Sollte es wirklich zur Trendwende bei der Inflation kommen?

Die große Frage ist weiter jene nach dem möglichen Trendwechsel von einem eher deflationären zu einem inflationären Umfeld. Heiß erstrebt von der Politik, erhofft man sich doch die schmerzfreie Lösung der Schuldenproblematik. John Authers diskutiert die Trendwende in seinem Newsletter und sagt, was zu tun wäre aus Sicht der Investoren:

- Er beginnt mit einem Zitat aus America in Search of Itself von Theodore H. White. “Inflation has no date of beginning. Inflation is the cancer of modern civilization, the leukemia of planning and hope; as with all cancers, no one can say when it begins or how fast it may spread. It is a disease of money, and when money goes, order goes with it. Inflation comes when a government has made too many promises it cannot keep and papers over the shortfall with currency which, ultimately, becomes confetti — and faith is lost.” – bto: Dies erinnert schon jetzt an heute, auch wenn wir noch gar keine Inflation haben.

- “Four decades later, with the Fed established as by far the most important institution in the global economy, people talk in exactly the same kind of apocalyptic terms about how lack of inflation leaves us being cheated by a thieving government. Four decades from now, it’s easy to imagine that historians will think it obvious that the current deflationary regime had become intolerable, and that it was already being shifted.” – bto: Es hängt auch mit der demografischen Entwicklung zusammen, wie wir gesehen haben.

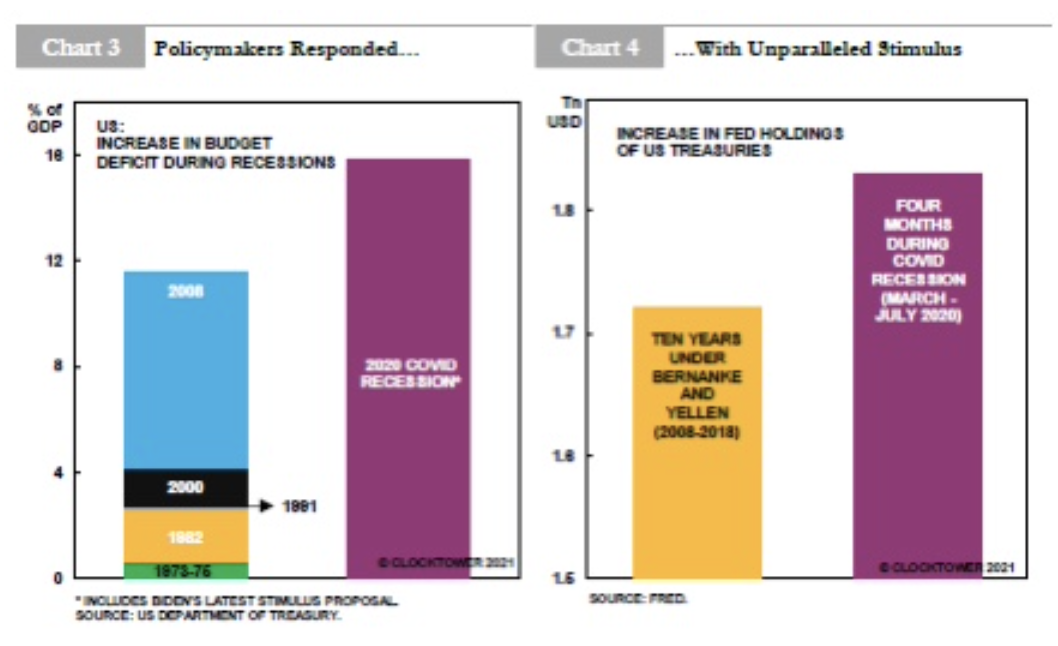

- “Inflation psychology is difficult to change. But last year might do the job. The monetary and fiscal response was of a different order of magnitude from the crises that preceded it. The following chart is from Marko Papic of Clocktower Group.” – bto: Wir sehen deutlich, dass die derzeitigen Maßnahmen alles Vergangene in den Schatten stellen.

Quelle: Bloomberg

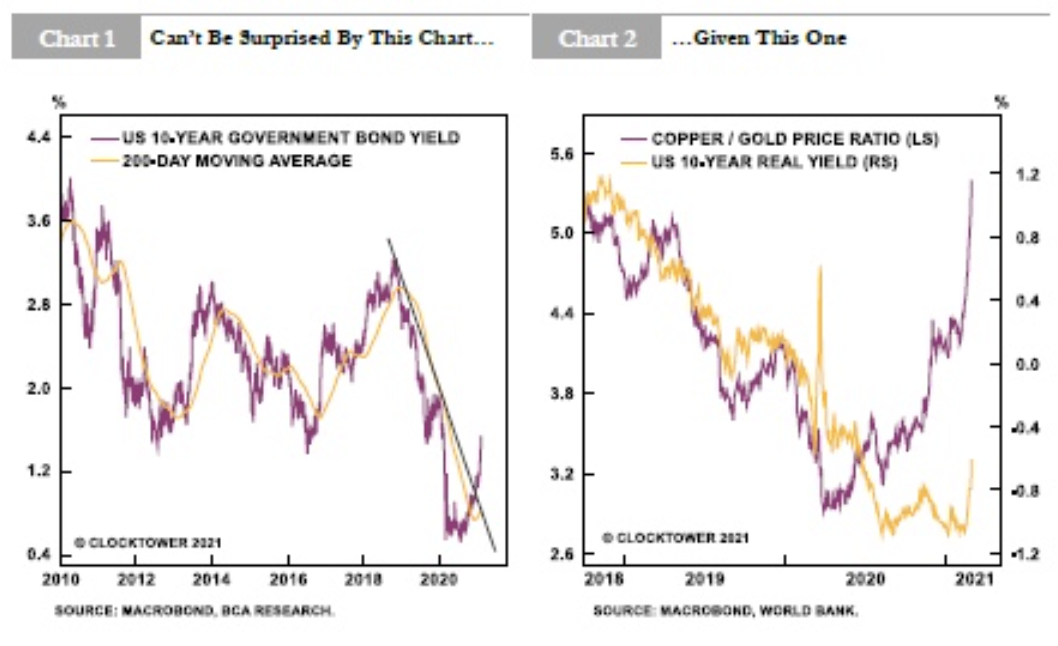

- “‘Volcker said he was going to tame inflation, unemployment be damned,’ says Alex Lennard of Ruffer LLP. ‘Now it’s the other way around. I don’t think people have quite realized that you’ve had this huge change in the mandate of policymakers.’ Added to this, there is now an agreement on fiscal expansion. Politicians around the world appear to be ‘going big.’ Meanwhile, as Papic of Clocktower shows, the underlying market moves have been suggesting a change in direction for a while.” – bto: Die Kapitalmärkte haben schon seit März 2020 begonnen, es zu “riechen”.

Quelle: Bloomberg

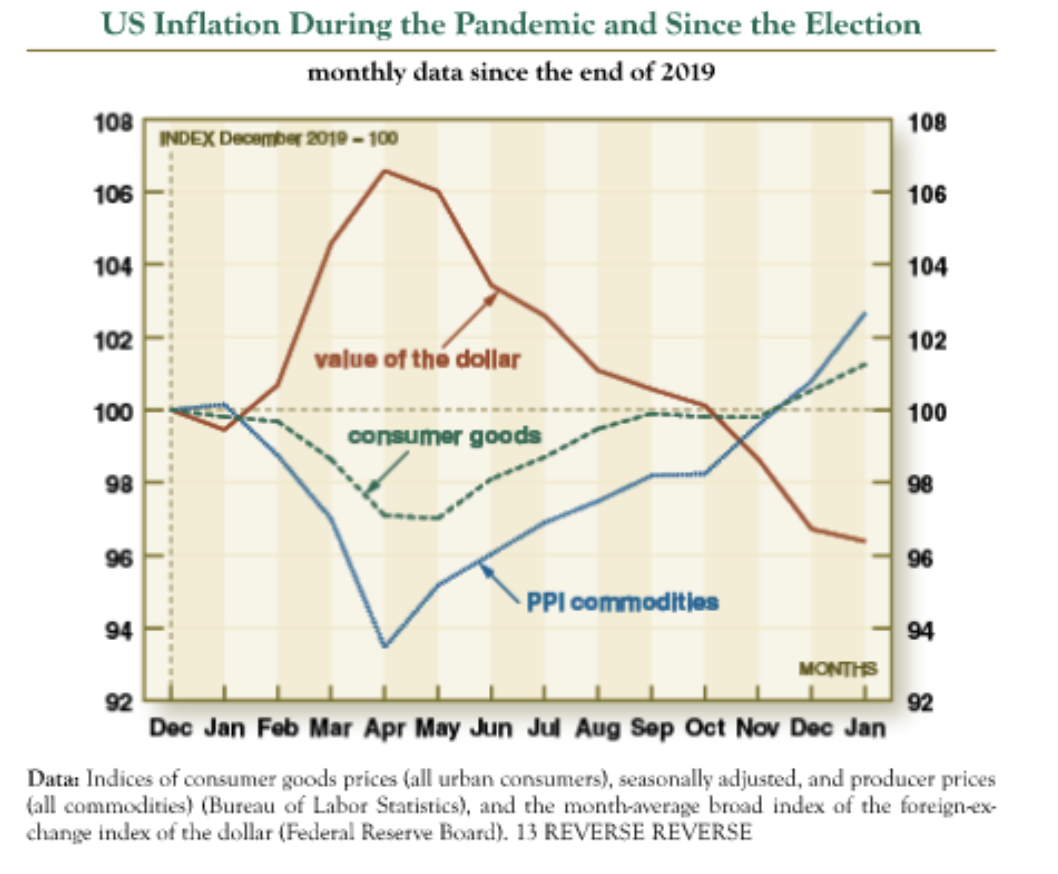

- “As for the constituent parts of inflation, this chart from David Ranson of HC Wainwright & Co. demonstrates a clear turn last year, which in the U.S. has been accelerated by the weakening of the dollar — a phenomenon that is widely expected to continue.” – bto: was aus Sicht der USA auch attraktiv ist.

Quelle: Bloomberg

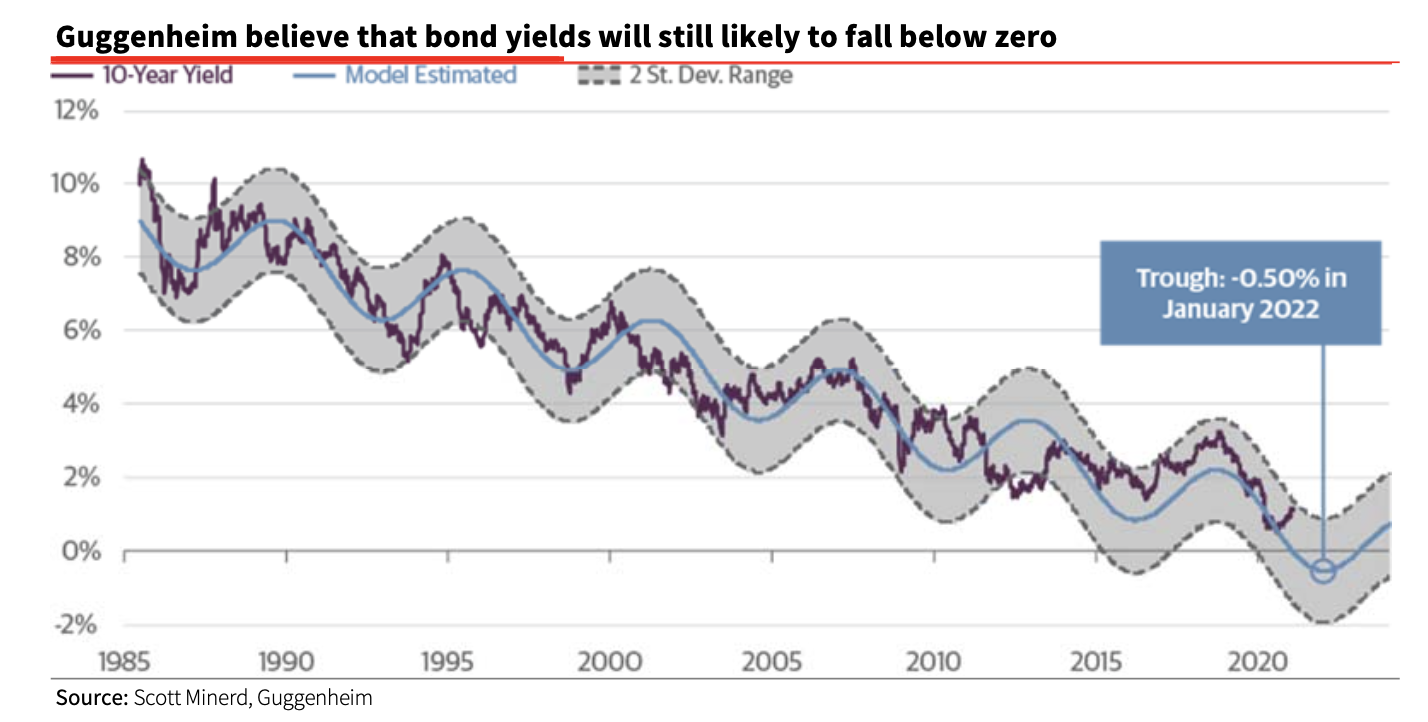

- “(…) Lawrence Summers, the former Treasury secretary who coined the phrase, has in recent weeks been cautioning about the risks of overdoing fiscal stimulus. More or less all the conditions for changing a regime are in place. Many still think that deflation and inequality are deeply ingrained and cannot be averted — but then that’s what Theodore H. White thought when the last great inflationary regime shift was already under way.” – bto: wobei es gut möglich ist, dass es noch eines finalen deflationären Pushs bedarf! So zumindest Scott Minerd, CIO von Guggenheim: “In our model of 10-year Treasury yields, the sine regression of 10-year rates since the mid-1980s, actual yields have generally stayed within a two standard deviation range of the model estimates. Currently our model suggests that while yields may drift up from here, there is still more downside. The model estimate for a trough of minus 0.5 percent in early 2022 is bounded by a two-standard deviation range of a high of 1 percent and a low of minus 2.0 percent.”

Quelle: Guggenheim

Doch was soll man angesichts dieses Szenarios tun?

- “What of the risk of a bubble from here? It’s substantial, as money is already plentiful and seemingly about to become more so. (…) Powell’s approach leaves him open to making a ‘new old mistake,’ in which the Fed takes comfort from low and stable inflation and thereby fails to act against a build-up of speculation. This is the inflation pattern that lulled the Fed into a false sense of security ahead of the Great Crash of 1929. – bto: ein interessantes Bild!

Quelle: Bloomberg

- “The risk is that while the Fed waits for inflation to average above 2% for an extended period of time, asset prices in other parts of the economy will have gone completely bonkers. That raises the danger of a crash, to add to the risk of inflation destroying portfolios. If inflation persists it will be bad for stocks as well as bonds, particularly given the extremely expensive valuation from which they start.” – bto: In der Tat droht die Achterbahn von Deflation zu Inflation in ziemlich abrupter Art und Weise.

- “Inflation-protected bonds remain under-appreciated and top the list, followed by equities that can benefit from the conditions ahead. (…) One final problem for asset managers is, of course, the need to guard against the distinct possibility that somehow the regime change doesn’t happen after all. Unfortunately, it will continue to be necessary to guard against the risk of being wrong. But there’s a strong and reasonable case that a regime change is under way.” – bto: vermutlich aber in Form der Achterbahnfahrt.