Why investors should be worried by all-conquering tech stocks

Letzte Woche habe ich in meiner WiWo-Kolumne auf die enorme Bedeutung der Technologieaktien für den gesamten Markt hingewiesen. Natürlich bin ich mit meiner Skepsis nicht alleine, wie auch dieser Kommentar aus der FT zeigt:

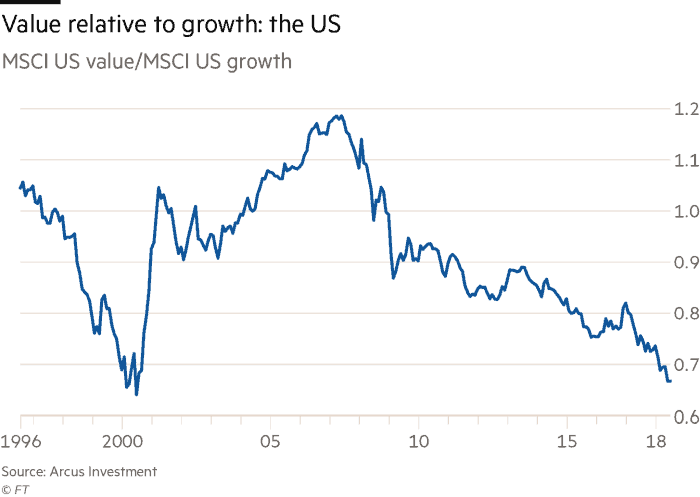

- “The internal workings of global stock markets are giving a flashing red signal. Cheaply priced stocks have been underperforming richly priced stocks for most of the past 10 years, but the predilection for high flyers has intensified sharply in the past eighteen months. The phenomenon is particularly noticeable in the US and Asian markets, excluding Japan, because of the enormous scale of the Faangs, (Facebook, Apple, Amazon, Netflix, Google) and ‚Bats‘ (Baidu, Alibaba, Tencent, Samsung) that dominate their market capitalisation.” – bto: eine Konzentration auf einige wenige Werte.

- “On some measures the gap between unloved value stocks and hot growth ones matches the excesses of the peak of the internet bubble in 2000.“ – bto: Das ist doch mal was!

- “(…) such polarisation is typical of a very late stage bull market. Average stocks of average companies are being shunned in favour of an elite group of stocks that appear immune to economic headwinds and competitive pressures. This narrowing of focus is never healthy, especially when the ascent of the chosen few becomes parabolic as investors grow increasingly worried about everything else.” – bto: Der Anstieg wird immer steiler.

- “MSCI indices of value and growth, which use the single metric of price book value, shows the degree to which the latter has outperformed. It is sometimes argued that book value is no longer meaningful in a world in which companies are increasingly reliant on intellectual property and brand value. Intuitively, that seems possible, but if off-balance sheet assets were indeed making a greater contribution to profits, there should be a structural rise in return on equity. No such rise is visible in either the US or ex-Japan Asia. Indeed, the RoE of the S&P 500 remains well below previous cyclical highs, despite the vast amount of equity that has been retired through share buybacks.” – bto: Das kann man gar nicht laut genug sagen! Die Eigenkapitalrendite liegt tiefer, obwohl wir doch profitablere Geschäfte betreiben und mit weniger Eigenkapital arbeiten! Das zeigt auch, auf welch schwachem Fundament die Börse zurzeit steht.

Quelle: FT

- Dann werden die richtigen Fragen gestellt: “What is the sustainable level of profitability for such businesses? Could they end up competing against each other? What are the political and regulatory risks? Most important of all, what is the duration of their business models in a time of constant disruption and technological change?” – bto: Es ist berechtigt. Kein Geschäft besteht ewig. Keine Überrendite besteht ewig, wenngleich ich bei bto diskutiert habe (basierend auf einem Paper von Jeremy Graham von GMO), dass es erstaunlich stabile Überrenditen gibt.

- “In recent history there have been few cases when periods of severe underperformance by value stocks have ended well for the overall market. (…) A closer parallel might be the Nifty Fifty mania in the early 1970s in the US. (…) Wharton School Finance Professor Jeremy Siegel revisited the Nifty Fifty in the late 1990s and concluded that their long-term performance as a group was reasonable. Other scholars have revisited Jeremy Siegel and declared the contrary. What is undeniable is that the Nifty Fifty were viciously de-rated in the ensuing 10-year bear market (…).” – bto: Jeremy Siegel ist der Prototyp des Aktienbullen, der zu jeder Zeit aufweist, dass Aktien gut sind.

- “The higher the valuation you pay for a stock, the more you are betting on an unknowable future. Value investment, by contrast, is grounded in epistemological humility. Its great apostle was Benjamin Graham, the pioneer of investment analysis and mentor of Warren Buffett. Writing in the shadow of the market meltdown of 1929, he came up with the concept of ‚the margin of safety,‘ a bulwark of fundamental value that would limit downside risk. That is the very opposite of ‚this time it’s different‘ — story-driven speculation that characterises major market tops. The value philosophy will have its time again — though some harsh lessons may have to be relearned first.” – bto: Und es kann bekanntlich lange dauern, bis es soweit ist …