Die Duration schlägt zurück

Wer verstehen will, was an den Märkten passiert, muss verstehen, wie wir dahin gekommen sind, wo wir heute stehen. Es ist die Folge der Politik des billigen Geldes, die die Anleger in die “Duration” getrieben hat. Ich habe mich in der Vergangenheit mehrfach mit der Duration beschäftigt.

Hier eine Studie, aus der ich bereits im August 2016 zitierte:

- “We believe further that it is important to realize that the strong returns to the assets that have done well over the last seven years are at best a one-off benefit and, more plausibly, will have to be given back over time. To us, this suggests that while alternatives have been a drag on institutional portfolios over the last six or seven years and privates (real estate, private equity, venture capital) have been a boost, in coming years the reverse may well be true.” – bto: Die Gewinne sind also nichts anderes als Vorwegnahmen künftiger Erträge, wie ich immer wieder betone.

- “The assets that have done well do not necessarily share that much in common, but they do all share a structure that they embody at least somewhat predict able cash flows that will occur over an extended period of time. The value of those cash flows changes materially if the discount rate applied to those cash flows changes.” – bto: Das ist der entscheidende Punkt! Stabile Cashflows werden gekauft und deshalb immer teurer.

- “(…) all of these assets can readily be valued through a discounted cash flow process, and the sensitivity of the present value to a change in the discount rate is precisely analogous to the duration of a fixed income security.” – bto: Es ist nichts anderes als ein abgezinster künftiger Ertrag, wobei dem der Abzinsungssatz immer tiefer wird.

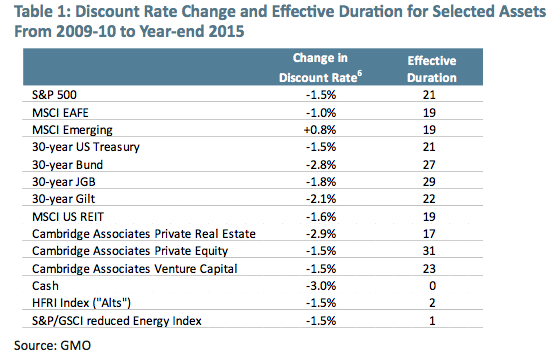

- “Table 1 shows an estimate of the change in the discount rate from a 2009-10 average to year end 2015 along with the effective duration of the asset class with regard to that change:” – bto: Das zeigt klar, wie sehr die Zinsen verzerrend wirken.

- “(…) the striking discrepancy is between the first 11 asset classes and the last 3. For any asset with a long duration, the discount rate fall has been a decided positive for returns for the asset class. But for short duration assets, it has actually been a negative. This occurs because there are two sides to the fall in discount rates. It increases the present value of distant cash flows, but it also decreases the current income available on the asset. The negative side of this is simplest to think about in the case of cash. Cash is the purest short duration asset. If cash rates fall, there is no capital gain to enjoy, but the income earned in subsequent periods will be reduced.” – bto: Das gilt allerdings umgekehrt auch, was Cash dann attraktiver macht. Also vermutlich für 2018.

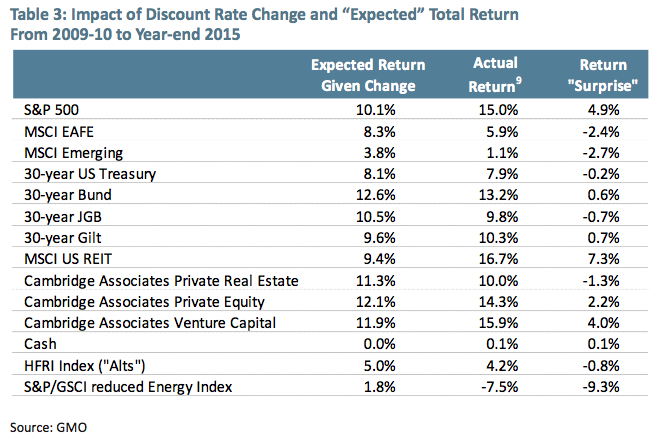

- Sodann vergleicht GMO den aus dem Fall des Diskontsatzes erwarteten Return mit dem tatsächlichen Return der Assets:

- “REITs have done surprisingly well behind pretty strong FFO (funds from operations) growth, the S&P 500 has done surprisingly well behind good earnings growth, and commodities have done impressively badly as boom turned to epic bust.” – bto: Was daran liegt, dass REITs einen stabilen Cashflow versprechen.

- “In general, there has not been a particularly apparent rush into long-duration fixed income despite the strong returns, because the simple math of bonds is such that most investors realize intuitively that falling bond yields are a negative for future returns.” – bto: … weil sie natürlich das Konzept des discounted Cashflows verstehen.

- “(…) the trouble with returns that come from falling discount rates is that they represent an increase in the present value of the asset without any increase to the cash flows to the asset class. The future expected return to the asset has fallen, and in a way that more or less precisely counteracts the increase in current value. In other words, the present value of the assets has risen but the future value of the assets has not.” – bto: Die Zukunft ist also heute schon da!

- “Let’s say that you will need, with absolute certainty, $1 million in 2026. The safest way to reach that goal is to buy a $1 million face value 10-year zero coupon Treasury bond maturing in 2026. Such a bond currently has a yield of 1.625%, which means it will cost you $851,127 to buy it today. Assume that tomorrow the yield falls by 1% to 0.625%. Your brokerage statement will declare the value of your bond to be $939,596, a gain of over $88,000.” – bto: Das ist aber nur ein Buchgewinn!

- “You’ve just made over half of the necessary return over the next 10 years in a single day. But the value of that bond in 2026 has not changed at all. It has a fixed maturity value of $1 million. The only thing that has changed is the discount rate being applied to that cash flow, not the cash flow itself. Assuming you still need $1 million in 2026, there is no windfall to spend. Economically, nothing has changed for you, whatever your brokerage statement says.” – bto: Dennoch dürften die Gebühren steigen, man ist ja jetzt “reicher”. Übrigens noch ein Punkt in unserer Vermögensdebatte.

- “(…) the fact that the valuation of US equities has risen guarantees that the future returns to US equities from here will be lower than they would have been otherwise, and the same is true for all of the long-duration assets whose discount rates have fallen over the period.” – bto: Und es geht genauso in die andere Richtung.

Deshalb hat auch Dylan Grice vor allen illiquiden Assets gewarnt:

→ Dylan Grice über die Zeitenwende an den Märkten

Heute nun die FINANCIAL TIMES (FT):

- “In the 1960s, commercial banks in the UK and much of the developed world held 25 per cent or more of their assets in cash and short term government paper that was free of default risk. This pained the banks because the return on cash was nil (…) So (…) banks ran down liquidity to about two per cent before the crisis (…) This left them dependent on the central bank to sort out the mess in the event of any shock to the system. In effect they outsourced liquidity management to the central bank with liquidity risk ultimately falling on the taxpayer.” – bto: Und das ist sicherlich nicht im Sinne der Gesellschaft.

- Heute passiert dasselbe: “Ultra-low interest rates have imposed a tight squeeze on bank profits. This, according to a recent report by the EU’s European Systemic Risk Board, has forced banks into a new search for yield and led them to tilt the composition of their assets towards riskier market segments such as commercial property. They have also increased their exposure to interest rate risk by granting fixed rate loans at longer maturities.” – bto: Das ist letztlich auch eine Art von Duration-Spiel.

- “Lloyds Banking Group announced last week that it was embarking on direct ownership of residential properties for letting, in some cases taking on development risk. Time was when directly owned property was not regarded as fit for bank balance sheets because real estate is relatively illiquid, especially in a downturn.” – bto: So etwas passiert, wenn man Banken strukturell unprofitabel macht. Sie suchen sich einen anderen Weg und die Risiken trägt wieder die Allgemeinheit.

- “The wider financial system has seen a similar retreat from liquidity. (…) Study shows that pension funds’ asset allocation to private assets including private equity, real estate and infrastructure has gone from seven per cent to 26 per cent over the past 20 years. These funds have sought to harvest an illiquidity risk premium, the extra return above that on quoted equities.” – bto: Auch ich beobachte bei mehr oder weniger vermögenden Privatleuten eine stark gestiegene Bereitschaft, in solche illiquiden Anlagen zu gehen.

- “The financial empowerment of private funds that this will all entail points to further shrinkage in the total pool of equities as private equity re-liquefies the market in corporate control. (…) since 2005 more than 30,000 companies have delisted from stock markets globally. These exits have not been matched by new listings, so there has been a big net loss of publicly listed companies.” – bto: Dies bedeutet, dass die Ungleichheit zunimmt, werden doch immer mehr Investoren vom Markt ausgeschlossen.

- “That is not all the work of private equity. Among other things it reflects the ready availability of super-cheap, tax privileged debt and the low capital requirement of tech companies. Interestingly, the OECD report records that 23 per cent of all equity raised in the US between 2010 and 2019 went to tech companies. This high number seems counter-intuitive until you recognise that much of that figure relates to phoney tech companies like Uber and Lyft, which rely on labour market regulatory arbitrage to extract value from pedestrian businesses in which technology plays a purely ancillary role.” – bto: Der Kommentar ist zwar hier wirklich off-topic, aber er ist brillant. Gorilla etc. könnte man da noch ergänzen …

Fazit FT:

“(…) the structure of capital markets generally is dictated increasingly by ultra-loose monetary policy. The message, once again, is that the Gadarene search for yield inevitably leads to phenomenal mispricing of risk. The risk premium in private markets is dwindling and in some areas may even be illusory.” – bto: Richtig, denn viele werden die Rendite nicht erbringen, die sie suggerieren.

Und jetzt – wo die Zinsen steigen – bekommen wir die Rechnung präsentiert.

→ ft.com (Anmeldung erforderlich): „A fetish of illiquidity is driving finance“, 12. Juli 2021