Immer kurz vor dem Platzen: Kredite an Private Equity boomen

Private Equity Fonds kaufen Firmen mit dem Ziel auf, in möglichst kurzer Zeit deren Wert zu steigern oder möglichst viel Mittel aus den Firmen abzuziehen. Das geht über operative Verbesserung, die Fusion mit anderen Unternehmen, den Einsatz von viel Fremdkapital und geschicktes Timing der Kapitalmarktstimmungen. Im Schnitt ist es ein sehr renditeträchtiges Geschäftsmodell, wobei es auch Studien gibt, dass man, kaufte man mit ähnlicher Verschuldung Indexfonds, gleichwertige Renditen zu günstigeren Kosten erzielen könnte. Doch das ist ein anderes Thema.

Die Verschuldung, mit der die Fonds bei der Übernahme von Firmen arbeiten, ist dabei ein guter Indikator für die Risikofreude an den Märkten. Je höher die Schulden, je tiefer der Zins und je geringer die geforderten Sicherheiten, desto besser für die Fonds und desto gefährlicher ist es am Markt.

So scheint es auch heute wieder zu sein. Die FT berichtet von einem Anstieg der Deals mit hohem Leverage:

- “Private equity dealmakers are riding high on a wave of cheap debt, pushing buyout values to levels not seen since the financial crisis. The deals may not yet be quite as large as those in the last buyout bubble (…) But in one respect at least, 2007 is back: today’s deals are once again fuelled by supersized portions of cheap debt, with few strings attached.” – bto: Das geht natürlich nur, wenn der Renditehunger der Investoren überhandnimmt.

- “In about half of this year’s deals, private equity firms were able to raise debt financing amounting to at least six times the annual earnings before interest, tax, depreciation and amortisation (ebitda)of the company they bought. Ebitda is a widely followed measure of profit that is calculated by taking a company’s headline earnings and adding back tax and interest payments, as well as non-cash charges such as depreciation and amortisation. It provides a rough indication of the money available for debt repayments.” – bto: und das auf schon überhöhten EBITDA-Niveau!”

- “Leverage on this scale has not been used so aggressively since 2007, when a sudden dearth of buyers for corporate debts meant banks were forced to clog up their balance sheets with risky loansthey had originally planned to sell on. Now a plentiful supply of cheap credit is once again pushing asset prices higher, allowing private equity bidders to offer more money upfront for every dollar of profit they expect a company to earn.” – bto: Mann muss wissen, dass es im Zweifel kein Problem für die Fonds ist, denn sie haften nicht weiter. Natürlich schmerzt es, den Einsatz zu verlieren, doch dieser ist mit höheren Schulden natürlich immer kleiner.

- “This is starting to raise alarm bells. Janet Yellen, the former chair of the US Federal Reserve, told the Financial Times last month that she was worried by a ‘huge deterioration’ in corporate lending standards, particularly for leveraged loans. The IMF has also singled out leveraged loans as a potential source of financial instability.” – bto: Nun könnte man meinen: ach was, der IWF. Ich denke aber, die wollen diesmal sagen können, sie hätten gewarnt.

- “Bankers and deal lawyers warn that even these stark figures may understate the build-up of loose credit. That is because, as well as offering larger amounts of debt in proportion to a company’s profits, lenders have become less exacting about how those profits are defined. Debt contracts now routinely include clauses allowing companies to inflate their ebitda numbers by ‘adjusting’ current-year profits to include the expected fruits of future cost savings or growth plans. Yet the cash benefits of such initiatives may take years to materialise — if they arrive at all.” – bto: Manipulation wie überall!

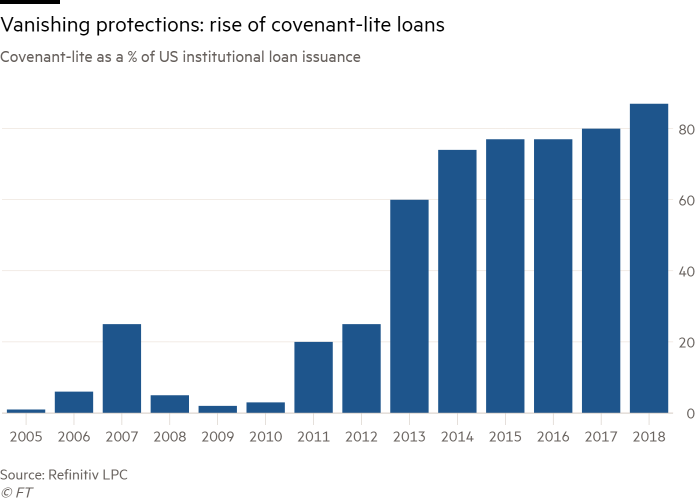

“Also in fashion are ‘covenant-lite’ loans, which deprive lenders of protections that customarily prevented borrowers from behaving recklessly, and allowed creditors to seize control when a company was in danger of missing payments. Even at the height of the 2007 lending frenzy, only about one-fifth of financing deals were written with loose covenants. Now the figure is close to four-fifths. Credit rating agency Moody’s warned recently that this could hamper recovery rates for investors in the next downturn. ‘In some cases it’s not really covenant-lite,’ says an executive at one fund that specialises in writing such loans. ‘Some of the documents are so loose you might as well have no covenants at all.’” – bto: was zu den in der letzten Woche hier diskutierten Problemen am Anleihemarkt noch hinzukommt!

Quelle: FT