long-term interest rates were allowed to rise. Furthermore, interest rates on long-term debt remain well below probable growth in nominal gross domestic product. As a result, government debt is unlikely to rise in an uncontrollable way, even if the central bank sells the debt back to the public one day, thus eventually raising bond yields and increasing the cost of financing the debt.“ – bto: Das ist die berühmte „financial repression“. Man hält die Zinsen unter dem Nominalwachstum und damit sinkt über die Zeit der Schuldenstand relativ zum BIP. Das klappte gut nach dem Zweiten Weltkrieg. Diesmal dürfte es allerdings wegen geringeren Realwachstums schwieriger sein und mehr Inflation erforderlich machen.

- „The bad news is that this form of financing can be dangerous if inflation starts to rise. We discovered during the financial crash that increases in central bank money do not automatically cause this. But today there is a complex mix of supply and demand effects at work and, together, they could cause inflation to rise. For example, if supply continues to be constrained while consumers simultaneously receive large government transfers, aggregate demand could rise in an inflationary manner.“ – bto: Und wir hätten endlich das, was seit Jahren von Staaten und Notenbanken herbeigesehnt wird.

- „Fortunately, the world economy has three factors on its side. First, this crisis comes at a time when inflation expectations are well anchored at, or below, central bank inflation targets. Second, lower oil prices are anyway helping to hold inflation down. (…) And third, the massive coronavirus stimulus will not need to remain in place as long as was the case after the financial crash.“ – bto: Beim letzten Punkt bin ich anderer Meinung. Wir werden viel mehr ausgeben müssen, weil es ein tiefer gehende Krise ist.

Nicht alle sind so optimistisch, was die Inflation betrifft. So schreibt der Telegraph in einem Kommentar (in einem Abonnenten-Newsletter, deshalb nicht verlinkt):

- “(…) once the pandemic has run its course, the oil price is going to come surging back. Demand will return to something like normal but supply will be much impaired. Nor will oil be the only inflationary force on the map. Economic supply in the round will have been damaged, adding to the inflationary pressures as demand recovers. Food, airfares, consumer durables and much else will become more expensive. Wages will seek to follow prices upwards.” – bto: Das mag sein, in einigen Bereichen wird es aber Preiskämpfe geben, um Liquidität für Schuldentilgung zu beschaffen.

- “Extensive quantitative easing at the time of the financial crisis, for instance, did not result in significant inflation, despite widespread predictions that it would. (Jetzt wird es anders sein) (…) US money growth over the next year might be 10pc to 12½pc. A correlation does hold over the medium term between increases in the quantity of money and increases in nominal GDP. Given that money and nominal GDP do track each other over time, it seemed plausible (before the virus) that inflation might reach 5pc at some point in the next two to three years. I now feel that I was being too conservative. The annual rate of money growth to spring 2021 might be between 10pc and 15pc, perhaps even heading towards 20pc. If so, the right sort of maximum inflation rate to expect in the next few years would be in the 5pc to 10pc band.” – bto: Und darauf sollten wir uns einstellen.

- “None of this is to say that Governments and central banks are doing the wrong thing. The return of a bit of inflation, after such a prolonged deflationary period, might even be thought a good thing. Higher inflation might also provide governments with a way of working off the increased debt mountains they are accumulating by closing down private sector activity. The alternative – more austerity – is scarcely likely to appeal. Nowhere is there any mandate for that.” – bto: Irrtum. In Deutschland reden die Vertreter der Neidgesellschaft schon von Lastenausgleich. Wir spinnen …