Zur technischen Machbarkeit der Energiewende

Vor einigen Wochen habe ich mich zur Zielscheibe von zum Teil heftiger Kritik zum Thema “Energiewende” gemacht. Wie versprochen, bereite ich eine ausführliche Antwort im Podcast vor, deshalb schon mal als Zwischenstand der Hinweis auf den einen oder anderen Artikel, den ich dazu lese:

- „Advocates claim that rapid technological changes are becoming so disruptive and renewable energy is becoming so cheap and so fast that there is no economic risk in accelerating the move to—or even mandating—a post-hydrocarbon world that no longer needs to use much, if any, oil, natural gas, or coal. Central to that worldview is the proposition that the energy sector is undergoing the same kind of technology disruptions that Silicon Valley tech has brought to so many other markets.“ – bto: In Deutschland setzen alle auf eine technologische Revolution.

- „There are two core flaws with the thesis that the world can soon abandon hydrocarbons. The first: physics realities do not allow energy domains to undergo the kind of revolutionary change experienced on the digital frontiers. The second: no fundamentally new energy technology has been discovered or invented in nearly a century—certainly, nothing analogous to the invention of the transistor or the Internet.“ – bto: Jetzt wissen wir aber, dass die Befürworter des Wandels immer betonen, dass Erneuerbare Energien schon jetzt günstiger sind als fossile Energien und Atomkraft.

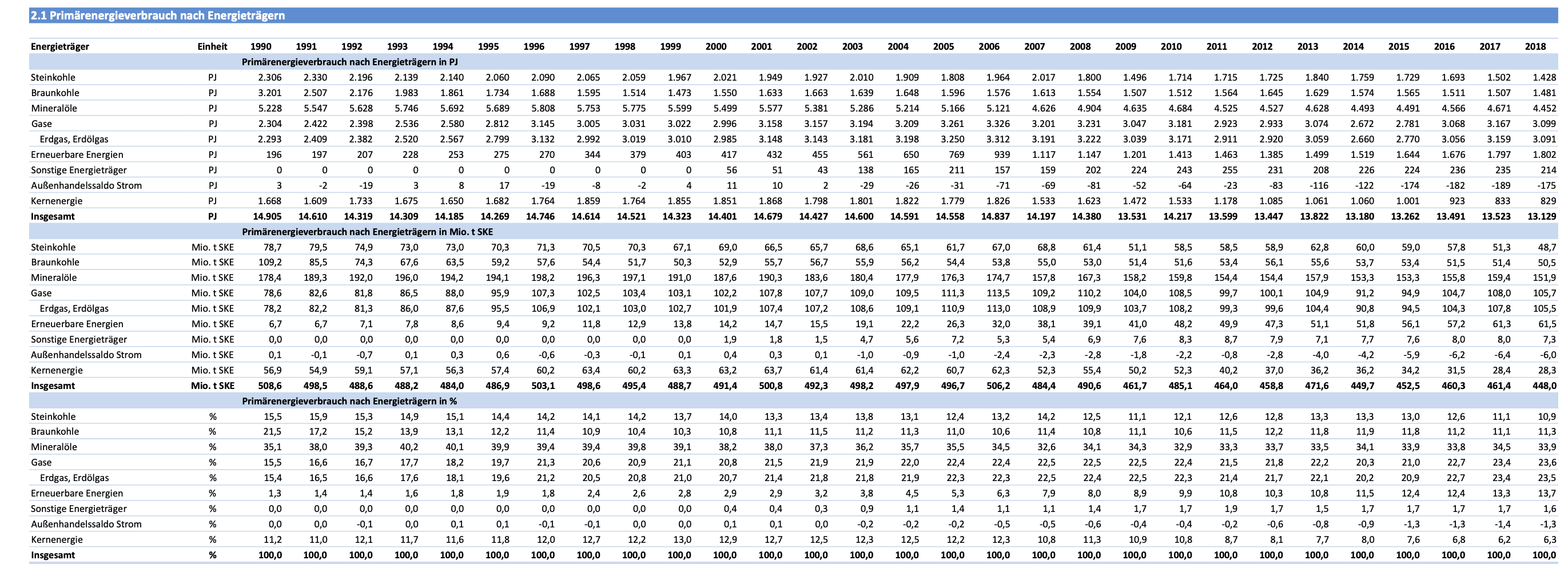

- „Today’s reality: hydrocarbons—oil, natural gas, and coal—supply 84% of global energy, a share that has decreased only modestly from 87% two decades ago. Over those two decades, total world energy use rose by 50%, an amount equal to adding two entire United States’ worth of demand. The small percentage-point decline in the hydrocarbon share of world energy use required over $2 trillion in cumulative global spending on alternatives over that period.5 Popular visuals of fields festooned with wind- mills and rooftops laden with solar cells don’t change the fact that these two energy sources today provide less than 2% of the global energy supply and 3% of the U.S. energy supply.“ – bto: Es lohnt, das in Erinnerung zu rufen. In Deutschland sieht es etwas besser aus – auf uns dürfte auch ein Großteil der Investitionen von zwei Billionen Dollar entfallen, ca. 25 Prozent:

Quelle: AGEB → Auswertungstabellen

- „Today, the world’s economies require an annual production of 35 billion barrels of petroleum, plus the energy equivalent of another 30 billion barrels of oil from natural gas, plus the energy equivalent of yet another 28 billion barrels of oil from coal. (…) To completely replace hydrocarbons over the next 20 years, global renewable energy production would have to increase by at least 90-fold. For context: it took a half-century for global oil and gas production to expand by 10-fold. It is a fantasy to think, costs aside, that any new form of energy infrastructure could now expand nine times more than that in under half the time.“ – bto: Jetzt mag man sagen, dass dies nicht stattfinden muss. Es genügt ja, wenn einige Willige vorangehen wie Deutschland und zeigen, dass es geht.

- „If the initial goal were more modest—say, to replace hydrocarbons only in the U.S. and only those used in electricity generation—the project would require an industrial effort greater than a World War II–level of mobilization. A transition to 100% non-hydrocarbon electricity by 2050 would require a U.S. grid construction program 14-fold bigger than the grid build-out rate that has taken place over the past half-century.” – bto: Wir sehen die Probleme in Deutschland auch. Von 7656 Kilometer erforderlichen neuen Netzinfrastrukturen sind knapp 20 Prozent umgesetzt.

- „The technologies that frame the new energy economy vision distill to just three things: windmills, solar panels, and batteries. While batteries don’t produce energy, they are crucial for ensuring that episodic wind and solar power is available for use in homes, businesses, and transportation.“ – bto: Das sind die Phasen, wenn die Sonne mal nicht scheint (kurzfristig) und natürlich das Problem des jahreszeitlichen Ausgleichs (Winter, “Dunkelflaute“).

- „Yet windmills and solar power are themselves not ‘new’ sources of energy. The modern wind turbine appeared 50 years ago and was made possible by new materials, especially hydrocarbon-based fiberglass. The first commercially viable solar tech also dates back a half-century, as did the invention of the lithium battery.” – bto: Und Sonne und Wind haben wir schon bis zur industriellen Revolution genutzt.

- „Over the decades, all three technologies have greatly improved and become roughly 10-fold cheaper. Subsidies aside, that fact explains why, in recent decades, the use of wind/solar has expanded so much from a base of essentially zero.“ – bto: Dies ist auch der Punkt, der immer wieder bei uns betont wird. Es ist unstrittig, dass diese Technologien wettbewerbsfähig geworden sind. Nicht berücksichtigt dabei sind die Frage der CO2-Wirkung der Herstellung und auch nicht die der Folgekosten für das Netz sowie die erforderlichen Back-up-Kapazitäten.

- „With today’s technology, $1 million worth of utility-scale solar panels will produce about 40 million kilowatt-hours (kWh) over a 30-year operating period. A similar metric is true for wind: $1 million worth of a modern wind turbine produces 55 million kWh over the same 30 years. Meanwhile, $1 million worth of hardware for a shale rig will produce enough natural gas over 30 years to generate over 300 million kWh. That constitutes about 600% more electricity for the same capital spent on primary energy-producing hardware.“ – bto: Da würde ich allerdings sagen, wenn wir einfach nur sechsmal so viel Geld ausgeben müssen, dann machen wir das doch einfach. Doch zum einen wäre es eine massive Überforderung der Gesellschaft und zum anderen bleibt es ja nicht bei diesen Kosten. Hinzu kommen Netzinfrastruktur und Back-ups.

- „It costs less than $1 a barrel to store oil or natural gas (in oil-energy equivalent terms) for a couple of months. Storing coal is even cheaper. Thus, unsurprisingly, the U.S., on average, has about one to two months’ worth of national demand in storage for each kind of hydrocarbon at any given time. Meanwhile, with batteries, it costs roughly $200 to store the energy equivalent to one barrel of oil. Thus, instead of months, barely two hours of national electricity demand can be stored in the combined total of all the utility-scale batteries on the grid plus all the batteries in the 1 million electric cars that exist today in America.“ – bto: Das gibt zu denken. Andererseits kann man daraufsetzen, dass Batterien günstiger und leistungsfähiger werden. Auch der Ausbau der Elektroflotte an Fahrzeugen kann hier helfen.

- „As a matter of geophysics, both wind-powered and sunlight-energized machines produce energy, averaged over a year, about 25%–30% of the time, often less. Conventional power plants, however, have very high ‘availability,’ in the 80%–95% range, and often higher.” – bto: Hinzu kommt, dass die Erneuerbaren – vor allem Wind – nur selten volle Kapazität erzeugen.

- „A wind/solar grid would need to be sized to meet both peak demand and to have enough extra capacity beyond peak needs in order to produce and store additional electricity when sun and wind are available. This means, on average, that a pure wind/solar system would necessarily have to be about threefold the capacity of a hydrocarbon grid: i.e., one needs to build 3 kW of wind/solar equipment for every 1 kW of combustion equipment eliminated. That directly translates into a threefold cost disadvantage, even if the per-kW costs were all the same.” – bto: Das sei aber angesichts der enormen potenziellen Schäden durch den Klimawandel berechtigt. So zumindest die gängige Argumentation.

- “Even this necessary extra capacity would not suffice. Meteorological and operating data show that average monthly wind and solar electricity output can drop as much as twofold during each source’s respective ‘low’ season.” – bto: was auch bei uns in der Diskussion immer verdrängt wird.

- “How do these capacity and cost disadvantages square with claims that wind and solar are already at or near ‘grid parity’ with conventional sources of electricity? The U.S. Energy Information Agency (EIA) and other similar analyses report a “levelized cost of energy” (LCOE) for all types of electric power technologies. In the EIA’s LCOE calculations, electricity from a wind turbine or solar array is calculated as 36% and 46%, respectively, more expensive than from a natural-gas turbine—i.e., approaching parity. But in a critical and rarely noted caveat, EIA states: “The LCOE values for dispatchable and non-dispatchable technologies are listed separately in the tables because comparing them must be done carefully” (emphasis added). Put differently, the LCOE calculations do not take into account the array of real, if hidden, costs needed to operate a reliable 24/7 and 365-day-per-year energy infrastructure or, in particular, a grid that used only wind/solar.“ – bto: wie bei uns. Auch hier wird immer auf die Grenzkosten der Erzeugung geblickt, ohne die Folgekosten überhaupt zu erwähnen.

- „An LCOE also requires an assumption about average multi-decade capacity factors, the share of time the equipment actually operates (i.e., the real, not theoretical, amount of time the sun shines and wind blows). EIA assumes, for example, 41% and 29% capacity factors, respectively, for wind and solar. But data collected from operating wind and solar farms reveal actual median capacity factors of 33% and 22%. The difference between assuming a 40% but experiencing a 30% capacity factor means that, over the 20-year life of a 2-MW wind turbine, $3 million of energy production assumed in the financial models won’t exist (…).” – bto: was umgekehrt natürlich bedeutet, dass die Stückkosten deutlich höher sind.

- “To address at least one issue with using LCOE as a tool, the International Energy Agency (IEA) recently pro- posed the idea of a ‘value-adjusted’ LCOE, or VALCOE, to include the elements of flexibility and incorporate the economic implications of dispatchability. IEA cal- culations using a VALCOE method yielded coal power, for example, far cheaper than solar, with a cost penalty widening as a grid’s share of solar generation rises.” – bto: aber natürlich nur, weil die CO2-Kosten hier nicht ausreichend internalisiert sind. Setzt man diese höher, gewinnen die Erneuerbaren an Wettbewerbsfähigkeit, was aber nichts daran ändert, dass Energie dann einen immer höheren Anteil am BIP kostet, was Wohlstand senkt und wenn es nicht alle machen, zu einem Verlust an Wettbewerbsfähigkeit führt.

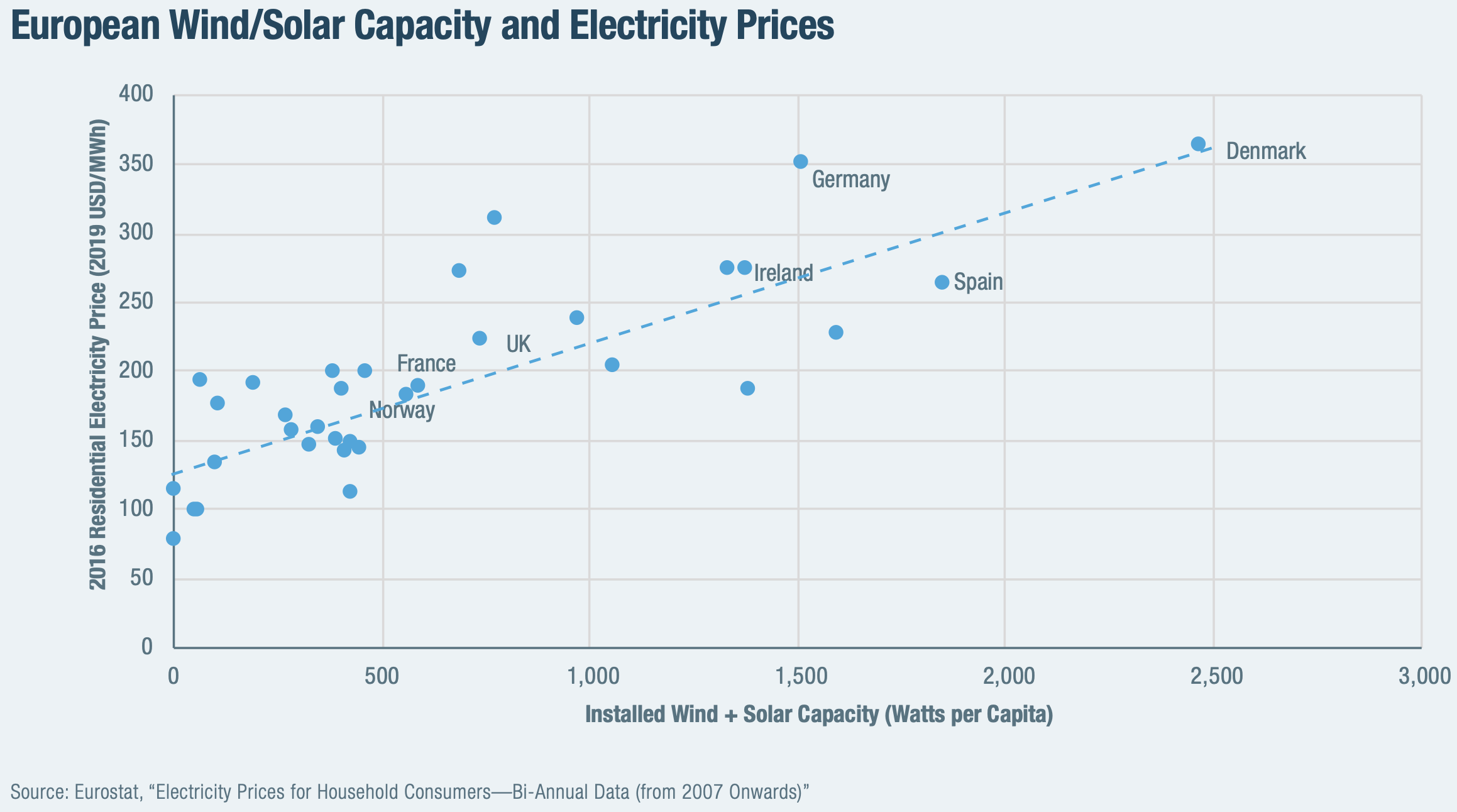

Zumindest auf den ersten Blick ist der Zusammenhang offensichtlich – und auch nicht erstaunlich. Deutschland fällt wieder durch besondere Ineffizienz bei dem Thema auf:

- „The increased use of wind/solar imposes a variety of hidden, physics-based costs that are rarely acknowledged in utility or government accounting. For example, when large quantities of power are rapidly, repeatedly, and unpredictably cycled up and down, the challenge and costs associated with ‘balancing’ a grid (i.e., keeping it from failing) are greatly increased. OECD analysts estimate that at least some of those ‘invisible’ costs imposed on the grid add 20%–50% to the cost of grid kilowatt-hours.“ – bto: Und diese Kosten muss irgendwer tragen.

- „Increased cycling of conventional power plants increases wear-and-tear and maintenance costs. It also reduces the utilization of those expensive assets, which means that capital costs are spread out over fewer kWh produced— thereby arithmetically increasing the cost of each of those kilowatt-hours.” – bto: Dafür waren diese Anlagen ja nicht gebaut. Es muss also flexiblere Back-ups geben und hier soll Gas die entscheidende Rolle spielen.

- “Then, if the share of episodic power becomes significant, the potential rises for complete system blackouts. That has happened twice after the wind died down unexpectedly (with some customers out for days in some areas) in the state of South Australia, which derives over 40% of its electricity from wind.” – bto: Und das ist nur theoretisch gut.

- “Batteries are a central feature of new energy economy aspirations. It would indeed revolutionize the world to find a technology that could store electricity as effectively and cheaply as, say, oil in a barrel, or natural gas in an underground cavern. (…) $200,000 worth of Tesla batteries, which collectively weigh over 20,000 pounds, are needed to store the energy equivalent of one barrel of oil. A barrel of oil, meanwhile, weighs 300 pounds and can be stored in a $20 tank. Those are the realities of today’s lithium batteries. Even a 200% improvement in underlying battery economics and technology won’t close such a gap.” – bto: Das ist das Problem der Energiedichte.

- “Nonetheless, policymakers in America and Europe enthusiastically embrace programs and subsidies to vastly expand the production and use of batteries at grid scale. Astonishing quantities of batteries will be needed to keep country-level grids energized—and the level of mining required for the underlying raw materials would be epic.” – bto: Deshalb kommt jetzt der Wasserstoff hinzu. Das soll doch die Lösung sein.

- “A grid based entirely on wind and solar necessitates going beyond preparation for the normal daily variability of windand sun for the frequency and duration of periods when there would be not only far less wind and sunlight combined but also for periods when there would be none of either. While uncommon, such a combined event—daytime continental cloud cover with no significant wind anywhere, or nighttime with no wind—has occurred more than a dozen times over the past century—effectively, once every decade. On these occasions, a combined wind/solar grid would not be able to produce a tiny fraction of the nation’s electricity needs. There have also been frequent one- hourperiods when 90% of the national electric supply would have disappeared.” – bto: Da könnte man ja sagen, wir stellen einfach alles ein, ziehen warme Pullover an. O. k., für die Kranken in den Intensivstationen wäre das unglücklich, aber dafür bauen wir dann Notstromaggregate.

- “So how many batteries would be needed to store, say, not two months’ but two days’ worth of the nation’s electricity? The $5 billion Tesla ‘Gigafactory’ in Nevada is currently the world’s biggest battery manufacturing facility. Its total annual production could store three minutes’ worth of annual U.S. electricity demand. Thus, in order to fabricate a quantity of batteries to store two days’ worth of U.S. electricity demand would require 1,000 years of Gigafactory production.“ – bto: Das ist eine Rechnung, die zu denken gibt.

- “Wind/solar advocates propose to minimize battery usage with enormously long transmission lines on the observation that it is always windy or sunny somewhere. While theoretically feasible (though not always true, even at country-level geographies), the length of transmission needed to reach somewhere “always” sunny/windy also entails substantial reliability and security challenges. (And long-distance transport of energy by wire is twice as expensive as by pipeline.)” – bto: Diese Vorschläge kamen auch von Lesern von bto – nach dem Motto Strom aus Spanien nach Deutschland liefern. Sicherlich kann man durch bessere europäische Integration einen Ausgleich erreichen. Dies dürfte aber nicht genügen, vor allem dürften die Produktionskapazitäten in einem Land nicht ausreichen, um ganz Europa zu versorgen.

- “Lithium battery production today already accounts for about 40% and 25%, respectively, of all lithium and cobalt mining. In an all-battery future, global mining would have to expand by more than 200% for copper, by at least 500% for minerals like lithium, graphite, and rare earths, and far more than that for cobalt.” – bto: Bergbauaktien sind demnach ein Kauf.

- “Then there are the hydrocarbons and electricity needed to undertake all the mining activities and to fabricate the batteries themselves. In rough terms, it requires the energy equivalent of about 100 barrels of oil to fabricate a quantity of batteries that can store a single barrel of oil-equivalent energy.” – bto: Na gut, nach dem hundertsten Laden rechnet es sich ja dann. Das gilt für alles. Selbst der Bau eines Gaskraftwerks, um ein Kohlekraftwerk zu ersetzen, setzt zunächst mal mehr CO2 in die Welt.

Dann zum Thema der weiteren Kostensenkung der Hinweis auf physikalische Grenzen:

- „For wind, the boundary is called the Betz Limit, which dictates how much of the kinetic energy in air a blade can capture; that limit is about 60%. Capturing all the kinetic energy would mean, by definition, no air movement and thus nothing to capture. There needs to be wind for the turbine to turn. Modern turbines already exceed 45% conversion. That leaves some real gains to be made but, as with combustion engines, nothing revolutionary. Another 10-fold improvement is not possible.“ – bto: Das ist bei Politikern und Polit-Umwelt-Ökonomen nicht bekannt bzw. wird verdrängt.

- „For silicon photovoltaic (PV) cells, the physics boundary is called the Shockley-Queisser Limit: a maximum of about 33% of incoming photons are converted into electrons. State-of-the-art commercial PVs achieve just over 26% conversion efficiency—in other words, near the boundary. (…) There are no 10-fold gains left.“ – bto: Auch dies ist enttäuschend. Wenn die direkten Kosten nur noch wenig sinken können, die Systemkosten aber steigen, müssen die Gesamtkosten steigen. Und das führt dann zu den massiven Wohlstandsverlusten.

- „The energy stored per pound is the critical metric for vehicles and, especially, aircraft. The maximum potential energy contained in oil molecules is about 1,500% greater, pound for pound, than the maximum in lithium chemistry. That’s why the aircraft and rockets are powered by hydrocarbons. And that’s why a 20% improvement in oil propulsion (eminently feasible) is more valuable than a 200% improvement in batteries (still difficult).“ – bto: Das könnten wir ebenfalls merken, allerdings erst dann, wenn die Automobilindustrie abgewandert ist.

- „In the energy world, one of the most vexing problems is in optimally matching electricity supply and demand. Here the data show that society and the electricity-consuming services that people like are generating a growing gap between peaks and valleys of demand. The net effect for a hydrocarbon-free grid will be to increase the need for batteries to meet those peaks.“ – bto: Außer, wir passen die Nachfrage dem Angebot an. Das wird beispielsweise in den Berechnungen des Fraunhofer Instituts zur Energiewende angenommen. Verzicht als Lösung.

- „An energy revolution will come only from the pursuit of basic sciences. Or, as Bill Gates has phrased it, the challenge calls for scientific ‘miracles.’ These will emerge from basic research, not from subsidies for yesterday’s technologies. The Internet didn’t emerge from subsidizing the dial-up phone, or the transistor from subsidizing vacuum tubes, or the automobile from sub- sidizing railroads. However, 95% of private-sector R&D spending and the majority of government R&D is directed at “development” and not basic research. If policymakers want a revolution in energy tech, the single most important action would be to radically refocus and expand support for basic scientific research.“ – bto: So ist es. Bei uns herrscht aber die Zuversicht vor, es wird schon ein technologisches Wunder geschehen oder aber, dass Geld keine Rolle spielt. Beides falsch.