Zur Mechanik von Ersparnis und Handelsüberschüssen

Es ist eine der spannenden Fragen: Soll man als Land einen Handelsüberschuss anstreben oder ist es sogar besser, ein Defizit zu fahren? Bekanntlich sehe ich die deutschen Überschüsse außerordentlich kritisch. Sie sind nicht in unserem Interesse und mindern am Ende unseren Wohlstand.

Nun will Donald Trump für die USA zumindest eine Reduktion des Defizits erreichen, besser wohl auch einen Überschuss. Nur wäre das sinnvoll? Michael Pettis – hatte ich auch schon mehrfach bei bto – sieht das kritisch und erklärt es sehr gut:

- “Although standard trade theory predicts that highly advanced economies with sophisticated financial sectors, like the United States, should generally run trade surpluses, the country has run persistent, and often large, trade deficits for five decades. This can only be a consequence of significant global economic distortions.” – bto: Klar, eigentlich sollte das Land sparen und damit Kapital exportieren, statt zu importieren.

- “(…) many (…) mainstream economists seem generally to misunderstand current trade dynamics.” – bto: Das kann man wohl sagen, wenn man die Diskussion bei uns betrachtet!

- “(…) is almost an article of faith among economists that the U.S. fiscal deficit contributes substantially to the U.S. trade deficit, and perhaps even causes it. But this claim is only true under certain conditions, which unfortunately most economists rarely bother to specify. If they did, they would probably see that these conditions no longer hold; and once we understand that the United States has little control over its domestic savings rate, we will see that the U.S. fiscal deficit is not a cause of the U.S. trade deficit as much as it is a consequence.” – bto: Hier wurde ich auch als Mainstream ertappt, denn ich hätte auch den Zusammenhang so gesehen.

- “Why (should) the United States (…) run trade surpluses in an open global system in which trade and capital flows are driven mainly by fundamentals? The reason is because investment should normally flow from advanced economies with high levels of capital, technology, and managerial know-how to less developed economies that need these resources, and in fact this has been the case for much of modern history.” – bto: Das leuchtet ein. Und es ist gerecht, weil es den ärmeren Ländern hilft, der Armut zu entkommen und sich selber zu entwickeln.

- “Advanced economies—that is to say, mature, capital-abundant, and slow-growing economies — should have many decades of investment in high-quality capital stock behind them, so their current investment needs are relatively low. What is more, with their high income levels and sophisticated financial systems, their savings should be relatively high. For these reasons, savings should normally be pulled from these advanced economies into faster-growing developing countries, where capital is relatively scarce, investment more profitable, and institutional and technological resources lacking.” – bto: Das kann man verstärken, wenn man wie wir die Infrastruktur verfallen lässt.

- “As the largest and most advanced economy in the world, and with by far the most sophisticated financial markets, the United States would normally be a net exporter of capital and technology to less developed economies: it should run on average a capital account deficit and its obverse, a current account surplus. This is just what the UK did in the late nineteenth century, perhaps the closest analog to the United States today. What is more, this tendency to run surpluses should be further exacerbated by the high level of income inequality from which the United States currently suffers — the highest since the late 1920s, when the United States, not coincidentally, ran the largest trade surpluses in history.” – bto: Dieser Aspekt, der durch die Ungleichverteilung höheren Sparquote, ist sehr interessant und macht die Lage der USA noch besonderer.

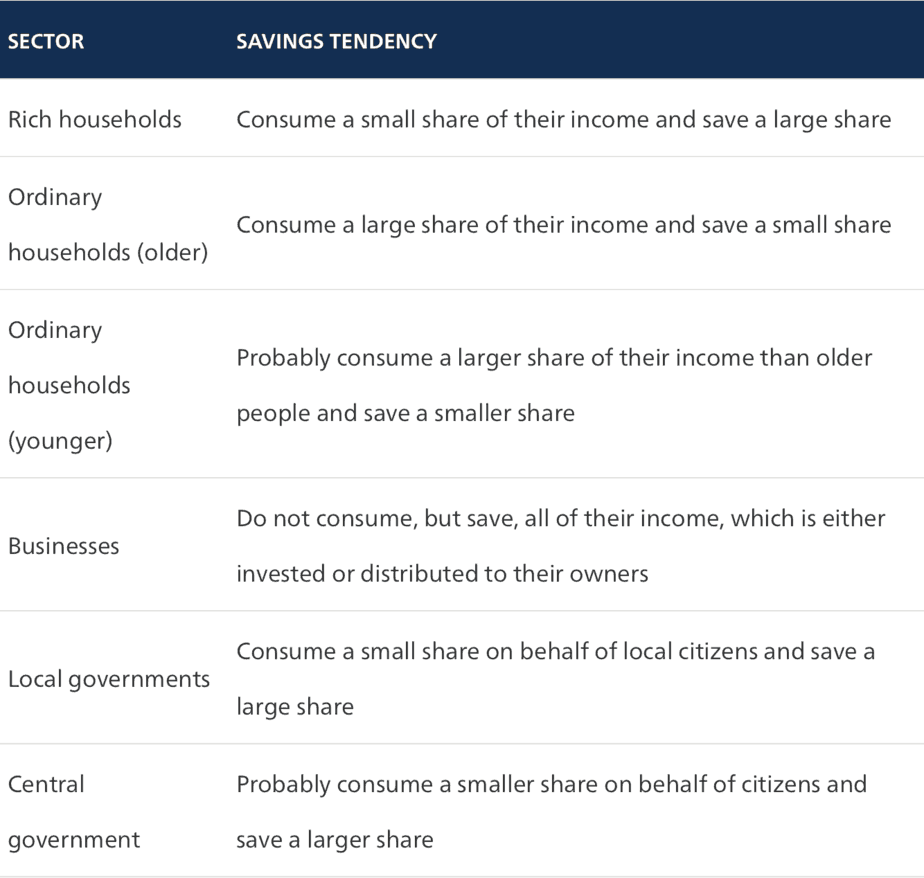

- “Any condition or policy that causes a transfer of income from one sector of an economy to another can affect the economy’s savings and consumption shares. Consider the table below, which divides an economy into six sectors, and describes each sector in terms of what share of its income is saved or consumed (all income is, by definition, either saved or consumed). As income is shifted from one sector to another, the differing tendencies of the two sectors to save or consume their incomes will change the overall savings rate of the economy.” – bto: was einleuchtet. Er bringt dann gleich das Beispiel Deutschland.

Quelle: Michael Pettis

- “(…) a country’s saving mainly reflects the way in which income is distributed. Notice the implication. Savings in a country usually don’t rise because the citizens of that country decide suddenly to become thriftier, nor do savings decline because citizens suddenly become more profligate. Savings rise and fall mainly as income is shifted among groups and sectors with different saving tendencies.” – bto: Das ist ein interessanter Gedanke.

- “Among recent examples was the 2003–2005 Hartz reforms in Germany, after which German wage growth slowed sharply relative to GDP growth while business profits exploded. This is the equivalent of a transfer of income from workers and ordinary households, who consume a large share of their income and save a low share, to businesses, who effectively save all of it. As this transfer occurred, German savings soared. The press responded by expressing admiration for the ways in which German culture worships thrift, but the rise in German savings actually had almost nothing to do with a cultural inclination toward thrift.” – bto: wobei es schon so ist, dass die deutschen Privathaushalte eine relative hohe Sparquote haben und Sparen bei uns als Tugend gepredigt wird. Richtig ist aber sicherlich, dass dies durch die Reformen verstärkt wurde.

- “It is this transfer that ultimately powered the huge subsequent increase in the German trade surplus. Contrary to popular opinion, in other words, Germany’s trade surplus does not reflect the fact that German workers are hard-working and thrifty (though they probably are, as indeed most workers everywhere are). (…) It is mainly the result of a reform that allowed German businesses to profit at the expense of German workers.” – bto: Und wenn man dann noch bedenkt, wie schlecht das Geld im Ausland angelegt wird, vergeht einem endgültig die gute Laune.

- “A country that saves more than it invests must export that balance. This is shown in the following accounting identities:” – bto: und hier wieder erklärt.

- GDP = Consumption + Savings, and also

- GDP = Consumption + Investment + Capital Account Surplus, therefore

- Consumption + Savings = Consumption + Investment + Capital Account Surplus, and because

- Capital Account Surplus = Current Account Deficit, therefore

- Current Account Deficit = Investment – Savings, or, which is the same thing,

- Current Account Surplus = Savings – Investment

- “This is why the effect of income transfers is more complicated than we might first assume. Most economists assume that the lower consumption created by income inequality is matched by higher investment, or they think it is at least partially matched by higher investment; this is because they assume that higher investment is the result of an increased availability of savings at lower costs.” – bto: Genau das stimmt nicht in den entwickelten Ländern. Investitionen werden nicht von teurem Geld gebremst, sondern von zu geringen Ertragsaussichten. Siehe die Akteinrückkäufe in den USA.

- “In such cases, when income inequality in the United States increases the gap between savings and investment—that is to say, if it causes savings to rise more than investment rises—the capital account deficit and the trade (or current account) surplus must automatically rise. As an advanced economy, the United States should normally run a trade surplus, in other words, and this surplus should be expanded by its high levels of income inequality.” – bto: So sollte es sein. Doch warum ist es nicht so? Bei uns hat es doch genauso „funktioniert“.

- “(…) it might be a mistake to assume that conditions that force up the ex-ante savings rate must always lead to some additional investment. There are conditions in which such conditions may actually lead to less investment; this is especially likely to be true today in most advanced economies. All it requires, broadly speaking, is that all or most investment falls into one of two categories. The first category consists of projects whose value is not sensitive to marginal changes in demand, perhaps because they bring about very evident and significant increases in productivity, or because the economy suffers from significant underinvestment. The second category consists of projects whose value varies as a function of future expected changes in demand. (…) in economies like the United States, in which the profitability of most investments is a function of changes in demand (the second category) rather than in the cost of borrowing (the first category), rising income inequality and higher ex-ante savings can actually result in less investment rather than more.” – bto: Hinzu kommt auch noch der geringe Wettbewerbsdruck, weil die Regulierung gegen Oligpole nicht richtig vorangeht.

- “The point is that U.S. income inequality could increase the gap between savings and investment by even more than we might otherwise assume. Not only does it cause the savings of the rich to rise faster than investment, but it might actually cause investment to decline. This isn’t just theory. The increase in the savings share of German GDP after the Hartz reforms was matched by a reduction in the investment share, not the expected increase.” – bto: Man müsste die Bürger hier dringend mehr entlasten und zugleich bei der Besteuerung auf Investitionsförderung abzielen.

- “(…) if a policy causes savings in one part of the economy to rise and investment to rise more slowly, or even decline, the domestic imbalance between savings and investment can be resolved in one (or some combination) of only two ways:

- The excess savings can be exported, in the form of capital account deficits along with the corresponding trade and current account surpluses.

- Something else must happen to cause savings in another part of the economy to drop, so in the aggregate there is no net increase in savings.”

- “It is clear that the first of these two conditions does not apply to the United States. The country has no control over its ability to import or export savings. Its capital account is largely determined abroad.” – bto: weil eben das Ausland gern in den USA investiert.

- “(…) the country ultimately absorbs a large part of the excess savings of the rest of the world — roughly 40–50 percent of the sum of foreign capital account deficits in recent years — the extent of which is only partially determined by domestic U.S. conditions or policies. As long as the United States runs a capital account surplus, and as long as this surplus is determined by foreign conditions and policies the country largely cannot control, the United States cannot be a net exporter of any excess savings accumulated through its high level of income inequality.” – bto: In Summe klingt das allerdings gar nicht gut.

- “That being the case, something else must happen to cause savings in another part of the U.S. economy to drop by enough to absorb the sum of excess U.S. savings (…) ultimately the United States must respond to the distortions created by net capital inflows, and the consequent current account deficit, with either more unemploymentor more debt. This explains the real relationship between the fiscal deficit and the current account deficit: if the United States is to avoid higher unemployment, either the U.S. government must run a fiscal deficit or U.S. authorities, including the Federal Reserve, must create conditions under which private American (mainly households) run deficits and raise debt levels.” – bto: Die Alternative wäre mehr Umverteilung und höhere Besteuerung der Unternehmen und damit weniger Ersparnis.

- “Under current conditions, however, the United States’ ability to control the amount of foreign excess savings that is invested in the country is very limited. As long as it has a completely open capital account, the U.S. current account deficit is likely to be a residual, mainly reflecting factors abroad. To the extent that the amount of excess savings in the rest of the world is determined partially or mainly by conditions and policies abroad, the United States cannot control or manage its current account deficit as long as it does not manage its capital account.” – bto: was für Donald Trump einen ganz anderen Weg aufzeigt.

- “If the country wants to escape this condition, the United States must reduce its trade deficit with the world, but not by addressing the trade deficit directly through import tariffs or quotas. Instead, the United States must address foreign capital inflows directly, perhaps by taxing them.” – bto: ein interessanter Gedanke. Jetzt müsste man dieses Modell noch um den Aspekt ergänzen, dass wir uns in einer Welt befinden, in der Geld = Schulden frei geschaffen werden und nachhaltig wachsen und das müssen. Die Ungleichgewichte resultieren ja nicht nur aus den Ersparnisüberhängen, sondern aus der ungleichgewichtigen Geldschöpfung. Spannend.