Zum (Un-)Sinn ökologischen Investierens

Die EZB will den Klimawandel bekämpfen. Zunächst denkt man da an die Lenkung von Krediten in gewünschte Bereiche, so wie hier diskutiert:

→ Nachhaltiges Finanzsystem statt Rendite?

Obwohl wir natürlich wissen, dass es um etwas ganz anderes geht:

→ Klimaschutz: Kampf gegen die Eiszeit

Befassen wir uns dennoch mit der Geldanlage nach “environmental, social, and governance (ESG) principles”, immer populärer in Medien und Politik und bei den Banken, die so hoffen, “to fight back, as it justifies the existence of active managers“, wie John Authers es in seinem Bloomberg-Newsletter formuliert. Sodann erklärt er, was es bedeutet:

- “This chart compares the performance of two exchange-traded funds. One is based on MSCI’s all-country ACWI index, while the other is in a low-carbon version of the same index, which claims to reduce the carbon emissions of the portfolio by 77%. Spot the difference.” – bto: Das ist natürlich nicht zu sehen und damit ärgerlich. Bei den “Sünden-Aktien”, also Alkohol, Tabak, Glücksspiel usw. konnte man wenigstens mit Sünde mehr Geld verdienen. Könnte es sein, dass ESG nicht sauber genug definiert ist?

Quelle: Bloomberg

- “The ACWI index holds $11 billion. The low-carbon version, almost five years after its launch, has just $450 million. So any overweighting of high carbon-emitters isn’t really the fault either of asset managers or of index providers, but of the ultimate clients.” – bto: An der Moral liegt es nicht. Liegt es vielleicht daran, dass das Geld an das Thema nicht glaubt? Trotz medialer Dauerbeschallung?

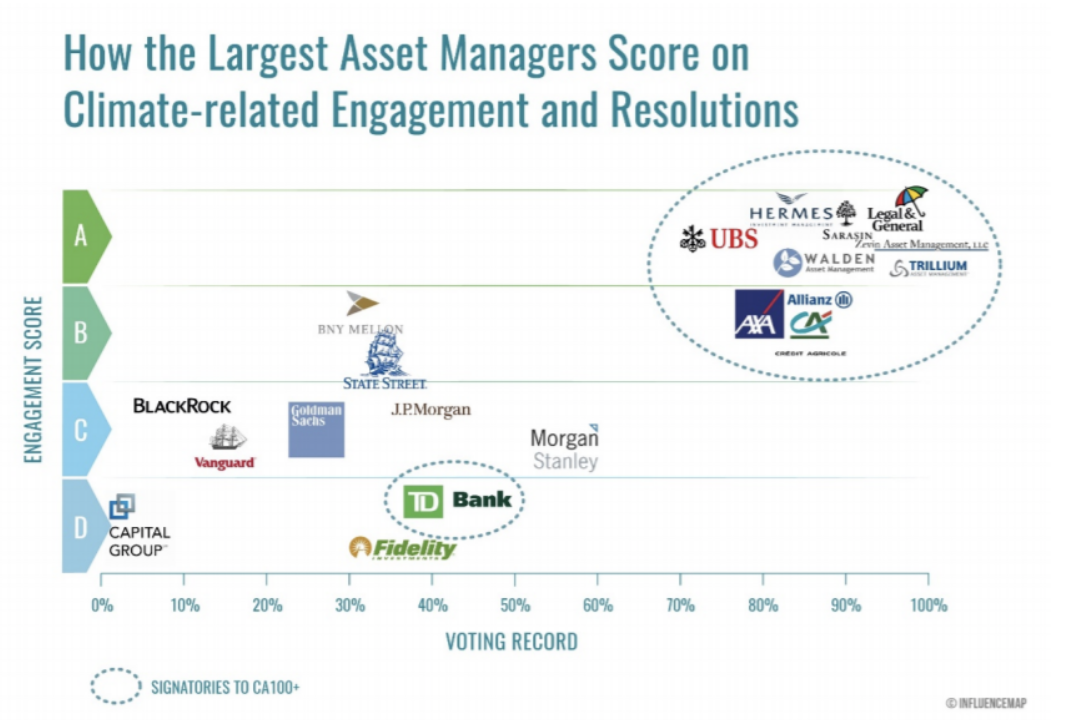

- “Fund managers can be active in more ways than selecting stocks. They also have a key role as stewards, voting their shares and putting pressure on managements. (…) However, the InfluenceMap research suggests that the big U.S. passive providers are also passive in their dealings with company managements. It is left to smaller active fund managers, and to large passive houses such as Legal & General in Europe — where pressure on them to be active environmental students is intense — to put pressure on managements. In this chart, a higher voting record means higher support for resolutions on climate-related issues.” – bto: was aber auch bedeutet, dass das Management der Firmen das Thema als weniger relevant ansieht.

Quelle: Bloomberg

- “The key difference here is evidently geography. In Europe, climate change is now widely viewed as an emergency, and asset managers have little choice but to act as the public’s agents and put pressure on companies. In the U.S., where a large chunk of the population thinks climate change is a hoax, the dynamics are very different.(…) Should American opinion swing on this issue, we can expect sharp moves out of carbon-emitting companies, and much more pressure on industry in an environmentalist direction.” – bto: Nun, wer mag sein Geld auf dieses Szenario setzen?