Ab sofort müssten wir 100 Milliarden p.a. mehr einnehmen / weniger ausgeben

Regelmäßig legt die EU-Kommission Studien vor, die zeigen, wie nachhaltig die Staatsfinanzen sind. Zuletzt habe ich an dieser Stelle den Fiscal Sustainability Report 2018 besprochen:

→ Staatshaushalt: Mindestens 58 Milliarden müssten wir ab sofort sparen

Diesmal ist das Ergebnis nicht besser.

Zunächst die aktuelle Lage der Staatsfinanzen vor den Kosten der Alterung:

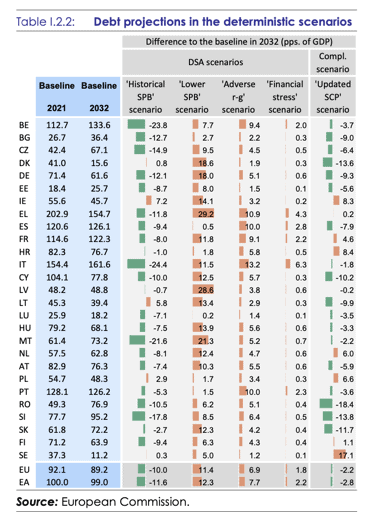

- „The first component of the debt sustainability analysis (DAS) consists in a set of deterministic projections based on various scenarios. Each deterministic projection provides a single path for debt until 2032 under certain assumptions for budgetary, macroeconomic and financial variables. In addition to the baseline, four other scenarios are taken into account for the medium-term risk classification. These are the ‘historical structural primary balance (SPB)’, ‘lower SPB’, ‘adverse interest-growth rate differential (r-g)’ and ‘financial stress’ scenarios. They highlight the impact on debt of alternative assumptions for fiscal policy, real GDP growth and interest rates (Table I.2.2).“ – bto: Das wenig verwunderliche Ergebnis: Die Schulden gehen hoch, vor allem dann, wenn die Zinsen steigen (was damals im April 2022 noch nicht erwartet wurde), haben die höher verschuldeten Staaten mehr Probleme.

Quelle: EU Fiscal Stability Report 2021

- „The baseline for the medium-term debt projections assumes that structural primary budgetary (SPB) positions remain at their 2023 level until 2032, except for the impact of ageing- related costs. (…) As from 2024, the projections do not incorporate any new measures, and the SPB is only affected by changes in the cost of ageing (…). Therefore, the baseline does not necessarily present what is most likely to happen, but rather highlights what would happen in the absence of new measures, as a benchmark.“ – bto: Vor allem ist es recht unwahrscheinlich, dass die Budgetdefizite nicht weiter steigen, bzw. hoch bleiben, gegeben dem Umfeld.

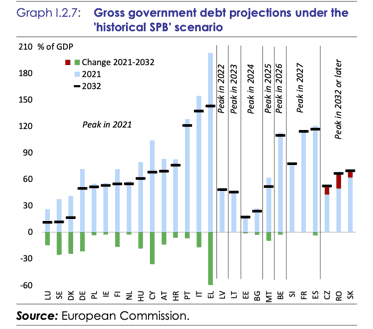

- „The first alternative scenario assumes a change in fiscal policy over the medium term – namely that the SPB will gradually converge to its average past value. This scenario illustrates the prospect of countries reverting to past fiscal behaviour instead of keeping the SPB at its 2023 level. More specifically, by 2027, each country’s SPB would reach the average value observed in the country over the past 15 years, i.e. in 2006-2020. For most Member States, this implies a tightening compared to the level forecast for 2023, although by 2027 there would still be a structural primary deficit, in some cases large, in nearly half of the Member States.“ – bto: Wir wissen, dass dieser Zeitraum als besonders kritisch gesehen wird, als „Austerität“, die dem Wachstum geschadet hat. Dahin kommen wir nicht zurück.

- „At the country level, the ‘historical SPB’ scenario generally leads to lower debt levels by 2032 compared to the baseline. In the 3 countries where this scenario implies a loosening compared to the baseline (Ireland, Lithuania and Poland), debt would still remain at a low level by 2032. In the other countries, debt would decline more and/or peak earlier, or at least not increase as much as in the baseline. This is particularly the case for Belgium, Spain, France and Italy.“ – bto: Wie gesagt, ein aus meiner Sicht völlig unrealistisches Szenario.

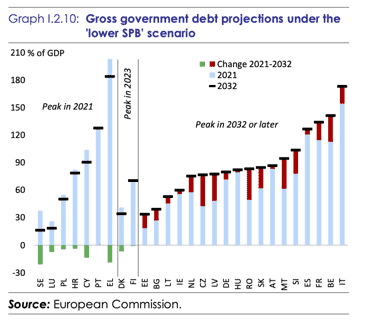

Und dann gibt es das Szenario, in dem man, wie von den Mitgliedsstaaten gewünscht, endlich aufhört zu sparen:

- „The ‘lower SPB’ scenario assumes less fiscal consolidation (or more deterioration) than in the baseline. As in the baseline, this scenario keeps the SPB unchanged as from 2023, but at a lower level than in the baseline. (….) A smaller consolidation by 2023 than expected in the Commission 2021 autumn forecast, followed by no consolidation, would imply a steady increase in EU debt over the medium term. The same holds for the euro area (Graph I.2.9). In both cases, debt would be about 10 pps. of GDP higher than in the baseline by 2032, reaching around 100% of GDP in the EU as a whole. Under this scenario, debt would not peak by 2032 but exceed its 2021 level in a majority of Member States. The largest debt increases from 2021 to 2032 would be recorded in Czechia, Latvia, Malta and Romania. Among the countries with highest debt levels, the debt increase would be sizeably larger than in the baseline for Belgium, France and Italy.“ – bto: Das kann nicht verwundern, ebenso wenig, dass es genau diese Staaten sind, die immer auf deutsches Geld pochen.

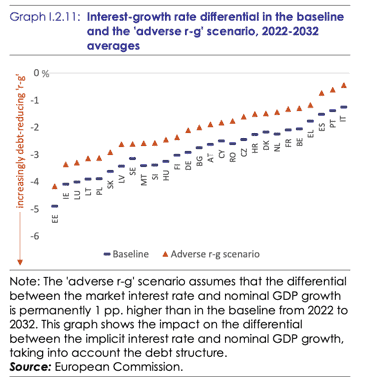

In einem weiteren Szenario wird davon ausgegangen, dass das Zinsumfeld weniger freundlich bleibt. Im April 2022 wie gesagt, noch ein als unwahrscheinlich angesehenes Szenario:

- „This new scenario captures risks related to a reversal or a reduction of the currently favourable interest-growth rate differential. It is motivated by the fact that, in most countries, the ‘r-g’ differential assumed in the baseline – extending the current environment of very low and often negative differentials – is lower than historical averages. Stress-testing this differential is therefore important to assess the consequences for debt sustainability risks of a possible structural correction of ‘r-g’. To do so, the difference between market interest rates and nominal GDP growth is permanently increased by 1 pp. compared to the baseline. (…) resulting in an even higher debt increase in the last years of the projection horizon in Italy and Romania.“ – bto: Ich würde es „Szenario weniger finanzielle Repression“ nennen:

Quelle: EU Fiscal Stability Report 2021

Im nächsten Teil geht es dann um die finanziellen Folgen der Alterung:

- „Due to a fast demographic ageing over the next decades, ageing costs are projected to rise in most Member States at unchanged policies. Due to a sharp expected decrease in the working-age population and growing shares of older people, pension expenditure would rise considerably in many Member States, especially in the next decades. Public spending on healthcare and long-term care is expected to increase in all countries, while education expenditure would fall for most. For a majority of countries, total age-related spending is projected to increase by 2070.“ – bto: Das muss man sich ansehen. Es geht immer um die verdeckten Schulden, nicht um die offensichtlichen.

- „(…) nine Member States have high fiscal sustainability risks in the long term: Belgium, Czechia, Spain, Italy, Luxembourg, Hungary, Malta, Slovenia and Slovakia. Thirteen additional Member States are considered at medium risk, namely Bulgaria, Germany, Ireland, Greece, France, Croatia, Cyprus, the Netherlands, Austria, Poland, Portugal, Romania and Finland.“ – bto: Frankreich mag überraschen, aber die Demografie ist dort besser als bei uns.

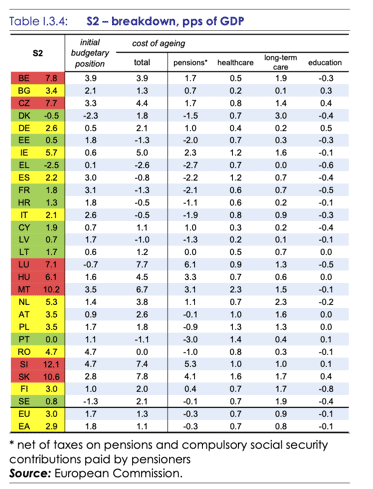

- „The S2 indicator measures the fiscal adjustment required to stabilise government debt in the long term. The S2 indicator identifies seven Member States as having high fiscal risk in the long term. Graph I.3.1 shows the results for S2, expressed as the permanent adjustment in the structural primary balance (SPB) in 2024 that would be required to stabilise public debt over the long term. Seven Member States are at high risk, i.e. an overall adjustment of at least 6 pps of GDP would be needed to prevent debt from entering on an ever-increasing path. For Slovenia, Slovakia and Malta, the fiscal effort is estimates at more than 10 pps. For Belgium, Czechia, Luxembourg and Hungary the S2 implies an adjustment of 6-8 pps.“

- „For another 10 Member States, long-term fiscal risks are considered medium based on S2. With a required fiscal adjustment of 2-6 pps of GDP, the S2 indicator points to medium risks in Ireland, the Netherlands, Romania, Poland, Austria, Bulgaria, Finland, Germany, Spain and Italy. For the remaining 10 countries, long-term fiscal risks are low based on S2.“ – bto: Italien schneidet hier recht gut ab, weil es dort starke Kürzungen für künftige Renten gab (die nun aber wieder zurückgedreht werden…). Deutschland steht besser da als viele andere, aber eben keineswegs gut. Nehmen wir 2,6% vom Bruttoinlandsprodukt als sofortige Budgetverbesserung an, dann reden wir von 100 Milliarden Euro, die wir ab sofort dauerhaft mehr einnehmen / weniger ausgeben müssen…

Quelle: EU Fiscal Stability Report 2021

- „The initial fiscal position is the main determinant of the S2 value, with ageing costs contributing less on average. In the EU as a whole, S2 indicates that an average fiscal adjustment of 3 pps of GDP would be required to stabilise debt in the long term. The initial budgetary situation necessitates a 1.7 pps of GDP adjustment, while ageing costs add another 1.3 pps to the sustainability gap. The fiscal starting point is the least favourable in Romania, Slovenia, Belgium, Malta, Czechia, France and Spain. Solely based on the SPB forecast in the 2023, a budgetary correction of at least 3 pps of GDP would be needed in these countries to prevent un upward public debt spiral.“ – bto: Frankreich…

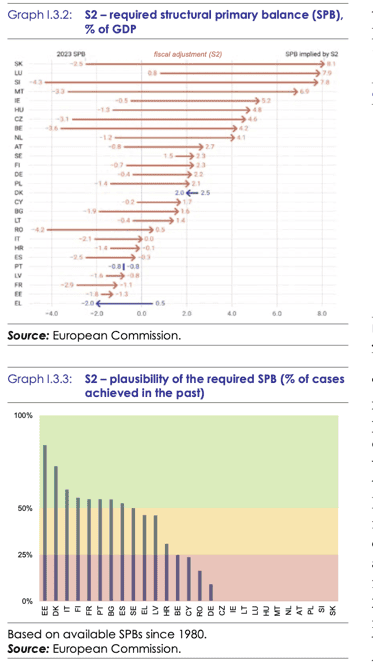

- „The SPB level implied by S2 informs about the fiscal policy needed to reach a steady state. The required SPB is the sum of the structural primary balance in 2023 – the end of the forecast period – and the fiscal adjustment required to stabilise the debt ratio in the long term as measured by S2. (…) government debt levelling off corresponds to an SPB of around 8% of GDP for Slovakia, Luxembourg and Slovenia, and to an SPB of 7% for Malta. In the cases of Ireland, Hungary, Czechia, Belgium and the Netherlands, a shift to an SPB of about 4-5% of GDP would be required.“ – bto: … was sehr unwahrscheinlich ist.

- „Past fiscal performance gives an idea about the plausibility of effectively achieving the required SPBs. (…) It shows how the required SPB has never been achieved in recent decades in Slovakia, Slovenia, Poland, Austria, the Netherlands, Malta, Hungary, Luxembourg, Lithuania, Ireland and Czechia. In Germany and Romania, the SPB implied by S2 was reached a couple of times over the past three decades; in Cyprus and Belgium about a quarter of the time.“ – bto: Frankreich sieht hier wieder wegen der besseren Demografie besser aus.

Quelle: EU Fiscal Stability Report 2021

→ economy-finance.ec.europa.eu: „Fiscal Sustainability Report 2021“, April 2022