“Investing is a marathon, not a sprint – even during revolutions”

In der FT berichtet ein Analyst von Schroders von der letzten Investorenkonferenz. Ein durchaus interessanter Blick auf die Sicht der Märkte:

- “Lenin once observed: ‚There are decades which pass and nothing happens; and there are weeks where decades happen.‘ And so it feels with technology. The bankruptcy of Toys R Us, the acquisition of Whole Foods, the upscale grocer, by Amazon, the ecommerce giant, and China banning initial bitcoin offerings have reminded us of the pace of tech transformation.” – bto: In der Tat kam es erst langsamer, dann schneller als erwartet.

- “In the past 10 years, Amazon’s market value has grown tenfold and the value of Alphabet, the parent of Google, over threefold. The value of Sears, the US retailer, has fallen more than 90 per cent, and that of Staples, the office-supply chain, by half.” – bto: was unterstreicht, wie groß der Wandel ist. Da die Gewinner wenige und die Verlierer viele sind, dürfte es auch die Märkte stärker bewegen.

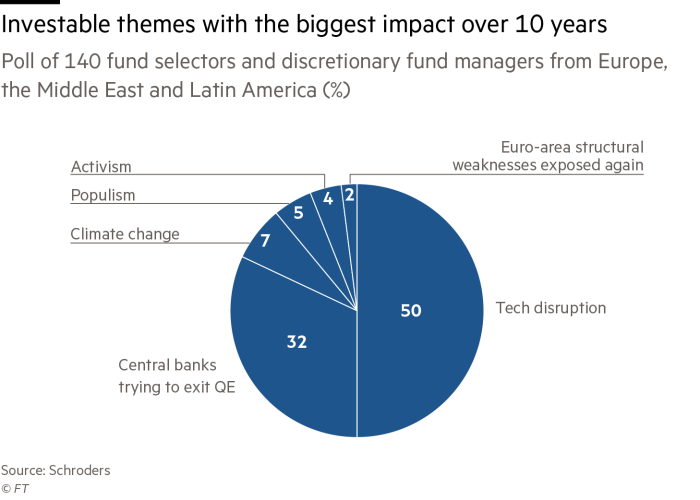

- “Little wonder that half of the investors at our conference said tech disruption would have the most impact on their portfolios over the next decade, ahead of quantitative tightening at 32 per cent, although this was the top issue for the next 12 months. The implications of populism came third.” – bto: wobei ich über den Optimismus zu Europa am meisten staune:

Quelle: FINANCIAL TIMES

- “We are well into this change in some sectors – such as music, advertising and books – but in others we are at a much earlier stage. Working out who’s next to be ‚Amazon-ed‘ is the topic du jour. One intriguing question is why financial services has not been disrupted much, at least not yet.” – bto: was eine gute Frage ist. Gerade der Finanzsektor ist derart ineffizient, dass es sich lohnen dürfte, ihn zu revolutionieren!

- “Quantitative tightening is the second transition investors need to navigate. Few interventions in the history of central banking have been as dramatic as the European Central Bank and Bank of Japan’s expansion of their balance sheets to support their economies. Their balance sheets now represent an extraordinary 80 per cent and 130 per cent of their gross domestic products — well ahead of the Federal Reserve. The $2tn these two institutions have injected this year have stimulated asset prices and suppressed volatility.” – bto: Und das war nicht so neutral, wie man gerne versucht zu signalisieren.

- “History is our database but we have no precedent for money printing on this scale to assess the impact of unwinding $10tn of bonds with negative yields. Central bankers are all feeling their way through the fog. So it is not surprising that investors remain doubtful about the pace of rate rises. (…) Behind the scenes, there is growing doubt in central bank thinking. (…) the case for emergency rates at the Bank of England or ECB has long since passed.” – bto: Das kann man wohl sagen, muss aber bedenken, dass die EZB den Euro zusammenhält.

- “So who are the winners and losers from rate rises? (…) For instance, higher rates are wind in the sails for banks, with the US speeding ahead. (…) What quantitative tightening means for equities versus bonds is also an unresolved debate. Few investors expected both to rally this year. It was striking that 87 per cent of our delegates were looking to add more risk to equity portfolios, both public and private.” – bto: was ebenfalls nur meine These der Woche unterstreicht, dass es eben ein Herdenverhalten gibt.

- “How the populist revolt against globalisation manifests itself is the third transition Western and emerging markets need to navigate. Investors in the West have long been able to ignore political risk and focus on the prospects of sectors or individual companies. Many hope they can revert to this norm.” – bto: Und da wäre ich skeptisch. Sobald sich die Krise zurückmeldet, ist es mit voller Wucht wieder da.

- “2017 has been a strong year for emerging markets, after a long period of unpopularity. The recovery is broadening as Brazil and Russia emerge from recessions. How cyclical upswings interact with secular transitions will be critical in the years ahead. All revolutions are fantasy until they happen. We will all need to pace ourselves on how to invest through them.” – bto: was natürlich ein Gemeinplatz ist. Ich denke, es bleibt bei der Zangenbewegung: Technologische Revolution, Schuldenkrise, Eurokrise und Populismus hängen zusammen und ergeben einen explosiven Mix.